Floating Offshore Wind Buoyant on New Developments, Projects

Floating offshore wind made a remarkable splash this fall. As two much-watched projects sailed toward construction, optimism about the industry’s accelerated growth was buoyed by projections from the International Renewable Energy Agency (IRENA) that based on the pace of development across regions, floating wind farms could cover about 5% to 15% of the global offshore wind installed capacity (now projected at almost 1,000 GW) by 2050.

As IRENA also pointed out in its October 2019–released “Future of Wind” report, interest in the fledgling sector is rooted in its potential to allow access to sites with water deeper than 60 meters (m); to ease turbine set-up, even in mid-depth conditions of between 30 m and 50 m; and, in the future, to offer a lower-cost and environmentally beneficial alternative to fixed foundations.

Meanwhile, according to the U.S. Department of Energy’s August 2019–issued “2018 Offshore Wind Technologies Market Report,” the world’s floating wind energy project pipeline soared to 4.9 GW in 2018. Only about 46 MW from eight projects are operating, however, and all are demonstrations except the 30-MW Hywind Scotland project, which was developed by Norwegian energy firm Equinor (formerly Statoil), and came online in 2017. Of the eight floating offshore wind farms installed around the world, five (37 MW) are in Europe and three (9 MW) are in Asia, mostly Japan. Still, the DOE notes that an additional 14 projects representing about 200 MW are currently under construction or have achieved financial close or regulatory approval. In total 38 projects have been announced worldwide—and more are certain to follow.

As IRENA noted, several countries have set specific targets for floating offshore wind. Chinese Taipei, for example, wants to install 1 GW by 2030. In Europe, floating offshore is poised to become a sizable part of the 450-GW European Union target for offshore wind by 2030. France this September, for example, put online the 2-MW Floatgen demonstration and is preparing for public debate around the first commercial floating offshore wind tender, which will be awarded in 2021. Meanwhile, the Japan Wind Energy Association says 18 GW of floating wind turbines could be installed in that country by 2050, and South Korea, which just floated a 750-kW floating trial, plans to sink $1.3 billion to install 50 more turbines by 2022, including the 200-MW Donghae 1 project, which is slated to come online in 2024.

The DOE cautioned, however, that the sector is still grappling with technology and cost challenges, and those could temper its growth. One of the biggest factors that determines project cost are the characteristics of its support structures. “The cost of the support structure itself is important, but so is the support structure’s ability to help lower costs in other parts of the system, such as by enabling serial fabrication, inshore assembly, and commissioning, and by minimizing expensive offshore labor, including [operations and maintenance],” the DOE explained.

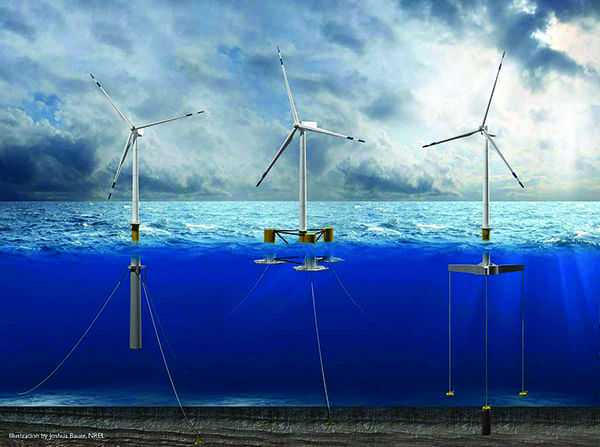

To date, four main designs of floating offshore wind units have been prominently developed and tested. The vast majority of installed and announced projects (94%) use semi-submersible substructures (Figure 2). These typically employ water-filled cylinders to serve as ballast for stability. Another 4% use spar technology, which typically involve a single ballast-stabilized spar. Less than 1% use tension-leg platforms and barges, the DOE said. However, emerging second-generation concepts are also noteworthy because they include hybrid floating platform designs. Innogy and Shell, for example, this February announced plans to demonstrate Stiesdal Offshore Technologies’ TetraSpar floater—comprising a floating substructure and a flexible cable system to deploy a ballast weight at sea—using a 3.6-MW Siemens Gamesa turbine in Norway in 2020.

According to ABS—a provider of of classification and technical advisory services to the marine and offshore industries, and today, a leading class society of floating offshore wind turbines—it may be too soon to gauge which platform technology will dominate the burgeoning market. “The majority [of different concepts] stem from what we already have seen in the traditional offshore industry—semi, spar, and tension-leg platforms—but we also see new concepts such as the damping pool barge, Steisdahls ‘Spar,’ etc.,” Gareth Lewis, an ABS spokesperson told POWER in November. “It is impossible to say which one is the most suited as this depends on many factors—local manufacturing capabilities, cost of installation of the unit, etc. Looking back how the industry selected for oil and gas developments, there are no trends of what type of floaters that were selected and I foresee we will see similar lack of trends in floating offshore wind developments,” he said.

|

|

2. This illustration shows commonly used floating offshore wind substructure designs: spar buoy (left), semisubmersible (middle), and tension-leg platform (right). Source: Josh Bauer/NREL |

For now, technology advancements appear to be driving uptake. Among critical cost challenges floating offshore project developers face are that because projects allow greater distances from shore, grid connection of floating offshore wind turbines can pose logistical issues. But here, too, innovation is propelling advancements—most notably in the field of dynamic cable designs—to ensure cyclic loads and bends in cables will not compromise the system.

One such innovation, the world’s first application of dynamic cables operating at 66 kV, could start operating at the end of this year at the 25-MW WindFloat Atlantic floating wind farm. The Windplus consortium, made up of EDP Renewables (54.4%), Engie (25%), Repsol (19.4%), and Principle Power Inc. (1.2%), kicked off construction of the WindFloat wind farm on Oct. 21, towing the first of three structures—each comprising an 8.4-MW V164 MHI Vestas wind turbine installed atop a floating platform (Figure 3)—to the wind farm’s destination 20 kilometers (km) off the coast of Viana do Castelo in Portugal. The semi-submersible floating platforms, which were built as a cooperative effort by Spain and Portugal, will now be anchored to the seabed at a depth of 100 m with chains. The project is a notable evolution of WindFloat 1, Principle Power’s 2-MW prototype that was deployed off the northern coast of Portugal. That prototype generated “uninterrupted” power between 2011 and 2016, “surviving extreme weather conditions, including waves up to 17 meters tall and 60-knot winds, completely unscathed,” Principle Power noted.

|

|

3. The WindPlus consortium in October sent the first of three WindFloat Atlantic turbines to the site of a 25-MW floating offshore wind farm 20 kilometers off the coast of Viana do Castelo in Portugal. The structure comprises an 8.4-MW V164 MHI Vestas wind turbine and a semi-submersible floating platform. Courtesy: Principle Power |

Also in October, Equinor announced a final investment decision to build Hywind Tampen, an 88-MW floating wind farm that will be located in waters 260 m to 300 m deep between the Snorre and Gullfaks oil and gas platforms in the North Sea, and it contracted Siemens Gamesa to supply 11 SG 8.0-167 DD turbines to the project. The 8-MW wind turbines will be installed on spar buoy foundations.

Siemens Gamesa said the project, which is expected to come online in late 2022, is a lucrative opportunity to gain a stronger foothold in the burgeoning floating offshore wind market. It noted that it worked with Equinor on the world’s first full-scale floating wind turbine project—the Hywind Demo, which was installed in Norwegian waters in 2009 and received a POWER Top Plant award that year—as well as on the 30-MW Hywind Scotland wind farm in 2017.

For Equinor, which has recently made notable deals for floating offshore projects in South Korea and Japan, the project could help demonstrate its newest efforts to slash costs for its Hywind offering. The company has said it will develop Hywind using a “Hywind factory” approach. “The ‘Hywind Factory’ is not a physical factory, but rather a systematic approach to mature and industrialize the Hywind concept, to significantly reduce costs and improve the competitiveness of floating wind,” it said. A key focus will be to optimize the substructure’s material use and production, and adapt it to volume production. Equinor also said, however, it will design Hywind to be compatible with trends in the fixed-bottom industry through the integration of standard turbines and standard installation vessels, for example. Finally, it will work to standardize solutions that are common to the floating wind industry, such as mooring, anchoring, and export cables, it said.

—Sonal Patel is a POWER senior associate editor.