The Quest at CERAWeek 2012

In March, Cambridge Energy Research Associates hosted its 30th annual CERAWeek, a conference that is renowned for high-profile attendees from around the world. During the week of March 8, security was tight in Houston as oil ministers from the Middle East and CEOs from the largest oil and gas companies and electric utilities rolled into town to exchange ideas and forecasts. More than 1,200 delegates from 50 countries attended to hear more than 300 distinguished speakers. POWER dispatched two editors to the conference to report on significant news and events. Gas Technology Editor Tom Overton provides his perspective in the March/April issue of GAS POWER at https://www.powermag.com. Contributing Editor Mark Axford filed the following observations as well as his interview with IHS CERA President Daniel Yergin (p. 52).

Gas, Gas, and More Gas

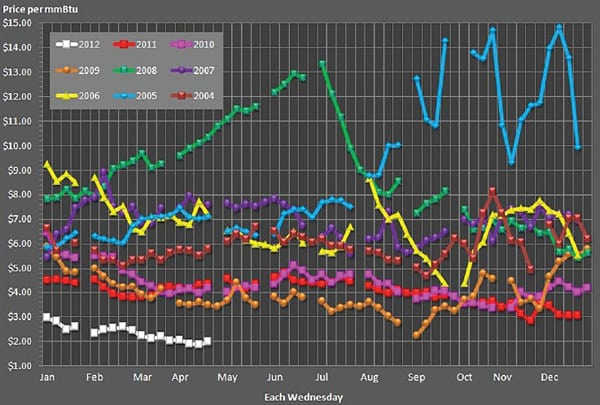

The theme for this year’s CERAWeek was “The Quest: Energy Security and the Future of Economic Growth,” but it could have better been titled “Oh My God, Do You Believe All This Shale Gas?” One speaker after another reinforced the enormity of the gas discoveries in the U.S. and the fracking technology that made it possible. Think back to 2008, and the average price of natural gas over that year at the Henry Hub was about $7/million Btu, peaking in March at $12.60/million Btu. The closing price on April 25, 2012, as this article was written, was $1.99/million Btu, up from $1.82 three days earlier (Figure 1).

|

| 1. Rock bottom gas prices. Historical natural gas spot prices at the Henry Hub, from 2004 to the present. The 2012 gas prices are shown in white at the bottom of the figure. Sources: Natural Gas Weekly Update, U.S. Energy Information Administration, and the Nebraska Energy Office |

Steve Farris, CEO of Apache Corp., one of the largest drilling companies, called the new gas supply the “Shale Gale.” “We are entering a new paradigm of abundant long-term supply, low prices, and low volatility,” said Farris (Figure 2). “You may have heard that we now have a 100-year supply of natural gas, and this is not true… it is closer to a 200-year supply. The anomaly is not that we are at $2.50 per million Btu today… the anomaly is that we were at almost $13 only four years ago.”

|

| 2. Gas in abundance. A slide from the presentation by Steve Farris, CEO of Apache Corp., illustrates the large amount of natural gas available to the U.S. Farris called the large gas reserves a “Shale Gale.” Source: Steve Farris/Apache Corp./EIA |

Dow Chemical CEO Andrew Leveris called the shale hoard a “once-in-a-lifetime opportunity. It is beholden to us to build upon it.” He implored America to “get its act together” to take advantage of this amazing discovery by putting gas at the forefront of a national energy policy.

Dow is enthusiastic about new expansion of the U.S. petrochemical industry based on low-cost feedstock. Leveris says Dow is planning major investments in the U.S. after pulling back during the recession. Dow is the largest industrial consumer of natural gas in the U.S. Its petrochemical plants in Michigan and on the Gulf Coast produce the plastics and vinyls that are essential to the automotive industry and countless consumer products.

Michael Morris, now non-executive chairman of AEP, chimed in: “About 70% of the U.S. natural gas supply today is shale gas. There is very little geologic risk. AEP will surely become more gas-balanced, in part because the installed cost ($/kW) of new gas-fired generation capacity is about half the price of coal and one-third the price of nuclear generation. But we are a regulated utility, and the state regulators will ultimately decide the generation mix and value of fuel diversity.”

Since the disaster at Fukushima, Japan is buying all of the liquefied natural gas (LNG) it can get at a delivered price of $18/million Btu. Though this is much more than the price of natural gas in the U.S., it is still a bargain compared to the cost of importing crude oil or refined oil. In fact, the LNG supply contracts utilized by Japan are pegged to the Brent crude oil price. Already, one U.S. LNG export terminal has been approved, and there are plans to convert several more import terminals for export to take advantage of the huge gap between the Henry Hub price of gas and the world market price of LNG.

Gas Is Also a Transportation Fuel

Transportation will also be affected by the great gas discoveries. Jeffrey Immelt, CEO of General Electric, noted that GE’s locomotive division is racing to adapt its railroad engines to burn LNG fuel.

Apache’s Farris also pointed out that the new supply and low prices should kick-start the conversion of 18-wheelers, pick-ups, and even automobiles to compressed natural gas (CNG). “It cost us $4,500 to convert a Chevy Avalanche to run on CNG, and Apache is converting its entire fleet of 300 vehicles. We decided that it was not enough to talk the talk; you gotta walk the walk.” Apache is also offering incentives to all of its employees to convert their personal vehicles to CNG.

Farris noted that GM announced fleet and retail customers began placing orders in April 2012 for bi-fuel 2013 Silverado and Sierra trucks. Factory direct purchase of gasoline-CNG vehicles eliminates the need for customers to make arrangements with aftermarket providers. The vehicles include a CNG-capable 6.0L V8 engine that seamlessly transitions between CNG and gasoline fuel systems. Combined, the trucks offer a range of more than 650 miles.

Farris described the compelling economics of using CNG as a transportation fuel. One gallon of unleaded gasoline contains approximately 125,000 Btu. At a price of $4.00 per gallon, this equates to $32 per million Btu. At a price of 5 cents/kWh, fueling a vehicle with electricity costs $14.50/million Btu. If CNG could be purchased at a fueling station for $5/million Btu, it is easy to see why the U.S. might be better off migrating to natural gas as a transportation fuel instead of gasoline or electricity. “The rest of the world gets it,” said Farris (Figure 3). While the U.S. has by far the largest fleet of cars and trucks, only a small fraction of the U.S. fleet is fueled by natural gas.”

|

| 3. Left behind. The acceptance of compressed natural gas vehicles is very low in North America compared with the rest of the world. Source: Steve Farris/Apache Corp. |

Gas Turbine Orders Up

Is it a coincidence that 2011 was a strong year for gas turbine orders, up 30% for U.S. projects alone (Figure 4)? Arguably, new generation capacity is closely linked to projected demand for electricity in regional markets, but the expectation of a stable, low-cost supply of natural gas may already be programmed into the decision-making mindset of U.S. utility executives.

|

| 4. Gas turbine orders up. 2011 was a strong year for gas turbine manufacturers. Source: McCoy/Axford March 2012 |

Tom Farrell, CEO of Dominion Resources, is still not completely comfortable, remembering the natural gas price run-up to $12/million Btu a few years ago. Nevertheless, he expects the fraction of natural gas–fired generation to increase from its current 25% to more than 35% over the next 10 years. Dominion needs to add approximately 5,600 MW of generation to its system by 2019. During 2011, Dominion ordered gas turbine and steam turbine generators for a 1,300-MW combined cycle in Warren County, Va., that will go into service by early 2015. “Our job is to keep the lights on and the server farms continuously powered,” said Farrell.

—Mark Axford ([email protected]) is a principal of Axford Turbine Consultants LLC and a POWER contributing editor.