CPS Energy Exploring Novel Geomechanical Pumped Storage Technology

Texas-based CPS Energy, the largest municipally owned electric and natural gas company in the U.S., has entered into a 15-year commercial agreement to explore installing up to 15 MW of geomechanical pumped storage (GPS). The agreement will kick off with a pioneering 1-MW project that will pump water into drilled wells and store it under pressure, providing up to 10 hours of long-duration energy storage.

CPS Energy, which is owned by the City of San Antonio, unveiled the agreement with Houston-based Quidnet Energy on March 7, noting it had engaged technology think tank EPIcenter to support its decision-making process for the novel form of energy storage. Under the agreement, CPS Energy and Quidnet will build the initial 1-MW, 10-hour storage facility with a commercial operating date in 2024 at a site in Texas that is still being evaluated. A Quidnet spokesperson told POWER on March 9 project partners are evaluating multiple candidate locations in and around the greater San Antonio area.

However, the agreement also provides “time for both parties” to explore the technology. “CPS Energy will have the option to expand the project to provide 15 MW as the project matures,” CPS Energy noted in a statement.

A Marriage Between Power and Oil and Gas

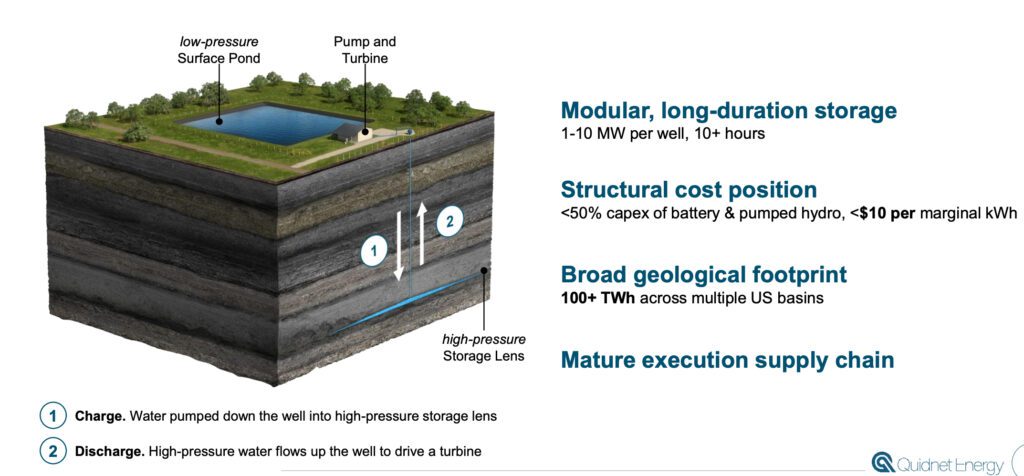

Quidnet Energy’s GPS technology essentially harnesses existing oil and gas drilling techniques and conventional drilling technology and hydropower equipment to facilitate underground closed-loop water systems designed to guard against evaporative loss.

The concept leverages three steps. When power is abundant, it pumps water from a pond down a well and into layers of shale. The well, which is closed, keeps the energy stored under pressure between rock layers “for as long as needed,” Quidnet said.

But, “when electricity is needed, the well is opened to let the pressurized water pass through a turbine to generate electricity, and return to the pond ready for the next cycle,” the company explained. “The natural elasticity of the rock performs like a spring and holds the water under pressure until it is needed, at which time it is released through a hydroelectric turbine to produce electricity to send back to the grid.”

The process involves drilling to depths between 1,000 feet and 1,500 feet to create a high-pressure “storage lens”—essentially an underground reservoir—operating in impermeable, non-hydrocarbon-bearing rock,” Quidnet explained. While the process uses oil and gas industry wellbores and tools, it is “quite different from fracking for oil and gas,” it noted.

“The size of the storage lens depends on the depth and storage pressure,” the company said. “We store energy by injecting water into the lens at high pressure and return power to the grid by releasing the high-pressure water back to the surface through a turbine.” The process is more similar to pumped hydro storage “but without the need for mountains, at lower cost, and in a highly modular fashion,” which enables siting of multiple wells near each other. Modules could share a surface pond for storing low-pressure water, it noted.

The 1-MW installation will be Quidnet’s first commercial project. Backed by Bill Gates’ Breakthrough Energy Ventures, Evok Innovations, Trafigura, and other investors, Quidnet has explored the technology’s feasibility with CPS and other partners since it was established in 2016. While it has refined the technology with federal backing from the Department of Energy’s HydroWIRES Initiative and the Advanced Research Projects Agency–Energy (ARPA-E) Duration Addition to electricity Storage (DAYS) program, Quidnet has also notably garnered state support from the New York State Energy Research and Development Authority and Emissions Reduction Alberta.

In Texas, the company has test sites in Medina and San Saba Counties. Quidnet is in tandem also working on several pilots. One pilot project in Appalachian Ohio is expected to help alleviate peak system load in PJM Interconnection, while another pilot is under development in rural upstate New York to potentially bolster the regional grid. But Quidnet’s potentially largest project is under development in Brooks, Alberta, where, armed with CA$5 million in funding from the Alberta provincial government, the company is exploring a “multi-gigawatt” geologic energy storage resource.

“Our Ohio, New York, and Alberta wells have enabled us to validate our ability to do geomechanical pumped storage in diverse basins,” Quidnet told POWER when asked about the status of these projects. “Prospective projects in these regions are in earlier stages of our commercial pipeline.”

A Low-Cost Profile

In November 2020, Quidnet CEO Joe Zhou told CPS’s Board of Trustees the technology’s key winning point is its low-cost profile. “It’s really a marriage at the end of the day between pump hydro storage and the oil and gas industry,” he said.

Compared to conventional pumped hydro, which would require sufficient elevation that CPS Energy cannot leverage given San Antonio’s terrain, “the civil scope is much simpler and, therefore, the cost profile is much lower for this form of storage,” Zhou said. Technology validation at an active test well suggested “storage pressures are comparable to the largest pump storage facilities in the country,” he added.

The technology’s economics also offers a “structural cost-advantage with lower per-MW installed costs,” when compared to gas peaking plants and other storage systems, Quidnet says on its website. “Long-range costs are projected at half that of all other leading storage technologies.”

Among its many other advantages over pumped storage hydropower is that GPS modules—of between 1 MW and 10 MW, depending on the resource—can be deployed across diverse geographic areas on small footprints to provide custom grid support. “The energy-storing rock bodies are non-hydrocarbon bearing and found abundantly throughout the world, intersecting with major electricity transmission and distribution hubs,” the company noted. Ten-hour-plus modules can also be grouped, “much like wind turbines—into larger configurations,” the company added.

Finally, the “uncomplicated approach” caters to established federal and state permitting structures, and its simple well construction techniques could allow new facilities to be added to the system in timeframes similar to renewable energy development, the company said. The San Antonio project, for example, already has a well permit granted from the Texas Railroad Commission, and partners have consulted with the Environmental Protection Agency and Texas Commission on Environmental Quality.

CPS Energy Seeking Long-Term Solutions

For CPS Energy, a key project draw is its potential as a new source of “reliable, safe, and resilient service,” said CPS Energy Interim President and CEO Rudy Garza. “New technologies like Quidnet’s GPS energy storage can enhance reliability and enable us to expand our renewable power resources and explore new technologies as we build our path for the future,” he said. “Incorporating Quidnet’s homegrown-Texan energy storage solution allows us to create a cleaner [electricity] supply while supporting our local energy industry workforce and lowering costs for our customers.”

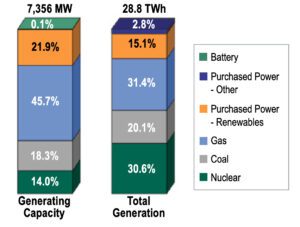

CPS Energy said the project will support its “Flexible Path” Resource Plan, under which the electric and gas company is seeking to reduce its net emissions by 80% by 2040 through a portfolio of “tried and true” technologies and new technologies. Though CPS Energy today still relies heavily on coal and natural gas for its electric sales of around 27.5 TWh, it plans to shutter all its coal plants while integrating new technologies like energy storage and electric vehicles, expanding renewable resources, and adding more programs and services such as energy efficiency and demand response.

By 2040, CPS wants to increase renewables by 127% while decreasing gas- and coal-fired generation by 72% and 61%, respectively. A global request for proposals it issued last year suggests the company is seeking up to 900 MW of solar resources, 50 MW of energy storage, and up to 500 MW of all-source firming capacity.

Reliability is especially crucial for the company, given that it powers electric and natural gas infrastructure for Joint Base San Antonio, a collection of U.S. military installations including Lackland Air Force Base, Randolph Air Force Base, and Fort Sam Houston/Brooke Army Medical Center, it said.

CPS Energy’s decision to proceed with the Quidnet agreement is also notable owing to its plans, for now, to use long-term debt to finance the recovery of purchased power and natural gas fuel costs. The company, notably, suffered elevated purchased power and natural gas fuel costs of an estimated $1 billion following the unprecedented winter power crisis that slammed the Electric Reliability Council of Texas in February 2021.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).