Pressure on U.S. Nuclear Power Could Mount if Sanctions Imposed on Russian Uranium

Russia’s invasion of Ukraine and ensuing sanctions may have a limited immediate impact on the U.S. nuclear industry, despite its reliance on uranium imports. Potential implications over the longer term, however, require urgent action, officials from the Nuclear Energy Institute (NEI) said.

NEI CEO and President Maria Korsnick told reporters at the ongoing CERAWeek by S&P Global conference in Houston on March 9 that the trade group is still evaluating whether President Biden’s March 8 Executive Order to ban the import of Russian oil, liquefied natural gas, and coal to the U.S. will affect the nuclear industry.

While the order does not include uranium, Korsnick said, “that does not mean that it does not affect what we’re doing, and so that’s very much why we’re evaluating it. I would encourage you likewise not to jump to a conclusion that it’s not affected,” she said.

The nuclear industry has reportedly lobbied the White House to continue to allow uranium imports from Russia as a parallel effort to shelve reliance on Russian energy imports gains steam in Congress. Bloomberg on Wednesday reported, citing unnamed sources, that the Biden administration may still be considering imposing sanctions on Russia’s state-owned nuclear fuel and generation giant, Rosatom, though consultations with the nuclear power industry are ongoing.

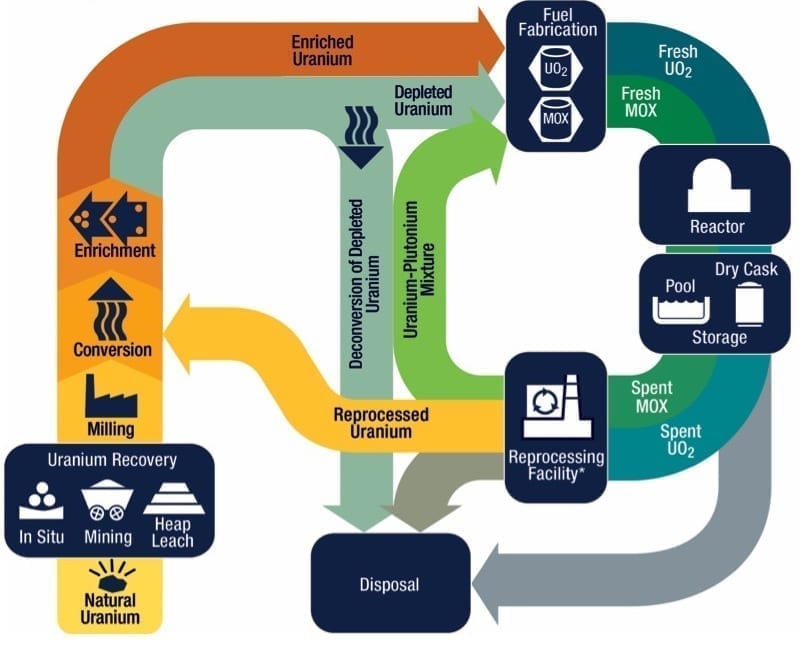

Korsnick, who on Wednesday noted uranium is plentiful across the world, including in Canada and Australia, said discussions in Washington have focused on “the need to invest in the front-end of the fuel supply—and that’s what we need, the conversion and the enrichment.”

Uranium and Enrichment Landscape Precarious

Between 2014 and 2018, the U.S. imported most of its uranium as uranium concentrate, mainly from Australia, Canada, Kazakhstan, and Uzbekistan, with a fraction (0.2%) coming from Russia. However, over that same period, U.S. utilities purchased about 20% of enriched uranium from Russia.

Rosatom, which covers 16.3% of the global nuclear fuel market, supplies nuclear fuel to 73 of the world’s 440 reactors in 13 countries through its subsidiary TENEX. Rosatom fuel company TVEL, which provides fuel to Russia’s nuclear plants, carries out enrichment through a gas centrifuge process. Ukraine’s 15 reactors, which generate about half its power, are all Russian VVER reactors that receive most of their nuclear services and fuel from Russia, although Ukraine has embarked on a fuel diversification program.

According to the Energy Information Administration, 16% of total U.S. “purchases of uranium” came from Russia in 2020. Meanwhile, only one commercial uranium conversion of six worldwide is sited in the U.S.—Honeywell’s plant in Metropolis, Illinois. While the plant has not produced uranium hexafluoride (UF6) since November 2017, Honeywell in February 2021 said it would restart conversion in 2023. The nation’s only commercial enrichment facility is the URENCO USA facility (licensed as Louisiana Energy Services) in Eunice, New Mexico. However, Centrus Energy (formerly USEC) is gearing up to demonstrate production of high-assay low‑enriched uranium (HALEU) this year, using existing U.S.-origin enrichment technology to provide the Department of Energy with up to 600 kilograms of HALEU (in the form of UF6) at the American Centrifuge Plant in Piketon, Ohio.

If sanctions were applied to uranium products, U.S nuclear operators may need to look toward importing enriched uranium from other countries, such as France, Japan, and China, Korsnick said on Wednesday. However, fuel supply is a “long-term play for nuclear,” she noted. “I think people are in good shape relative to fuel supply for that, and I think that gives us time to react,” she said. “There are ways we can increase from the facilities that produce it today. And then, of course, build additional facilities. These are all conversations that are happening, and things that are playing out right now.”

Key Pressures: Time and Cost

How long it will take to get an effective domestic front-end nuclear industry running again remains a concern, however. John Kotek, senior vice president of policy development and public affairs at NEI, told POWER it could take “a few years.” Crucial to these efforts will be a signal from the federal government that provides some incentive for the necessary investment.

“If you look at the types of tools that the federal government and state governments used to create a very strong wind and solar sector in the U.S, they used demand-inducing policies like renewable portfolio standards and production or investment tax credits to give investors confidence that there would be a return at the end of their investment,” he said. “We need to use the same type of thinking to get new enrichment and conversion capability available—not just to the U.S. market, but to the broader set of partners who want to rely on somebody other than the Russians for this material.”

Potential cost implications stemming from a ban on Russian uranium and enrichment, which is today cheaper than other global sources, may also be problematic. But asked about how a shake-up on the fuel supply landscape could affect nuclear power plant economics, in light of the industry’s efforts to remain competitive within cutthroat electricity markets, Kotek said the impact could be “relatively modest.”

Fuel spans several processes, including mining, conversion, enrichment, and then fuel fabrication, he noted. “All told, that’s about 20% of the total cost of nuclear power generation,” Kotek said. “So even if one part of that or a couple parts of that 20% spikes, it’s still relatively modest as compared, to say, natural gas. If prices go up, you see it very directly in the price of gas generation. With nuclear, 80% of the cost falls outside of the fuel areas, so the effects are dampened.”

Kotek acknowledged that anything that drives up costs “is not helpful” to nuclear’s competitiveness, but he said competition is relative to where a plant may be sited. “In the regulated states, you have an ability to absorb that sort of an increase. In the competitive markets, it becomes more of a challenge,” he said.

However, “It’s yet another one of the reasons why we think it’s really important that as we are trying to move toward the increasingly decarbonized energy system, we value nuclear for all it delivers as the largest source of zero-carbon generation in the U.S,” he said. It’s also why effective implementation of initiatives like the Department of Energy’s recently announced civil nuclear credit program and the inclusion of a production tax credit for existing nuclear could play a significant role, he said. “We’re very hopeful that moves forward.”

Potential Jeopardy for HALEU

Potential sanctions, however, could have more severe implications for advanced nuclear fuel. Many advanced nuclear reactor designs, including nine of the 10 designs awarded under the Department of Energy’s (DOE’s) Advanced Reactor Demonstration Program (ARDP), require HALEU, which is a form of uranium fuel enriched up to 20%. HALEU is currently available from only two sources: limited amounts from the DOE via down-blending of existing stockpiles of material and Russia. Both the DOE’s active demonstrations for an X-Energy project in Washington state and the Natrium project in Wyoming, which are slated to begin operations in 2028, will require HALEU.

Think tank Third Way has warned that barring any dramatic near-term actions, “there is essentially no choice for advanced reactor developers but to initially rely upon Russian-supplied HALEU, particularly given the expedited timeframes for their first demonstrations and units.” Reliance on Russian fuel for advanced nuclear poses several inherent risks, including a vulnerability to supply disruption, affect export competitiveness, and unintentional spread of Russian or Chinese influence. “Long-term reliance on Russian and/or Chinese HALEU—particularly if this reliance extends to fuel supply for U.S. advanced reactor exports—could make U.S. industry an unwitting medium for spreading geopolitical influence on behalf of Moscow and Beijing, in that it would also tie other countries to Russian/Chinese supply,” Third Way experts Alan Ahn and Josh Freed argued last year.

For now, it’s clear that Russia’s invasion has halted American-led prospects to install small modular reactors by NuScale, and Westinghouse’s effort to build AP1000 reactors at multiple sites in Ukraine. But over the longer term, the circumstances may prove beneficial to U.S. developers. “Over the longer term, I think what we are going to see is an increased awareness of the importance of energy security, and also the importance of reliable partners when it comes to global energy supply,” Kotek said.

“What we have seen, for example, in the Czech Republic was that they disqualified the Russian and Chinese state-owned nuclear companies from the tender that they intended to issue here in the very near term for new nuclear construction, because of concerns about their reliabilities as partners.” Those issues are also playing out in Poland and other central and eastern European countries, Kotek noted.

According to the NEI, nuclear’s standing will triumph over concerns about safety and security as Russia battles Ukraine for control of its nuclear power plants. Asked whether Russia’s actions at the Zaporizhzhya Nuclear Power Plant would chill nuclear’s trajectory, Korsnick said, “I don’t think it should.”

Nuclear’s “value proposition is basic and it’s fundamental. It’s reliable. It’s carbon-free,” she said. “It’s a wonderful value proposition, not only for the U.S., but for the rest of the world as we decarbonize. What’s important in front of us is not just that we have to decarbonize the electric sector, we have to decarbonize the entire economy. And so, I think it’s really important that we keep our eyes focused on what’s most critical and what’s most important to the globe.”

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).