Wind farmers: Heed the lessons of the merchant gas-power business

I remember how precisely we performed the "pour" when my buddies and I economized and bought beer by the pitcher in college. You had to get the flow just right to maximize the liquid without frothing over. This analogy seems perfect to describe the current state of the U.S. wind power market.

Like most infrastructure businesses, the electric utility industry has a penchant for overestimating the need for new capacity. Three or four years are spent furiously installing supercritical coal-fired boilers, nuclear units, cogeneration and merchant plants, or, most recently, gas-fired gas turbines and combined-cycle facilities. This boom then turns into a drawn-out bust, during which many projects are cancelled and the new capacity that makes it on-line is integrated with the old in the existing infrastructure.

Call it feast or famine, boom and bust, irrational exuberance and post-Enronitis, or whatever you want. Admittedly, part of this phenomenon is not within the industry’s control. Remember how the accident at Three Mile Island helped precipitate a wave of cancellations of nuclear units in the 1980s? Soon it became clear that we didn’t need all that capacity because most of it was not immediately replaced.

Later, in the late 1980s, the industry overbuilt independent power plants. Then came the 1998–2001 irrational exuberance for gas-fired merchant power. Many projects were cancelled, and those that limped to completion didn’t—and still don’t—operate at very high capacity factors because the price of natural gas skyrocketed. Not all of the debacle can be blamed on the fall of Enron, though, or the discrediting (at the time) of electricity trading.

To foster caution and reflection, here are 10 reasons why the wind energy market is beginning to look a little frothy, like the premillennium merchant gas-fired market. I also note key differences between the two situations. At the end are some perspectives and actions that industry players may wish to consider.

In an era of high oil and natural gas prices, insecurity about terrorism, and rural economic blight, it is important that renewable energy succeed. Wind is the closest thing we have to "utility-scale" renewable energy, so its penetration is both vital to the electricity industry and to the public if wind is to get what it appears to want.

Similarity #1: One dominant supplier

By the late 1990s, one domestic supplier of large turbines, holding 60% to 75% market share, had come to dominate U.S. gas-fired plant contracts. The other major U.S. supplier ran a distant second. Two European suppliers that had entered the market earlier fought for the crumbs. Consolidation occurred, and by the time of the bust, one of the European companies was essentially in receivership.

Today, one domestic supplier (coincidentally, the same company that dominated the large gas turbine business) enjoys a 60% share of the U.S. wind turbine market, based on 2005 figures reported by a Danish consulting firm in a proprietary study. This supplier entered the market through a key acquisition in early 2002 and rose to dominance in only a few years. In the process, it knocked off the top dog, a European whose U.S. market share is now less than 20%, according to 2005 data.

Similarity #2: A long order queue

Remember when developers and utilities were waiting in line for large gas turbines? At the time, customers were "encouraged" to accept long-term service agreements (LTSAs), which were richly rewarding to suppliers and enabled the monetization of long-term service, component replacements, and repair work over a five- or 10-year period.

Today, wind farm developers and many others are saying that the market is starved for turbines. Even more significantly, the availability of turbines is controlled both by the dominant suppliers and the largest developers, which are now "long" on turbines. Faced with burgeoning demand and limited supply, project developers have no choice but to turn to new market entrants. In the meantime, the market leaders can exert control over both the project pipeline and the turbine supply pipeline. The intent of recent acquisitions, for example, has been to capitalize on complementarity between companies with turbines and companies with projects.

Similarity #3: Necessity breeds invention

Demands on schedule, performance, and project financials drive developers of power projects of any type to embrace advanced technology. In the case of gas turbines, the advanced F-class machines—with substantially higher firing temperatures, greater efficiencies, and lower emissions than competing machines—became attractive because of the incremental financial gains they promised, at least on paper (the pro forma).

Responding to their own pressures, regulators often ratcheted down emissions levels, especially for NOx, and developers were happy to oblige, to get permitting off the critical path. Meanwhile, turbine vendors came up with machines that were said to meet the new limits. This was described as a vicious circle dance among developers, financiers, regulators, and equipment suppliers. Ultimately, plants began to be permitted with NOx limits as low as 9 ppm—with no downstream cleanup!

By the mid-1990s, advanced turbines were being rushed into commercial operation without adequate testing and demonstration. In the 1996–1997 time frame, many of these machines were back on the "repair rack" to fix design or structural deficiencies.

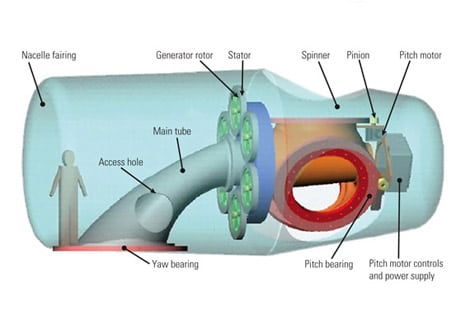

Wind turbine technology may be in the midst of a similar phase. Suppliers relatively new to the U.S. market, or with unique designs, are beginning to sell substantial numbers of machines. One supplier, with an innovative design consisting of multiple gears and permanent magnet generators (Figure 1), recently received orders for hundreds of this turbine. The confidence being expressed by the market in this design is rather remarkable, given that it is based on a single machine being demonstrated in Wyoming for less than two years.

1. Capacity from complexity. This multiple generator–drive machine, a significant design departure, has been ordered by the hundreds for commercial projects. It puts out two-thirds more power than the turbine currently dominating the U.S. market. Source: NREL Report No. CP-500-31178 (January 2002).

In general, turbine blades are getting larger, with more complex, composite construction materials; machines have higher output; and towers are getting taller. New composite materials are reducing weight but not strength, designs are accommodating "issues" with the gearbox and drive train, and new suppliers are gaining a foothold in the market. The fact that the new machines are both larger and more efficient at capturing wind energy means fewer of them are needed for a given plant rating. That makes the financials look a lot better in many, though not all, cases.

A business aspect peculiar to wind, however, is that patent issues involving variable-speed design have kept several prominent European suppliers from entering the U.S. market. Case in point: The second leading supplier of wind turbines worldwide in 2005, a German firm, has no significant sales in the U.S. Recently, the affected suppliers have either settled with the patent holder or found ways around the issue.

As a result, although the U.S. wind power market is still short of turbines, at least five suppliers are, or soon could be bidding on near-term projects. The lesson to be learned from the late 1990s large gas turbine situation is this: Competition is healthy until it leads to price wars, which destroy the delicate balance between first costs and the costs of being on the repair rack, product recalls, design deficiencies, and other surprises. In the U.S. wind power market, the situation could quickly shift from shortage to glut.

Similarity #4: Project risk

From a financial perspective, both wind and gas-fired projects embody a primary source of risk that is difficult to mitigate. Gas-fired projects suffer from volatile fuel prices. Certainly, the stakeholders in gas-fired projects of the 1990s thought they were hedging fuel risk. But it quickly became clear, notably over the last three years, that they weren’t hedging enough.

Wind energy projects, similarly, suffer from volatile "fuel" supply—day to day, month to month, and season to season. In essence, a wind project trades premium fuel price volatility and financial impact for variability in output and its financial impact. The potential discrepancy between the predicted and actual energy output of a wind farm is significant. Some reports indicate that errors of 20% to 50% in day-ahead production volumes are common.

Similarity #5: State-by-state patterns

There has been a shift of activity in the U.S. wind power market from the West to the Northeast and Midwest. In particular, New York, Pennsylvania, and Illinois are instituting aggressive wind and renewable energy development programs. The largest single wind project currently being built in the U.S. is in Illinois. California, of course, continues to be a hotbed of activity, along with Texas. Both are vying for the top of the mountain, so to speak, in wind energy development.

What do all these states have in common? They were in the vanguard of retail electricity deregulation, the result of which was large additions of gas-fired merchant capacity. They also generally have higher electricity rates than other states, especially in the population centers. The convergence of high energy costs, large fractions of gas-fired capacity in the mix, the end of moratoriums on electricity rate increases as part of restructuring, and capital needs for infrastructure expansion programs has led to sizable rate increases in these states (and, for that matter, around the country). It remains to be seen how long escalating rates can coexist with the development of relatively high-cost capacity such as wind power.

Similarity #6: O&M issues

The average wind energy project has a capacity factor of 35% or less. This magnifies the negative effect of any outage, planned or unplanned, on project financials. At the annual American Wind Energy Association conference in Pittsburgh in May of this year, more than one Wall Street analyst reported that the industry’s top issue, after supply chain concerns, is the quality and reliability of turbines.

By now you shouldn’t be surprised that this brings to my mind the worldwide spate of F-class gas turbine recalls circa 1995 to 1997, following the catastrophic failure of several machines. Thankfully, history hasn’t repeated itself for onshore wind turbines. But offshore units in Europe have undergone enough across-the-board repair and modification to constitute a recall.

One organization staying on top of the O&M issues is Sandia National Laboratories. In March 2006, Sandia issued a report titled, "Wind Turbine Reliability: Understanding and Minimizing Wind Turbine Operation and Maintenance Costs." The labs followed up with a workshop on the subject in October.

One key passage in the report reads as follows:

- In the late 1990s, manufacturers began to introduce wind turbines in much larger sizes. While the larger kW size machines are being produced by many manufacturers, the new "MW" size machines are being installed in significant numbers. Most major vendors offer turbines in the 1.5 MW size range and are actively developing and installing first versions of 2 MW and 3 MW machines. Most of these larger machines employ technologies that are sufficiently new that the validity of extrapolating data from the ‘standard" machines of the 1990s is questionable. An example of the dramatic difference in technology is the trend toward direct-drive turbines that eliminate the gearbox entirely and employ a low-speed large diameter synchronous generator.

As gas turbines were scaled up, many expected their O&M costs to decline because the new units were extrapolations of current designs. Relative O&M costs do fall after a technology matures via production experience, but the early years are a different story. In addition, the larger size of the machines means that more capacity fails to generate (more) revenue whenever one goes down.

The Sandia report goes on to state that the track record of upsized machines does not justify downward extrapolation of O&M costs. It references data from the German insurance industry, which estimates the incremental O&M cost of a megawatt-class machine at 1.0 cents/kWh, or $25,000 per year per machine.

Here’s another passage from the Sandia report that harkens back to the heyday of gas turbine development: "There exist large fleets of similar model turbines but in many cases detailed changes and revisions have been implemented, often in response to serial defects." Those who remember the parade of engineering solutions to problems with large gas turbines surely will get a sense of déjà vu from this statement.

Similarity #7: Transitioning owner/operators

Over the past five years, every surviving merchant gas-fired power producer had to evolve from being primarily a project development company to being an owner/operator of assets. A project’s initial operating years typically were covered by LTSAs that made the gas turbine vendor largely responsible for O&M performance—for a price, of course. Later, facilities learned to at least break even by reducing annual production costs, including using non-OEM repairs and replacement components.

Over the next few years, wind farm owner/operators will have to adapt to wind capacity’s increasing presence on most transmission grids. On more systems, that penetration will grow from insignificant to noticeable. Some describe this as a maturing of the industry: Wind turbine-generators will increasingly be required to behave like other kinds of power plants. As penetration grows, so too does wind’s impact on the grid with respect to voltage regulation, ancillary services, and other grid requirements.

Similarity #8: Nervous insurers

In the mid-1990s, insurance companies became vocal and engaged about advanced gas turbine technology. Industry meetings focused specifically on this issue were organized as some insurers threatened to exit the sector or raise premiums to a degree that created the same result.

In some respects, the LTSA was a response both to the inadequate performance of early machines and persistent claims for damages and business interruption. Now it seems apparent, based on articles in wind energy trade publications, that insurance firms are becoming worried about advanced wind turbine technology.

Similarity #9: Financial engineering

You could spend all night over multiple pitchers of beer arguing whether the investor class drove the gas-power merchant business to its doom, whether overenthusiastic developers ignored the warning signs, or whether inexperienced electric utilities got in over their heads trying to become growth stocks rather than value plays. One thing is certain, however: Wall Street played a big role in the scene.

With the wind business, it already seems like déjà vu all over again. A top Wall Street firm has become a major and direct player in wind energy by acquiring two prominent developers. An international investment group has taken a huge stake in U.S. wind and is evolving into a top-five player on the development side. Another major Wall Street player recently announced a commitment of $250 million to develop wind. European investors have been prominent on the project finance side of the business. And, of course, the largest equipment supplier also has a hand in the game as a financial services company.

What is the relevance of this? For one thing, financial players usually are not in the business of owning and operating power generation facilities over the life of the plant. This makes them different from utilities, which generally must take a long-term, life-cycle view of their assets.

Similarity #10: The cure du jour

This last similarity is more amorphous but still pertinent. In the 1990s, the industry seemed to converge on the belief that gas-fired independent and merchant generation was the one option that could satisfy all the stakeholders in virtually every region of the country:

- Local communities wanted the tax base and the economic development but also an unobtrusive power station. The low physical profile of a combined-cycle plant met that need.

- Environmentalists wanted the lowest emissions—no sulfur or particulates and minimal NOx. They got their wish.

- Investors wanted short project schedules, low capital costs, and high fuel conversion efficiency. Advanced gas turbines based on the more-efficient Brayton cycle (compared with the Rankine cycle), and taking advantage of aero-derivative technology, filled the bill.

- Owner/operators wanted simplified plant designs, modularity, and strong vendor support because they intended to run lean and mean. Suppliers delivered.

- Natural gas companies, struggling at the time to monetize their gas bubble assets over long periods of time, wanted to sell their product in high volumes and play the so-called spark spread (the ratio of gas to electricity prices at any given time). They, too, were satisfied.

Not surprisingly, gas-fired capacity was embraced as the cure for all that ailed the electricity business, so the business climbed on the back of gas turbine technology. What was recognized, but not necessarily managed well, was that the ride was made bumpy by necessary sacrifices in key areas of turbine performance. For example, the materials needed to withstand high firing and turbine inlet temperatures pushed the envelope of metallurgy. This subsequently led to reliability and durability issues. What’s more, raising firing temperatures to increase efficiency and specific power output was in direct opposition to another goal: lower NOx emissions. Dry low-NOx combustors and single-digit NOx limits essentially limited a site’s fuel options not only to natural gas but also to gas with tight specifications. Fuel flexibility became a casualty of the move to single-digit NOx.

Today, it seems clear that wind turbine blades are straining the possibilities of materials technology, especially for such heavy components hanging several hundred feet in the air. New power electronics components are being added to address grid interface issues. Wholesale new designs, such as direct-drive machines, are being introduced to avoid persistent difficulties with "old technology" like gearboxes (Figure 2).

2. Bigger, faster, cheaper, better. The wind turbines being specified for projects in development today represent a decade’s worth of cumulative design and technology innovations. Source: U.S. DOE

It’s easy to see how wind generation could assume the mantle of the industry’s cure du jour. Wind could even be considered a panacea: It has no emissions (including CO2), it helps farmers and rural communities, it burns no costly fossil fuel of domestic or foreign provenance, it qualifies for valuable renewable energy credits, it can be brought on-line quickly, and it appeals to the investment community. Although wind energy may not achieve the same capacity addition levels as gas-fired power in bygone years, it certainly satisfies many important constituencies today, and undoubtedly will in the near future as well.

Distinctions remain

Of course, the analogy between the wind energy and gas-fired power businesses can only be taken so far. Distinctions abound. Following are three.

First, there were really only four suppliers of large, F-class gas turbines to the U.S. market in the 1990s. A merger reduced that number to three by the latter part of the decade, but then a Japanese supplier entered with a new design. Today, there are between a half dozen and a dozen potential suppliers of wind turbines in the 2- to 3-MW size range. How many of them can truly compete in the U.S. is another issue.

Second, the U.S. wind industry is subsidized by the federal production tax credit and renewable portfolio standards that have been implemented to varying degrees in more than 20 states.

Third, a gas-fired plant really can operate like a traditional central power station with respect both to the grid and to a utility’s resource portfolio. No one is talking about wind facilities with capacity factors higher than 40%. Without energy storage, wind is an intermittent energy and electricity source. Building transmission infrastructure is difficult enough under any circumstances today, but in remote areas is even harder to justify for a resource that, at best, will be productive only one-third of the time.

Heeding the lessons

What are the takeaways from this analogy? How do we prevent a repeat of the gas-fired merchant power debacle of 2002? Here are some issues to reflect on.

Get organized. Owner/operators of gas turbine and combined-cycle plants participate in user groups specific to their type of machines. Some are organized and administered by turbine vendors, others by user boards or technical associations. Perhaps wind farm owner/operators and developers should organize their own users" group now, before O&M issues with some of the new machines get out of hand. Finding out more about the work being done at Sandia would be a good first step in that direction.

Collect and use data. Many gas-turbine user sites share O&M and performance data that are filtered and made "generic" (for general trends) by an independent third party. That is, the data are collected, analyzed, and reported back to the facilities as "fleet" data. Building this capability into projects from the get-go might be a way to ensure that technology issues are analyzed and solved through data-driven processes. EPRI’s Wind Turbine Verification Program and the Utility Wind Integration Group (UWIG) could provide a framework for such activities on a broad industry scale. In the meeting notes associated with the workshop referenced earlier and available on the Web, Sandia notes that the American Wind Energy Association and UWIG may be forming user groups.

Cooperate. Ten suppliers beating each other up isn’t healthy for anyone. Developers and owner/operators should cooperate through industry-based groups to qualify and fully demonstrate new turbine designs. By the vendors" admission, gas-turbine technology development often took place with initial "commercial" units, not through traditional technology demonstrations.

Be wary of new technology creeping into machines. For example, the industry is currently focused on the premature failure or unreliability of mechanical components such as gearboxes and bearings. However, the new power electronics components that are being added to manage the grid interface may be the new frontier with respect to O&M and reliability (Figure 3). According to an article in the Spring 2006 EPRI Journal, power electronic controllers suitable for large, more complex generator designs provide power output smoothing and support variable-speed operation. Although falling costs will make these new components viable, there’s precious little about their long-term performance to be found in the literature.

3. AC/DC plus. Power electronics packages for controlling a wind turbine’s speed and output and interfacing it to a grid are becoming more sophisticated. Two examples are the doubly fed generator and power converter for a variable speed wind turbine (top) and full-conversion variable-speed generator and converter system (bottom). Source: California Energy Commission report CEC-500-2006-050 (May 2006).

Keep engineering ahead of financial engineering. The reality of today’s power generation business is that it is driven more by private capital—either through utility company equities and bonds and private equity investment pools—than by the regulated rate of return construct. Engineers need to maintain oversight of the financial pro forma—vigilantly, not as a token gesture. There can be significant differences between theoretical and actual machine performance and between forecasted and actual wind energy profiles. Making sure that adequate reserves are available for unexpected O&M events is a must

.

Consider adding energy storage to your wind farm. A variety of storage schemes are available to manage wind energy’s interface with the grid. Having energy storage makes production more predictable and thus more attractive to grid operators, bilateral contracts, and others. With storage, you could even imagine selling a fuel- and CO2-free source of electricity into peak electricity markets as a structured product.

As stated at the top of this article, it would be a shame if wind power ends up getting a black eye from the same irrational exuberance that took down the gas-fired power business. Staying alert to the dangers of such exuberance is the best way to avoid its nasty consequences.

—Jason Makansi is president of Pearl Street Inc., a technology deployment consulting firm based in St. Louis. He can be reached at 314-495-4545 or [email protected].