Whatever Happened to Fuel Cells?

Hydrogen-powered fuel cells were supposed to be the “Next Big Thing” a decade ago, but the hype ran well ahead of the market and technology. Yet some quiet advances and steady work have the sector on the brink of significant impact—if some promising tech bears fruit.

Not so long along, the world appeared to be on the cusp of a fuel-cell revolution. Gas prices were high and battery technology had not yet matured enough for realistic electric vehicles. Fueled by hydrogen, fuel cell–powered cars were poised to seize a market niche, and cheap, clean power would be available for numerous other applications.

That was the idea, anyway. In 2017, three fuel-cell vehicle models—the Honda Clarity Fuel Cell, the Hyundai Tucson Fuel Cell, and the Toyota Mirai—are now commercially available, but fueling infrastructure remains in its infancy. Only a few dozen hydrogen fueling stations exist, mostly in California, which is projected to have about 100 of them by 2020. Most projections for market share suggest fuel-cell vehicles will remain a novelty for now.

Over in the power sector, things are a bit different. Fuel cells remain a tiny share of total generation, but that share is growing. The largest fuel-cell power plants now reach into the tens of megawatts.

What sets them apart from the vehicle sector and what has pushed the power sector further along is the fuel—these projects are powered not by hydrogen but by abundant supplies of cheap natural gas. Carried along with gas turbine–based plants in the recent glut of shale gas, fuel cells are drawing attention as a cleaner, more efficient alternative. Yet even there, the road has not been without its bumps.

The Limping Fuel Cell Business

As a business proposition, fuel cells have so far failed to live up to their technological promise. Developers and entrepreneurs have been able to dazzle venture capitalists and attract conventional investors, but thus far none have been able to realize sustainable profits.

In its 2016 review of the industry, E4tech said, “The fuel cell industry remains a challenging place. While some companies and technologies inch further up the mountain face towards the summit of commercial achievement, others hang in crevasses or have been engulfed by avalanches.”

A good case study, outlined by GreenTech Media, is ClearEdge, an Oregon company founded in 2006. ClearEdge was able to raise some $136 million from Kohlberg Ventures, Applied Ventures, Big Basin Partners, and Southern California Gas Co. ClearEdge’s strategy was to develop proton exchange membrane (PEM) fuel cells for combined-heat-and-power applications at hotels, apartment buildings, and schools. They were developing modular systems ranging from 5 kW to 200 kW.

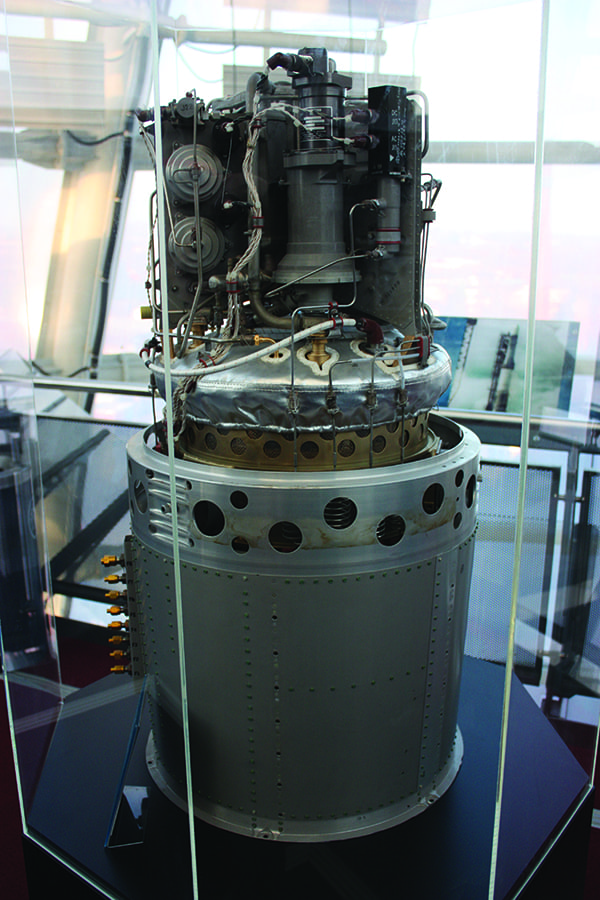

In late 2012, ClearEdge acquired United Technologies Corp.’s fuel cell business. UTC Power was the most experienced fuel cell company in the U.S., having developed the fuel cells for NASA’s Apollo program and the space shuttle. With the acquisition, ClearEdge abandoned PEM cells and switched to UTC’s phosphoric acid systems in the 5-kW to 400-kW range.

It didn’t go so well. In April 2014, ClearEdge filed for bankruptcy. It was bought by South Korea’s Doosan conglomerate and renamed Doosan Fuel Cell, headquartered in South Windsor, Conn., in UTC’s former offices. Its financial results are not publicly available, although it is selling products, particularly in Asia.

Four other companies are major players in the U.S. fuel cell business. Three are publicly traded on the NASDAQ exchange and the fourth is reported to be eying an initial public offering.

|

| 1. Power box. The Dominion Bridgeport Fuel Cell facility in Connecticut is powered by five FuelCell Energy power plants. The 14.9-MW project came online at the end of 2013. Courtesy: FuelCell Energy |

FuelCell Energy (FCE). Danbury, Conn.–based FCE has been around since 1969, focused on large, multi-megawatt utility-scale systems. Thus far, FCE appears to have deployed the most fuel cell–based power plants (Figure 1), with the largest being a 59-MW system in South Korea. The company in March reported its first quarter 2017 financial results, with total revenues of $17 million, compared to $35.5 million in the first quarter of 2016. That worked out to a loss for shareholders of $0.39/share, compared to $0.48/share loss in the 2016 first quarter.

The company had anticipated getting selected in a Connecticut bid last fall for 700 MW of clean technology resources. No fuel cell bidders succeeded in the state-run auction. Hartford Courant columnist Dan Haar commented, “At Danbury-based FuelCell Energy, the sting was especially sharp, and contributed to a round of layoffs.”

The company’s stock has been trading around $1.50 per share. If the shares fall below $1, NASDAQ could delist the stock.

Plug Power. Based in Latham, N.Y., Plug Power was founded in 1997 as a joint venture of Detroit’s DTE Energy and Mechanical Technology Inc. The company went public in 2002, specializing in indoor forklifts. It is now also selling fuel-cell engines designed for electric delivery vehicles and for ground-based airport vehicles. In the fourth quarter of 2016, PlugPower lost $0.11/share on revenue of $32.6 million. That compares to 2015 fourth quarter revenue of $38.4 million (a loss of $0.14/share). The company’s stock in mid-March was trading at $1.01/share.

Ballard Power Systems. Ballard is based in Vancouver, Canada, but has a large U.S. presence. It is listed on both the Toronto Stock Exchange and NASDAQ. The company was founded in 1979 as Ballard Research Inc. to conduct research and development of lithium batteries. In 1989, the company switched its focus to PEM fuel cells for heavy-duty vehicles such as bus and tram applications, portable power, and material handling.

Ballard reported a fourth quarter 2016 loss of $1.1 million ($0.01/share) on revenue of $30.7 million, compared to fourth quarter 2015 revenue of $20 million and a $1.4 million loss (also $0.01/share). Ballard’s stock has been trading at around $2/share.

Bloom Energy. Bloom is perhaps the most intriguing of the U.S. fuel cell players. Founded by K.R. Sridhar in 2002, the Sunnyvale, Calif., firm has been able to tap into Silicon Valley’s rich vein of venture capital. The Wall Street Journal reported that the company was able to raise $1.2 billion in venture capital. Chief among the early investors was John Doer of the legendary firm Kleiner Perkins Caufield & Byers. It was the first venture into energy for Kleiner Perkins.

Bloom sells stationary solid-oxide fuel cell systems for commercial and industrial distributed generation (Figure 2). In January, IKEA announced it had completed installing its fourth “Bloom Box” at its store in San Diego, putting it on track to generate a total of 1.5 MW of power from Bloom’s fuel cells. The 200-kW system in San Diego will work together with an existing 252-kW solar array to supply most of the power for the 200,000-square-foot store.

The Journal reported that Bloom had a value of $2.9 billion in 2011, and a board member predicted that the company would file for an initial public offering (IPO) by 2014. That didn’t happen. Last October, the newspaper reported, “Bloom Energy, Inc., a once-ballyhooed alternative energy startup that has raised $1.2 billion, is in confidential registration with the U.S. Securities and Exchange Commission [SEC] for an IPO, according to people familiar with the matter.”

That suggests that the bloom may be off on Bloom Energy’s value. The report said the company has filed under the federal “Jumpstart our Business Startups Act,” which “allows companies with less than $1 billion in revenue to register privately with the SEC.” Bloom Energy’s financial performance is not public.

The Promising Fuel Cell Tech

The basic technology behind fuel cells has actually been around for a long time (see sidebar), and this isn’t the first time it’s been hailed as the future of energy. Yet despite hiccups in multiple balance sheets, there remains considerable promise to fuel cells for utility-scale generation. One of the most interesting possibilities is the use of fuel cells for carbon capture and storage (CCS).

In mid-2016, ExxonMobil shook up the fuel cell world by announcing that it was expanding its previously private cooperation with FCE to explore the use of the latter’s technology to capture carbon dioxide (CO2) from natural gas–plant flue gas. What sets this approach apart is that—if it works—rather than being a parasitic drain on the plant, it would actually generate additional power.

Normally in FCE’s molten carbonate fuel cells, methane is reformed in the cell anode to create CO2 and hydrogen, which is then used to generate electricity by combining with oxygen from ambient air to create an electric current and exhaust streams of water vapor and CO2. A carbon-capture fuel cell would still be powered by methane, but by using flue gas instead of ambient air, the chemical reactions in the cell can concentrate up to 90% of the incoming CO2, which flows with the CO2 generated in the reforming process into the normal exhaust stream, where it can easily be separated from the water vapor. According to FCE, the power output is larger than the parasitic drain from previous CCS technologies.

In October, FCE and ExxonMobil announced that they were deploying a pilot test at Southern Co.’s Plant Barry in Alabama to gather data for the development of a large-scale test using flue gas from both coal and natural gas exhaust streams. The Department of Energy, which has already been supporting FCE’s research into coal-plant CCS, is also a partner in the project. That announcement drew additional attention, with other companies in the U.S. and Canada reaching out to FCE about possible CCS applications, not just in power generation but additional fields such as oil and gas processing, cement manufacturing, and steel mills.

According to Tony Leo, FCE’s vice president of applications and advanced technologies who spoke to POWER in March, FCE and ExxonMobil will be working on the initial testing and engineering for the next nine to 12 months, with an aim of beginning construction in 2018 and starting up in late 2018 or 2019. Leo said the approach does not vary that much whether coal or natural gas flue gas is used.

“Because there is so much cleanup of the flue gas in a modern coal plant, the primary differences are just that the coal flue gas is at ambient temperature but has a higher CO2 concentration, which make it easier to capture,” he said. “But because our fuel cell is a high-temperature system, the hotter flue gas from a gas turbine means we can capture thermal energy from it. So there are pluses and minuses for both.”

ExxonMobil has not been shy about their enthusiasm for the partnership. Vijay Swarup, vice president for research and development, called the technology a “game changer” for CCS when it was first announced. As a sign of how seriously the company is taking things, new CEO Darren Woods called out the project as one of his priorities for the company’s future in a February 23 blog post. “ExxonMobil is investing heavily in CCS, including research in a novel technology that uses fuel cells that could make CCS more affordable and expand its use.”

A Path to Profits?

Fuel cells remain a relatively expensive means of generating power, and repeated stumbles by some fuel-cell companies make it clear the sector is still in search of a profitable niche. Could it be CCS? Thus far, no other CCS technology comes close to offering what fuel cells could, with all other approaches being parasitic drains—sometimes very large ones—on generation. If FCE and ExxonMobil can make it work cost-effectively, CCS could be the “killer app” fuel cells have been seeking for decades. ■

—Thomas W. Overton, JD is a POWER associate editor and Kennedy Maize is a long-time energy journalist and frequent contributor to POWER.