Europe Rebuilds Grid to Accommodate Green Energy Swell

A flood of renewable capacity in the European Union is forcing member countries to consider grid upgrades that offer a more substantial power supply management role to distribution system operators.

With the final numbers now in, European grid operators and regulators report that almost 90% of all new power coming online in the European Union (EU) last year came from renewable sources. This trend is anything but over: Of the 24.5 GW of new capacity built across the EU in 2016, 21.1 GW—or 86%—was from wind, solar, biomass, and hydro, eclipsing the previous record of 79% in 2014.

Also, for the first time, wind farms now account for more than half of installed capacity in the region, according to data from trade group WindEurope. Wind energy has now also overtaken coal as the EU’s second largest source of power capacity after natural gas—though due to the technology’s intermittent nature, coal still meets more of the bloc’s actual electricity demand. Gas, because of its expense, remains primarily as a back up to maintain grid integrity.

Not surprisingly, Germany installed the most new wind capacity in 2016. However, France, the Netherlands, Finland, Ireland, and Lithuania all set new records for wind farm installations too. Although total capacity added was 3% lower than in 2015, a surge in offshore wind farms—which are twice as expensive as those built on land—saw investment from nearly every European country (including in Britain, which has opted to leave the EU), hitting a record €27.5 billion.

Integrating Renewables

With renewables booming, one of the biggest challenges for European distribution systems operators (DSOs) is integrating all these new intermittent sources that are coming online, which often flood into existing grid systems. According to the European Commission (EC), to keep up the pace with the estimated renewable expansion, €400 billion worth of new distribution network investments will be needed across Europe by 2020.

Going forward, if electric vehicles catch on in Europe (so far they have not), even more complexity could be added to the situation. Also challenging the status quo: As the price of solar continues to fall and small-scale installs remain popular, increasing amounts of “prosumers” have also come into the market.

These developments are birthing new, innovative, tech-heavy smart meters and smart grids, which are now being built across Europe. Throughout the region, the distribution grid will have to rapidly adapt as the wind gush is upending how energy needs to flow.

Overall, integration of decentralized sources along with robust demand-side management/response may allow DSOs to become central platforms for the energy transition by coordinating between energy producers and consumers—attempting to play something of a neutral referee. DSOs have to straddle the boundaries between existing and emerging fields, particularly flexibility, energy storage, data handling, and analysis, providing real-time information as well as helping to analyze where markets are heading—all, perhaps, while subtly helping involved parties move in concert.

A Flurry of Mergers and Acquisitions

Over the next three years, many of Europe’s top utilities are planning to invest tens of billions of euros to catch up with the green energy revolution. One simple growth path is through acquisitions. This is driving a flurry of takeovers by tech and engineering firms of niche, smart-energy innovators, according to reports by Reuters and other news organizations.

“Everywhere in the supply chain of power there is disruption going on,” said Bruce Jenkyn-Jones, co-head of listed equities at Impax Asset Management, which focuses on investments in environmental markets and resource efficiency.

The massive volume of renewables coming online has translated into a need for intelligent information technology (IT) systems that can balance out demand and supply swings while meeting energy and carbon emissions targets. Industrial and technology providers like Siemens, ABB, General Electric (GE), and others have become key players in this transformation, often working in close partnership with grid developers and operators to manage the grid’s evolution.

Merger and acquisition activity is also moving forward in storage and smart meter providers, both of which are key sectors in securing access to customers and, more importantly, their data, to help the utilities tailor their power purchases and save costs. According to Reuters, three major German meter makers—Techem, Ista, and Qundis—are up for sale, and in France, energy conglomerate Total recently purchased battery maker Saft Groupe for €950 million.

Across the pond, Oracle took over Opower, a maker of utility software, in a bid to reap key markets, especially emerging European ones. Other niche players being showcased include U.S. smart meter maker Itron, which relies on Europe for more than a third of its sales.

Utilities Prioritize Network Upgrades

Together, major European utilities may spend more than €40 billion over the next three years to upgrade their networks, according to ongoing investment plans. This includes replacing old cables, buying new smart meters, and putting new IT in place. These investments follow almost a decade of steep losses for major power producers like E.ON and RWE, which hemorrhaged many billions of euros in value as their fossil fuel systems were marginalized by increasingly less-expensive renewables.

Also in France, national utility EDF is moving quickly to install smart meters as that nation looks to increase renewable systems. The country’s future, however, is clouded by upcoming elections that could change its energy direction back towards nuclear. But if a left-leaning coalition government comes into office, then renewables will likely continue to grow there as well.

Goldman Sachs estimates power producers might invest more than €60 billion by 2025 to digitalize their grids. In Europe, big conglomerates, including ABB and Siemens, are so far seen as the leading integrated providers of smart grid technology and hardware, simply because they already cover a wide range of sectors, including IT.

“Sometimes it is hard to draw the line between IT and industrials. A company like Siemens is a bit of both,” Frederic Fayolle, senior fund manager at Deutsche Asset Management, said. GE in November bought Bit Stew Systems and Wise.io to expand its platform for industrial internet applications, which connect big machines such as power plants to databases and analytical software.

Utilities, however, will likely stay on the sidelines rather than become developers themselves. “I doubt that a utility can compete with Siemens, GE, nor with Google and Apple,” said Oskar Tijs, senior investment analyst at NN Investment Partners. “On the grid side, the utilities will be mostly clients of technology companies.”

New Technology, New Partnerships: E.ON and Siemens

Meanwhile, a partnership between E.ON and Siemens is breaking new ground as it develops smart metering technology in Germany. The collaboration forms part of E.ON and Siemens’ efforts to contribute towards Germany’s plan to replace, process, and systemically convert a large numbers of meters. Additionally, Siemens is providing its smart grid platform EnergyIP for integration with E.ON’s existing EniM program.

According to Siemens, the integration will allow E.ON network operators ease and optimal integration of smart metering infrastructure into IT systems to allow meter data acquisition for improved grid management and customer billing. “By integrating EnergyIP into our systems, we will be able to offer our customers the best possible advice and support with regard to the smart meter rollout,” said Paul-Vincent Abs, metering managing director at E.ON.

Looking ahead, “with implementation of our EnergyIP smart grid application platform, E.ON Metering is prepared for future rollout scenarios as a metering point operator and, when it comes, to smart meter gateway administration,” said Ute Redecker, head of the Siemens Digital Grid business unit in Germany. The integration will allow the analytics application to utilize various big data options for administering smart meter gateways and meter data processing for external market participants on the German market.

Siemens hopes the development will yield a rich treasure of finely granulated data for functionalities including energy theft and overloaded distribution equipment detections through grid load analysis, grid incident analysis, and end-customer consumption load analysis. In other words, Siemens will have a clear insight not only into E.ON’s grid, but a much better platform on which to build going forward, as other grid operators tackle the demands of a renewable energy backbone. The inclusion of the big data option will also allow for the creation of load forecasts for different levels in the distribution grid as well as an analysis of distributed energy resources.

EU Steps Up Funding for New Energy Infrastructure

In February, the EC announced that it would fund almost half a billion euros in selected power, smart grid, and gas energy infrastructure projects through the Connecting Europe Facility, the EU’s funding scheme for infrastructure. An ongoing project—valued at a total €5.35 billion—has been allocated to trans-European energy infrastructure between 2014 and 2020. This year, more than a third of the selected projects are in the energy sector, winning support of €176 million.

Another EC–funded project is a €40.25 million investment in Tennet’s “SuedLink” smart grid system. The project is planned to connect wind power generated in breezy northern Germany with consumer and industrial centers in the nation’s economically booming south. To do this and get buy-in from conservatives in Bavaria annoyed by the “unsightliness” of so many new wind towers, the project will require over 700 kilometers of new, buried underground, high-voltage cables—the first system of its kind on such a large scale. Despite everything else Germany has done, this represents the nation’s largest energy infrastructure project to date.

One of the challenges the nation faces is that Germany has an ambitious objective: to get 80% of its power supply from renewables by mid-century. To do that, not only do existing power grids have to be upgraded, but also political compromises have to be made. SuedLink satisfies what has been something of an imbroglio that has gridlocked future renewable development in the nation.

The north has offshore wind, but the south has the load that needs it. Sitting in between have been a lot of folks already shocked by the transformation of Germany’s landscape to accommodate the Energiewende. New transmission lines across conservative Bavaria have long been politically unpopular and local opposition has been a serious bottleneck.

German energy companies are pouring resources into digitalization across the entire value chain of the industry, writes Bernward Janzing in the Handelsblatt, a German language business newspaper. Both old, established companies and new, creative start-ups are jumping on board, he writes. “Digitalisation is one of the biggest topics in the energy industry,” Janzing quoted Stefan Kapferer, head of the German Association of Energy and Water Industries, as saying.

Interflex: Demonstrating a Grid Revolution

Another new initiative announced this year, again with key participation by E.ON, is the new European smart grid project, InterFlex, which aims to explore new ways of using various forms of flexibilities to optimize electric power systems on a local scale.

Coordinated by the University of Aachen, the project focuses on the interoperability of systems, the replicability of solutions, and on the possible resulting business models. Twenty industrial partners, including utilities, manufacturers, and research centers, are involved in the project, which has a budget of €23 million and seeks to apply smart grid technologies at an industrial scale to achieve a high penetration of renewables.

Part of the biggest current EU Research and Innovation program, Horizon 2020, InterFlex is scheduled to run three years. During that time, project participants will investigate the interactions between flexibilities provided by energy market players and the distribution grid, with a particular focus on energy storage, smart charging of electric vehicles, demand response, islanding, grid automation, and the integration of different types of energy carriers (gas, heat, electricity). Project findings will allow consortium members to replicate the demonstrated solutions and business models. Their overarching goal is to further develop advanced monitoring, local energy control, and flexibility services at the EU level.

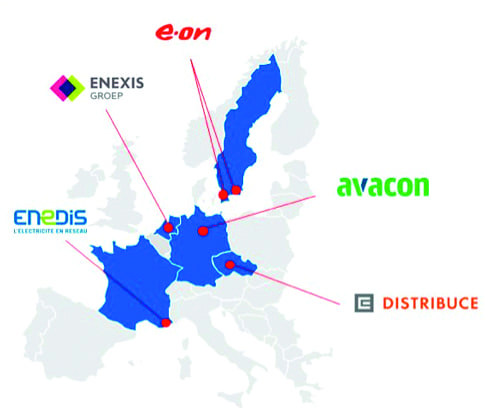

Six projects (Figure 2) are slated for demonstration by five European distribution companies—CEZ Distribuce (Czech Republic), Enedis (France), E.ON (Sweden), Enexis (The Netherlands), and Avacon (Germany). The demonstration project in Germany will be implemented by Avacon, a German grid operator belonging to the E.ON group. Avacon will manage a centralized platform of flexibilities and distributed energy resources in a rural area to use energy only where it is generated in order to relieve congestion on the distribution grid.

E.ON subsidiary Sverige, will undertake two projects. One is in Malmö, Sweden, designed to study energy integration, using the heat inertia of buildings as a flexibility measurement to achieve more optimized and environmentally friendly production throughout a distributed energy system. The other is in southern Sweden. It will explore ways of operating part of a distribution grid on a stand-alone basis (“islanding”).

NiceGrid—a demonstration project located in Nice, France—will be spearheaded by Enedis. It is pioneering peer-to-peer energy exchanges between solar photovoltaic installations and storage suppliers, allowing the integration of intermittent renewable energy into the distribution grid to be maximized.

CEZ Distribuce will lead another project to use grid automation and energy storage to integrate decentralized renewable energy within the distribution grid. Smart functions for electric vehicle charging stations will also be developed as a source of flexibility.

Finally, the Enexis demonstrator project, in Eindhoven, Netherlands, proposes a multiservice approach to harnessing local flexibilities. It will use stationary storage and electric vehicle batteries, and involve distribution system operators, charge point operators for electric vehicles, and other relevant parties. ■

—Lee Buchsbaum (www.lmbphotography.com), a former editor and contributor to Coal Age, Mining, and EnergyBiz, has covered coal and other industrial subjects for nearly 20 years and is a seasoned industrial photographer.