IEA: Global Power Demand to Surge 2.2% Annually Through 2035

Though electricity generation has entered a key period of transition—as investment shifts to low-carbon technologies—world electricity demand is set to grow faster than any other “final form of energy,” the International Energy Agency (IEA) says in its latest annual World Energy Outlook.

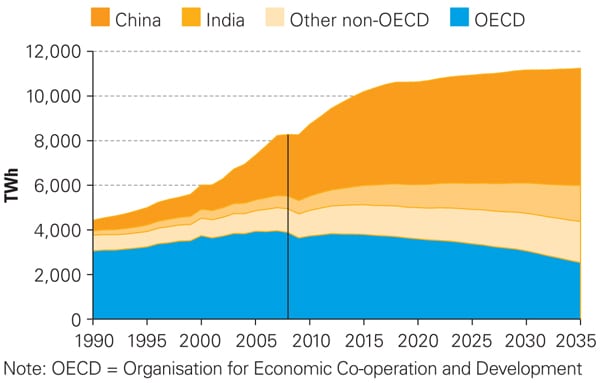

Under the central scenario in the report—the so-called New Policies Scenario, which takes into account broad policy commitments and plans that have been announced by countries around the world—world power demand will shoot up 2.2% per year between 2008 and 2035, from 16,189 TWh to about 30,300 TWh. More than 80% of that growth will come from developing countries—led by China and followed by India—spurred by economic activity, industrial production, population, and urbanization, the intergovernmental organization that acts as energy policy advisor to 28 member countries said at the 738-page report’s launch in November.

According to the IEA, China overtook the U.S. in 2009 as the world’s largest energy user. The organization says the country’s energy demand is foreseen to surge a stunning 75% between 2008 and 2035, when it will account for 22% of world demand. China will lead the surge in electricity generation growth, and power demand in the country is expected to triple between 2008 and 2035. To put this into perspective, the IEA says, “Over the next 15 years, China is projected to add generating capacity equivalent to the current total installed capacity of the U.S.” Factoring in China’s contribution, globally, gross capacity additions (to replace obsolete capacity and meet demand growth) will amount to about 5,900 GW through 2035. That’s 25% more than total current installed capacity. Nearly half of the 5,900 GW will be added by 2020, the IEA says.

Power generation is expected to swell by 75%, rising from 20,183 TWh in 2008 to 27,400 TWh in 2020, and 35,300 TWh in 2035. Fossil fuels—mainly coal and natural gas—are expected to remain dominant, but owing to higher fossil fuel prices and government policies to enhance energy security while curbing carbon emissions, their share of total generation drops from 68% in 2008 to 55% in 2035. “Rising fossil fuel prices to end users, resulting from upward price pressures on international markets and increasingly onerous carbon penalties, together with policies to encourage energy savings and switching to low-carbon energy sources, help restrain demand for all three fossil fuels,” the IEA asserts.

Globally, coal will remain king though 2035, though its use for power generation will diminish from 41% now to 32% (Figure 1). Natural gas use will grow in absolute terms, continuing to fuel 21% of world electricity generation through 2035. Growth in natural gas will far surpass the growth in other fossil fuels’ use, owing to its “more favorable and practical attributes, and constraints on how quickly low-carbon energy technologies can be deployed,” the agency said.

|

| 1. Coal to remain king. The International Energy Agency (IEA) forecast in its newly released World Energy Outlook that coal will remain dominant worldwide through 2035, though its use for power generation will diminish from 41% now to 32%—putting it on par with the global share of renewable generation in 2035. This graph shows how the drop in coal-fired generation in developed countries (members of the Organisation for Economic Co-operation and Development [OECD]) is expected to be more than offset by massive increases elsewhere—especially in China. Worldwide coal-fired generation is projected to increase from 8,273 TWh in 2008 to about 11,200 TWh by 2035. China could add nearly 600 GW of coal-fired capacity, which exceeds the combined current coal capacity of the U.S., the European Union, and Japan. Courtesy: IEA |

Nuclear power is also expected to see a spurt, growing from 6% in 2008 to 8% in 2035. More than 360 GW of new additions—40% in China alone—and extended lifetimes for several plants worldwide will contribute to the rise in nuclear capacity.

Above all, renewable energy—hydro, wind, solar, geothermal, “modern” biomass, and marine energy—is expected to skyrocket. The IEA sees the general use of renewable energy tripling through 2035 and demand (compared to other fuels) for energy produced from renewables such as wind, solar, geothermal, marine, modern biomass, and hydro increasing from 7% to 14%.

One dramatic assertion is that the share of renewables used to generate global electricity is forecast to increase from 19% in 2008 to almost 33% by 2035, which means renewables could catch up with coal. The increase will come mostly from wind and hydropower. Output from solar photovoltaics is also expected to increase “very rapidly,” though the IEA admits that its share of global generation will reach only 2% in 2035.

One reason that renewables will see such a surge is because governments will massively increase subsidies. The IEA says: “We estimate that government support for both electricity from renewables and for biofuels totaled $57 billion in 2009, of which $37 billion was for the former. In the New Policies Scenario, total support grows to $205 billion…. Between 2010 and 2035, 63% of the support goes to renewables-based electricity.”

In general, the world’s power sector will require heavy investment to fuel its growth, the IEA suggests. Overall, it projects that $16.6 trillion (in 2009 dollars) will be required from 2009 through 2035, about 60% (or $9.6 trillion) of which will be needed to build new plants. The remainder—$2.2 trillion for transmission and $4.8 trillion for distribution—is expected to be spent on improving and expanding power networks.

As far as new technologies evolving, the IEA predicts that generation from less-efficient subcritical plants around the world will fall dramatically from 73% to 48% in 2020 and 31% in 2035. Most of those plants will be replaced by supercritical plants and a rising number of combined heat and power plants. After 2020, more ultrasupercritical and integrated gasification combined-cycle plants will be deployed. But carbon capture and storage (CCS) plants will likely generate power on a more limited scale, the IEA suggests. Even under the New Policies Scenario, CCS plants could produce just 1.5% of the world’s generation in 2035—up from 0% today.