How the Clean Energy Transition Is Intensifying the Energy-Water Nexus

Decarbonization is posing a fundamental dilemma that could have widespread serious implications for the power sector: the clean energy transition, if not properly managed, could increase water stress, or be limited by it.

The emphasis on decarbonization over the past decade has prompted intense scrutiny of how the world can ramp up its energy consumption while reducing the impacts of global warming. However, sustainability efforts have mostly been centered on tamping down air pollution, and less so on water conservation. While several countries and companies have set objectives—for example, actions to achieve reductions in greenhouse gas emissions (GHGs) to meet the 2015 Paris Climate Agreement—few mitigation and adaptation strategies underscore resilient water management as a goal and a solution to ensure accessibility to water in quantity and quality, as the Stockholm International Water Institute (SIWI) noted at COP25 last December.

SIWI warned that a failure to address complex climate change and water availability feedback loops could have myriad implications for an array of water-intensive economic sectors, including for energy and agriculture. But in a March 2020 report, the International Energy Agency (IEA) went further, suggesting the fuels and technologies used to achieve the clean energy transition could increase water stress, and even be limited by it, if they are not properly managed.

The IEA laid out the problem starkly. Even if the world achieves the IEA’s long-touted Sustainable Development Scenario (SDS)—which it describes as an “ambitious and pragmatic” vision to hold global average temperatures to below 1.5 degrees Celsius above pre-industrial levels—an integrated approach that involves delivering energy for all could result in water withdrawals by 2030 that would be 20% lower than today. The increased deployment of solar PV and wind, a shift away from coal-fired power generation, and a greater focus on energy efficiency all contribute to this decline.

|

|

1. Global water withdrawal (left) and consumption (right) in the energy sector by fuel type in the International Energy Agency’s Sustainable Development Scenario, 2016–2030. Source: IEA, Global water consumption in the energy sector by fuel type in the Sustainable Development Scenario, 2016–2030, IEA, Paris |

But, under the same SDS, water consumption would move in the opposite direction—increasing by a stunning 50% compared to today, driven upward by other clean energy technologies. While the bulk of the increase is related to biofuels, which are liquid fuels derived from biomass and used as alternatives to fossil-based transportation fuels, increased water consumption under the SDS is also attributed to higher deployment of concentrating solar power (CSP); carbon capture, utilization, and storage; and nuclear power (Figure 1). “Though water withdrawals are the first limit for energy production when water availability is constrained, water consumption—the volume that is withdrawn but not returned to the source—reduces the overall amount of water available to satisfy all users,” explained Molly Walton, an IEA energy analyst.

An Enduring Dilemma

The IEA’s finding is another complicating factor for the power sector, where the pervasive and complex connection—or “nexus”—between energy and water resources has long been recognized as a dilemma. Historically, concerns within the industry have mostly focused on how thermoelectric power generation—especially in arid regions—can manage water resource scarcity, variability, quality, and uncertainty.

Those concerns endure. As a May 2020 study published by researchers at the University of California, Berkeley points out, 43% of the current installed global coal-fired power capacity is located within regions that now experience water scarcity for at least one month a year, and more than 30% of global capacity faces scarcity for five or more months a year.

In India, this issue has rattled energy security and has proven costly. According to the World Research Institute, 40% of the nation’s power plants are located in water-scarce areas. The organization found that between 2013 and 2016, 14 of India’s 20 largest thermal utilities experienced at least one shutdown owing to water shortages, costing companies $1.4 billion. China, too, has several coal plants that suffer extreme water stress, which is why the nation is implementing stricter water resource management. Last year, for example, it set a cap on water use by coal plants that is estimated to increase water use efficiency by up to 20%.

In the U.S., most thermoelectric plants that use freshwater are in “water-abundant” regions, but 13% are located in water-stressed regions, as an October 2020–published study from three national laboratories suggests. Still, the uncertainty posed by water stress is now being flagged as a key sustainability risk factor.

Ratings agency Moody’s this August, for example, warned that the nation’s nuclear operators faced growing credit risks associated with extreme weather events, including drought. “Parts of the Midwest and southern Florida face the highest levels of heat stress, while the Rocky Mountain region and California face the greatest uncertainty regarding long-term water supplies,” said David Kamran, a Moody’s analyst. “We count about 48 GW of nuclear capacity with elevated exposure to combined rising heat and water stress across the U.S.”

Hydropower, the cornerstone of many states’ and countries’ decarbonization plans, is especially vulnerable in the overall climate change–related energy-water nexus. In its preliminary root cause analysis of the load shedding events this August, for example, California grid operator and regulatory agencies noted hydro conditions in the state for the summer 2020 were below normal owing to heat and drought. In Africa, where hydro accounts for 22% of power generation (compared to 16% globally), droughts or water scarcity last year prompted blackouts in Zambia and Zimbabwe, and prompted fresh calls for countries to rethink major hydropower projects, like the 6.4-GW Grand Ethiopian Renaissance Dam (GERD). Escalating water tensions between Egypt and Ethiopia relating to the GERD project this summer, notably, illustrated the geopolitical impacts of the deep connection between energy and water security. In Europe, meanwhile, major utilities with large hydropower portfolios, such as Electricité de France SA and Energias de Portugal SA, are shedding hydropower assets in a bid to relieve “hydrological risks” posed by climate irregularities.

Energy Needed to Ensure Water Security

At the same time, however, general uncertainties over water supplies and diminishing water quality—including for potable water and industrial purposes—are prompting new energy projects to meet increasing demand to move, pump, and treat water. Interest in desalination has flourished all over the world, but most prominently in the Middle East. In that region, desalination accounts for just 3% of the water supply today but 5% of its total energy consumption, according to the IEA. The agency projects that by 2040, under the SDS, desalination could account for roughly a quarter of the region’s water supply and almost 15% of total final energy consumption.

But close coupling of the power and water sector comes with risks, too. As a recent example, when Israel, which depends on desalinated seawater for 80% of its domestic drinking water, suffered an extreme heat wave in May 2019, the Israeli Electricity Authority urged large consumers, including the nation’s five desalination plants, to shed load, even though water demands in the national system were also soaring.

As experts widely note, the sustainability of desalination, which is still majority owned by the power sector, remains under question. Today, for example, two-thirds of the water produced from seawater desalination in the Middle East is derived from fossil fuel-based thermal desalination, while the rest is from membrane-based desalination that relies heavily on electricity produced using natural gas. However, several entities are also exploring the use of renewables to produce the power and heat needed for desalination. So far, solar PV and solar thermal are leading that charge, making up more than half of the world’s renewable desalination capacity, followed by wind power.

What Can Be Done?

Beyond increasing installations of less-water-intensive technologies like wind and solar PV, the power sector has made substantial gains in retooling facilities. Many have adopted dry cooling, for example, or advanced technologies that reduce water withdrawal and consumption, such as plume abatement equipment, which reduces cooling tower auxiliary power loads and water vapor emissions. Costs, however, remain a key challenge to encouraging uptake of new cooling technologies. Alternative water sources, meanwhile, could negatively impact cooling equipment, create regulatory compliance issues, and limit siting locations.

Water management plans have also gained prominence both at the state and grid level. Today, some power plants in the western U.S., for example, have their own water plans to forecast and optimize water use.

|

|

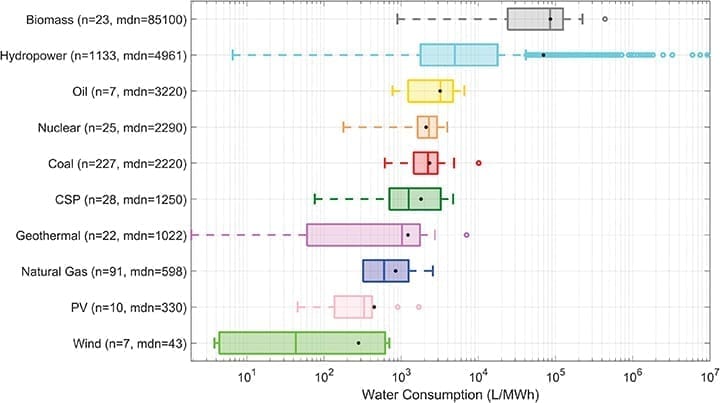

2. Dutch researchers last year conducted a meta-analysis of how much surface or ground water (blue water) is consumed in liters per megawatt-hour (L/MWh) over the lifecycle across several energy generation types including photovoltaic solar (PV) and concentrating solar power (CSP). The circles represent outlying influences on water consumption, while the dots represent the average for each power type. mdn = median value of water consumption for each fuel type. Source: Water use of electricity technologies: A global meta-analysis (November 2019) |

On a larger level, however, how the world should move to address the energy-water nexus in the climate context may be impaired by crucial data gaps, as three Dutch researchers, Paul Behrens and Arnold Tukker from Leiden University, and Laura Scherer from the Netherlands Organization for Applied Scientific Research, pointed out. The researchers, who last year surveyed the vast body of existing literature on the nexus between power production and water use, found that studies generally present estimates of water uses “without simultaneously presenting their influencing factors,” leaving data gaps that may add to planning uncertainty. If available data is considered along with factors that lie outside power plant lifecycle water consumption, a new picture emerges that suggests a larger range of water use across all energy types, the researchers said (Figure 2).

Generally, the researchers found that solar PV, wind power, and run-of-river hydropower consume relatively little water, but that CSP and geothermal consume “intermediate” volumes of water. But within the renewable energy category, woody and herbaceous biomass, and reservoir hydropower were shown to have “extremely high” volumetric water footprints. Coal, predictably, led water use among non-renewables, while nuclear had the lowest water consumption per unit of power production (owing to its high electric output over generally longer lifetimes). As significantly, if thermal power plants were outfitted with carbon capture and storage, their operational water consumption could increase up to 81%, they found.

The researchers also stressed that the deployment location of power production largely affects countries’ water use of energy systems due to different climate conditions and water resources, as well as the impacts caused by it due to water scarcity. “However, the latter are rarely considered,” they said.

—Sonal Patel is a POWER senior associate editor.