A Multi-Dimensional Crisis: Six Global Power Sector Trends to Watch

Fifty years after the first global oil shock in 1973, the world’s energy sector is again facing high geopolitical tensions and uncertainty—though this time around, “pressures are coming from multiple areas,” Dr. Fatih Birol, executive director of the International Energy Agency (IEA), wrote as he introduced the latest World Energy Outlook (WEO2023).

“Alongside fragile oil markets, the world has seen an acute crisis in natural gas markets caused by Russia’s cuts to supply, which had strong knock-on effects on electricity. At the same time, the world is dealing with an acute climate crisis, with increasingly visible effects of climate change caused by the use of fossil fuels, including the record-breaking heatwaves experienced around the world this year,” Birol wrote.

“Ultimately, what is required is not just to diversify away from a single energy commodity but to change the energy system itself, and to do so while maintaining the affordable and secure provision of energy services. The growing impacts of global warming make this all the more important, as an increasing amount of energy infrastructure that was built for a cooler, calmer climate is no longer reliable or resilient enough as temperatures rise and weather events become more extreme.” In short, he wrote, “we have to transform the energy system both to stave off even more severe climate change and to cope with the climate change that is already with us.”

According to the 355-page WEO2023, which the IEA issued in late October, momentum for the “transformation” toward “clean energy” has been building. The IEA outlined several factors that are poised to reshape the world’s energy profile by 2030. However, it also underscored several risks to anticipated change, such as cost inflation pressures, supply chain hurdles, critical mineral availability, and geopolitical tensions.

Following are some key trends the Paris-based intergovernmental organization highlights in its latest annual global outlook.

1. A Projected Surge in Power Demand

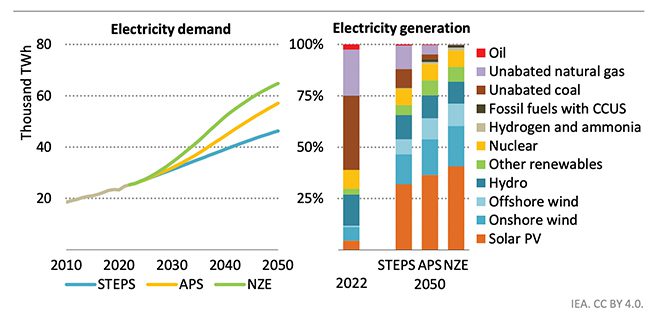

The WEO2023 explores three primary scenarios: a stated policies scenario (STEPS), which assumes today’s policy settings will endure; the announced pledges scenario (APS), which assumes all governmental aspirational targets will be achieved; and the net-zero by 2050 (NZE) scenario, which maps a pathway to achieve a 1.5-degree-Celsius stabilization above pre-industrial levels in 2100 while nurturing universal access to energy by 2030. STEPS is notably associated with a temperature rise of 2.4 degrees Celsius in 2100 (with a 50% probability), the agency says.

|

|

1. Global electricity demand, 2010–2050, and generation mix by scenario, 2022 and 2050. Electricity demand rises over 80% to more than 150% by 2050 across scenarios and is met increasingly by low-emissions sources at the expense of unabated coal and natural gas, the International Energy Agency’s (IEA’s) latest World Energy Outlook suggests. Source: IEA |

While the agency highlights several uncertainties that could affect its scenario outcomes, a uniform finding across all three scenarios is that global electricity is set to increase rapidly (Figure 1). Population and income growth, along with the electrification of growing numbers of end-users, could set demand soaring by over 80% by 2050 in STEPS (and up to 150% in the NZE scenario). In STEPS, the building sector will remain the largest in terms of consumption, driven by demand for appliances, space cooling and heating, and water heating. The industry sector will follow it. Electric vehicles (EVs) account for about 15% of demand growth through 2050 in STEPS. The report also points to hydrogen production via electrolysis as a potentially sizeable electricity consumer, which is limited in STEPS and more prominent in the APS and NZE scenarios.

2. Renewed Policy Momentum for Cleaner Electricity Supply

Recent energy crises have highlighted energy security challenges, prompting a short-lived uptick in coal generation. However, the IEA said the crises also accelerated clean energy transitions in the power sector. “Recent policy developments have boosted the prospects for renewables in major markets, including China, European Union [EU], India, Japan, and United States,” the report notes. “Prospects for nuclear power have also improved in leading markets, with support for lifetime extension of existing nuclear reactors in a number of countries including Japan, Korea, and United States, and support for new reactors in Canada, China, United Kingdom, United States, and several EU member states.” Policy developments for natural gas use in the power sector, however, have been “mixed.” The EU, South Korea, and Japan have taken efforts to reduce demand and reliance on imports, while China “sees a continued role for natural gas,” it notes.

The effort may be bolstered by new pledges in support of the Paris Agreement. In December 2023, negotiators from nearly every country in the world closed COP28 with a decision that—for the first time—formally recognizes the necessity of moving away from fossil fuels to achieve Paris Agreement targets.

Overall, the IEA expects power generation from low-emission sources to accelerate, with a “combined output quadrupling” from 2022 to 2050 in STEPS. In the APS, it would grow to 5.5 times its current level, and in the NZE scenario, it is poised to increase sevenfold.

Renewable capacity, in particular, is slated to grow 2.4-fold in STEPS by 2030, enabling renewable’s share of total global generation to soar from 30% today (15% of which is hydropower) to 50% by 2030. However, that growth isn’t certain. Hydropower’s “annual output can vary widely, and high upfront capital costs and limitations on development of favorable sites constrain further growth prospects,” the IEA suggested. “Other renewables—bioenergy, geothermal, concentrating solar, and marine power— have a part to play too, but solar PV and wind are the central technologies in the roll-out of renewables to decarbonize energy supply faster. The share of wind and solar PV is set to rise from 12% today to about 30% by 2030. To accommodate their variability, utility-scale battery storage capacity will increase nearly 85-fold in the STEPS, rising to more than 2 TW by 2050, the IEA said.

While nuclear power capacity could increase from 417 GW in 2022 to 620 GW in 2050, its share of total generation will fall from about 9% today to 8% in 2050, the report suggests. Nuclear’s growth, notably, will continue to be led by large-scale reactors and lifetime extensions, even though “the development of and growing interest in small modular reactors increases the potential for nuclear power in the long run,” it says.

3. A Peak for Fossil Fuels

In contrast, coal—still the largest source of power in the world today with a 36% share of total generation—is slated for a quick decline. By 2030, the IEA suggested unabated coal’s share of generation could fall below 25% in the STEPS. Natural gas power’s outlook is as dismal. While natural gas provides 22% of global electricity—along with crucial flexibility and reliability services—gas-fired generation will “peak” before 2030 in all three scenarios, falling to 11% in 2050.

Advanced economy markets are “increasingly looking to gas-fired power plants for flexibility rather than bulk output as they integrate rising shares of solar PV and wind,” the report notes. “While gas-fired power rises in absolute terms in China and other emerging market and developing economies beyond 2030, its share gradually declines.”

“A global peak of fossil fuels doesn’t mean all the countries of the world, all their fossil fuels, will peak,” Birol underscored during a livestream on Oct. 24. “For example, we see that especially oil and gas consumption will increase in several developing and emerging countries, while they see a sharp decline in the advanced economies.”

The IEA was more optimistic about coal- and gas-fired plants equipped with carbon capture, utilization, and storage (CCUS), and plants co-fired with hydrogen and ammonia. While the IEA projected “limited progress” in STEPS, it expected the pace will pick up, rising to more than 1,500 TWh under APS and 2,100 TWh under the NZE scenario.

4. Investment Trends Shying from Fossil Fuels

According to Birol, investments will make up a major factor driving the fossil fuel decline. In STEPS, global power sector investment could rise from $1 trillion on average over 2018–2022 to $1.4 trillion by 2030, and it expected that level to continue through 2050. The investment will likely go to cleaner energy sources and battery storage.

“Currently, the amount of investment going to offshore wind is about half the investment going to coal and gas power plants—but it is changing fast,” he noted. “In 2030, we see the amount of investment going to offshore wind will be three times higher than money going to gas and coal plants.”

The IEA, however, urged more grid investment, noting a dire need for grid modernization and expansion. “Grid investment is key to connect millions of new customers and new renewable sources, reinforce transmission and distribution, and modernize and digitalize systems,” the report underscores.

The IEA projected total grid line lengths should increase by about 18% from 2022 to 2030 in STEPS and APS, and by 20% in the NZE scenario. High-voltage direct-current (HVDC) projects may initially lead that charge. The report notes the announced HVDC pipeline is set to lead to an increase in the length of HVDC lines by about 45% by 2030. Investments in digitalization, smart systems, and advanced high-power semiconductor technologies will also be needed to improve the control and stability of electricity flows.

5. Looming Risks for Energy, Electricity Security

Despite optimistic forecasts and substantial investment, the IEA projected large decarbonization “ambition gaps” toward net zero. “The largest single contribution to closing the ambition and the implementation gaps in both the APS and the NZE Scenario comes from replacing coal-fired power generation with renewable energy sources,” the agency noted. “In emerging market and developing economies, the switch to clean sources of electricity makes up 40% of total emissions reductions between today and 2030 in both scenarios.”

Practical implementation of decarbonization, meanwhile, hinges on more near-term risks, particularly concerning energy security. While geopolitical tensions roiled energy markets in 2022, fragmented approaches by oil and gas producers and consumers “could heighten energy security risks” during net-zero transitions. “Any mismatch in the pace of demand and supply reductions could cause very high or low prices, leading to turbulent and volatile markets. Uncoordinated policy implementation could lead to overinvestment in new oil and gas capacity or the premature retirement of existing infrastructure, and either of these could undermine efforts to bring about secure energy transitions,” it says.

In the power sector, electricity security—ensuring a reliable and stable supply of power that can meet demand at all times at an affordable price—is threatened by the evolving complexity of modern power systems.

The report highlights a glaring need for power flexibility, which is only set to increase sharply, owing to rising shares of variable wind, solar PV, and soaring demand. STEPS projects that power system flexibility needs will more than triple globally by 2050. Most flexibility is today provided by dispatchable thermal power plants and hydropower (including pumped storage).

All three scenarios project additional short-term flexibility may be provided by batteries and demand response, especially after 2030, while thermal and hydro resources will provide seasonal flexibility. However, new sources providing crucial flexibility may arrive with the build-out of nuclear, fossil fuels with CCUS, bioenergy, hydrogen, and ammonia. In addition, demand response and curtailment of surplus generation may play an “increasingly important role” closer to 2050.

Beyond that, the power sector must collaboratively execute a delicate balance. “Power generators will need to be more agile, consumers will need to be more connected and responsive, and grid infrastructure will need to be strengthened and digitalized to support more dynamic flows of electricity and information,” the IEA said. “Sufficient flexible capacity will have to be available to deal with variability across all timescales, from the very short term to the very long term, across seasons and years. Power systems will also need to adapt to both changing climate and weather patterns as well as changing consumer behavior.”

6. Grappling with New Risks Posed by Increased Electrification

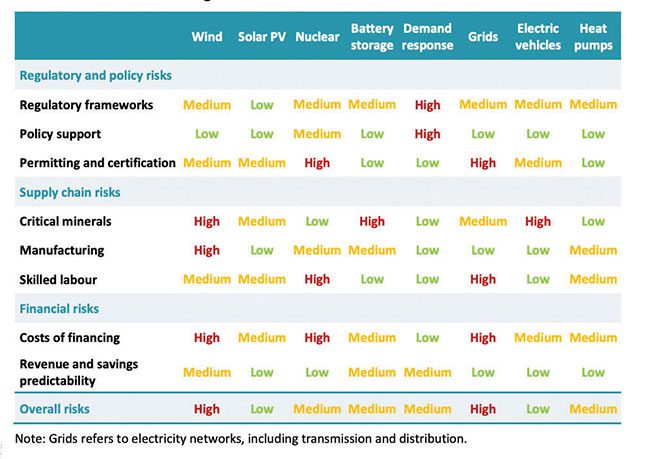

The IEA noted that the quest to transition to a more electrified future on its own is riddled with risks. Foremost among them is support for technology development. “It is critical to have sufficient policy support and enabling regulatory frameworks, efficient and timely permitting and certification, while developing robust and resilient supply chains, from raw materials to manufacturing and construction and skilled labor to ensuring access to financing,” the IEA noted.

|

|

2. Primary risks associated with key clean electrification technologies. Source: IEA, World Energy Outlook 2023 |

Supply chains for clean energy technologies pose glaring risks (Figure 2). “Some relate to the fact that both the supply of critical minerals and the manufacture of solar modules and other key goods are dominated by a small number of countries,” the report says. “Others stem from the danger that demand will outpace the scaling up of mining, processing, and manufacturing capacity along the supply chain, pushing up costs and constraining clean energy transitions. In 2021 and 2022, for example, higher input prices for critical minerals, semiconductors, and bulk materials resulted in price increases for key clean energy technologies.” Shortages of workers with specific skills, meanwhile, are also slowing the expansion of power grids, the construction of new nuclear power plants, and the installation of heat pumps.

In addition, the IEA urged measures to reduce the cost of financing and ensure some certainty for revenues or cost savings. Financing risks include those that relate to the cost of obtaining finance. Financing costs have recently been driven up significantly by rising interest rates in markets around the world, with substantial impacts to large-scale projects involving capital-intensive technologies like offshore wind, grid expansions, and new nuclear power plants. “The progress of electrification will depend on reducing the cost and improving the availability of capital. This is of particular importance for emerging market and developing economies, many of which are currently struggling to raise the capital needed to finance their transitions.”

The IEA also pointed out that risks are often interdependent. “A lack of policy support can, for example, make a project less bankable, which raises financing costs. Permitting delays also raise financing costs, while the poorer-than-expected performance of an asset will depress revenue or raise maintenance costs. Disruptions at one stage of the supply chain can feed through to other technologies, sectors, and markets. Poor progress for one technology can also negatively affect others. Delays in extending and reinforcing power grids, for example, can also slow the deployment of renewables, heat pumps, and EVs,” the report explains.

Efforts to lower risks “across the board” will be vital, whether they relate to regulation and policy, power supply chains, and the availability of labor or access to finance. “This highlights the need for a holistic approach that ensures every technology is able to play its role in delivering secure and cost-effective electrification,” the agency said.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).