Global Monitor (September 2008)

Cost hikes for all things nuclear in the U.S. and UK

This August, the U.S. Department of Energy said a revised estimate of the cost to plan, build, and operate its Yucca Mountain nuclear repository in Nevada for its 150-year life cycle was an astounding $96.2 billion dollars–a 67% hike from the agency’s last estimate in 2001. The 2007 estimate took into account a 30% increase in the amount of commercial spent nuclear fuel and added $16 billion to cover inflation. The cost increase was significant, Ward Sproat, director of the DOE’s Office of Civilian Radioactive Waste Management, told reporters–but it was necessary, and much more cost-effective than doing nothing. In fact, though the department had crunched no numbers on how much nuclear waste disposal would cost if the U.S. saw a major nuclear renaissance, the agency had already begun to determine if another repository was needed, he said.

Across the pond in July, as UK Prime Minister Gordon Brown called for “at least” eight new nuclear power stations during the next 15 years to replace the country’s aging plants, the House of Commons Committee of Public Accounts (CPA) criticized ministers for not providing safeguards to cover the future cost of decommissioning the UK’s existing sites (Figure 1). In its report titled “Nuclear Decommissioning Authority–Taking forward Decommissioning,” the CPA estimated that running and decommissioning 19 designated public sites owned by the Nuclear Decommissioning Authority (NDA) over the next 100 years would cost £73 billion ($139.8 billion)–a £7 billion ($13.4 billion) increase in the discounted cost since 2003. This estimate was wrought with “considerable uncertainty,” and there was a risk that costs could rise further, the CPA said.

1. Costly to shut down. In preparation for a new generation of nuclear power plants, the UK is trying to pin down cost estimates for the decommissioning of its aging fleet. British Energy’s Hinkley Point, Sizewell, and Dungeness (shown here) power stations are widely expected to be included in the list of sites selected for decommissioning by 2010. Courtesy: British Energy Plc

The £7 billion increase could be explained in two parts, said NDA Chair Stephen Henwood: Roughly half resulted from re-phasing work to focus on higher hazards, and it factored in inflation rates in the construction sector; the remainder arose from revisions to the Magnox Operating Programme, which resulted in the need to operate a reprocessing facility in Sellafield for longer. Having more certainty about costs for intermediate-level waste and contaminated land remediation also added to the increase, he said.

North Americans plan liquid makeover for coal

On August 8, Governor Joe Manchin of West Virginia–the second-largest coal-producing state in the U.S. and a major electricity exporter–said at a Southern States Energy Board meeting that he would push renewable energy projects for his state. The reason: He wants greater credibility for the state’s manufacture of gasoline and other products from coal.

The state was not trying to do away with coal power, he said; rather, it was seeking economic stability by promoting technologies that would leverage the state’s role in the future of coal. Manchin noted that clean coal was a priority for West Virginia, pointing to approval by the state’s Public Service Commission of a $2.3 billion clean coal plant proposed by American Electric Power this March. But the state was also encouraging fuel liquefaction–or the conversion of coal to diesel and other liquids.

Coal-to-liquids technology is used worldwide, particularly in South Africa, where Sasol, the world’s biggest coal-to-fuel producer operates. In North America, development of the technology had been overlooked largely because of affordable petroleum-based fuels. But with oil at $115 per barrel and a pending bill (sponsored by a West Virginia legislator) that would mandate that by 2022, 6 billion gallons of coal-to-liquid fuels be produced annually from coal reserves, the technology is looking increasingly viable, says the Coal to Liquids Coalition.

Only a week before announcing his push for renewables, the governor and West Virginia’s congressional delegation had, as a show of support, announced an $800 million project by Pittsburgh-based Consol Energy and Houston-based Synthesis Energy System (SES) to build the nation’s first modern coal-to-liquids plant in West Virginia’s northern panhandle. Consol, the nation’s largest producer of bituminous coal, and SES, a gasification company, have formed a new firm, Northern Appalachia Fuel (NAF), to proceed with the venture and proposed the plant be sited near Benwood, in Marshal County.

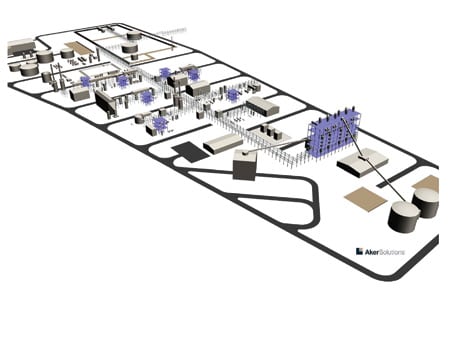

The plant would be a mine mouth facility with feedstock–a blend of run-of-mine coal and coal otherwise not recovered in the normal preparation process–supplied directly from Consol’s nearby Shoemaker complex (Figure 2). Using SES’s technology, coal would be converted to synthetic gas, which would then be used to produce about 720,000 metric tons per year of methanol for the chemical industry. NAF is looking to convert some methanol into about 100 million gallons per year of 87 octane gasoline, and it said it is currently negotiating for a license for ExxonMobil’s methanol-to-gasoline technology. The project’s plans include a carbon management strategy–specifically, plans to sequester carbon dioxide in a deep saline aquifer–but NAF has yet to file for environmental and other permits to build the plant.

2. Transforming coal. West Virginia officials wholly support the nation’s first modern coal-to-liquids plant proposed by Consol and SES for that state. This artist’s rendering shows the proposed plant site arrangement. Courtesy: Northern Appalachia Fuel LLC

Meanwhile, five days prior to NAF’s announcement, Calgary-based Alter NRG Corp., called attention to its coal-to-liquids project with carbon dioxide capture, which it said was “Canada’s first.” Alter NRG said its $4.2 billion project would develop a mine near the Fox Creek area in coal-rich Alberta and build a plant to convert coal through gasification and other processes into as much as 40,000 barrels per day of diesel fuel and naphtha.

Having already initiated the regulatory process and a strategic partner selection process, Alter NRG said the project was expected to be operational as early as 2014. The company’s incentive to proceed with the project was to reduce the energy industry’s carbon footprint, and–as with West Virginia’s proposed plant–to serve as a long-term contributor to the regional economy and “set a precedent for clean energy solutions,” said the company’s president and CEO, Mark Montemurro.

California balloon bill deflates in legislative process

This July, a California legislator, several utilities, and unions banded together in an effort that swelled and then shriveled–but did not pop–to ban helium-filled foil balloons in that state.

“This is no laughing matter,” said Sen. Jack Scott (D-Pasadena), the author of Senate Bill 1499. In 2007, Pacific Gas & Electric (PG&E) said foil balloons caused some 211 power outages; Southern California Edison (SCE) reported nearly 470 outages; and Burbank Water and Power said about one-third of its outages were caused by escaped foil balloons that were caught in transformers. These outages cost businesses between $220,000 and $357,000 dollars per minute, or a loss of $120 million annually, suggests the Electric Power Research Institute.

The damage is done when the foil lining or Mylar from a flyaway balloon meets power lines of pole-mounted transformers, triggering a power surge. The line could short-circuit, and this can lead to power outages and sometimes fires. The problem isn’t just California’s: On July 31, 330 Commonwealth Edison (ComEd) customers in Chicago lost power because of a Mylar balloon. It was one of many incidents that have so far caused 20,000 customers a loss of power, ComEd says. Earlier that month, about 1,700 National Grid customers in Central Falls, R.I., lost power when a foil balloon tangled in a power line, caught fire, and eventually brought down the wire.

3. A ballooning issue. A California senator, backed by utilities and unions, sponsored a bill to ban foil-lined party balloons in that state. When caught in power lines, balloons could cause outages and, sometimes, a fire. Courtesy: AEP

Sen. Scott’s bill drifted easily through the state senate in May, buoyed by a varied bunch: PG&E, SCE, California Municipal Utilities, Sempra Energy, San Diego Gas & Electric, Los Angeles County Sheriffs, California Professional Firefighters, and the International Brotherhood of Electrical Workers, among other organizations. But before the Assembly Appropriations Committee could float the idea, it ran into the bluster of florists, special-event planners, and small businesses–much of the blowback coordinated by the Balloon Council–who said that the original bill could cost vendors $100 million and deflate the state’s tax revenues by $80 million every year.

Rather than risk a ballooning issue, Sen. Scott amended the bill to reflect a compromise. First, the University of California would be asked to conduct a $200,000 study to find a suitable alternative to metallic foil. The bill would also double existing fines from $100 to $250 for violating current law, which requires helium-filled balloons to be weighted, and it would force manufacturers to print a warning on them about their risk to power lines. Currently, the balloon bill is hovering in the committee’s “suspense file.” The consensus is that it will likely be discussed–and passed–this August.

The Lego skyscraper

The newest addition planned for Dubai’s skyline–already a burgeoning showcase of innovative buildings–is a self-powered twirling skyscraper whose 80 stories will each rotate at different speeds around a central core.

The Dynamic Tower, slated for completion by 2010, will be the first skyscraper assembled entirely from prefabricated parts–an approach that gives the structure flexibility in form and function, says the tower’s designer, Italian architect David Fisher.

Though smaller in stature than the 2,625-foot Burj Dubai skyscraper that Dubai plans to complete next year, the 1,380-foot Dynamic Tower–as tall as Shanghai’s Jin Mao building (currently the sixth-tallest in the world)–will be built on site by only about 80 technicians in about a year. Each of the structure’s 80 floors will be custom-assembled in an Italian workshop, equipped with all necessary plumbing and electrical systems.

During final on-site assembly, the floors will be fastened onto the central core, which will house all engineering systems. The core will also act as the central column to which 79 carbon-fiber wind turbines–one sandwiched between each floor–will be attached (Figure 4). The turbines are estimated to produce 0.3 MW each–more than enough electricity for the building and its residents, says Fisher, who expects the building will rely entirely on self-generated power and possibly light up other buildings in the neighborhood as well. His design also calls for photovoltaic cells to be fitted on top of the construct’s 80 “roofs.” Fisher estimates that with 20% of each roof exposed to the sun each day, total exposure will be equal to the roofing exposure of 10 similar-size buildings.

While the Dubai project progresses, Dynamic Architecture (dynamicarchitecture .net), Fisher’s firm, is planning to build a 70-story rotating tower in Moscow. That 1,312-foot structure will cost about $400 million. When construction is completed next year and the tower begins operation in 2010, it could become “the new icon” of the Russian Federation, Fisher said.

4. Revolving and evolving. Each floor of an innovative 80-story skyscraper planned for completion in Dubai by 2010 will rotate independently, at different speeds, on a central axis–so that the structure never has a defined shape. Architect David Fisher designed the building to maximize its power generation potential, adding a 0.3-MW wind turbine between each floor and integrating photovoltaic cells on the tower’s 80 “roofs.” Courtesy: Dynamic Architecture

The firm intends to build a third rotating skyscraper in New York, and additional towers could be built in Canada, Germany, Italy, Korea, and Switzerland if officials or developers show enough interest.

Of manure and methane

Manure has been much bleated of late for causing a major global warming stink. Dung and droppings from cattle, swine, chicken, and other farmyard animals produce methane, a greenhouse gas (GHG) that has 25 times the heat-trapping potential of carbon dioxide, and nitrous oxide, which is a whopping 296 times more potent than carbon dioxide. According to a 2006 Food and Agricultural Organization (FAO) study, the world’s animal agricultural sector emits 18% of human-induced greenhouse gases–more than the transportation sector. And with livestock inventories expected to double by 2050, several countries have prioritized their manure management programs, or are seeking alternatives to cut animal-based GHG emissions without crippling their economies.

An interesting study from the Australian Wildlife Services released this August proposed that eating more kangaroos might help save the planet. The researchers took into account that cattle and sheep alone produce 11% of Australia’s emissions and argued that if kangaroos, nonruminant (non-cud-chewing) creatures, replaced part of Australia’s cattle herds, the nation could cut its emissions by 3% without compromising food sources.

That suggestion has more bite than a methane tax actually imposed in 2003 on New Zealand farmers, whose animals’ burps and waste were said to have caused 90% of that country’s methane emissions. The so-called “Flatulence Tax,” which was eventually shelved after angry protests, aimed to garner money for methane-reduction research so that New Zealand could meet its commitments under the Kyoto Protocol.

In July, a study from Texas, the hub of U.S beef production, avoided promoting veganism or methane taxes and concluded instead that manure converted into biogas using anaerobic digesters could supply up to 2.4% of U.S. electricity needs. And if that biogas were used to supplant coal, it could cut GHG emissions by 4%, the researchers from the University of Texas at Austin said.

The U.S. Environmental Protection Agency has long recognized the potential for biogas power–and even encouraged livestock methane recovery ventures through the AgSTAR program, which it sponsors along with the departments of Agriculture and Energy. In the U.S., manure-sourced methane emissions make up more than a quarter of the nation’s methane load, second only to landfill-produced methane. Those emissions continue to increase every year by about 2%. Particularly culpable are swine and dairy cows, whose manure-sourced emissions increased 34% and 49% respectively between 1990 to 2006, the EPA suggests. So far, the country has seen an upsurge of installations to reap the massive energy potential: By 2007, 111 digesters were in operation at commercial livestock facilities in the U.S. These generated 215 million kWh of energy, 170 million kWh of which was electricity, the agency reports (Figure 5).

5. Manure digesters. The number of commercial livestock facilities in the U.S. that use anaerobic digester technology to produce biogas for energy production has grown recently, says the EPA. By 2007, 111 digesters produced 215 million kilowatt-hours (kWh) of energy, 170 million kWh of which was electricity. Source: EPA

Meanwhile, prominent biogas power developments continue in rural areas, developing nations, and in India and China, where manure is abundant. The most recent large-scale facility is the Beijing Deqingyuan Chicken Farm Waste Utilization plant, which will use two GE Energy Jenbacher 1.06-MW JMS 320 GS-B.L gas engines to produce 14,600 MWh of electricity per year (Figure 6). The farm’s new cogeneration system features an anaerobic digester system to treat the waste of three million chickens–about 220 tons–and 170 tons of wastewater per day.

6. Chicken and horsepower. Methane emitted from manure is more frequently being used as a power source. At the first plant of its kind in China, biogas sourced from the waste of three million chickens will fuel two GE Jenbacher engines and produce 14,600 MWh of electricity per year. Courtesy: GE Energy

U.S. small wind turbine market moving slowly

The U.S. market for wind turbines with rated capacities of less than 1 kW and up to 100 kW grew 14% last year. With 9.7 MW deployed, that brought the total small wind generating capacity in the country to 55 to 60 MW. But this growth paled in comparison with the solar photovoltaic industry, which spurted 53%, said the American Wind Energy Association (AWEA) in its annual small wind turbine market report in July.

The discrepancy was in large part due to a federal tax incentive adopted for the solar industry in 2005, which the small wind industry does not have, AWEA suggested. Market growth for the U.S., the largest small wind turbine market in the world, was also stunted by “impractical and prohibitive zoning practices” and “balkanized grid interconnection standards,” it said.

AWEA reported that at least 58 U.S. companies and 84 non-U.S. companies manufacture or plan to manufacture small wind systems. Last year the global industry had produced more than 300 different models in various stages of development, a third of which were engineered by U.S. manufacturers. Advances included sound-dampening devices, operation capability at lower wind speeds, and advanced blade design and manufacturing methods (Figure 7).

7. A draft for small wind. In 2007, the global small wind turbine sector produced 300 different models that were in various stages of development. An example is this horizontal-axis turbine from U.S.-based Broadstar, which is designed to work on the physics of airlift and in low wind. The AeroCam can also automatically adjust the pitch or angle of the blades as the turbine rotates. Courtesy: Broadstar Wind Systems

Although exports accounted for about 40% of U.S. manufacturers’ sales in 2007, AWEA predicted the U.S. would face competition from the global market–particularly from Canada and Germany. “Disadvantageous currency exchange rates have begun to affect the profitability of U.S. exports, though the relatively high cost of electricity in Europe has helped to fuel growth overseas. Lagging U.S. policy may also affect competitive growth for the U.S. industry, though market barriers tend to be similar worldwide,” it said.

Corroborating AWEA’s findings, Carbon Trust, a UK government-funded independent company, released a study in August of small-scale wind energy’s potential and found that this source could provide up to 0.4% of the UK’s total electricity supply if 10% of households installed turbines at costs competitive with grid electricity.

However, the study also found that small turbines in the UK would produce four times more energy and be considered cost-effective if installed in high-wind rural areas rather than in urban settings. Carbon Trust even went so far as to suggest that roof-mounted turbines on suburban homes may not be able to generate enough wind energy to make up for the carbon emissions produced when the turbines were made.

Israeli desert center tests solar thermal tech for California desert

Modern experiments to discern whether Archimedes, that scientist of classical antiquity, could really have set fire to a Roman ship by means of a “burning glass” have concluded that it could be possible–but only if his heat ray were projected by a large array of mirror-like burnished shields, the conditions were right, and the ship’s wood were coated with a flammable substance.

This bright idea from the 3rd century B.C. has potential to generate vast amounts of solar power–900 MW–say California-based BrightSource Energy Inc. and subsidiary Luz II. The companies plan to build a number of solar thermal power plants in southern California’s Mojave Desert using a similar technology. They recently completed a large-scale pilot plant in Israel’s parched Negev Desert to test equipment, materials, and methods.

The Solar Energy Development Center is an operational solar field to test and evaluate equipment and materials for future commercial solar energy power plants and includes more than 1,600 glass mirrors (heliostats) and a tower 197 feet tall that is topped by a solar boiler (Figure 8). During operation, the power tower and surrounding heliostats concentrate the sun’s energy onto the boiler, heating water inside to more than 1,000F.

8. The tower of Negev. BrightSource Energy and subsidiary Luz II inaugurated a solar thermal pilot plant in Israel this June to test equipment and methods for several plants planned in southern California. The solar field consists of 1,600 mirrors that concentrate the sun’s rays onto a tower boiler, heating water inside to more than 1,000F. Courtesy: BrightSource Energy Inc.

“In a commercial plant, the utility-grade superheated steam will be piped from the boiler to a standard turbine where electricity will be generated, all at a much higher operating efficiency and lower cost than other solar power plants,” said BrightSource in a statement. The Center’s test field will air cool the steam back into water and return it to the boiler in a closed loop.

BrightSource has already raised $160 million from backers including BP, Google, and VantagePoint Venture Partners and says it already has 4.2 GW of solar thermal power projects under active development in the Southwest U.S. In March, PG&E contracted with the company to buy 900 MW of power from the planned southern California plants, the first few–a series of 100-MW and 200-MW plants–slated to open in 2010. BrightSource estimates these plants will cost some $2 billion to $3 billion to build.

POWER digest

News items of interest to power industry professionals.

AREVA names planned U.S. enrichment facility “Eagle Rock.” Nuclear technology vendor AREVA announced on July 23 that its facility under development in Bonneville County, Idaho, near Idaho Falls, will be called the “Eagle Rock Enrichment Facility” in recognition of the name’s symbolism and significance to the surrounding community.

“This name was selected for several reasons. It includes the American symbol of strength, the eagle, and envisions the strength of America as we move towards greater clean energy security, while the rock represents a symbol of endurance and quality. Most of all, the name embodies an important connection with the history of Idaho Falls, whose early name was Eagle Rock,” said AREVA Inc. President Michael McMurphy

The multi-billion-dollar facility will provide enrichment services to U.S. nuclear plant operators using advanced centrifuge technology developed by Areva subsidiary Enrichment Technology Co. Centrifuge technology has been successfully deployed in Europe for more than 30 years and uses 50 times less electricity than the gaseous diffusion process, Areva said.

AREVA operates the Georges Besse enrichment plant in France, which it says has operated safely for nearly 30 years. The company is currently constructing a new gas centrifuge enrichment facility in France–Georges Besse II. First deliveries are expected in 2009.

MAN Solar Millennium preps third parabolic-trough solar plant. Germany’s MAN Solar Millennium GmbH is to conduct preliminary work before the official contract award for Andasol 3, the third plant of a 150-MW parabolic trough solar power system in the southern Spanish province of Andalusia. The Essen-based company is to act as general contractor on the project and will deliver the solar plant in turnkey condition by February 2011 in partnership with Spanish construction firm Duro Felgueara S.A. Energia.

The Andasol 3 power plant will be built close to sister projects Andasol 1 and 2. Andasol 1, the first parabolic trough power plant in Europe, has been under construction since June 2006 and will go into operation this year. Commissioning of Andasol 2 will follow in spring 2009.

Each plant takes up an area of about 2 square kilometers (0.78 square miles). With a collector surface area of 510,000 square meters (5,500 square feet), each produces about 50 MW to help the Spanish grid meet peak summertime demand. Each plant will also be equipped with a thermal energy reservoir holding 28,500 tons of molten salt, enough to run a turbine for about 7.5 hours at full load and supply the grid with power while it is raining or long past sunset, says the company.

Parabolic trough power plants employ trough-shaped mirrors to concentrate sunlight onto a tube along the collector’s focal point. Once absorbed, the solar rays pass their heat on to a conducting fluid. Energy is transferred in a heat exchanger to generate the steam used to produce power in a turbine generator.

Wärtsilä opens fuel cell power plant in Finland. On July 15, Finland’s minister for economic affairs, Mauri Pekkarinen, inaugurated the New Energy power plant at the Vaasa Housing Fair. The plant is a fuel cell unit, developed by Wärtsilä Corp., that is based on planar solid oxide fuel cell (SOFC) technology. The unit is the first of its kind in the world and Wärtsilä’s first field application of the technology, according to the company.

The plant is fueled by methane gas originating from a nearby landfill. During the initial phase, it will produce approximately 20 kW of electricity and a thermal output equivalent to 14 to 17 kW. The plant will also produce power and heat generated by micro-turbines and by low-temperature heat that is collected from the seabed using a geothermal heat pump.

Landfill methane is considered a renewable fuel, which means that this fuel cell technology is compliant with the energy and climate package of the EU Commission, the company said. The EU requires Finland to increase its share of renewable power sources from its current 28.5% to 38% by 2020.

Fermi 2 completes 10 million safe work hours. Employees at Detroit Edison’s 1,100-MW Fermi 2 boiling water reactor reached 10 million hours worked on June 30 without a work-related accident. The safe-work period stretches back to June 17, 2002. The company said in a statement released on July 31 that the record string of safe days had continued without interruption.

Fermi 2, which began commercial operation in 1988, employs about 900 workers and produces about 15% of Detroit Edison’s generated power. The 72-month period is the station’s best performance, surpassing a 52-month stretch of 8.34 million hours from 1992 to 1996.

Plant Manager Kevin Hlavaty noted that Fermi 2 exceeds another important safety measure–the total industrial safety accident rate (TISAR)–which is the official nuclear industry safety gauge. The industry goal is a 0.2 TISAR. “We are well below that, but our goal will always be no recordable injuries,” Hlavaty said.

Training, safety meetings, and preventive measures all are elements of Fermi 2 safety culture, George MacAdam, a senior safety and health engineer, said. MacAdam added that the key to achieving a high level of safety is that individual employees make safety a personal priority. “People are aware of its importance and are committed to working safely every day, regardless of what job they are doing,” he said.

Vogt Power to provide HRSGs for Spanish group’s project in Argentina. Babcock Power Inc. subsidiary Vogt Power International announced in July it would supply heat recovery steam generators (HRSG) to the Isolux Corsan Group for Pampa Holding’s Loma de la Lata Plant in the Patagonian Province of Neuquen in Argentina.

As part of a $25 million contract, Vogt Power said it would will design, manufacture, and deliver three natural circulation HRSGs for installation behind General Electric Frame 9E gas turbines. The combined-cycle systems would increase the generation capacity at the Loma de la Lata plant to 545 MW, it said.

Alstom to build 235-MW Unit 5 for Javanese plant. Alstom, in consortium with Marubeni Corp., announced in August it had won a $238.8 million contract with Indonesia’s national electricity utility, PT.PLN., for the construction of a combined-cycle power plant at Maura Tawar, on the northern coast of Java.

The project consists of adding a fifth unit to the existing power plant. The Alstom-Marubeni consortium already built Unit 1, a combined-cycle plant, and Unit 2, a gas turbine peaking plant, in 1995. Unit 5 will increase the total output of the plant by 235 MW, from the current 1,800 MW, and will help to meet the current high electricity demand on the Java/Bali grid. The plant will be operated with natural gas.

Under the terms of the contract, Alstom, as the consortium leader, will engineer, procure, and commission a fully integrated power island. The island will consist of one GT13E2 gas turbine with one HRSG, one COMAX steam turbine, two turbogenerators, and the ALSPA control system. Alstom will engineer and manufacture the HRSGs at its boiler facility in Surabaya, the capital of east Java. Marubeni Corp. will supply the balance of plant, high-voltage switchyard, civil works, and erection services.

Alstom said it has been a key player in the Indonesian power generation market since the 1960s, helping PT. PLN to support the country’s growing energy demand via the construction of gas, coal, and hydro plants. That company currently employs more than 900 people in Surabaya, where it produces HRSGs, fluidized-bed and supercritical boilers mainly for export.

–Compiled by Sonal Patel.

Correction

In the August issue we listed the wrong owner and general contractor in Table 2 on page 35. Wisconsin Public Service Corp. is the owner and was the general contractor on its recently commissioned Weston Unit 4. POWER regrets the error.