Report: Decarbonization of World’s 50 Most Influential Power Companies Bleak

Two reports analyzing energy transitions toward low-carbon resources released this week offer mixed assessments of how the power industry is faring in efforts to tamp down carbon emissions.

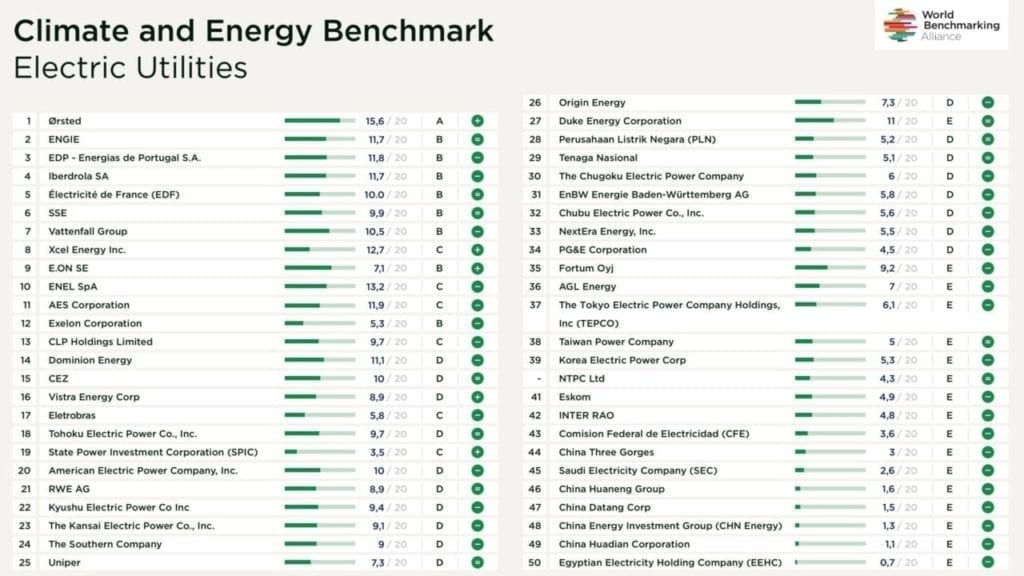

The World Benchmarking Alliance (WBA), a broad group of stakeholders committed to 17 Sustainable Development Goals developed by the United Nations (UN) in 2015, on July 6 launched a Climate and Energy Benchmark focused on electric utilities. The detailed analysis found that only four of the world’s 50 most influential power companies have defined a “clear target” to provide low-carbon generation aligned with the Paris Agreement. These companies are: Ørsted from Denmark, Enel from Italy, AES Corp. from the U.S., and EDP from Portugal. But, “Of these, only Ørsted, EDP, and Enel are on track to meet their targets,” WBA said.

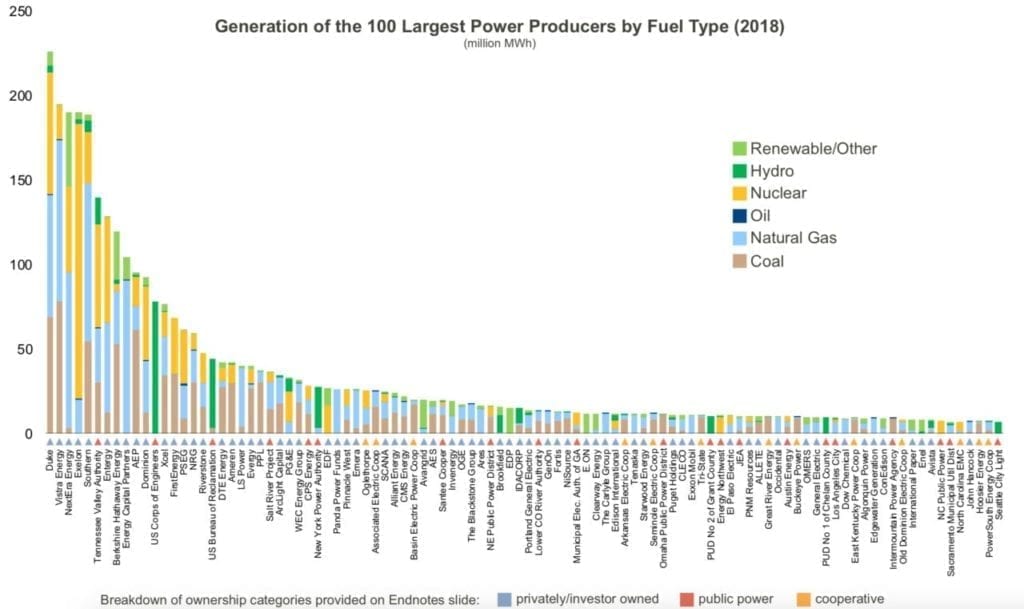

A separate benchmarking analysis released on July 8 that compares key air pollutant emissions from 100 of the largest U.S. power producers, meanwhile, suggests the U.S. power sector made “significant progress” in the transition away from coal in 2019. That analysis, Benchmarking Air Emissions of the 100 Largest Electric Power Producers in the United States, is the 16th edition of the report. It stems from a collaborative effort between Ceres, a sustainability nonprofit that works with investors and power companies; Bank of America; power producers Entergy, Exelon, and Tenaska; and environmental group Natural Resources Defense Council.

Lights Out for the Paris Agreement?

The WBA’s benchmark is the second in its series that scrutinizes high-emitting sectors and assesses company preparedness in the low-carbon transition. It was prepared in partnership with global nonprofit CDP, a company that works with companies to reduce their greenhouse gas emissions; ADEME, the French agency for ecological transition; and ACT, a joint voluntary initiative recognized by the UN Framework Convention on Climate Change.

The analysis is limited to 50 of the world’s “keystone” electric utilities—meaning companies that dominate global or regional revenues and offer substantial influence over regional governance—but it projects bleak outcomes for overall sectoral decarbonization globally.

A key reason: “The ten worst performers on future emissions projections—which together have just over half of the electricity generation capacity of the 50 companies—account for 97% of the projected emissions that will exceed the well-below 2-degree pathway between 2018 and 2033,” WBA said. “This shows that the worst performing companies by future emissions projections tend to be the biggest by installed generation capacity, fossil fuel use and emissions intensity,” WBA said.

Pressure on these major companies is intensifying because electricity demand is projected to increase nearly 80% by 2050, and the power sector will be crucial in enabling a widespread transition to a low-carbon economy. “This sector is often seen as the ‘great enabler’ to cleaner green energy use across transport, real estate and industry,” noted Charlotte Hugman, a researcher for the Climate and Energy benchmark at WBA. “But for too long the sector has been content with making small reductions in the carbon intensity of electricity production. This could mean lights out for the Paris Agreement.”

Few Major Generators Have Planned Coal Phaseouts

The dim projections for power sector decarbonization are despite net-zero carbon ambitions that have so far been set by 67 countries and eight U.S. states to net-zero carbon ambitions, WBA noted.

In its assessment, the group found that 60% of the 50 companies’ installed capacity still comes from coal, oil, and gas. Only 12% of the companies’ installed capacity is from solar and wind. And so far, only 11 of the 50 companies have a phase-out date for coal. “Only Ørsted has a clear, firm commitment to exit all fossil fuels (by 2023). A further five companies (RWE, CEZ, E.ON, Iberdrola and EDF) have a commitment to carbon-neutral generation (some also including a coal phase-out), all with target dates between 2040 and 2050,” said WBA.

Banking on a rapid transition by these massive companies to achieve Paris Agreement goals is also far-fetched, it suggested. “There are 35 out of the 50 companies locked-in to exceeding their carbon budget by 2033 unless they cancel some of their plans to build further fossil fuel power plants or decommission early,” WBA said. “Ten of the 35 companies, for example, CHN Energy and China Huaneng (China) and NTPC (India) account for 97% of excess emissions of the 50 companies. These big emitters are based in China, India and Egypt. Forty-five companies tie executive incentives to fossil fuels (or do not report on this) which is further preventing the sector from decarbonization,” WBA said.

The group also noted that while some companies such as Vattenfall, Iberdrola, and E.ON have set carbon-neutrality targets, “these are not ambitious enough to meet the rate of reductions required by the [International Energy Agency’s] Beyond-2-Degrees Scenario (B2DS)—which ends in net negative emissions for this sector by 2050.” It added: “The climate performance of two thirds of the companies benchmarked is expected to decline in the near-term.”

Meanwhile, 42 of the 50 companies assessed have set low-carbon transition plans, but half of these (21 companies) “do not contain appropriate financial content,” the group noted. Most companies are also not “investing adequately” in the research and development (R&D) needed to enable the decarbonization and energy transition, WBA said. “Very few companies are providing transparent reporting in this area, though Fortum emerges as a clear leader, investing 7.5% of its total capital expenditure in low-carbon R&D.”

“These companies can and need to adapt before they run out of road,” said Vicky Sins, Transformation lead on Decarbonisation and Energy at WBA. “With new scenarios measuring towards a 1.5-degree path the ambition gap will only increase. These companies need to embed transition planning, milestone creation and greater accountability across the entire sector.”

The benchmark is based on an overall assessment to measure a “company’s degree of alignment with the transition to a low-carbon economy.” It comprises three parts: a performance assessment, a narrative assessment, and a trend assessment, it explained. The benchmark boils down the analysis to a letter rating, from A, the highest rating, to E, the lowest rating. This score “provides a holistic analysis of a company and rates the maturity of the companies’ low-carbon transition against four key criteria: business model and strategy; consistency and credibility; reputation; and risk,” it said.

To date, only Ørsted has managed to achieve an A rating. Of the remaining 49 companies, 17 received an E, 18 received a D, six received a C, and eight received a B, WBA said.

Discrepancies Between Climate Rhetoric and Reality

The WBA’s findings notably also reveal that “Clear discrepancies exist between some companies’ climate rhetoric and the reality.” For example, Korea Electric Power Co. (KEPCO) and NTPC’s plans to expand renewables “were undermined by plans to significantly expand coal capacity as well,” it said.

Several companies have also been embroiled in “persistent environmental regulation violations and pollution of local ecosystems,” WBA noted. These include “China Huaneng Group, Taiwan Power Company and NTPC,” it said. “Korea Electric, Kansai Electric Power Company and Saudi Electric have all been involved in corruption and bribery cases, which may undermine the effectiveness of their climate governance.” Meanwhile, “Companies with smaller generation capacity, E.ON and Ørsted, do have main business models that are likely to remain profitable in the low-carbon economy. However, 35 of the 50 keystone companies assessed derived over half of their electricity generation from fossil fuels in 2018,” it said.

Decarbonization Momentum Building in the U.S. Sector

The WBA’s analysis includes 10 U.S. companies and ranks their performance in the following order (from best to worst): Xcel Energy, AES, Exelon, Dominion, Vistra Energy, American Electric Power, Southern Co., Duke Energy, NextEra Energy, and Pacific Gas and Electric. Xcel leads the list because it differs from other U.S. companies is in its “commitment to a target of 100% emissions reductions by 2050, based on an external report and assessing its plans against a wide range of scenarios,” WBA said.

But according to the newest analysis from Ceres and its partners, the U.S. power sector is faring very well. In 2019, it found that power sector carbon emissions decreased 8% between 2018 and 2019, while SO2 and NOx emissions decreased 23% and 14%, respectively. During that time, gross domestic product (GDP) rose 2.3%.

From 2000 to 2019, CO2 emissions decreased 28% while GDP grew 45%, Ceres noted. “Over the same period, generation from renewables doubled, further clarifying that with the right generation mix, reduced emissions and economic growth can go hand-in-hand.”

“It is encouraging to see that our analysis shows a substantial drop in carbon emissions in 2019, particularly at a time when the economy was strong,” said Dan Bakal, senior director of electric power at Ceres. But while the sector is slated to see an “even more dramatic plunge in 2020 due, in part, to the COVID-19 pandemic, it will be critical to ensure we continue the momentum in decarbonizing the power sector,” Bakal said. “Utilities should deploy zero-carbon resources and electrify other sectors in order to accelerate the pace of decarbonization as the economy recovers and energy demand increases.”

But progress here, too, is clear, Ceres noted. “Some of the highest emitting power companies have recently made commitments to reduce their emissions to net-zero by 2050. Over the past two years Southern Company, Xcel, Duke, Dominion, NRG, CMS, DTE, and APS have all committed to achieving net-zero emissions by 2050,” it said.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).