NERC Warns of Tight Generation Resources, Fuel Supply Issues This Winter

Power shortfalls could be rife over the next three months across a large portion of the North American bulk power system (BPS), particularly during extreme and prolonged cold conditions, the North American Electric Reliability Corp. (NERC) has warned.

The nation’s designated Electric Reliability Organization (ERO) in its latest Winter Reliability Assessment, issued on Nov. 17, said several regions face risks of insufficient electricity supplies during peak winter conditions owing to higher peak-demand projections and inadequate weatherization. The reliability watchdog also prominently highlighted fuel supply risks for coal, natural gas, and oil, and it underscored risks related to natural gas infrastructure constraints.

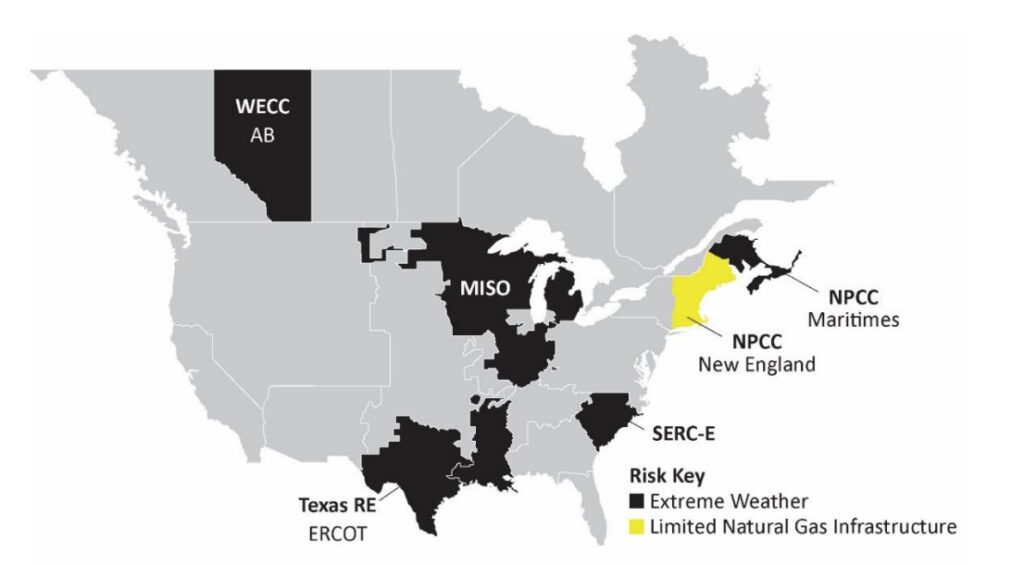

According to NERC’s evaluation of the generation resource and transmission system adequacy to meet projected peak demand, several regions may be highly vulnerable to extreme weather this winter and could require load-shedding procedures. These include the Electric Reliability Council of Texas (ERCOT); the Midcontinent Independent System Operator (MISO); SERC-East—a region that includes North Carolina and South Carolina; WECC-Alberta; and the Northeast Power Coordinating Council (NPCC) Maritimes, a region that comprises the Canadian provinces of New Brunswick, Nova Scotia, and Prince Edward Island, and the northern portion of Maine.

“In summary, though we found that there are several areas where more severe conditions are likely to lead to an electricity supply shortfall, the good news is that almost all areas are well-prepared for a normally occurring or average winter year,” noted Mark Olson, NERC’s manager of Reliability Assessments, during a press briefing on Thursday.

Several Vulnerable Regions

According to the assessment, ERCOT, a region serving nearly 90% of Texas that was hard hit during Winter Storm Uri in 2021, continues to face the risk of a significant number of generator forced outages in extreme and prolonged cold temperatures. These risks are pronounced especially “where generators and fuel supply infrastructure are not designed or retrofitted for such conditions,” despite winterization checks, the assessment says.

Texas, notably, may also grapple with the closure of two CPS Energy coal-fired units, a combined 1.5 GW, at its J.K. Spruce power plant at the end of the year if the Environmental Protection Agency denies conditional acceptance of CPS Energy’s coal ash disposal plan to address two ponds at the plant. NERC’s assessment, however, notes that ERCOT otherwise has an anticipated reserve margin of 36.4%, capacity reserves that “are sufficient to meet forecasted peak demand to cover the types of weather events regularly experienced.”

In MISO, a region that avoided supply disruptions this summer, reserve margins have diminished by more than 5%. “Nuclear and coal-fired generation retirements total over 4.2 GW since the prior winter. Declining reserves are the result of few resource additions,” the assessment notes.

That could mean a falling reserve margin, said Olson. “It means there’s less generation excess above the peak demands, and so the energy risks in the more severe conditions are more likely when you have that shrinking capacity and shrinking reserve margin,” he explained. “And then under severe winter conditions that can extend deep into the south as we’ve seen in Polar Vortex conditions, you have the risk of southern generation being forced offline in the extreme cold. We’ve seen that in a number of winter events.”

In SERC-East, like ERCOT and the southern part of MISO, extreme cold could result in high generator outages and demand volatility. The region is “at risk this winter for potential energy emergencies and a little bit less generation and resource capacity in the area,” Olson said. “Also, there’s been growth in demand and increasing demand volatility.”

Alberta and the Maritimes, both winter-peaking systems, face a surge in peak electricity demand. “Typically, their winter reserve margins—which is the amount of generation they have relative to those peak demands that they can expect to see—are usually a little bit closer anyway because they are winter peakers,” said Olson. “So. with the additional growth there—we’re seeing those—that leads to a very, very thin margin over what peak demand could be. And so that can lead to energy shortfalls, particularly if you see demands going above those average mature peaks.”

A Convergence of Fuel Supply Risks

Along with regional supply and demand vulnerabilities, this year’s assessment highlights a rare convergence of potential fuel supply risks. “The current state of domestic and global affairs warrants even greater attention on generator fuel supplies, including natural gas, fuel oil, and coal. Low fuel storage levels coupled with a range of potential fuel resupply challenges are creating additional risks for winter regional BPS reliability,” the assessment says.

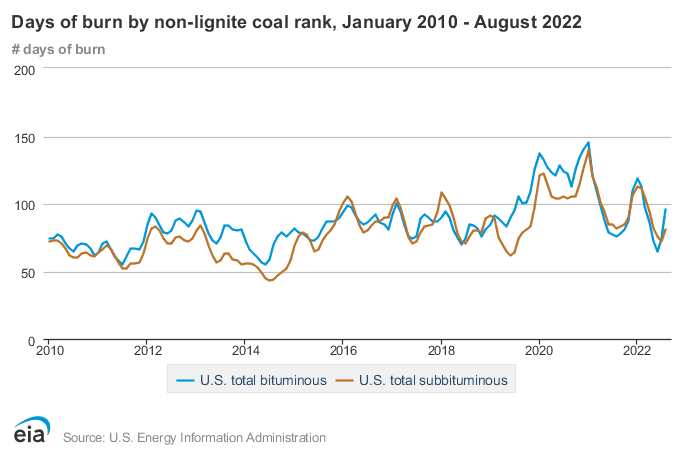

NERC said coal and fuel oil inventories, which are typically replenished following the peak summer season in preparation for winter, are a specific concern. Over 2022, coal inventories suffered supply gaps as staffing shortages and other issues affected the rail industry. Some generator owners in the Midwest and Southeast are experiencing delivery issues for coal and certain emissions-control chemicals, and a “small number of units” currently have low coal inventory, NERC noted. According to the Energy Information Administration, fuel inventories for bituminous units largely located in the eastern U.S. hovered at 96 days on average in August 2022, while for subbituminous units largely located in the West, the average number of days increased to 81 days. “Some plants reported as low as 15 days of supply during the past summer,” NERC noted.

While NERC’s assessment notes that coal fleet stocks have since improved to “near pre-winter average levels,” it urges reliability coordinators in the U.S. Southeast, MISO, and PJM to continue to monitor coal and consumables.

It also suggests that while natural gas storage inventories are rebounding from the summer, cold weather production and delivery are ongoing concerns, given uncertainties prompted by “the continuing disturbance to global energy markets.”

The report also highlights specific fuel risks in New England. “Generation in the area can rely more than most other areas on stored fuels due to the constraints on the natural gas supply infrastructure. Liquid fuels—petroleum fuels—are a primary backup fuel for New England,” Olson noted. “However, currently, the stored capacity levels are only at about 40% of what they’re capable of holding, and this is something that the system operator in New England is monitoring.” NERC encourages generators to “fill up those tanks” in the event of a cold snap. However, generators have indicated they are delaying procurement of fuels “until later in the winter for economic reasons,” he said.

On-site fuel oil stores, typically used as either a primary fuel or as a backup to natural gas, are also lagging, NERC said. “In New England, the Independent System Operator (ISO) survey of generators in October indicates that onsite stored fuel oil used for electricity generation is just over 92 million gallons, or 40% of available storage capacity,” it added. That’s “close to being insufficient for the kind of extreme winter events that could occur in the area,” it noted. “For instance, during a 13-day cold snap over the 2017–2018 winter, over 80 million gallons of fuel oil was used for electricity generation in the New England area.”

Olson noted that the fuel supply concerns warranted a serious warning. “We do look at the individual conditions, and so the fuel situation, particularly when we started writing this report a month ago or longer than that, was shaping up to be a very significant factor, and I don’t think we’re out of the woods on fuel,” he said. “It’s a particular focus item with current circumstances around the world on the worldwide energy markets. All things are looking a lot better than they were a few months ago. But nonetheless, this is an area that’s of concern and warrants considerable attention and monitoring as we get into the winter,” he added.

Generators Have Stepped Up Weatherization

Asked whether the report presented a more dire risk outlook compared to last winter, John Moura, NERC’s director of Reliability Assessment and Performance Analysis, suggested the trends were concerning. “Year after year, there’s been a lot of factors that have pushed the system in a tighter condition,” he said. “What we find is a progression of risk over the last several years—really unlike what we’ve seen in the past—so this is a bit unprecedented,” he said.

Factors over recent years that have compounded overall system reliability are entrenched in rapid changes to its generation profile, Moura suggested. “The system hasn’t been stressed in this manner in the past, and probably more importantly, it hasn’t been as widespread where many of the areas we see are more prone to this,” he said.

The outlook isn’t optimistic. “There isn’t a lot of dispatchable generation on the rise [or] miles of new interstate pipeline being developed to support our natural gas infrastructure. We don’t see robust dual-fuel resilient fuel systems,” Moura said.

“The trend is we’ve seen more areas more at risk,” he added. “We see more retirements of critical generation, fuel challenges, and we’re doing everything we can to make sure in the operational phase these resources are in place to maintain reliability. And we’re giving the right situation awareness at the highest levels to ensure reliability even during our most extreme conditions.”

A specific bright spot NERC’s officials highlighted on Thursday relates to generator winter readiness. The assessment notes that the three areas hardest hit by Winter Storm Uri—ERCOT, the Southwest Power Pool (SPP), and MISO—have implemented “several improvements” based on their operating experience.

Prompting perhaps the most sobering U.S. reliability crisis in recent decades, Winter Storm Uri caused 4,124 outages, derates, and failures at 1,045 generators—a combined 193,818 MW—scattered across Texas and parts of the southcentral U.S. for four consecutive days, from Feb. 15 to 19, 2021. So far in Texas, generators and natural gas facilities designated as critical infrastructure are abiding by weatherization standards to improve availability during extreme weather this winter. SPP and MISO have meanwhile ramped up a focus on “operational coordination and situational awareness,” NERC said. “While the risk of energy emergencies for the upcoming winter has not been eliminated, improvements—due to lessons learned from Winter Storm Uri—are expected to reduce the likelihood and lessen the severity of a future Winter Storm Uri scale event,” it said.

NERC has also taken steps to address forced outages. Winter Storm Uri prompted “rigid requirements, including NERC standards, but also standards and requirements within states to improve winterization of units,” Moura said on Thursday. In September, NERC issued a Level 2 alert to grid operators to evaluate the bulk electric system’s winter readiness. “Really, it was an extensive ‘condition’ survey of our generator units and other entities to better understand how much progress they’ve made. While there’s been some progress, there’s still more work to be done,” he said.

Moura, however, also underscored that system reliability factors in improvements to natural gas infrastructure, though he noted NERC has no jurisdiction authority on gas transportation and gas supply production. “A lot of that is more unclear to the electric side around preparations or equipment or progress that’s been made,” he warned.

Reliability Assessment Prompts Industry Calls for Action

NERC’s grim warnings in its winter assessment almost immediately elicited reactions from industry.

Jim Matheson, CEO of the National Rural Electric Cooperative Association (NRECA), a trade association representing nearly 900 local electric cooperative, said the assessment served as a “clear and constant warning about the nationwide consequences of continuing a haphazard energy transition.”

The assessment “paints a stark and disheartening picture of the reliability challenges facing much of the U.S. this winter,” Matheson added. “As the demand for electricity risks outpacing the available supply during peak winter conditions, consumers face an inconceivable but real threat of rolling blackouts. It doesn’t have to be this way. But absent a shift in state and federal energy policy, this is a reality we will face for years to come,” he said.

Matheson urged policymakers to assess the rapid pace of change, which is primarily driven by policy, market shifts, and technology forces, and consider how it affects reliability, affordability, and grid resilience. NRECA’s not-for-profit electric co-op members, which sell the majority of their power to households rather than businesses, have expressed transition-related challenges, including maintaining reliable baseload power sources as part of their lower-carbon futures.

On Thursday, Matheson pointed to a recent report from the National Renewable Energy Laboratory that suggests achieving the Biden administration’s goal of a zero-carbon grid by 2035 will require a tripling of U.S. power generation capacity from 2020 levels. “Electric transmission infrastructure would need to double or triple as well,” NRECA noted.

Matheson said electric co-ops have so far remained focused on working toward “meaningful solutions,” including pressing for action to reform the process for permitting and siting new power generation and transmission infrastructure. “The pursuit of an energy transition that prioritizes speed over practicality has jeopardized America’s ability to keep the lights on,” he said. “Today’s energy decisions will determine whether there are sufficient resources for the lights to come on tomorrow. Failure is not an acceptable option for the American families and businesses we serve.”

America’s Power, which says it is a “partnership of industries involved in producing electricity from coal,” also urged vigilance in the pace of transition. “One of the reasons for this risk is the closure of coal power plants,” said America’s Power president and CEO Michelle Bloodworth. “Although NERC has issued similar warnings before, coal plant closures have not stopped. Almost 27,000 MW of coal-fired generation in 24 states are expected to retire this year and next year. More than half the coal fleet has announced plans to retire by 2030.”

Bloodworth said NERC’s warnings are not enough. “Coal power plants, which have on-site coal stockpiles, are six times more dependable than wind farms, which depend on the weather. We need to pause coal plant closures until NERC assures us that the electricity grid is as reliable as it needs to be to withstand extreme weather during both winter and summer,” she said.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).

Updated (Nov. 18): Includes more details from NERC’s assessment and industry comment.