Could Success Spoil ISO-NE?

Independent System Operator-New England celebrated its 20th anniversary last July with a solid record in its energy and capacity markets, turning around a fragmented regional electric system. Can it repeat that performance in the face of new challenges: retiring coal, oil, and nuclear plants; gas deliverability problems; the rise of renewables; and the need for decarbonization?

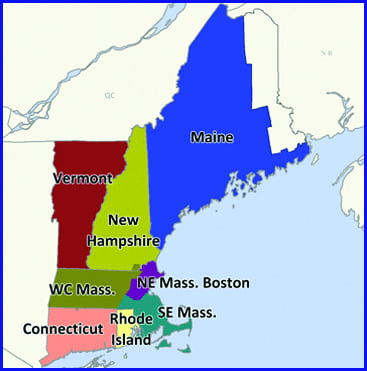

On July 1, the Independent System Operator-New England (ISO-NE), headquartered in Holyoke, Massachusetts (Figure 1), marked 20 years as a wholesale, competitive market covering Connecticut, Rhode Island, Massachusetts, Vermont, New Hampshire, and most of Maine (Figure 2). When the ISO began operations, competitive wholesale markets were a bold experiment for the 1990s, fostered by the Federal Energy Regulatory Commission (FERC). The foundation was FERC’s belief, based in classical economics, that market competition would produce superior results compared to the conventional model of the state-regulated, vertically integrated monopoly electric companies.

FERC’s theory was that separating electric generation, which had seen competition arise as a result of the 1978 Public Utility Regulatory Policies Act and the appearance of nonutility generation companies, from transmission and distribution would lower consumer prices, introduce new investment, and spur innovation. It was called “restructuring.” There were plenty of skeptics.

|

| 2. Covering a six-state region. The ISO-NE serves six states, from Maine at its northern end, to Connecticut and Rhode Island in the south. Source: FERC |

New England’s electric market in the 1990s, dominated by vertically integrated monopoly electric utilities, was a mess. Consumer rates were high. Generation was dominated by oil, coal, and nuclear. Little electric system investment was occurring in the region. Reliability was problematic. Then FERC unleashed its experiment in wholesale electric market competition.

“The experiment was extremely successful,” ISO-NE CEO Gordon van Welie told POWER in an interview shortly after the anniversary. “The aim of restructuring was more efficient production and greater reliability. We can check both those boxes. We also needed to attract investment in the region.” That box also got checked.

ISO-NE claims the following benefits have been realized:

■ Wholesale energy prices (which translate into consumer prices) have dropped 44% since 2004, which was the first year of the ISO’s energy market. 2016 saw the lowest wholesale electric prices since 2003.

■ Some 14,000 MW of new—mostly gas combined cycle—generation has replaced older coal- and oil-fired generating capacity, a private investment of about $14 billion. Another $8 billion of private-sector investment has gone into new high-voltage transmission, with another $4 billion coming along.

■ The new generation has slashed regional air pollution. Nitrogen oxide emissions decreased by 68%, SO 2 emissions plunged 95%, and CO 2 emissions dropped 24% between 2001 and 2015.

■ New technology and efficiency has arrived, including wind, solar photovoltaic, demand response, and energy efficiency.

The changed generating profile of the region illustrates the generation transition that has occurred in a system that now totals 30,500 MW in capacity. According to the ISO, in 1990, the region saw nuclear power as the dominant generating source, at 36%, followed by oil at 34%, coal at 16%, hydro at 7%, natural gas at 6%, and pumped storage at 1.7%. That general profile remained the case for more than a decade, but that’s changed. Today “it’s a much more reliable system, cleaner and greener,” said van Welie.

Changing Generation Mix

During the mid-2000s, the generating mix changed rapidly, driven largely by the rise in natural gas produced by horizontal drilling and hydraulic fracturing. By 2015, natural gas held the dominant market share at 49%, followed by nuclear, renewables, coal, and—badly trailing a market it once dominated—oil.

At the moment, New England faces an oversupply of electric generation, as van Welie acknowledged, which he said was “temporary overcapacity.” New market entry, mostly gas, he said, “cleared a bit more than we needed. Demand reduced slightly, and we are expecting to see more [retirements of older coal and oil capacity].”

The market profile will continue to change in the years ahead, according to van Welie. Coal and oil capacity will slide (see sidebar). For nuclear, Entergy’s 640-MW Vermont Yankee plant shut down in 2014 and the company’s 690-MW Pilgrim nuclear plant on Cape Cod will be out of the mix in 2019. That leaves only Dominion’s two-unit, 2,000-MW Millstone station in Connecticut, the largest generating plant in New England, and NextEra Energy’s single unit, the 1,200-MW Seabrook in New Hampshire, successfully bidding into the ISO-NE market.

Dominion failed to get Connecticut lawmakers to adopt a Millstone subsidy similar to what Illinois and New York adopted to keep marginal nuclear units able to bid into the competitive capacity markets. These “zero emissions credits (ZECs)” give a value to avoided carbon dioxide emissions from nuclear power in order to boost the ability of the nuclear plants to bid into the competitive markets.

Several independent analyses, including a study by the Massachusetts Institute of Technology, said Millstone is profitable. Dominion has said it fears the plant will become a money-loser. NextEra has made no similar statements about Seabrook. “In the future,” said van Welie, “we expect economic pressure on both” nuclear stations.

Subsidies Distorting the Market

While ISO-NE has not faced the issue of subsidized nuclear units bidding into the market, as in PJM and the New York ISO (NYISO), New England states are subsidizing wind and solar generation, distorting the competitive market. ISO-NE’s proposed solution, drafted earlier this year and unveiled prior to a FERC technical conference in May, is a two-part auction process.

The first stage would be a capacity auction run just as it is today, including a “minimum offer price rule” (MOPR). The minimum price rule would likely mean that the subsidized generation wouldn’t clear the market and get capacity payments. A second, “substitution” auction would then follow, run without the MOPR. Winners in the first auction that are open to retirement could pair up with subsidized resources not selected in the first auction.

Analysts Robbie Orvis and Eric Gilmon of the Energy Innovation firm, writing in Utility Dive, offer a hypothetical example of how the ISO’s two-step process would work. If a coal plant cleared the first auction at $10/kW-month and acquired a forward capacity obligation. Then the same plant cleared the second auction at $2/kW-month, it could decide to retire and make “a profit of $8/kW-month from transferring its capacity obligation to a new unit and permanently exiting the market.” A retiring 500-MW plant could see nearly $50 million as a result. The analysts noted, “The goal is to pair units that are willing to retire with other resources that are not selected in the first auction, in a pay-for-retirement scheme.” ISO’s van Welie calls this a “severance” payment. Others have called it “cash for clunkers.”

The two-round capacity auction is “on the drawing board,” said van Welie. “We will talk to our stakeholders,” he said, noting that the timeline for the plan is to circulate it and get various views, and vote on it in December. The plan would then require FERC approval.

Orvis and Gimon are not high on the two-stage auction schemes (PJM has proposed a somewhat different two-stage plan). “In ISO-NE,” they wrote, “if resources don’t clear in the second stage of the market but are built anyway due to state policy, too much capacity will be built.” That would add to ISO-NE’s problem of excess generating capacity, not alleviate it.

In addition to the two-step auction, the ISO is also looking for a way to build carbon prices into its processes. Van Welie would like to do that, and there is a mechanism in place that could do the job: the multistate Regional Greenhouse Gas Initiative (RGGI). “We would love to use RGGI,” he said. But the states, which govern RGGI, won’t go along with folding RGGI’s carbon price process into ISO-NE’s markets.

Analysts Orvis and Gimon like carbon adders (which NYISO and PJM are considering) better than the two-stage auction plan. “Since the marginal unit typically has higher-than-average emission intensity, a [carbon adder] increases the incentive for energy efficiency, providing the largest efficiency incentive in hours when carbon emissions are highest.” But there is a carbon adder downside. “The key vulnerability of a [carbon adder] is the need for agreement on setting and changing the [carbon] price.” That’s the problem that ISO-NE would like to solve through RGGI, but cannot.

Gas Deliverability a Challenge

Another generating challenge for ISO-NE is natural gas deliverability. While gas has enabled a major transition away from coal and oil, it has brought on its own problems. New England’s gas infrastructure is built around serving heating load. Most of the year, there’s enough gas to supply electric generation. But when winter hits hard, residential users have preference for pipeline gas, and electric generators are last in line. The result is curtailment of gas-fired power and a complex search for alternatives to keep the lights on.

That happened in January 2014, with the “polar vortex” plunging most of the eastern U.S. into record low temperatures. New England was hit hardest. Natural gas prices soared—and so did prices bid into ISO-NE’s energy market, resulting in spiking electricity prices and considerable public consternation and opposition. There was little ISO-NE could do about it.

The obvious solution for the long term is to build more gas pipelines from gas fields to New England, and add more gas storage. But attempts to bolster gas deliverability to the region have failed.

Most recently, at the end of June, Enbridge shelved a $3.2 billion pipeline project to bring enough gas to power 5,000 MW of generation. Enbridge cited an inability to line up financing in the face of hostility from Massachusetts toward the idea that electric customers would pay for the pipeline. A Massachusetts state court in 2016 ruled against putting the cost of the project into electric distribution rates. Last year, Kinder Morgan also dropped a planned $5 billion pipeline, which would have brought Marcellus Shale gas to New England.

According to van Welie (Figure 4), the ISO has largely given up on the idea of bringing more gas to the region, in the face of the inability of pipeline developers to win support for their projects. The problem now, he said, “is how to get efficient electricity production during winter, assuming we see no further investment in gas infrastructure.” He added, “Fuel has to come from somewhere when the existing pipelines are constrained.”

|

| 4. Confronting new challenges. Gordon van Welie, CEO of ISO-NE, acknowledged the group faces many issues in an ever-evolving power generation landscape, but said he is confident “we will continue to make wholesale markets work.” Courtesy: ISO-NE |

The need to keep the lights on during the winter clashes with the ISO’s desire to retire the region’s old and inefficient oil-fired steam plants, which burn heavy residual fuel oil. They generally don’t run, but when winter slams the region, ISO-NE has to replace gas with oil-fired capacity. The region’s oil-fueled units represent 23% of the total regional generating capacity. But in 2016 (with a warm winter), oil made up only 0.5% of the year’s generation.

“We are studying that problem right now,” van Welie told POWER. The study is looking at retirements, additions of renewables, and imports, mostly from Canada and New York. “There is surplus capacity in upstate New York, including a lot of wind.” New York has north-to-south transmission constraints but not east-to-west.

Renewables on the Rise

Renewables are booming in New England, which means that the issue of subsidized power and capacity may grow. Massachusetts is in the process of procuring 1,200 MW of onshore wind. At the end of June, the state issued a new request for proposals for 400 MW of offshore wind generation, which could grow to about 800 MW, according to an analysis by Washington’s Pierce Atwood law firm. Rhode Island has announced a plan for 1,000 MW of renewables in 2020. Solar investment is going on all over New England, most of it rooftop solar. “Add all those up,” said van Welie, “and you see very low marginal cost and very low prices.”

The Northeast electricity blackout of 1965, which turned out the lights on 30 million Americans in a region that spanned from eastern Canada to Pennsylvania, was the impetus for the 1990s’ federal restructuring of much of the U.S. electric market. In New England, hardest hit by the blackout, the initial response was the 1966 formation of the Northeast Power Coordination Council. In 1971, the region’s utilities formed the New England Power Pool (NEPOOL), which operated as a power coordinator for the six-state region.

When FERC began serious restructuring of wholesale markets 25 years later, NEPOOL became the foundation of the new independent system operator. (NEPOOL remains, largely as a trade association for the regional utilities.)

Over its 20-year history, ISO-NE has shown a record of success in the face of numerous challenges. Now it faces new challenges: retirement of coal, oil, and nuclear baseload generation; the rise of renewables and how to fit them into the region-wide generating system while continuing to provide reliable service; and the potentially game-changing role of energy storage, if it actually becomes economically competitive. In the background is a growing resistance to wholesale markets, led by utilities with substantial nuclear and coal-fired generation who are seeking state subsidies to essentially put their thumbs on the scale of the competitive wholesale markets.

“I am confident we will continue to make wholesale markets work,” said van Welie, who has been working for ISO-NE since 2000 (and was inducted into the National Academy of Engineering this year). “That’s not going to be without big challenges. But New England has a good history of working through issues.” He said he hopes the region can “begin a long-run direction to how to decarbonize,” adding that “this is not just about carbon reduction, but economic development.” ■

Read more about electricity markets in transition in POWER’s exclusive series:U.S. Electric Markets in Transition (January 2017)Duck Hunting at the California Independent System Operator (March 2017)New York’s Ambitious Transitions: Who Wins? Who Loses? Who Knows? (May 2017)MISO: Avoiding the Mess Facing Other Wholesale Competitive Electric Markets (July 2017)Could Success Spoil ISO-NE? (September 2017) |

—Kennedy Maize is a long-time energy journalist and frequent contributor to POWER.