Duck Hunting at the California Independent System Operator

California’s excess of solar power challenges the statewide independent system operator’s ability to balance its system without curtailing low-carbon supplies and ramping up natural gas generation. It’s called the “duck curve.” Is the region’s growing energy imbalance market the solution, or will it take a full-fledged independent transmission organization to slay California’s electricity duck?

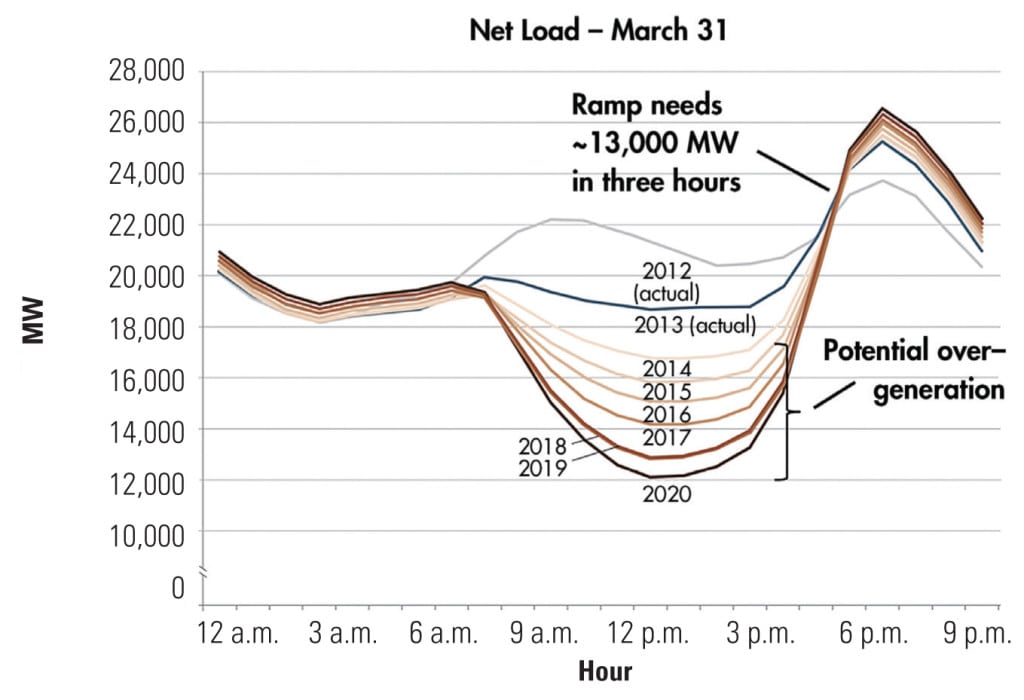

The California Independent System Operator (CAISO), manager of the Golden State’s wholesale electricity market, in its 2015 strategic plan identifies “overgeneration” as a major challenge. The ISO has a lot of renewable generation—particularly solar—that does not match when customers need power. The problem is reflected in the well-known “duck curve” (Figure 1), first published in 2013.

The duck curve is a graphic representation of a mismatch between the time when a large supply of solar power comes onto the California grid and when the system demands power. The duck curve shows a major drop in electric load in midday when solar hits its peak, swamping the grid at a period of low demand and potentially pushing net load below the point where older baseload plants can ramp down to compensate. In the late afternoon and evening, when solar begins to fade, people are arriving home and boosting electricity use, ramping up demand. With the sun going down, quick-ramping gas has to come online in a hurry.

In its 2015 plan, CAISO said that overgeneration “arises when there is more electricity than there is demand to use it…. Current studies show that this risk will grow quickly after 2020 with higher levels of renewable generation in the mix—even after fossil fuel power plants have reduced output as much as possible. When that occurs, some renewable generation may need to be curtailed, which would be a missed opportunity to use clean power at a minimal marginal cost.”

“The downside” of the duck, CAISO CEO Stephen Berberich told POWER recently, “is turning off power that is clean, with low marginal cost, and that people have paid for.” The solar generation gets dumped mid-day because the state’s older fossil plants can’t cycle fast enough to deal with the late afternoon shift. Come sundown, the demand neck of the duck ascends as solar trails off. “That requires ramping” of the power system’s fossil generation to meet demand, Berberich said. California has built some high-tech, fast-responding gas plants recently, but that runs counter to the state’s goal of reaching 50% renewables by 2030. “We are relying on gas plants here in California” to meet the afternoon and evening demand. “Our goal is to decarbonize the grid, and we don’t want to have to rely on gas.”

So far, however, it is. California is dependent on gas for about 56% (some 42,000 MW) of the state’s 75,000 MW of electric generation, compared to 5,800 MW each for solar and wind (and 10,000 MW of hydro), according to Energy Information Administration (EIA) data. Those figures include all of the state’s generation, from investor-owned utilities, non-utility generators, and public power systems.

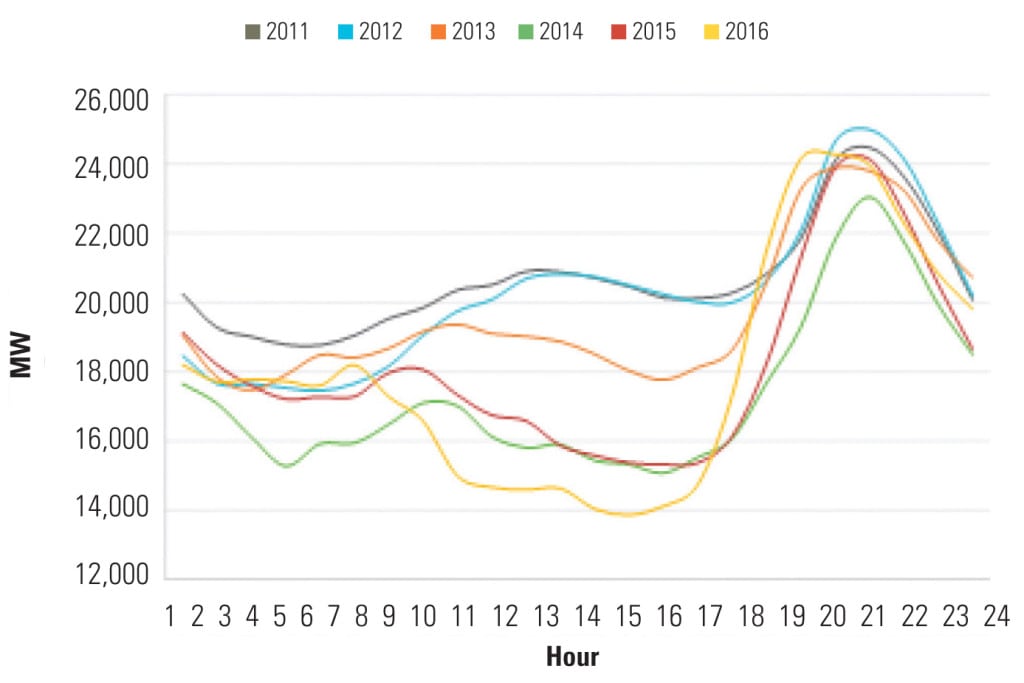

The problem may be growing faster than CAISO estimated two years ago. An analysis last fall by the Atlanta-based ScottMadden energy consulting firm—“Revisiting the California Duck Curve: An Exploration of Its Existence, Impact, and Migration Potential”—found that the mismatch between load and generation is growing “faster than expected” (Figure 2). The analysis outlined surprising nuances in the duck curve:

■ Power ramps between 2 p.m. and 9 p.m., the “neck” of the duck, are increasing yearly, “indicating changes in system operations are occurring in all parts of the year.”

■ The duck curve is most severe on weekends “because of their lower system loads” despite consistent solar generation. “Conversely, higher system loads on weekdays mitigate the midday decline in net load and the impact of the duck curve.”

■ The duck curve doesn’t occur just in sunny spring months, as earlier analyses had assumed. CAISO’s 2013 analysis that first identified the duck curve was based on data for March 31. The ScottMadden analysis found the steepest ramps in 2015 came in December, November, and January, not March.

■ Utility solar, not rooftop panels, feeds the duck. “If the belly of the duck is formed by less visible distributed resources,” says the report, “one would see it manifested in both the system load and the net load. This is not the case in the California duck curve. Instead, we see a smooth system load and a concave net load, which is indicative of the influence of utility-scale solar rather than distributed generation.”

ElectricityPolicy.com commented that, “it appears the famous fowl known as the California ‘duck curve’ is developing a deeper belly, with steeper ramping that will require more flexible and fast-responding resources.”

| Is California’s Duck Migratory?

The duck curve may not be limited to California. Greg Litra, the ScottMadden partner watching over renewable energy issues, said, “One of the most important implications is the ‘duck curve’ may migrate to other parts of the United States. Growing numbers of utility-scale installations could mean that ‘the duck’ could migrate to states like Arizona, Georgia, Nevada, North Carolina, and Texas in the not-too-distant future.” The ScottMadden analysis said, “Many parts of the United States are poised for market-driven growth in utility-scale solar. For example, North Carolina is already expecting solar to inject energy significantly in excess of system needs by 2020. Additional states to watch in the near term include Arizona, Georgia, Nevada, and Texas. Each of these states, including North Carolina, may have more than 3,000 MW of utility-scale solar by the end of 2021. The duck may also appear in less obvious environments, such as small balancing authorities with high penetrations of utility-scale solar.” In Hawaii, where solar is a big resource, the duck curve is less likely, as the state’s average system load “has changed over time due to much higher penetrations of distributed generation, notably residential solar. In 2015, the 305 MW of residential solar operating in the state was equal to 9% of the front-of-meter generation capacity managed by Hawaiian Electric Company,” the analysis found. According to ScottMadden, comparing California and Hawaii “illustrated that understanding the root cause of the duck curve is essential before preparing for and developing strategies to address the operational impacts.” |

Regional Balance

CAISO is leading the hunt for ways to slay the duck, though the problem is not unique to California (see sidebar, “Is California’s Duck Migratory?”). In fact, Berberich sees the rapidly developing regional energy imbalance market as key. CAISO’s energy imbalance market is a voluntary, real-time wholesale market offered to utilities in the region in 2014 as a way to coordinate their generation and loads more broadly. Oregon’s PacifiCorp was the first participant.

The West has a surfeit of balancing authorities, which isn’t necessarily a good thing. The EIA defines a balancing authority as, “The responsible entity that integrates resource plans ahead of time, maintains load-interchange-generation balance within a Balancing Authority Area, and supports Interconnection frequency in real time.” The western region has 38 different balancing authorities by recent counts, and many analysts view this as excessive and inefficient.

The idea behind the CAISO energy imbalance market—which runs parallel to CAISO but does not constitute a full-fledged regional system operator—is to reduce the number of balancing authorities in the region and make the resources of various parties available to each other with fewer jurisdictional seams. Says Berberich, “A portfolio effect across a larger region dampens overgeneration. Let’s share the overgeneration and leverage regional generation.”

He adds that all of the states in the region except Idaho “have some version of a renewable portfolio standard.” That means, the “more we collaborate across the region, leaning on one another, we don’t all have to build new capacity.” The larger grid network, centrally controlled, becomes a partial equivalent to energy storage.

California’s electricity market has undergone several transitions over the past 25 years (see sidebar, “The Roots of CAISO”) and seems poised for another as the CAISO imbalance market expands. It has attracted a growing list of non-California generating utilities since Oregon’s PacificCorp became the first. The current roster includes Puget Sound Energy in Bellevue, Wash.; Arizona Public Service; Oregon’s Portland General Electric; Idaho Power; and Nevada’s NV Energy. Last October, the ISO said the benefits of the energy imbalance market for the third quarter of 2016 exceeded $26 million, bringing the savings since 2014 to $114.35 million.

CAISO late last year said two major California public power systems—the Balancing Authority of Northern California (which includes the Modesto Irrigation District, City of Redding, City of Roseville, Sacramento Municipal Utility District [SMUD], City of Shasta Lake, and Trinity Public Utilities District) and SMUD itself—had agreed to join the imbalance market.

Gateway to an RTO?

Is CAISO morphing into a larger integrated wholesale market for the western U.S.? Berberich is cautious. “Even a small sliver of the market has significant value,” he says. He adds that “collaboration in the West is growing,” but that the imbalance market “is not necessarily a gateway drug to a regional transmission organization.”

The Natural Resources Defense Council (NRDC) argues that the imbalance market makes the case for a region-wide operator. Ralph Cavanagh, co-director of NRDC’s energy program and a long-time participant in the shape of the California and western markets, told POWER in a January interview that CAISO is too timid about the value of a full-fledged ISO.

Cavanagh says the imbalance market is helpful in combating California’s overgeneration. “The imbalance market is a baby step in the right direction,” he said. But a full-scale regional market is the way to completely doom the duck (Figure 4).

The imbalance market “demonstrates a small part of the benefits of full integration,” Cavanagh said. “There is a strong indication that this is the direction that everyone is prepared to go.” He added that CAISO “has performed very effectively,” and that it “long ago evolved into a western institution,” not just a California-centric operation. “We do have a western grid,” he said. “The question is whether we should manage it effectively,” by which he means a regional transmission organization.

A recent paper by NRDC attorney Allison Clements—“Making Sense of Potential Western ISO Governance Structures: The Role of the States”—says, “A broader regional grid operator can provide substantial annual savings for customers across Western states. In California alone, for example, benefits from grid regionalization are estimated to increase over time from $150 million per year to more than $1 billion in 2030. It also allows for even more rapid and cost-effective integration of wind and solar power than is already happening and lowers the cost of satisfying state and federal environmental regulations with implications for the grid.”

Clements adds, “Developing wholesale energy markets also provides an opportunity for competition in the power industry that has not existed previously across the Western Interconnection.” Failure to build a region-wide wholesale market will “likely cost consumers billions of dollars over time, require the development of duplicative infrastructure and generation because less resource sharing will be possible, and make regulatory compliance more difficult and expensive for states in the Western Interconnection.”

Steep Obstacles

Despite the supposed benefits, implementing a new Western ISO could face political obstacles among some of the electric systems in its ambit and at the Federal Energy Regulatory Commission (FERC), which regulates interstate electricity commerce. The NRDC analysis says Section 205 of the 1935 Federal Power Act, which gives states the right to participate in FERC proceedings to establish that wholesale rates are “just and reasonable,” is a path for a western ISO. FERC and the courts have said this provision gives states the ability to participate in proceedings establishing an ISO under federal law. The Midcontinent Independent System Operator and the Southwest Power Pool used Section 205 to establish who gets to run the systems in the broader interstate wholesale market for their regions.

In California, the Imperial Irrigation District (IID), a public power utility managing water and electricity in the Southern California desert with 150,000 electric customers, opposes a regional ISO. IID says a wholesale market and integrated grid means that, “California could be forced to accept ‘dirty’ [coal-fired] electricity generated in other states, and federal lawsuits that could destroy years of clean-energy legislation in California, due to preemption by the Interstate Commerce Clause and the Federal Energy Regulatory Commission.” CAISO nevertheless argues that a regional ISO would follow the state’s prohibition of coal-fired power from anywhere, including out-of-state generation.

This year could be crucial for the emergence of a western system operator, according to NRDC’s Cavanagh. In order for the fully integrated regional market to work, governance must be region-wide, divorced from parochial state politics, he says. California would have to change its law covering the ISO, as the governor now appoints the ISO’s board.

The California Legislature returned to Sacramento in January and will be in session into September. Cavanagh says the current session is the time to act on legislation creating an independent board of governors as the crucial step for a region-wide transmission operator. Notably, Gov. Jerry Brown is backing the plan to build out an ISO.

Meanwhile, a rival western regional system operator could undercut efforts to expand CAISO. The Mountain West Transmission Group—seven Rocky Mountain transmission-owning utilities working with the Department of Energy’s Western Area Power Administration (WAPA)—are exploring their own organized market that could compete with a California-centric ISO. The Mountain West footprint would encompass Colorado, Wyoming, and pieces of Arizona, Montana, New Mexico, and Utah, according to the RTO Insider newsletter. The WAPA relationship makes the proposed ISO attractive to some utilities that view the CAISO expansion as too California-oriented and to stakeholders long wary of trends coming from the Left Coast.

Utah Associated Municipal Power Systems (UAMPS), supplying power to eight western states, is among those viewing a larger California ISO skeptically and looking at Mountain West. UAMPS CEO Doug Hunter told Utah legislators last July that CAISO “is not the only game in town,” saying UAMPS likes the model based on WAPA’s footprint. “It runs right through us,” he said. “It would be much better if the entire west had access to it.” Sources in California told POWER that the Mountain West group is looking at the Southwest Power Pool, headquartered in Little Rock, Ark., as a leader for their alternative to the California proposal for a regional ISO.

The market and political dramas could play out this year. One outcome could be a new wholesale independent transmission operator in the West, built from the CAISO. Or there could be two regional transmission operators: a CAISO-oriented system including much of the Pacific Northwest, and a Mountain West system encompassing much of the Rocky Mountain West. Both could compete for dominance in the Western Interconnection. ■

Read more about electricity markets in transition in POWER’s exclusive series:U.S. Electric Markets in Transition (January 2017)Duck Hunting at the California Independent System Operator (March 2017)New York’s Ambitious Transitions: Who Wins? Who Loses? Who Knows? (May 2017)MISO: Avoiding the Mess Facing Other Wholesale Competitive Electric Markets (July 2017)Could Success Spoil ISO-NE? (September 2017) |

—Kennedy Maize is a frequent POWER contributor.