Analysis Supports Competitive Southeast Power Market

A new report from two groups that study energy policy supports the establishment of a fully competitive regional electricity market in the U.S. Southeast, something already being discussed by at least two of the region’s largest utilities.

The analysis published August 25 from San Francisco, California-based Energy Innovation, and Boulder, Colorado-based Vibrant Clean Energy (VCE), says competitive pricing across the Southeast U.S. would save electricity customers a combined $384 billion through 2040. Such a market also would lead to the retirement of most of the region’s coal plants and gas-fired peaking plants over the next 20 years, according to the report.

The groups said a regional electricity market with competitive pricing would lead to decarbonization even without state policies mandating renewable energy and putting a price on carbon. The report details the addition of clean energy resources, saying there is potential for another 52 GW of solar power, 42 GW of wind power, and 37 GW of storage.

Regional utility majors Southern Co. and Duke Energy in mid-July confirmed they are discussing the formation of a regional energy market. Southern said energy companies in the Southeast are exploring a “centralized, region-wide, automated intra-hour energy exchange,” that could be known as the Southeast Energy Exchange Market (SEEM). Other utilities also have confirmed that discussions regarding such a market have been ongoing for months; Duke Energy confirmed those talks in a stakeholder meeting on July 13.

Tuesday’s report did not model a SEEM-based scenario, since there are few details available about that plan. It did, however, say that a Southeast regional competitive electricity market would prioritize the least expensive and most-efficient power resources, which primarily would be renewable energy instead of coal-fired power.

Mike O’Boyle, electricity policy director for Energy Innovation and one of the report’s authors, said, “If Duke and Southern can’t find ways to do that in their region … you’re going to see them struggling to do it all on their own cost-effectively.”

Vibrant’s CEO and founder, Christopher Clack, previously has raised concerns that a market mechanism like SEEM needs to remove self-scheduling assets. Clack has said such a market need to be controlled by an independent group in order to guarantee benefits to every participating state. Clack has said that without independent oversight, utilities with large generation fleets could possibly use their participation in the market to serve other regional utilities with their excess power, potentially prolonging the life of their assets.

Southeast ‘Devoid of Market Competition’

The report notes that there are seven independent system operators (ISOs) or regional transmission operators (RTOs) that “serve close to 70 percent of all United States electricity consumers,” and says the “Southeast … is particularly devoid of this type of market competition.” The report, in its executive summary, says it “details the impacts of enhancing competition for wholesale electricity transactions through a theoretical organized market in the Southeast region.”

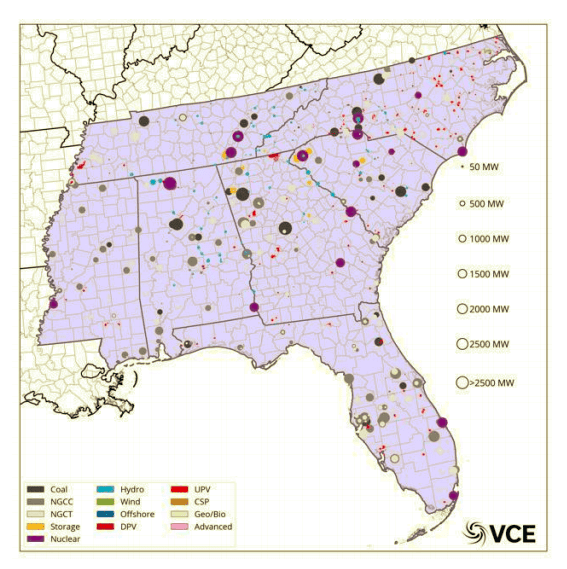

The summary report provides high-level information from the groups’ “combined production-cost and capacity expansion model of the electric power system” in Alabama, Florida, Georgia, Mississippi, North Carolina, South Carolina, and Tennessee over the next 20 years. A companion technical document provides greater detail of the report’s modeling and scenario analysis.

VCE modeled two core scenarios and two sensitivities for the report. The core scenarios compare a business-as-usual (BAU) approach and a fully competitive regional approach. The group said the BAU scenario is modeled “through an Integrated Resource Plan (IRP) Scenario, whereby the model builds capacity embedded in existing Southeast utility resource plans and dispatches these resources in line with historical trends or as stated in the IRPs.”

The group said “Competition is represented in the Regional Transmission Organization (RTO) Scenario, which mimics a competitive wholesale market for the entirety of the Southeast region, in which the model chooses the most economically efficient resources from an open regional market, optimizes dispatch of these resources to minimize cost, and performs co-optimized transmission.”

$384 Billion in Savings

VCE and Energy Innovation said a competitive Southeastern RTO “creates cumulative economic savings of approximately $384 billion by 2040 compared to the business-as-usual (BAU) case.” The BAU case is based on announced IRPs from regional utilities. The report said that in 2040, there would be an average savings of about 2.5¢ per kilowatt-hour (kWh), or 29% in retail costs compared to BAU. It said 2040 retail costs in the RTO scenario are 23% below today’s costs, and carbon emissions fall by about 37% relative to 2018 levels.

Justin Kearney, vice president of market development at Hartford, Connecticut-based Titan Energy, an independent energy consulting firm that works within electricity markets, told POWER his company “supports the move to a competitive electricity market setup in the Southeast United States, which would be best accomplished by establishing an independent Regional Transmission Operator (RTO).”

Kearney agreed with the conclusions from Tuesday’s report, saying “it is vital that the party overseeing the wholesale electricity market remains neutral, and therefore unaffiliated from any market participant [such as utilities, power generators or suppliers]. In this way, the role of the RTO should be strictly to ensure reliability, and promote competition—i.e. the RTO sets the rules, and the market decides which power plants get built. Aside from the savings numbers estimated, which we view as accurate and potentially undervalued, a competitive electricity market will lower costs, create jobs, drive innovation, and refocus the utility companies on their primary mandate of delivering power.”

Among the report’s findings is analysis that shows if an RTO keeps existing uneconomic nuclear plants online, emissions would fall 41% by 2040, from 2018 levels, compared to a 37% drop in emissions in the main RTO scenario. An RTO-plus-nuclear plan would cost 0.5% more, bringing a cumulative $375 billion in savings by 2040, as opposed to $384 billion.

Taylor McNair, program manager at GridLab and co-author of the report, said in a press briefing, “We do see job gains in all four scenarios that we model, but the employment benefits are far more striking in the RTO scenario,” in which gains are made in the renewable energy sector. McNair said, “There are lots of advocates and experts in the region” who can provide insight into what type of governance structure is appropriate, noting that “Part of the impetus for this study is really teeing up this question.” McNair also said the report includes separate policy recommendations.

The policy recommendations direct state legislatures and regulatory agencies to study the feasibility and benefits of power market reforms, including a scenario with RTO oversight. North Carolina already is studying that situation, and South Carolina officials have said they also will look into such a market structure.

Utility Support for Decarbonization

The policy recommendations also suggest states should support utility decarbonization goals, and says state lawmakers and regulators should help manage a transition away from coal-fired power. The RTO scenario in the analysis phases out coal by 2040. It says the resulting generation mix would be 51% clean electricity generation, and other generation would include natural gas combined cycle power plants.

The groups’ analysis said the most cost savings would be achieved by a grid with at least 22% renewable generation by 2040. The modeling constrained solar and wind installations at 1.8 GW each in the first year, and increasing 5% per year thereafter, to track historical capacity expansion of renewable generation. The groups said the modeled solar and wind additions “essentially” reached the limits each year, noting that 12 GW of solar projects gained interconnection approval from ERCOT, the Texas wholesale market operator, in a recent seven-month period.

The report also said that continuing programs that offer credits for zero emissions, which primarily prolong the life of nuclear plants and are in operation in states such as New York, New Jersey, and Illinois, would lower the need for gas-fired generation in the region.

Bryn Baker, policy innovation director for the Washington, D.C.-based Renewable Energy Buyers Alliance, in a press briefing said, “The legislature has been seen as the body that will probably take action” with regard to looking at different market structures.

—Darrell Proctor is associate editor for POWER (@DarrellProctor1, @POWERmagazine).