The U.S. is among the top countries worldwide in the production of geothermal energy, with output of about 4 GW, according to the U.S. Energy Information Administration. California leads the nation, in large part due to the Geysers field in the northern part of the state, which is the largest dry steam geothermal field globally. Indonesia is another top producer, and that country has an estimated reserve capacity of nearly 28 GW, according to government data, far and away the highest potential output of any nation.

The U.S. Dept. of Energy last year said the U.S. had 99 geothermal power plants, with 53 in California, and 32 in Nevada. Other plants are located in Alaska, Hawaii, Idaho, Oregon, New Mexico, and Utah, with the latter becoming a literal hotbed for testing and research into geothermal technology.

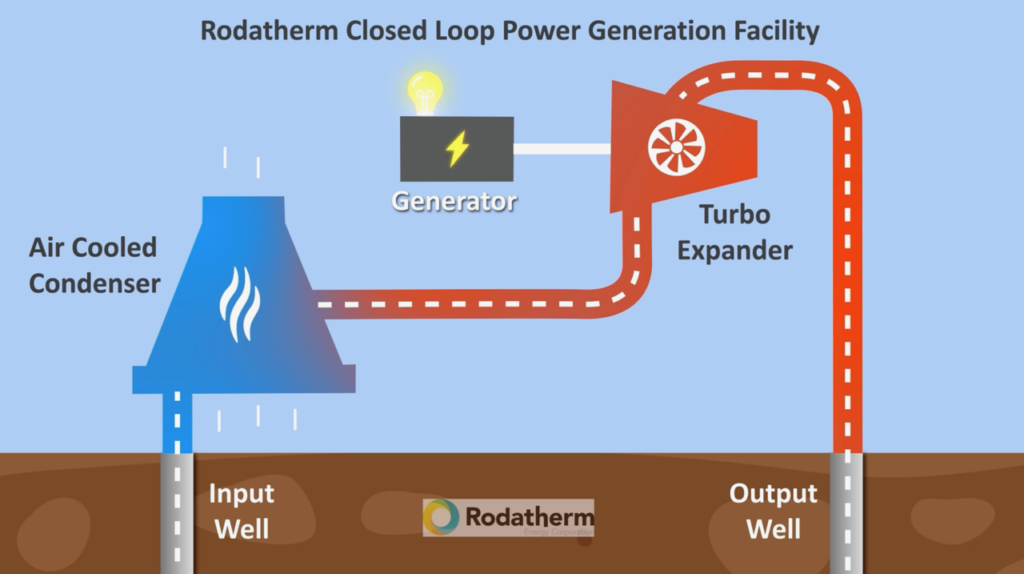

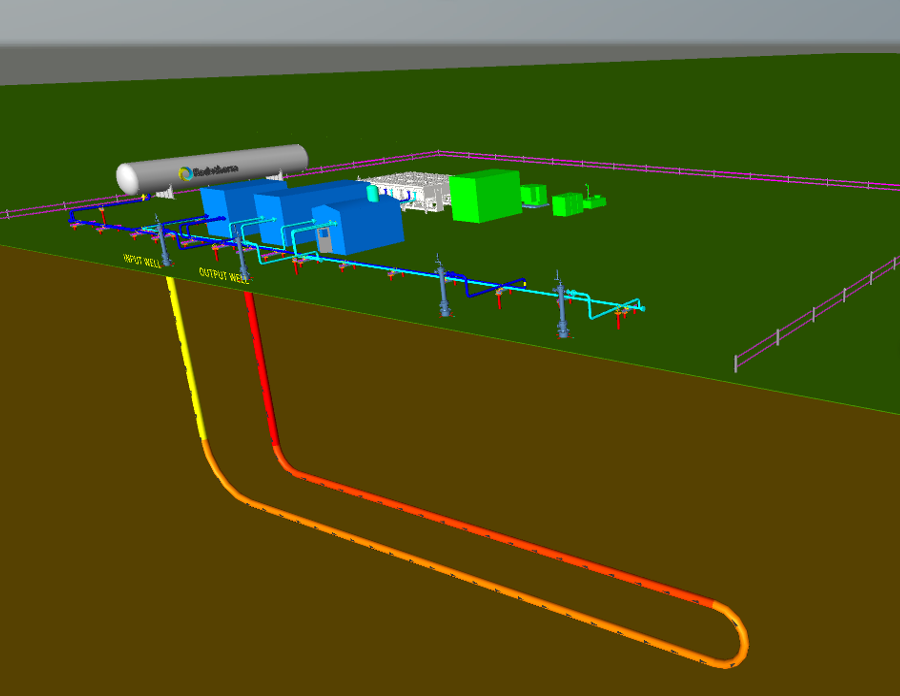

Among the companies working on advanced geothermal tech is Rodatherm Energy Corp., a privately held company with a primary focus on the Great Basin region in the Western U.S. The Utah-based company, which also has operations in Calgary, Alberta in Canada, is known for its pioneering Advanced Geothermal System (AGS). The group’s technology includes a fully enclosed well loop, drilled into the Earth’s heat reservoir. The loop serves as a conduit for the circulation of a working fluid, effectively converting the Earth’s thermal energy into electricity.

Rodatherm in September of last year completed an oversubscribed $38-million Series A funding round, which it said was the largest first-round venture raise for a geothermal startup to date. Investors include Evok Innovations, TDK Ventures, Toyota Ventures, TechEnergy Ventures, MCJ, Active Impact Investments, Renewal Funds, the Grantham Foundation, Giga Investments, and others. The company is working on a pilot project in Beaver and Millard counties in Utah, seeking to validate the efficiency of its closed-loop, refrigerant-based technology over traditional water-based technologies.

Curtis Cook, founder, president, and CEO of Rodatherm, provided POWER with information about the company’s work and technology, along with what he sees as the key elements for geothermal energy moving forward.

POWER: You talk about how cost is king when it comes to geothermal deployment. What are the factors that lead you to say that?

Cook: Consumers ultimately want affordable energy, and investors require a reasonable return on capital. Within this construct, geothermal projects compete with all other forms of power generation for consumers and capital. In 2026, geothermal companies will showcase their path to affordability and reliability gauged by CAPEX per MWh (LCOE) and OPEX, respectively. Large-capacity geothermal projects require billion-dollar investments, and regardless of the technology, companies will need to show, through cost metrics, that they can scale effectively.

POWER: You’ve said geothermal is hitting an inflection point when it comes to the industry. Are you referring more to technology advancements, or to the financial aspects of geothermal?

Cook: Both. Most geothermal companies will have showcased their technology/method by the end of 2026 and likely share that with potential customers—data centers and communities. That discussion will focus largely on affordability and reliability. If those fundamentals are well received, the discussion will quickly turn to project development—the inflection point for geothermal electrical generation. In 2027, financing considerations will dominate: cost of capital and debt structures, development timelines, build-out staging, and project execution. For many, the discussion will transition from technology to economic development.

POWER: The oil and gas industry, through its use of hydraulic fracturing, is becoming more involved in geothermal. How should long-time geothermal supporters react to having new players in the market?

Cook: Oil and gas service companies are paying close attention because geothermal represents a direct market extension for their capabilities. Oil and gas producers, the project developers, are also starting to take note; however, their interest is framed within the ability for a return on capital employed. Once geothermal can demonstrate positive project economics, oil and gas producers, electricity developers, and utilities will quickly enter the space. This should be viewed positively; it accelerates development and brings experienced operators into the industry.

POWER: How can geothermal energy support data centers and business expansion? Should tech companies be looking to site business complexes near geothermal resources?

Cook: Absolutely. Affordable and reliable, geothermal electrical generation is also secure. Because data centers connect to the cloud, they’re largely location-agnostic. Dedicated to their use, data centers can directly connect to a geothermal project site to obtain baseload, secure power without stressing the existing electrical grid. This reduces transportation costs, electrical grid stress, and guarantees secure baseload power.

POWER: We are seeing residential communities being built near geothermal resources. Is this a trend that is likely to continue, and perhaps expand?

Cook: Yes, pairing geothermal development within residential communities is an excellent application. In combination with its primary focus of electrical generation, there is also waste heat generation. Although relatively small, in aggregate it is substantial. This use of geothermal is called district heating and is widely used globally to heat homes and businesses. Within the U.S., Boise, Idaho, is a good example of this application, and internationally, Northern Germany is embarking on a substantial investment in district heating. This is also an easy economic application for more remote communities where electrical and heating costs are high.

POWER: Rodatherm is developing a system designed to achieve a competitive levelized cost of energy, with zero emissions, no water usage, and the ability to provide secure energy close to demand centers. Can you talk a bit about the technology and engineering behind this system, and why it’s important to growth in the geothermal sector?

Cook: Almost all geothermal technologies and companies rely on water as a working fluid. The problem is that water is a poor refrigerant; the process is inefficient with high operating costs—in short, poor cash flow. Further, sourcing sufficient groundwater limits geothermal applicability to remote areas. Electrical loads generally coincide with high-density population areas with stressed groundwater resources.

The Rodatherm system is essentially water-free geothermal. The system relies upon an organic working fluid that is efficient (50% more power output than water-based systems) with low operation costs. Simply put, the technology is a method to efficiently generate power from heat, analogous to a heat pump. Rodatherm’s solution can be applied broadly, close to demand loads, and geologically co-located with traditional reservoirs, enhanced reservoirs, or ideally with existing sedimentary basins.

POWER: What do you think will define success for geothermal in 2026 and beyond?

Cook: It is a very exciting time for geothermal with new technologies and approaches that will unlock practical, economic power from the earth. Accelerating electrical demand growth (27% increase in 2025 alone), combined with market deregulation, will drive geothermal to grow and expand. At Rodatherm, we believe our product is practical, economic, and simple enough to be applied within high-demand areas to meet that demand.

—Darrell Proctor is a senior editor for POWER.