Power Co-op Files Bankruptcy After $2.1 Billion ERCOT Bill

The group considered Texas’ oldest and largest electricity cooperative has filed for Chapter 11 bankruptcy protection, saying it can’t pay money wanted by the state’s grid operator in connection with power outages during a major winter storm that hit in February.

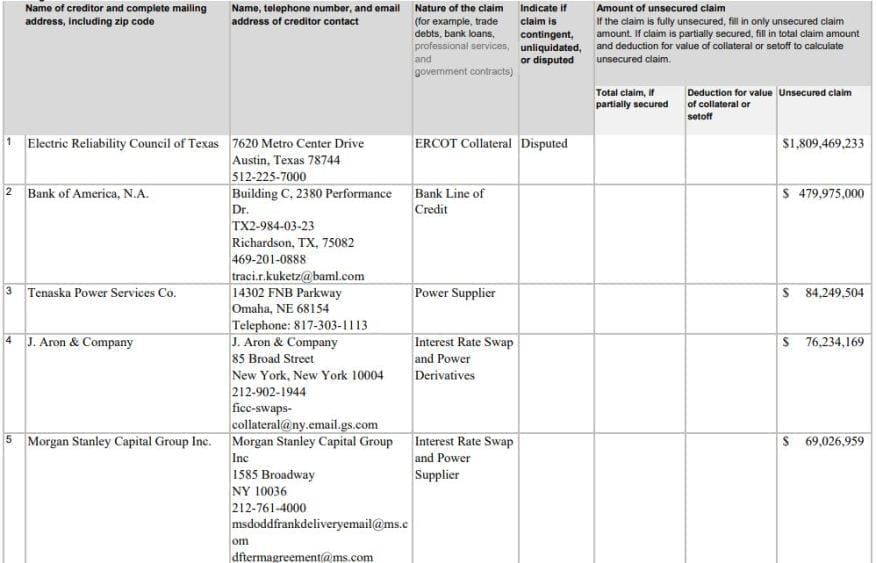

Brazos Electric Power Cooperative filed its bankruptcy petition March 1 in the U.S. Bankruptcy Court for the Southern District of Texas. The company said it received a $2.1 billion charge from the Electric Reliability Council of Texas (ERCOT), the group that maintains and operates much of the state’s electricity grid. Brazos Electric is the wholesale energy provider for its 16-member cooperative.

Texas’ deregulated power market, which is not connected to other U.S. electricity transmission systems, means that most of the state’s power customers are not beholden to any one energy provider. Instead, customers can choose among dozens of electricity retailers on an open market.

Chairwoman of Texas Public Utility Commission resigns as investigation into power outages continues.

Electricity generators—companies such as NRG and Vistra—produce power, which can then be sold by retail electric providers. Those retail companies include Griddy, which is being sued by the state attorney general’s office for sending customers bills for as much as $5,000 for the cost of power during the weeklong storm.

State officials said they received more than 400 complaints about Griddy in less than two weeks. Texas Attorney General Ken Paxton in the lawsuit said Griddy deceived customers when it promised low “wholesale” energy prices.

Power companies that went offline during the winter storm from Feb. 13-19 were required to pay for replacement power sources. Brazos in its petition described those payments as being charged at “excessively high” rates. Many other energy providers in the state face massive charges for electricity and other fees incurred during the storm; officials have said those bills could run into the billions of dollars.

Vistra, the state’s largest power generator, has seen its stock price fall after it disclosed it might see as much as a $1.3 billion charge from the February event. “I can assure you that there isn’t anybody more disappointed than us, and it’s disappointing to me, that we let you down,” Vistra CEO Curtis Morgan told analysts and investors on a Feb. 26 conference call. Morgan added, “I am convinced that this is not a liquidity crisis for this company,” but rather a “short-run material hit.”

‘Black Swan Winter Event’

Waco, Texas-based Brazos said it was presented with a bill for more than $2.1 billion for seven days of what it called a “black swan winter event.” The energy group said it could not pay the bill, and also said the circumstances of the winter storm legally eliminated its requirement to pay the charges.

Brazos Electric provides power for more than 1.5 million Texas customers. It said it filed the bankruptcy case “to maintain the stability and integrity of its entire electric cooperative system.”

Clifton Karnei, the group’s general manager and executive vice president, in the court filing wrote, “As the month of February 2021 began, the notion that a financially stable cooperative such as Brazos Electric would end the month preparing for bankruptcy was unfathomable.” The company in a statement said, “Before the severe cold weather that blanketed Texas with sub-freezing temperatures … Brazos Electric was in all respects a financially robust, stable company with a clear vision for its future and a strong ‘A’ to ‘A+’ credit rating.

“Yet that changed as a direct result of the catastrophic failures that accompanied the winter storm that blanketed the state of Texas on or about February 13, 2021 and maintained its grip of historically sub-freezing temperatures for days,” the company said. “Electric generation equipment and natural gas pipeline equipment have been reported to have frozen, causing the available generation within ERCOT to dramatically decline.”

Said Karnei: “Simply put, Brazos Electric suddenly finds itself caught in a liquidity trap that it cannot solve with its current balance sheet.” Karnei until last week was a member of the ERCOT board. At least seven ERCOT board members have resigned their positions in the wake of the massive power outages across the state during the winter storm.

Criticism of Leadership

Texas ratepayers and the state’s politicians have criticized ERCOT’s leadership for failing to prepare for the storm, which brought record cold temperatures, snow, and ice to the state. Texas Gov. Greg Abbott, himself criticized for the state’s response to the crisis, has called for a reform of the grid operator’s business practices.

The Federal Energy Regulatory Commission (FERC), along with state lawmakers, is investigating ERCOT’s actions leading up to and during the storm, which at its peak left about 4.4 million Texas customers without power.

Karnei was a member of the ERCOT board in 2011 when FERC published a report urging Texas to winterize its power grid following a severe cold snap that year. The 357-page report detailed nine separate findings that detailed what happened inside ERCOT’s power grid during the winter event, a storm that also left millions without power.

Brazos on Feb. 25, the day Karnei resigned from ERCOT’s board, sent the grid operator a letter that said the cooperative would not pay the $2.1 billion bill. ERCOT on Monday in an emailed response to a question from POWER wrote, “We are aware of their filing and will be participating in the court proceedings.”

Brazos Electric in its court filing claims the ERCOT wholesale market will see $55 billion in charges resulting from the week-long winter storm, which it said would be four years’ worth of charges from a single week.

$9,000 Per Megawatt-Hour

The price for wholesale electricity in Texas was set at the maximum of $9,000 per megawatt-hour (MWh) for more than four straight days during the storm. ERCOT also imposed other ancillary fees on power companies that totaled more than $25,000/MWh. ERCOT data shows that the price for wholesale power in the weeks prior to the storm was below $21/MWh.

Brazos in its court filing said, “The consequences of these prices were devastating.” The company in the filing said it received invoices from ERCOT during the storm “which, when combined, amounted to over $2.1 billion, payment of which was required within days.”

Brazos as a power cooperative recovers its costs from its members, which collect money from their power consumers. The company said its bankruptcy filing is a way to protect itself, its member cooperatives, and power customers from a massive bill.

“Brazos Electric will not foist this catastrophic ‘black swan’ financial event onto its members and their consumers, and commenced this bankruptcy to maintain the stability and integrity of its entire electric cooperative system,” the company said. Brazos lists its assets and liabilities as between $1 billion and $10 billion.

—Darrell Proctor is associate editor for POWER (@POWERmagazine).