Horizontal drilling technology and fracking techniques have created a natural gas revolution in the U.S. The future looks bright for gas-fired power generation but there are three potential storm clouds that require tracking: gas deliverability, cybersecurity, and Donald Trump.

By all accounts, the supply and deliverability of natural gas to electric generators in the months ahead (and perhaps years) face sunny prospects. The Federal Energy Regulatory Commission’s (FERC’s) “Summer 2018 Energy and Market Reliability Assessment,” published in May, says, “Nationwide, this may be a record summer for natural gas demand for electric generation.”

The FERC assessment cites work by the U.S. Energy Information Administration (EIA) forecasting that natural gas production would reach near record highs. EIA’s Natural Gas Monthly report—released at the end of May, based on March data—notes, “In March 2018, for the tenth consecutive month, dry natural gas production increased year-to-year from the same month a year ago. The preliminary level for dry natural gas production in March 2018 was 2,467 billion cubic feet (Bcf), or 79.6 Bcf/day. This level was 8.0 Bcf/day (11.2%) higher than the March 2017 level of 71.6 Bcf/day. The average daily rate of dry natural gas production for March was the highest for any month since EIA began tracking monthly dry production in 1973.”

The EIA added, “Electric power deliveries were 743 Bcf, or 24.0 Bcf/day, up 9.4% from 21.9 Bcf/day in March 2017. Electric power deliveries were the second highest for March since 2001, when EIA began using the current definitions for consuming sectors.”

Looking longer term, EIA’s Annual Energy Outlook 2018, released in February, says, “Production of U.S. liquids and natural gas continues to grow through 2042 and 2050, respectively. In the Reference case, production of shale gas resources is projected to increase through the end of the projection period. U.S. liquids production begins to decline towards the end of the projection period as less-productive areas are developed.”

EIA’s report states, “Almost all of new electricity generation capacity is fueled by natural gas and renewables after 2022 in the Reference case. This is the result of natural gas prices that remain below $5/million British thermal units until the very end of the projection period and the continued decline in the cost of renewables, especially solar photovoltaic.”

Drilling into the data, FERC’s analysis says the summer could see a gas burn of 35.16 Bcf/d through August, “just 0.3 Bcf less than the record high natural gas power burn set in the summer of 2016 and 3 Bcf/d higher than last year. The addition of over 16,000 MW of new capacity to the natural-gas fired generator fleet since the record highs in 2016 and relatively low natural gas prices contribute to expectations for strong natural gas generation this summer.”

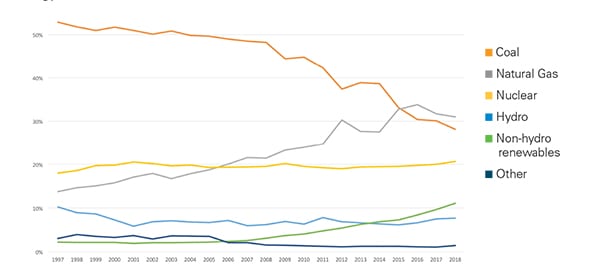

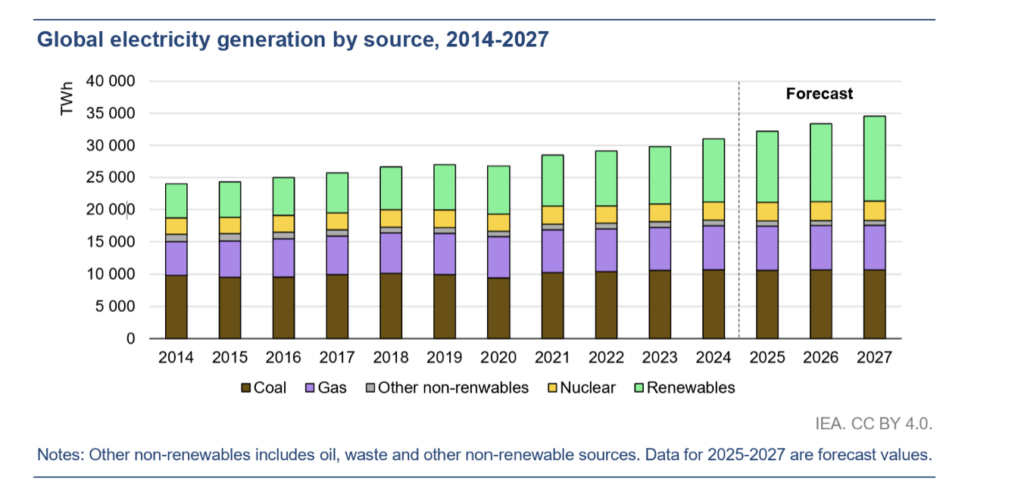

Gas should continue to push coal out of electric markets, according to FERC, although coal is far from becoming a minor fuel (Figure 1). “EIA generation forecasts for June, July, and August show natural gas averaging 37 percent of total generation, while coal averages 30 percent. This compares to 31 percent and 35 percent respectively during those months, in 2017.” Not many years ago, coal was the dominant generating fuel, producing more than half of the electric power in the U.S.

Gas prices, continuing a long-term decline driven by new supplies flowing from fracking, primarily in the Marcellus and Utica shale formation in the middle Atlantic region, and the Permian Basin in the Southwest, are still falling. FERC noted, “Summer 2018 natural gas futures prices are generally lower compared to those for summer 2017. At $2.76/MMBtu, Henry Hub summer future prices are down $0.52/MMBtu, or 16 percent, compared to a year ago.”

FERC noted, “Growing gas production from fields in Appalachia, Texas, and elsewhere increased U.S. output to record highs. In March 2018, the U.S. produced 84.9 Bcf/d of marketed natural gas, a year-over-year gain of over 8 Bcf/d. Continued production at this volume should position the market to meet summer demand and adequately restock storage inventories.”

Natural gas storage looks solid, according to FERC. The gas storage season started slowly in April “at 1,354 Bcf, about 350 Bcf less than the 5-year average.” Extreme cold in the Northeast in December and January “led to record storage withdrawals, resulting in a deficit of 486 Bcf from the 5-year average at the end of January.” EIA said it expected inventories would grow to 3,800 Bcf by November, “which is within the 5-year range.”

The U.S. natural gas industry is different from other industries that supply generating fuels. Gas has three major markets. Gas supplies home heating, industrial heat and feedstock, and, most recently, electricity. While that was once the role of coal, which supplied home and industrial heat and light (through coal gas in the 19th century), coke for steel production, and electric generation, today U.S. coal’s markets are almost entirely electric generation and steel production.

History of a Versatile Fuel

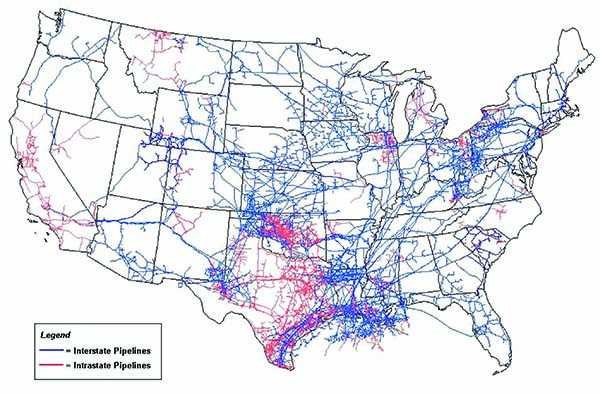

While natural gas wells have been known for centuries, it took the development of pipelines to turn gas into a ubiquitous energy source. The NaturalGas.org website details the history of natural gas development. It notes, “Without any way to transport it effectively, natural gas discovered [pre-World War II] was usually just allowed to vent into the atmosphere, or burnt, when found alongside coal and oil, or simply left in the ground when found alone.”

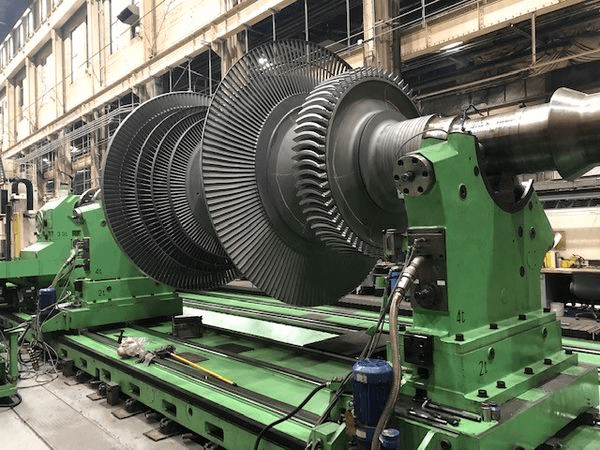

After the war, welding techniques and advances in metallurgy and steel pipe rolling led to a boom in gas pipeline construction and well development (Figure 2). “This post-war pipeline construction boom lasted well into the ‘60s, and allowed for the construction of thousands of miles of pipeline in America.”

Federal regulation of the gas industry began in 1938, when Congress viewed natural gas production, transportation, and sale as a natural monopoly, much at it had a few years earlier seen electricity production and distribution. The Natural Gas Act gave the Federal Power Commission, the predecessor to FERC, authority over natural gas, including federal price controls.

Price controls applied only to interstate gas markets. In-state pipelines were free to respond to market prices. Gas shortages in the interstate market (while plentiful gas flowed in states such as Texas) led Congress in 1978 to enact the Powerplant and Industrial Fuel Use Act (PIFUA). It banned gas for electric generation, preserving it for so-called “higher uses” such as home heating. One of the unintended consequences (perhaps intended by some parties) was the construction of new nuclear generating plants in the middle of major natural gas fields in Texas, Louisiana, and Arkansas.

By the 1990s, it became clear that federal price controls and limits on use of natural gas did not serve the national interest. In 1987, Congress repealed PIFUA. In 1989, Congress ended wellhead price controls on natural gas, eliminating all price controls by 1993. FERC continued to approve natural gas pipeline siting. The modern gas industry is the result. Today’s gas industry is fully competitive, with markets setting prices and long-term contracts governing the market.

Technology in the mid-2000s created a gas revolution. After years of experimentation and technology advances, gas drillers learned how to use horizontal well drilling and water under extreme pressures to fracture impervious shale deposits deep underground, releasing copious amounts of gas. In addition, in some of the new gas-producing regions, particularly in the Mid-Atlantic Marcellus shale, fracking also produced valuable natural gas liquids that reduced the costs of developing the gas to exceptionally low levels. In other regions, such as the Permian Basin and North Dakota, the new fracking technology also produced large amounts of crude oil.

By about 2008, new gas supplies transformed electric generation, pushing coal out of the market as the low-cost fuel. Gas plants, including simple cycle and combined cycle technology, were so inexpensive that new coal was not economical. Existing coal-fired plants and nuclear units also were in jeopardy.

Over a decade, gas has replaced coal as the dominant electric generating fuel. Neither can claim to be the unassailable king of the generating hill, but it appears that gas is in ascendance and coal is in decline.

Clouds on the Gas Generation Horizon

The future of natural gas for electric generation looks favorable but there are three, interconnected, clouds on the horizon. They are: Donald Trump, gas deliverability, and cybersecurity.

Donald Trump. First up is President Trump. During his 2016 campaign, Trump pledged to aid the stumbling coal industry and coal miners, blaming prior administration regulatory policy for the decline of the industry (Figure 3). When he won the election and came into office, he soon offered an antidote to what he viewed as a “war on coal.”

The Department of Energy (DOE) followed up in September 2017 with a proposed rulemaking, directing FERC to overturn its policies on competitive wholesale markets to accommodate uneconomic coal and nuclear plants based on the concept that coal and nukes had large onsite fuel supplies, making them more resilient to disruptions than gas and renewables. The proposal aimed to keep coal plants running. FERC, including four new Trump appointees, unanimously rejected the DOE proposal in early January 2018, debunking the resilience argument.

In June, the Trump administration resurrected its resilience claim, offering a draft policy statement aimed at bypassing FERC. The draft proposed a regime to keep failing coal and nuclear plants running under emergency provisions under section 202(c) of the Federal Power Act and the 1950 Defense Production Act (DPA). The DOE draft says, “In particular, resources that have a secure on-site fuel supply, including nuclear and coal-fired power plants, as well as oil-fired and dual-fuel units with adequate storage, are essential to support the Nation’s defense facilities, critical energy infrastructure, and other critical infrastructure.” As of late June 2018, the draft has not emerged as administration policy.

The second-generation coal rescue created immediate outrage from gas producers, transporters, and electric generators. The gas industry quickly assembled a lobbying consortium of what could be considered strange bedfellows to oppose the administration plan. It included the American Petroleum Institute, Advanced Energy Economy, American Council on Renewable Energy, American Wind Energy Association, the Business Council for Sustainable Energy, Electricity Consumers Resource Council (ELCON), Electric Power Supply Association (EPSA), Energy Storage Association, Natural Gas Supply Association, and the Solar Energy Industry Association.

In a joint statement, John Hughes of ELCON, a group representing industrial electric consumers, said, “Any action taken by the Department of Energy today to use 202(c) and DPA to prop up uneconomic coal and nuclear plants is unnecessary, anticompetitive and would increase the price of electricity to businesses and consumers, resulting in a substantial loss of U.S. manufacturing capacity jobs.” John Shelk of EPSA, the lobbying group for non-utility electric generators, said, “There was no emergency when coal and nuclear interests sought federal relief and there is none today that justifies such unprecedented executive branch intervention in the economic life of the country.”

Separately, the Interstate Natural Gas Association of America (INGAA) hammered the Trump plan. “There is absolutely no justification for the extreme intervention in energy markets suggested in the draft National Security Council memo,” INGAA CEO Don Santa said. “Such a move would be bad public policy, costly to American consumers and the economy, and legally questionable.”

A second Trump initiative also has the gas industry spooked. In March, Trump announced a 25% tariff on steel imports, applied to Canada, Mexico, and the European Union. INGAA, representing pipeline companies, responded that the tariffs would harm new gas pipeline projects. Santa said, “The administration’s decision to immediately impose a 25 percent tariff on steel imported from our long-standing allies of Canada, Mexico and the European Union is very troubling to the U.S. pipeline industry and inconsistent with the administration’s long-standing goal to capitalize on our nation’s energy abundance to help bring low-cost energy to American consumers.”

Santa said that U.S. steel producers aren’t currently able to provide some of the material needed for gas pipelines. The large-diameter, thick-walled steel used to construct transmission pipelines is a niche product with unique technical specifications and limited domestic manufacturing capacity, according to INGAA. “For certain steel products used in pipelines, there is zero domestic availability today,” Santa said.

Gas Deliverability. INGAA’s complaint about specialty steel highlights another, localized, cloud on the gas horizon: regional gas deliverability problems. The Houston-based Institute for Energy Research notes, “The shortage of natural gas pipelines is well understood during the winter months in New England when electricity and natural gas prices have skyrocketed due to weather conditions increasing demand and hindering the availability of supplies.” The problem is unique to the region, a result of an inability to overcome differences between gas contracting practices and the need for new capacity to serve electric markets.

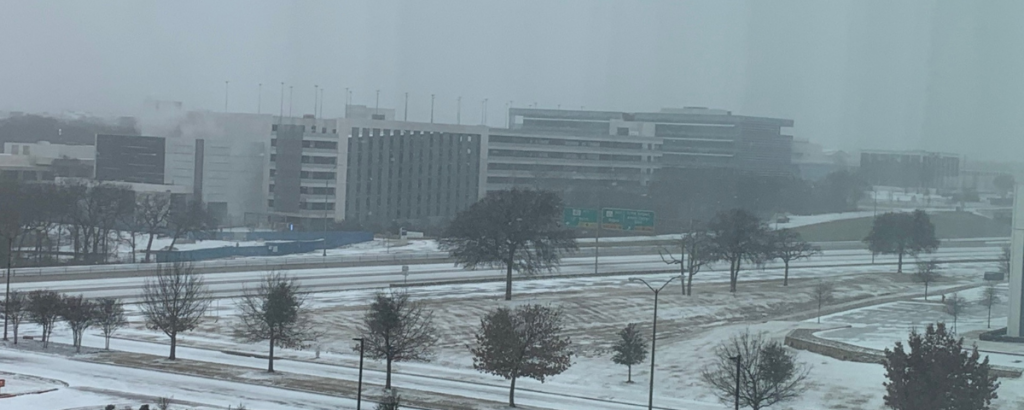

New England’s gas infrastructure is built around serving heating load. Most of the year, there’s enough gas to supply electric generation, the secondary market. But when winter hits hard, industrial and residential users have preference for pipeline gas. Electric generators are last in line. The result: curtailment of gas-fired power and a complex search for alternatives to keep the lights on. That search has landed on elderly, inefficient oil-fired plants to fill the generation gap.

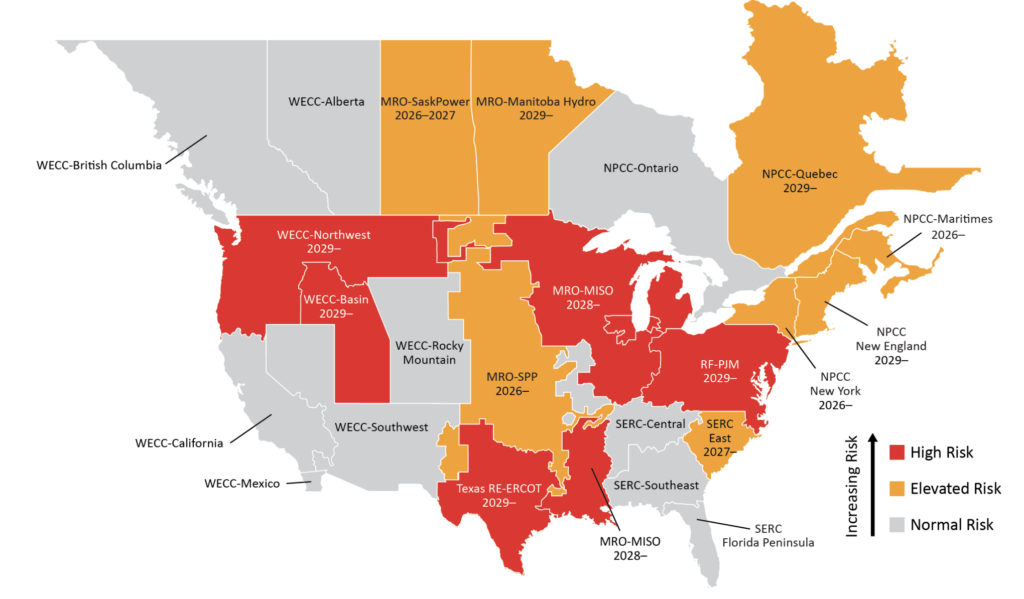

ISO-New England (ISO-NE) and the distribution utilities have worked hard to find ways to finance new pipeline capacity but have failed (Figure 4). Last fall, ISO-NE CEO Gordon van Welie told POWER that the ISO had given up on the idea of bringing more gas to the region in the face of its inability to win support for projects (see “Could Success Spoil ISO-NE?” in the September 2017 issue). The problem now, he said, “is how to get efficient electricity production during winter, assuming we see no further investment in gas infrastructure.” He added, “Fuel has to come from somewhere when the existing pipelines are constrained.”

Another deliverability bottleneck is in Southern California where a massive 2015 gas leak at Southern California Gas Co.’s Aliso Canyon underground storage facility upset the ability to deliver gas in the region. Hydropower to serve the California Independent System Operator (CAISO) depends on precipitation, especially snowpack. FERC reported that warmer-than-normal springtime temperatures melted snowpack faster than usual, reducing the amount of summer hydro available. But, its report notes, “natural gas supply limitations in southern California this year may affect CAISO’s use of its natural gas generation fleet and present some risk to CAISO’s markets and operations this summer.” That’s because of distribution-level pipeline outages, limited operations at the Aliso Canyon storage facility, and state rule changes reducing the rate at which gas can be injected or withdrawn from storage.

Cybersecurity. A final, speculative, cloud on the U.S. gas horizon is cybersecurity. In its draft on how to keep inefficient coal and nuclear plants in service, DOE raised the issue of gas pipeline vulnerability to cyberattacks. “A robust and secure network of natural gas pipeline infrastructure is also indispensable to the security of the nation’s electricity system,” the draft says.

That prompted FERC commissioners Neil Chatterjee, a Republican, and Richard Glick, a Democrat, to highlight in an article published by Washington, D.C.-based The Hill newspaper, the woeful status of gas pipeline protections against cyberattacks. Noting the extensive work undertaken by FERC, with the North American Electric Reliability Corp., to harden the electric grid against cyber threats, Chatterjee and Glick said, “The U.S. has no comparable standards for its network of pipelines.”

The authority to protect pipelines from attacks rests with the Transportation Security Administration (TSA), an arm of the Department of Homeland Security, which spends hundreds of millions of dollars and employs thousands of workers to screen airline travelers. Chatterjee and Glick said, “In May 2017, TSA confirmed that it had just 6 full-time employees tasked with securing the more than 2.7 million miles of natural gas, oil and hazardous liquid pipelines that traverse the country. Moreover, despite having the authority to enforce mandatory cybersecurity standards, the TSA relies on voluntary ones.”

The two FERC commissioners said, “Given the high stakes, Congress should vest responsibility for pipeline security with an agency that fully comprehends the energy sector and has sufficient resources to address this growing threat. The Department of Energy (DOE) could be an appropriate choice: It is the Sector-Specific Agency for energy security and recently created its own cybersecurity office.” ■

—Kennedy Maize is a long-time energy journalist and frequent contributor to POWER.