Money Makes the Power and Energy Sectors Go 'Round

If you’ve seen the musical “Cabaret,” you know that “money makes the world go ‘round” in a variety of ways. While it may not indeed make the power and energy sectors “go ‘round,” money does make plants and other projects get built. So, where is cash flowing into the industry these days?

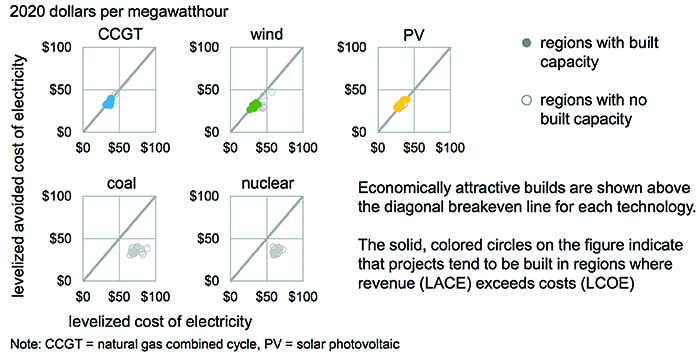

When looking for answers to difficult questions, the phrase “follow the money” is often worth remembering. There is a lot of money being spent in the power industry, so following it all can be challenging. Nearly every day, analysts release new financial forecasts for one energy-related sector or another. Many predict unending growth in wind and solar, and persistent struggles for the coal and nuclear power sectors (Figure 1).

|

|

1. The economic cost competitiveness of generating technologies favors combined cycle gas turbine (CCGT), wind, and solar photovoltaic (PV) technology over coal and nuclear for units coming online in 2026. The charts here show levelized avoided cost of electricity (LACE) on the vertical axis and levelized cost of electricity (LCOE) on the horizontal axis, according to Annual Energy Outlook 2021 reference case projections. Source: U.S. Energy Information Administration |

The Age of ‘Green Finance’

A strong wind blew into the Power & Energy industry’s proverbial sail when President Biden rolled out his $2 trillion American Jobs Plan, a program designed to “create millions of good jobs, rebuild our country’s infrastructure, and position the United States to out-compete China.” Among items tucked into the massive plan is a goal to achieve 100% carbon-free electricity by 2035. That will be a tall task, indeed, but if money is ultimately procured to help make that happen, companies working in the Power & Energy industry stand to cash in big.

“The sprint toward net-zero emissions targets and the resulting need to decarbonize the energy grid is making Power & Energy one of the most attractive industries for investment, and mergers and acquisitions. To meet global decarbonization goals, the sources of power and energy will need to transition from fossil fuels. As such, we are seeing a drastic reduction in capital chasing fossil fuel projects, and exponential increases in investments in renewable and clean energy generation,” Michael Castellarin, a managing director with Clairvest, a private equity management firm based in Toronto, Canada, told POWER.

Castellarin noted that SPACs (special purpose acquisition companies) are the newest source of funding for clean energy firms. SPACs are shell companies that list on a stock exchange, and seek to acquire private firms and take them public. The Wall Street Journal reported on May 22 that SPACs have agreed to about 35 deals worth nearly $95 billion with clean energy–related firms since March 2020.

Yet, big companies and deep-pocketed investors are also heavily involved in the new “green finance” trend. “To put it in perspective, assets in environmentally focused investment funds reached almost $2 trillion globally in Q1 2021, more than tripling assets under management in three years,” Castellarin said.

Fossil-Fueled Projects

In a report released on May 25, Fitch Ratings, a provider of credit ratings, commentary, and research, agreed that private equity deals in solar and wind projects are growing in scale. Still, the firm said private equity financing of fossil fuel assets has dwarfed that of renewables over the past decade.

At least some of the deals have been driven by pressure placed on public companies and financial institutions from activist investors who want them to divest fossil fuel assets. Private companies and private equity firms are less exposed to these trends, the report says, but they aren’t fully insulated and many limited partner institutional investors are pushing for greater adoption of environmental, social, and governance (ESG) principles in investment practices.

“There’s a growing trend towards listed companies or investors opting to divest from fossil fuel or carbon intensive assets. Comparatively little focus is on who purchases these assets—private equity and state-owned enterprises will generally have fewer incentives to reduce emissions than their public counterparts,” David McNeil, director with Fitch Ratings, said in the report.

Analysis conducted by researchers at the University of Oxford found that financial institutions are de-risking renewable projects and increasing the risk ratings on coal projects, as measured through loan spread changes over the past 20 years. Loan spreads are the interest rate charged by banks to reflect the riskiness of the company or project that is being lent to. Banks apply a higher spread to riskier loans, as there is a greater probability that the borrower will default and not pay them back. Therefore, a decrease in loan spreads shows an increase in creditworthiness, which reduces the costs for companies to finance their operations or invest in new projects.

The Oxford academics compared data from 2007–2010 with data from 2017–2020 and found the loan spreads for onshore wind projects fell by an average of 12%, while offshore wind loan spreads decreased 24%. They said decreases have accelerated since 2015 as the deployment of renewables has increased, with solar photovoltaic, onshore wind, and offshore wind financing costs falling by 20%, 15%, and 33%, respectively (comparing 2010–2014 with 2015–2020).

In contrast to renewables, comparing 2007–2010 with 2017–2020, coal power stations have seen their loan spreads increase 38%. This trend holds when comparing 2000–2010 with 2011–2020, with loan spread increasing 56%. Loan spreads for gas-fired power stations have also been increasing, but by a smaller margin than coal recently. Gas project loan spreads rose by 68% when comparing 2000–2010 to 2011–2020, but increased only 7% the past decade (comparing 2007–2010 with 2017–2020).

Bright Future for Consulting and Engineering Firms

Another area where Clairvest sees promise is in consulting and engineering firms, particularly those that have a strong practice focused on serving the changing needs of the Power & Energy market. “Given the significant growth in spending, innovation, and construction required to achieve clean energy targets, consulting and engineering firms with the right expertise and market focus will enjoy considerable growth and success. Services from planning, design, permitting, testing, and overseeing construction are in high demand. Along these lines, our research suggests that consulting and engineering firms focused on the Power & Energy end-markets are growing faster and with higher margins than firms which are not,” Michael Andrisani, senior associate with Clairvest, told POWER.

“Given the significant growth and change occurring in the Power & Energy industry, consulting and engineering firms with the right capabilities to cater to this end-market are set to grow and achieve new heights,” Castellarin added.

Others seem to agree that consulting and engineering firms offer great potential for growth. For example, Montreal, Canada–based WSP, one of the world’s leading professional services firms with about 54,000 employees, recently acquired Golder, a private employee-owned engineering and consulting firm based in Mississauga, Ontario. According to a press release, the deal was intended to capitalize on ESG trends.

“Private equity firms are also focused on the consulting and engineering industry,” said Andrisani. “Given that the industry is fragmented, private equity firms can follow an inorganic growth strategy by pursuing acquisitions to enter new markets and add new capabilities. Additionally, private equity investors believe they bring complementary skills to consulting and engineering firms and can improve financial performance by relentlessly focusing on the most important operational levers and investing in technologies.”

Clairvest’s strategy is to partner with heavily invested management teams, often remaining a minority investor. The approach fits well with the consulting and engineering sector, particularly when succession issues are a concern. “There is an increasing cadre of baby boomer partners or employee-owners looking to retire. The younger and rising stars in many consulting and engineering firms do not have the financial capacity to buy out the selling partners. As a result, a private equity firm like Clairvest can be an excellent equity partner to assist with such an ownership transition while also providing capital for growth,” Castellarin explained.

The Growth of VPPs

Demand response (DR) programs allow utilities to curtail customer usage during periods of peak electricity demand. For example, some direct load control programs give power companies the ability to cycle air conditioners and water heaters on and off for limited durations when advantageous for system reliability in exchange for a financial incentive given to the customer. The programs can help reduce the need for new power generating units, as well as investments in grid upgrades, at least for a while.

Virtual power plants (VPPs) offer a new take on DR. A VPP is a network of decentralized power assets, such as rooftop solar panels, wind turbines, and small on-site diesel or gas generating units, as well as flexible power consumers and storage systems. The interconnected units are dispatched through a central VPP control system but remain independent in their operation and ownership. As technology has evolved, and more behind-the-meter generation and energy storage has been added to the grid, aggregators have pooled some of these resources into VPPs.

The objective of a VPP is to relieve the load on the grid by smartly distributing the power generated by the individual units during periods of peak load. Additionally, the combined power generation and power consumption of the networked units in the VPP can trade on energy exchanges.

“A virtual power plant is like a demand response program, but it’s all automated. It’s remotely dispatched and it responds to actual real-time market signals,” Peter Asmus, research director with Guidehouse Insights, a global consulting services provider, told POWER.

Asmus helped author a report on the residential DR and VPP markets that Guidehouse Insights released in late May. The report predicts the role of flexible capacity, such as VPPs, will grow from less than $1 billion in 2021 to more than $6.5 billion by 2030, a compounded annual growth rate of 23.3%. The firm said “customer engagement trends, an evolving market ecosystem, and supportive regulatory environment” are the main drivers of VPP growth.

Asmus said VPPs typically offer the most value in deregulated markets. He noted the PJM Interconnection has historically been the best market for DR and VPP participants, but he also said the New York and New England Independent System Operators (ISOs) are among the market leaders in the VPP space. “The VPP is more about bringing value up to the wholesale markets,” Asmus said.

“Europe is the main other market focused on residential demand response, but they started a lot later than the U.S., mainly because they’re so efficient already,” he said. Asmus suggested the success of DR programs hinges on inefficiency, that is, there must be excess load that can be cut in order for operators to effectively harvest the inefficiency from the system. “In Europe, ironically enough, they’ve been so efficient over the years, so they’ve come late to this market. But in Europe, it’s more focused on renewable integration,” Asmus said.

“Our forecasts show that beginning this year more distributed energy resources are coming online globally than centralized generation, and that gap grows over time,” said Asmus. “The wave of the future is depending more on these smaller, often non-utility-owned assets, and these programs—VPPs—allow both those asset owners to get more value and the utility to also get value from those assets. So again, it’s this win-win scenario. And we see these things as absolutely being necessary in the future, because more and more of our power will be coming from these smaller resources.” ■

—Aaron Larson is POWER’s executive editor.