Market Transitions: The MOPR Merry-Go-Round

The PJM Interconnection’s Minimum Offer Price Rule (MOPR) was introduced in 2006 as a floor to bar new generators from artificially depressing capacity auction clearing prices through below-cost bids. In December, the Federal Energy Regulatory Commission directed PJM to expand MOPR to nearly all state-subsidized capacity resources.

“The transformation of the power sector is changing the landscape of energy supply … Generally, electricity systems and markets are complex and not always easy to understand.” That statement from a 2019 paper by The Oxford Institute for Energy Studies sums up more than a decade of turmoil and tension in U.S. wholesale competitive power markets.

Trying to adapt these markets, now serving more than half the country, to new, non-dispatchable and zero-carbon sources such as wind, solar, and nuclear involves disputes among state governments, market operators, conventional merchant generators, renewables advocates, legacy generators, and Republican and Democratic regulators at the Federal Energy Regulatory Commission (FERC). FERC oversees competitive power markets, but only to a limited degree over state utility regulators.

Renewables Grow, Policies Change

The march of wind and solar across the land is likely to continue. The Energy Information Administration on Jan. 18 said U.S. power generation from renewables—mostly solar and wind, and not including hydropower—likely will grow to 17% of the nation’s total electricity output in 2023, up from 13% in 2021.

|

|

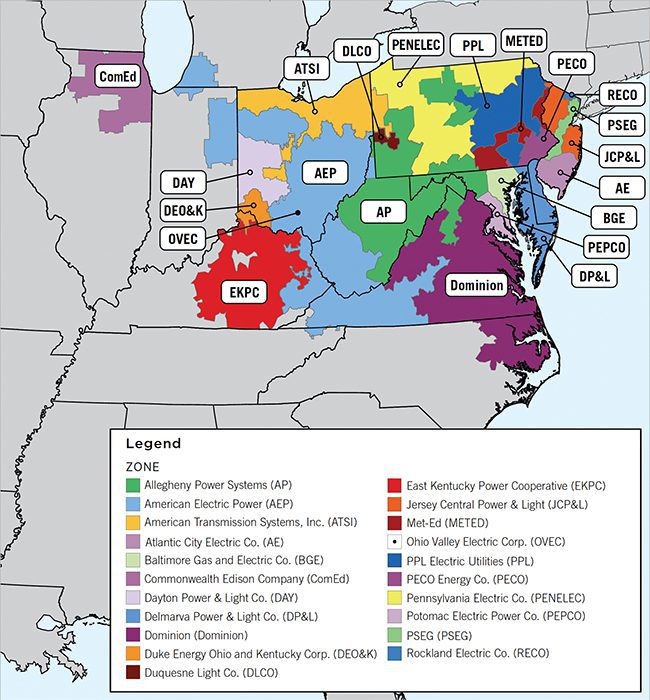

1. PJM Interconnection coordinates the movement of electricity through all or parts of Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia, and the District of Columbia. Courtesy: PJM Interconnection |

Last December, FERC on a 3–2 vote (all three Democratic commissioners in favor; the two Republicans against) approved a mechanism to allow state-subsidized power to bid into the PJM Interconnection (Figure 1) capacity market, proposed by PJM. Two years before, FERC on a 3–2 vote (the Republican majority voting in favor against the two Democrats) voted to bar subsidized power bids into the auction.

The parties are wrangling over state-mandated subsidies such as renewable portfolio standards and zero-emissions credits, and how those impact markets. Later, some states began subsidizing their uneconomic nuclear plants to keep them operating. Involved are a plethora of esoteric economic concepts (see sidebar) including buyer-side market power and reverse Dutch auctions.

Esoteric Economic ConceptsReverse Dutch Auctions. Conventional auctions, such as art auctions, are designed to get the seller the highest possible prices. Reverse auctions aim to get the buyer the lowest cost for what they are trying to buy, such as electric capacity reserves. A standard explanation of why reverse auctions are used comes from the website ProcurePort: “A reverse auction forces your suppliers to compete in real-time, providing their best possible pricing.” PJM’s auctions use the reverse Dutch auction mechanism. Buyer-Side Market Power. The conventional market power problem is the ability of a seller, a monopoly, to set prices in a market. That’s one of the reasons for competitive auctions. There is also the case when the buyer can dictate prices to its benefit. In electric capacity markets, if a market participant is both a seller and buyer, which is common, it may be in that firm’s interest to bid extremely low prices if its needs as a buyer exceed its interests as a seller. The Federal Energy Regulatory Commission’s authority extends to both market power problems. |

An Evolving Market

Nowhere has this tension between buyers and sellers played out with more twists and turns than at the PJM Interconnection, the power market for buyers and sellers in 13 populous states and the District of Columbia. Located in historic Valley Forge, Pennsylvania, PJM began life in 1956 as the Pennsylvania-New Jersey-Maryland power pool, aimed at dispatching electric generating plants on a lowest-cost basis.

A series of FERC orders, beginning in 1996 with Order 888, based on a 1992 law, transformed PJM into a competitive wholesale energy market. The FERC order, shepherded by then-Chair Betsy Moler, ordered public utilities to provide open access transmission service on a comparable basis to the transmission service they provide themselves.

The way to do that was to establish new open-access institutions called independent system operators (ISOs) or regional transmission organizations (RTOs), basically interchangeable terms. Generators would bid their supplies into auctions run by the ISOs, which would, in turn, dispatch the power at the lowest prices. The result was the great restructuring of U.S. electric markets from the 1990s to today. PJM is the exemplar.

Capacity Payments

In addition to operating as a place for buyers and sellers to transact daily business on an arms-length basis, PJM also operates a capacity market aimed to assure that there is always a reliable supply of power available ahead of almost any circumstances. Stu Bresler, PJM senior vice president-markets, told POWER, “The whole purpose of electricity markets is to enforce reliability. Giving owners access to capacity markets is part of that, just more forward-looking. Reliability is job No. 1, and the capacity market is the competitive mechanism.”

What is a capacity market? A paper from Penn State’s department of energy and mineral engineering explains it well in layman’s terms: “Many restructured electricity markets offer power generators payments for the capacity that they have ready to produce electricity, not just for the electricity that they actually produce. For example, if you owned a 100 MW (100,000 kW) power plant and the capacity payment was $10 per kW per month, you would earn $12 million per year regardless of how much electricity you actually produced. In areas that have them, capacity payments have become a major portion of a generator’s revenue stream.”

In addition, “Capacity markets are a little bit odd. Almost no other market for any commodity, anywhere in the world, has them. (There is a capacity market for natural gas pipelines, but it is operated differently than electricity capacity markets.) In markets for other non-storable goods, like hotel rooms and seats on airplanes, any fixed costs of operations are rolled into the room rate or ticket price. If there is enough unused capacity, then it will exit the market (the hotel will close, or the airline will go bankrupt). Yet, this doesn’t really happen in electricity.”

Setting a Floor

PJM’s energy market, not controversial, pays generators only when they provide power on a daily basis. Capacity markets have been controversial.

The turmoil in PJM’s capacity market began earlier this century. Bresler said gas generation, taking advantage of the shale-gas revolution, began submitting extremely low bids into the capacity market. To prevent bidders who are primarily buyers from artificially lowering the clearing price, PJM created what it called the “minimum offer price rule,” commonly known as MOPR, in 2006. That drew little attention.

More recently, several states, responding to issues such as global warming, started offering subsidies to generators to push development of renewables such as wind and solar. Some providers began bidding low prices, based on the subsidies, into the PJM capacity market. The result was to cause some conventional generating sources, including coal and nuclear, to fail to get paid for their capacity.

The losers cried foul, taking their complaints to FERC. They alleged that bidding state-subsidized resources into the market depressed prices and threatened their continuation. That set off a round-robin of litigation at FERC. The federal agency and PJM tried and failed repeatedly to cut this regulatory Gordian knot.

PJM attempted to accommodate both the complaints of traditional generators and state government policies to push to advance low-carbon resources. Their response was to adapt the MOPR as a floor for subsidized bids into the capacity market. Predictably, the legacy generators said the result was not competitive prices, or, in FERC parlance, “just and reasonable” prices.

Delays and Lower Offers

The Electric Power Supply Association, which represents merchant generators, commented after FERC’s latest December 2021 decision allowing subsidies in the capacity market, “We will continue to pursue what we think is the better path forward, which would be to reject the as-filed MOPR and allow sufficient time to pursue a more holistic approach to respond to the concerns raised by FERC and the states.” Watch for lawsuits.

The wrangling about the PJM auctions at FERC has meant extended delays in PJM’s capacity auctions. Until a May 2021 auction, PJM’s last capacity auction was in December 2018. FERC’s ruling last December has forced the next auction into another delay.

The most recent capacity auction last May for the 2022–2023 period saw a significant decline in capacity payments. The clearing price fell to $50/MW-day from $140/MW-day for the 2021–2022 period. PJM attributed the decline to a lower load forecast for the period and, according to PJM’s Bresler, to “lower offers from resources participating in the auction. So, basically, we saw a shift downward of the supply curve, really across the system.” PJM estimated a 19% reduction in the cost of new generation entering the market, which tracks the impact of lower-cost wind and solar.

What’s to Come?

According to Bresler, PJM is digesting the latest FERC ruling on the MOPR, and the schedule for a new capacity market auction is uncertain. “FERC has delayed the auction for several months and it will probably be in June,” he said. (PJM in January 2022 proposed to hold its Base Residual Auction for the 2023/2024 Delivery Year on June 8, 2022, with the first and second incremental auctions canceled.)

What’s ahead in the dispute over subsidized resources and competitive markets? In early 2020, PJM’s independent market monitor, Joseph Bowring, said renewables are at the point where they don’t need state government support in competitive markets. Bowring said the cost of new entry for renewable resources “is low enough to compete right now and certainly in three or four years when it becomes more relevant under MOPR it will be even lower. The people who are actually designing, selling, and developing the renewables are not the ones yelling about MOPR … those involved in the business keep telling us and saying publicly that they think they are competitive now and will be more competitive in the future.”

But Bowring and others have noted, offshore wind and nuclear are unlikely to be competitive in open markets, requiring some form of subsidies that could distort prices. Former FERC Chairman Norman Bay commented several years ago that “an idealized vision of markets free from the influence of public policies … does not exist, and it is impossible to mitigate our way to its creation.”

—Kennedy Maize is a veteran energy journalist and long-time contributor to POWER magazine.