Group Forecasts Massive Increase in Energy Storage by 2030

Global installations of energy storage systems will experience rapid growth this decade, resulting by the end of 2030 in gigawatt capacity more than 20 times larger than the amount online at the end of 2020. That’s according to a forecast from research company BloombergNEF (BNEF), which in a report released Nov. 15 said the huge increase will require investment of more than $262 billion in stationary energy storage over the next 10 years.

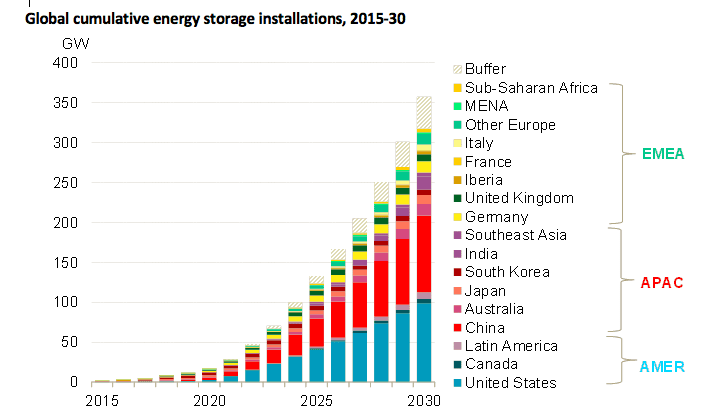

BNEF on Monday said energy storage installations worldwide would reach a cumulative 358 GW, or 1,028 GWh, by year-end 2030. That compares to the group’s finding of 17 GW/34 GWh operating at the end of last year.

While the pace of growth in energy storage accelerates, the group said there will be some constants. Yiyi Zhou, Energy Transition Specialist at BNEF and lead author of the report, told POWER, “We expect lithium-ion batteries to dominate the market at least until 2030 given their cost competitiveness and established supply chain,” meaning lithium-ion technology will continue its lead role in the sector. Zhou said, though, that the group does “see new storage technologies and battery materials that are emerging and can potentially play a meaningful role over the long-term.”

Yayoi Sekine, head of decentralized energy at BNEF, added: “This is the energy storage decade. We’ve been anticipating significant scale-up for many years and the industry is now more than ready to deliver.”

U.S., China Lead Way

The report released Monday said the U.S. and China will remain the two largest markets for storage, accounting for more than half of all global installations in the next decade. BNEF said moves toward cleaner energy in both those countries are key for storage deployment, as the U.S. and China both commit to an increase in the use of renewable energy resources. It’s expected that most utility-scale, along with smaller distributed generation solar and wind projects, will integrate energy storage.

Other top markets include the UK, Japan, India, Australia, and Germany, where BNEF said supportive government policies, along with commitments to combat climate change, and a growing need for flexible power generation resources, are common drivers.

The report forecasts that the Asia-Pacific (APAC) region will lead the storage buildout on a megawatt basis this decade, though the Americas will build deploy more storage on a megawatt-hour basis, because U.S. storage projects usually have more hours of storage capacity. BNEF in its report said Europe, the Middle East and Africa—collectively known as EMEA—”currently lags other regions due to the lack of targeted storage policies and incentives, which may be surprising, considering Europe’s ambitious climate targets.” The report said growth in the EMEA region “could accelerate as renewables penetration surges, more fossil-fuel generators exit, and the battery supply chain becomes more localized.”

Energy Shifting

BNEF’s forecast notes that most, or 55%, of energy storage deployed by 2030 will be to provide energy shifting, where wind and solar energy are stored to be released later. The group agreed with industry analysts who have said storage integrated into renewable energy projects is becoming more commonplace.

“The global storage market is growing at an unprecedented pace,” Zhou said. “Falling battery costs and surging renewables penetration make energy storage a compelling flexible resource in many power systems. Energy storage projects are growing in scale, increasing in dispatch duration, and are increasingly paired with renewables.”

Zhou told POWER other factors also are at work. “We are seeing many start-ups launching non-battery storage products,” she said. “Many of those can provide longer storage duration compared to batteries. However, most of them are still at early commercialization phase without much proven track record. It will take time for these technologies to establish footprints and bring down costs.”

Those non-battery technologies include compressed air and thermal energy storage, which could be used to supply power during prolonged periods of low renewable energy generation in future net-zero power systems. The report said, though, that BNEF expects batteries to dominate the market at least well into the next decade, “in large part due to their price competitiveness, established supply chain and significant track record. If new technologies successfully outcompete lithium-ion, then total uptake may well be larger.“

New Battery Technology

The report details how rapidly evolving battery technology is supporting the storage market, as the industry adopts multiple lithium-ion battery chemistries. The group said that lithium-iron phosphate (LFP) this year is being used more often than nickel-manganese-cobalt (NMC) chemistries for stationary storage for the first time. The report said LFP “will become the major lithium-ion battery chemistry choice in the energy storage sector until at least 2030, driven by its dominant role in China and increasing penetration in the rest of the world.” BNEF also updated its technology outlook to include sodium-ion batteries, which it said “could play a meaningful role by 2030.”

Zhou said the design of electricity markets also will play a role in storage deployments. More storage projects “will also require potential power market design change to make their business cases more economically viable,” she said. “For instance, there’s a lack of market for the seasonal storage assets to bid days and weeks ahead of their power dispatching.” She added that new technologies will advance storage, particularly those that can be deployed at lower costs and provide more safety with their design.

“Sodium-ion battery is one of the examples,” Zhou told POWER, noting the group’s decision to include that chemistry in its technology outlook. “This technology is expected to have lower cost, higher safety and wider operating temperature range compared to lithium-ion batteries. Leading Chinese battery suppliers such as CATL are now scaling up the supply chain, ramping up production and launching pilot projects to verify their products.”

The report said that distributed, decentralized power generation also will contribute to growth in energy storage projects, with batteries in both residential and commercial and industrial settings growing at a steady pace. BNEF said sizable markets already exist in Australia and California, and the group “expects energy storage located at homes and businesses to make up about one-quarter of global storage installations by 2030. The desire of electricity consumers to use more self-generated solar power and appetite for back-up power are major drivers.”

The power industry has talked about using energy storage as a means to defer more investment in grid infrastructure, though BNEF expects that type of application “may remain marginal in most markets out to 2030.” The group’s report said projects in that realm “could pick up, if regulatory barriers are removed and incentives are aligned for network owners to consider storage as an alternative to traditional infrastructure investment.”

—Darrell Proctor is a senior associate editor for POWER (@POWERmagazine).