First Hydrogen Burn at Long Ridge HA-Class Gas Turbine Marks Triumph for GE

Hydrogen combustion has begun at the 485-MW Long Ridge Energy Terminal combined cycle power plant—a flagship GE HA-class project that is purpose-built to transition from natural gas to hydrogen blends and ultimately be capable of burning 100% hydrogen.

While the sprawling multimodal facility in Hannibal, Ohio—which sits on the Ohio and West Virginia border—achieved commercial operation in October 2021, efforts to kick off its GE 7HA.02 gas turbine’s transition to hydrogen combustion began in earnest earlier this year. A test to combust an initial blending of 5% hydrogen and 95% natural gas fuel successfully completed on March 30 demonstrated that capability, said the plant’s owners, Fortress Transportation and Infrastructure Investors, and Grosvenor Capital Management—Labor Impact Fund.

The test is part of a project spearheaded by Long Ridge Energy Generation, Black & Veatch, GE, NAES, and Long Ridge’s engineering, procurement, and construction (EPC) contractor Kiewit to integrate hydrogen fuel blending at the plant without disrupting its power production for PJM Interconnection. The project’s key aim was to create an operational regime for hydrogen blending of 5% maximum hydrogen by volume in preparation for the next phase, which could involve blending of 20% hydrogen. GE implemented the project’s scope of supply, including its hardware design and procurement, as well as the GE Mark VIe and distributed control system modifications.

The blended fuel’s injection into the gas turbine’s combustion system marks a substantial triumph for gas power technology, Jeff Goldmeer, director of Emergent Technologies at GE Gas Power’s Decarbonization division, told POWER. “It’s definitely GE’s first HA machine to start using hydrogen, and it may be the first H-class machine anywhere in the world to start using hydrogen,” he said.

A Demonstration with Deep Implications

Hydrogen integration in a gas power plant is a complex undertaking that requires careful assessment of the gas’s safety challenges, Goldmeer noted. While GE has successfully tested hydrogen blends on other classes, HA-class machines—which are much bigger—have larger fuel requirements, Goldmeer explained. “So it’s great that we can actually start to learn real lessons from the real world about how to use hydrogen, especially as we start talking about this on an HA [machine],” he said.

The 7HA.02 combustion turbine—a model GE debuted in 2017—is already “innately capable” of burning 15% to 20% hydrogen by volume given its DLN 2.6+ combustion system, he noted. Crucial to this effort, however, are aligning the differences in the combustion properties of hydrogen and natural gas, as well as impacts to all gas turbine systems, and to the overall balance of plant. “The 7HA.02 at Long Ridge has not been modified for hydrogen,” Goldmeer said. “When we talk about going to 50% or 100% hydrogen, then we’ll start needing to see changes in the combustion system, primarily on the gas turbine, and changes in the balance of plant to handle much more hydrogen.”

Another key feature of the Long Ridge demonstration—and a facet whose significance will continue as the project pursues higher volumes of hydrogen—is the H2 Integrated Fuel Blending System, a system that GE provided to allow the initial blending of 5% hydrogen with natural gas by volume. The system comprised two hydrogen trailers each holding up to about 100,000 cubic feet of hydrogen. Once the hydrogen was on-site, supply from the two tanks “went into a blending system—because you’ve now got to take that hydrogen stream and blend it into an existing natural gas stream—and then bring the blended fuel to the gas turbine,” Goldmeer said.

That technology evolved from previous GE fuel blending applications at facilities like refineries where hydrogen is available as a byproduct, Goldmeer acknowledged. One example is the Dow Plaquemine plant, a petrochemical project in Louisiana, where a 5%/95% hydrogen/natural gas blend was achieved and fed to four GE 7FA turbines configured with DLN 2.6 combustion systems in 2010. “GE has been doing fuel blending for our industrial customers for many years, and each time we do this, we’re looking at what lessons we’ve learned to improve upon the work we’ve done in the past,” he said.

Prominent Challenges: Technology Readiness, Hydrogen Supply

How soon Long Ridge may be able to transition to 100% hydrogen by volume, however, will be determined by several factors, Goldmeer said. “There are three pieces there,” he noted. “There’s the technology readiness, the supply chain component, and then, when it makes sense for the customer to do so,” he said.

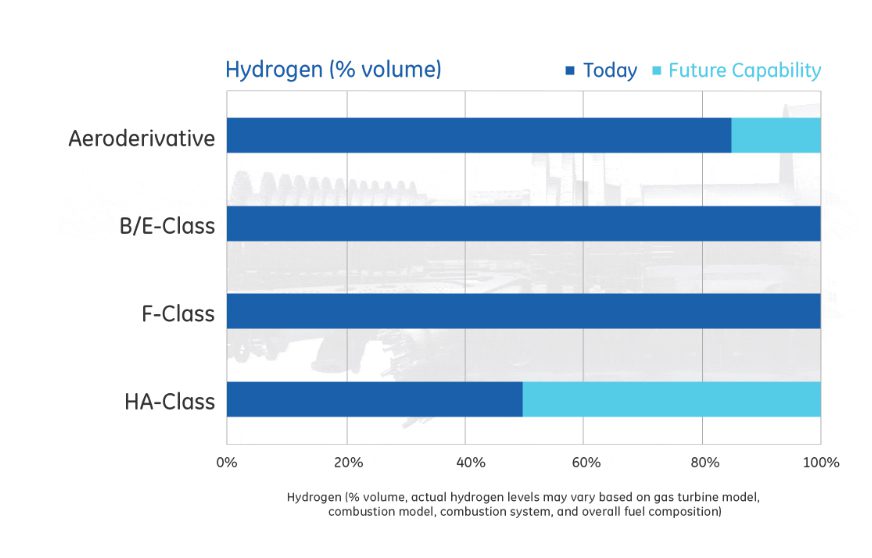

GE’s technology readiness is founded on a target to provide 100% hydrogen technology to its customers by 2030, and so far, GE has already deployed a broad range of combustion technologies across its gas turbine portfolio that enable a wide range of hydrogen concentrations—up to 100% by volume—on its aeroderivative and B/E class fleet, Goldmeer noted. GE’s advanced-class fleets (F, H-class) have configurations that allow operation on fuels up to 50%–60% by volume hydrogen concentration, depending on the specific gas turbine—with technology paths to higher concentrations depending on customer needs. The HA gas turbine, notably, is capable of 50% hydrogen by volume for units with the DLN 2.6e combustion system, which is found on the 7HA.03 (60Hz)—GE’s newest HA-class model—and the 9HA.01 and 9HA.02 (50Hz).

Along with the Long Ridge hydrogen demonstration, GE will this year kick off a six-to-eight-week pilot project at the New York Power Authority’s Brentwood power station on Long Island to replace a portion of the natural gas that runs the plant’s GE LM6000 combustion turbine—an aeroderivative gas turbine—with a blend of green hydrogen and natural gas. The pilot “will test varying concentrations of green hydrogen in its fuel mix to determine how the system responds and learn how different blends affect greenhouse gas emissions,” GE said. Findings are expected to be shared with the industry, “with the hope of influencing adoption of green hydrogen by other states and nations,” it added.

In another much-watched demonstration announced last year, GE will pilot an F-class dual-fuel gas and hydrogen plant at EnergyAustralia’s 316-MW Tallawarra B Power Station in New South Wales (NSW), Australia. As POWER has reported, that project will demonstrate how the coal-rich nation could accelerate its energy transition using gas. GE meanwhile last December bagged a contract to supply two GE 9HA.01 gas turbines for Harbin Electric Corp.’s Guangdong Huizhou combined cycle power plant in China. That 1.34-GW project will be expected to burn a blend of up to 10% of hydrogen by volume upon operation start in 2023.

However, how many turbines will be able to achieve 100% hydrogen by volume will be highly dependent on hydrogen supply. “It’s one thing to say ‘I’ll burn a certain percentage of hydrogen,’ but if you can’t get it, or if you can’t get it reliably, or can’t get it with a fuel price that’s sustainably viable, economically,” that affects overall ambitions, Goldmeer noted on Friday. “Whether it’s viable because the price of hydrogen has come down, or you get a subsidy on the fuel price, or a subsidy on your electricity tariff, burning hydrogen has to make sense economically.” That could take regulatory or policy support, he noted.

Purpose-Built for Hydrogen Combustion

At Long Ridge, which was designed, developed, and constructed to combust hydrogen—and remains one of the first purpose-built generation projects of its kind in the U.S.—hydrogen supply may be easily accessible because the station has access to industrial byproduct hydrogen nearby, Long Ridge has said.

The plant is located at the site of a former aluminum smelter that operated for more than 50 years in the Appalachian Basin. It sits within a 1,660-acre facility in the heart of the Marcellus and Utica shale formations alongside other natural gas infrastructure, including two storage tanks and four gas pipelines.

Eventually, “For the production of green hydrogen with electrolysis, Long Ridge has access to water from the Ohio River.” In addition, over time, below ground salt formations can be used for large-scale hydrogen storage, it said. Along with Long Ridge’s proximity to large-scale storage, “the plant will be capable of supporting a balanced and diverse power generation portfolio in the future; from energy storage capable of accommodating seasonal fluctuations from renewable energy, to cost-effective, dispatchable intermediate and baseload power.”

Successful testing of the 5% hydrogen blended fuel into the gas turbine’s combustion system marked a “profound achievement for Long Ridge Energy Terminal, GE, and the entire power generation industry,” said Bo Wholey, president of Long Ridge Energy Terminal, on Friday. Long Ridge is “focused on delivering low-carbon, reliable, and cost-effective energy to our customers including local data centers and technology companies,” he said. “Data centers represent one of the many industries that can benefit from hydrogen-fueled power generation and—supported by GE’s advanced gas turbine—we are committed to meeting these needs.”

Gas Turbine Potential as a ‘Destination’ Technology

On a higher level, the demonstration marks a new pathway for GE’s lucrative Gas Power segment, which has seen improved earnings but flagging revenues over the past three years. A significant concern is the role gas power will play as the world moves toward decarbonization. GE executives told investors in March the segment—whose installed gas turbine base is twice as large as the next closest peer—expects low single-digit growth in global gas-based generation for power. However, Martin O’Neill, head of Strategy at GE Gas Power, suggested the energy transition would position gas turbines as a “destination” technology.

“Through pre- and post-combustion, we need to decarbonize gas turbine assets for our customers,” he said. “They’re going to be a fundamental part of the energy landscape on the other side of the transition. In this decade of action, we’re going to see more coal to gas switching. That’s decarbonization in real terms. And we’re going to see aeroderivative technologies being added to grids globally so that they can support the more accelerated and rapid addition of renewables technologies. Gas turbines operate in sync with transmission and distribution networks, they’re the connective tissue that hold together grids and grid stability and resilience. And we really need to spend some more time on that narrative, understanding the interplay there with synchronous rotating assets and the massive installed base of gas turbines that we’ve built up over decades, 7,000 operating assets.”

While GE is already exploring carbon capture and sequestration (CCS) as a post-combustion decarbonization option, it views hydrogen as a lucrative pre-combustion option within the developing hydrogen economy and low-carbon intensity fuels. “The good news here again is the installed base is key,” said O’Neil. “You have to decarbonize that installed base. It’s the fundamental linchpin of operating grids globally. We’ve got 8 million hours operating with low carbon intensity fuels already in more than 100 machines around the world. We were doing hydrogen work with the [Department of Energy] as far back as 2002. We’ve got embedded capability in our H-class turbines and our aeroderivatives, and we’re going to continue to develop that,” he said.

However, a key enabler of this strategy will be growth for GE’s HA installed base. In March, GE reported it had 65 H-class turbines running, but it suggested it would have about 100 by the end of the year and into next year. “This is an area of underappreciation for how important this part of this business is for the long term,” Scott Strazik, CEO of GE’s Global Energy Business Portfolio, said in March. “This is a part of the business that in 2020 generated $300 million of services collections. But by mid-decade, that number will be $1 billion.”

On Friday, Strazik hailed the demonstration at Long Ridge as a crucial milestone that was built on a legacy of more than 8 million operating hours on non-HA turbines that have burned hydrogen or similar low-carbon fuels. “We are pleased to collaborate with Long Ridge to demonstrate pre-combustion decarbonization is something we can and must pursue today, even on GE’s largest utility-scale HA gas turbines, to demonstrate that gas generation can be a destination technology in the energy transition,” he said.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).