GE Vernova, IHI Developing Novel Ammonia-Capable Gas Turbine Combustor

GE Vernova will collaborate with Japanese integrated heavy industry group IHI Corp. to develop a retrofittable 100% ammonia-capable gas turbine combustion system that would be compatible with GE’s 6F.03, 7F, and 9F models, targeting a potential commercially available product by 2030.

The companies on Jan. 24 signed a joint development agreement (JDA) that formally launched technology development and engineering work for the novel combustor. The effort will also include a “significant amount of combustion test work that will happen at IHI facilities in Japan,” Jeffrey Goldmeer, GE Vernova director of Hydrogen Value Chain, told POWER. “So we’re really taking this from the investigation stage and discussions of a technology roadmap to now the execution phase, and that’s incredibly exciting,” he said.

A First Crucial Step: Technology Validation

Under the JDA, GE Vernova and IHI will focus on a technology validation of a combustion system that can be retrofitted on an existing F-class machine, burn ammonia at scale, operate reliably, and comply with environmental regulations. The combustion system will build on work conducted by IHI to develop a combustor for a 2-MW class IM270 gas turbine with funding from Japan’s New Energy and Industrial Technology Development Organization (NEDO).

Tests IHI conducted to mono-fire liquid ammonia to the turbine in June 2022 at its Yokohama Works facility in Japan showed a reduction rate of greenhouse gas, including nitrous oxide, exceeding 99%, “even when the ammonia fuel ratio is at 70~100 %.”

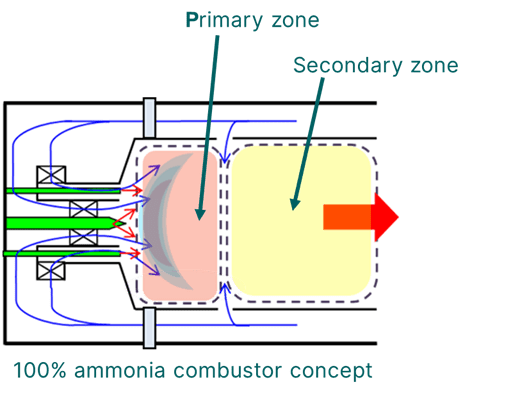

GE Vernova and IHI will now work to scale up the 2-MW system’s combustor to meet F-class conditions, including temperatures and pressures, Goldmeer said. The novel combustor will likely require a two-stage combustion system featuring both a “rich” and “lean” stage, he said.

“We know there are significant challenges with using ammonia as a fuel,” he explained. “The real challenge is what does the combustion system look like when you’ve got a fuel that’s 83% nitrogen, and you’ve got to meet, if you’re in the U.S. or Japan, single-digit nitrogen-oxide (NOx) emissions from the plant,” he said.

“We know if you just put ammonia into a very traditional [dry-low NOx (DLN) ] combustor that you might find that an F-class unit today, or even a diffusion flame combustor, you might find, on an existing gas turbine, emissions are likely going to be measured in thousands of [parts per million (ppm)].” Delivering a retrofittable solution adds more complexity to the challenge, he suggested, because an existing plant has an existing footprint, and “you’re going to have [a selective catalytic reduction (SCR) system] that has an existing capability,” he noted.

Standard DLN or DLE combustors offered by OEMs are fundamentally lean head end combustors, which involve the injection of a little bit of fuel and a lot of air to achieve very low NOx. “So if I’m running on the lean side of stoichiometric, I’m actually coming down in flame temperature, which means I’m coming down in NOx—perfect for a fuel like methane,” he explained.

But, “If you put ammonia in that scenario, as the ammonia breaks apart, and because it’s 83% nitrogen, I get a lot of nitrogen,” which seeks out oxygen in the air and starts down the NOx production pathway, Goldmeer said. Based on work IHI and academia have completed, “it turns out you have to be on the rich side of the stoichiometric conditions—you have to be fuel-rich,” he noted. “Now I have a lot of fuel and a lot less air, and as the ammonia breaks apart, there’s a lot less oxygen for the nitrogen to pair with, and so immediately you can bring down the amount of NOx you make,” he explained.

Over the next two years, GE Vernova and IHI will develop the rich head end combustor technology and validate it to ensure it can meet typical gas turbine requirements, including reliability and start-up and shutdown. However, “we’re going to call it a ‘two-stage combustion’ system because you still have to ensure you get complete combustion. We’re likely going to have a rich head end, followed by a lean stage,” Goldmeer said.

The concept of multiple stages, or axial stages, isn’t “that dramatically different,” from what many OEMs offer today, even GE, Goldmeer noted. “I think about our H-class machines, where we have axial fuel stage, and our F-class, where we have quaternary fuel. But what we’re doing here is that rich head end followed by a second stage, which will be lean, and that is very different from anything you find in the industry commercially operating today.”

Readying the Technology for Commercial Use by 2030

The two companies expect to begin work under the JDA with an immediate focus on the technical and engineering development of validation. IHI already has a test facility at its research and development center in Tokyo, while GE will contribute its legacy knowledge about combustion technology. “And so we bring knowledge of what we look for in terms of manufacturing, in the configuration of the combustor, and operating requirements, and IHI brings its experience, having done work on ammonia combustion. We will marry those two sets of knowledge and skill, and experience,” Goldmeer said.

“Once we validate the technology, we’ll know what’s going to work, and then we can think about what the commercial phase looks like beyond that,” he added. “The expectation is to have this technology ready for commercial use in 2030.”

However, “Obviously, a lot will depend on how the market evolves,” he underscored. Key factors include whether enough ammonia for fuel will be available, he suggested. The partners will also consider “the price point of ammonia our customers [are] looking at to make the fuel switch,” he said.

How policy evolves may deliver another crucial factor. In November, a Japanese government committee report suggested the government is poised to launch contracts for difference as a subsidy mechanism to support the use of hydrogen and ammonia in fossil fuel-intensive markets, starting with power generation.

“If all of a sudden you start subsidizing the cost of a low carbon fuel so that it is cost competitive, relative to, let’s say, imported [liquefied natural gas (LNG)], that could be a game changer,” Goldmeer noted. “Because, if the end user sees no difference in fuel cost, they could start thinking about making the switch.”

A Key Driver: Providing Optionality for the Market

The effort marks another new chapter for GE Vernova, one of the world’s largest gas turbine original equipment manufacturers that has developed several generations of gas turbines. While GE Vernova is preparing to launch as a spin-off in April, the company on Wednesday reported that its Gas Power business remains strong, driven by growth in aeroderivatives and heavy-duty gas turbines.

However, to provide optionality to the emerging market demand for low-carbon power generation, GE Vernova has, in recent years, marked a series of notable “firsts” as part of customer projects to test hydrogen combustion on H-class, F-class, and aeroderivative gas turbines. The company’s industrial fleet—6B, 7E, and 9E gas turbine models—already feature combustion systems that make them technically capable of combusting 100% (by volume) hydrogen when blended with natural gas.

The company notes more than 1,600 GE F-class are deployed worldwide. GE is in tandem also exploring combustion solutions to enable 100% hydrogen combustion on existing and new F-class turbines under a project that is backed with $6.6 million in federal funding.

GE Vernova’s efforts with IHI to develop a retrofittable 100% ammonia-capable combustor are geared to provide even more flexibility to power generators worldwide, which continue to discern how to execute long-term decarbonization plans, Goldmeer said.

“I think ammonia becomes yet another pathway for folks to consider,” he said. Ammonia, already abundantly produced, can be cracked from hydrogen, either produced via electrolysis using low-carbon power sources or “blue” hydrogen. Interest in utilizing ammonia as a fuel is surging, he suggested. “In conversations I’ve had over the last year, not just with customers in Asia, but customers in Europe, they’ve asked us about ammonia,” he said.

Customers are exploring whether it would be more cost-effective to transport hydrogen directly or as ammonia, and that has prompted questions about whether ammonia can be used directly as a fuel, he noted. “I think that’s great optionality in the energy transition. It’s going to be really important because there is not going to be a singular answer for any one person, customer, or region.”

Several other OEMs, notably, are also exploring ammonia combustion. Mitsubishi Power, a Japan-based global gas turbine competitor, is leading the charge with parent company Mitsubishi Heavy Industries to develop a 40-MW class gas turbine that can directly combust 100% ammonia. As POWER has reported, the company is currently working out how to directly combust ammonia using a Type 1 diffusion combustor while removing NOx byproducts. One solution, which is applied to the company’s H-25 gas turbine series, combines a gas turbine system with NOx removal equipment. An actual plant validation could occur in 2025.

The Long Road to Delivering an Ammonia Value Chain

IHI, meanwhile, is already leading several notable projects to build out an ammonia value chain. IHI, so far, also has agreements to explore supply chain prospects or undertake ammonia co-firing with companies in Japan, Indonesia, Malaysia, the United Arab Emirates, India, and Australia. On Wednesday, Kensuke Yamamoto, IHI vice president of Business Development HQ’s and GM of the Ammonia Value Chain Project Department, noted the JDA with GE comprised a major effort to decarbonize utility-scale power generation across the world. The effort “is part of our mission to develop an ammonia value chain to accelerate the global transition to Net Zero,” he noted.

GE and IHI’s partnership kicked off in June 2021, when the companies signed a memorandum of understanding (MOU) to define an “ammonia gas turbine business roadmap.” Under the MOU, the companies agreed to conduct research on the marketplace volume of ammonia, as well as feasibility studies for ammonia as feedstock for gas plant installations in Japan and Asia. In January 2023, GE and IHI companies signed another MOU to explore the development of ammonia combustion technologies by 2030 that could enable GE’s F-class heavy-duty gas turbines (6F.03, 7F, and 9F gas turbines) to fire up to 100% ammonia.

As part of the January 2023 MOU, GE and IHI conducted a joint year-long Japan-focused study, mapping a value stream for hydrogen and ammonia from their points of production to their point of use as fuel in a power-generating gas turbine. As POWER reported, the study suggests that ammonia could be a potentially lower-cost alternative fuel for gas turbines in Japan than liquid hydrogen if the full import value stream is considered.

The companies have also secured some industry backing. Last October, the companies partnered with Singapore-based Sembcorp Industries to examine potentially retrofitting two GE 9F gas turbines at the 815-MW Sakra power plant gas-fired combined cycle power plant in Jurong Island with ammonia capabilities. IHI and Sembcorp, notably, have separately set out to explore developing an integrated “green” ammonia supply chain, focusing on both upstream and downstream elements.

According to Goldmeer, the development of the new combustor is geared both toward supporting customers like Sembcorp and bolstering industry confidence for the development of an ammonia value chain. “I’m sure other customers are going to be expressing interest in this announcement and what we’re doing,” he said.

Operational and Safety Considerations

Discussions with customers will be important to pin down what a fuel switch to ammonia will mean for existing plants, Goldmeer noted. Factors power plant owners are considering, for example, include feasible timelines and what the switch could mean for an existing plant’s fuel accessory systems, fuel storage, operations and maintenance, and regulatory requirements.

“If our intent is to use ammonia as a liquid fuel, you need the right accessories, the right pumps, the right materials and seams that have compatibility with ammonia,” he said. “You’d ask how the ammonia is coming to the site. Are you storing it in a tank? Do you have a pipeline? We know that ammonia, unlike natural gas, carries some toxicity risks, so we have to think about plant safety.”

But while GE and IHI are eager to engage with customers, “I think it’s important to realize we’re still a couple of years away from being ready to go,” he said. The first crucial step will be to focus on the viability of the combustor technology, he noted. Beyond that, the challenges will relate to getting it commercially accepted.

“I still think there is a huge urgency to demonstrate to the world that we have technology that can decarbonize the installed base of gas turbines and even new gas turbines. I don’t think this is a fundamental question of whether the technology is viable. I think this comes down to a question of what society really wants to do,” Goldmeer said.

“We can decarbonize faster, but some of these low-carbon fuels, zero-carbon fuels come at a price premium relative to natural gas or LNG. Who pays for that difference?” he asked. “It’s not about if the technology is going to be available. It’s how do you make it more affordable.”

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).