Evolving Roles for the Grid and Generation

In the beginning, all power generation was local, distributed, and small. With technology improvements and a desire to serve far-flung customers, centralized generating facilities were added and grids grew larger. Today we’re seeing new technologies and capabilities shift attention back to smaller scales. Will central station generation remain central?

It’s not being overly dramatic to say that the power industry is at its biggest inflection point to date.

Even ignoring the effects of environmental regulations and (in North America, at least) cheap natural gas, the speed at which distributed generation and storage options are entering the market, and the more widespread availability of technical tools to deploy greater energy efficiency and demand response are all reshaping the electricity sector. As Robert F. Powelson, first vice president of the National Association of Regulatory Utility Commissioners (NARUC), said at the February 4 public stakeholder meeting on the second installment of the U.S. Department of Energy’s (DOE’s) Quadrennial Energy Review (QER), “The revolution is upon us, in a very positive way.”

Others may disagree about the benefits of the revolution, but it’s clear that utilities today have options beyond building new central station generation to balance supply and demand. In fact, given the combination of dropping costs for distributed renewables and energy storage, consumer demand for new choices, and the recent stay of the Clean Power Plan, anything but central station generation may become the near-term preferred option in many cases. According to Lisa Davis, member of the Managing Board for Siemens, speaking at February’s IHS CERAWeek, 50% of new capacity being installed today is distributed, which presents, in her view, a “huge opportunity.”

These developments mean that, while the distribution grid’s role is becoming more critical as it’s called upon to serve more masters, the transmission grid and reliable fast-start baseload generation continue to serve critical roles.

POWER has published a number of articles over the years on the technology developments and developers that have brought us to our current, complex state of the industry—including solar and wind power, energy storage, and smart grid technologies. This article takes a different approach—a 30,000-foot view—to offer a snapshot of how some of the pieces are fitting together today. Given our space limitations, it cannot be comprehensive, but we hope it will spark some conversations.

Changes Are Already Affecting the Balance of Power

The QER (see sidebar “More About the Quadrennial Energy Review”) is designed to develop a vision of the future for the U.S. energy system by providing “unbiased data and analysis on energy challenges, needs, requirements, and barriers” to inform both policy and industry participants. The first installment, released in April 2015, focused on “Energy Transmission, Storage, and Distribution Infrastructure.” The DOE noted that, “Given the critical enabling role of electricity articulated in the first installment, the Administration has determined that the second installment of the QER will develop a set of findings and policy recommendations to help guide the modernization of the nation’s electric grid and ensure its continued reliability, safety, security, affordability, and environmental performance through 2040.”

|

More About the Quadrennial Energy Review See http://energy.gov/epsa/quadrennial-energy-review-qer for more details on many of the issues mentioned in this article and 1.usa.gov/1pmjxeQ for the 24-page February 4 Briefing Memo regarding the second installment. All comments regarding the QER can be uploaded at www.energy.gov/qer or submitted to [email protected] until July 1, 2016. |

That focus by the administration is one of many indications that change is not just afoot—it’s moving faster than a jog.

During the February stakeholder meeting, Lisa Wood, Institute for Electric Innovation (IEI)—part of the Edison Electric Institute’s (EEI’s) Edison Foundation—listed three trends highlighted in the institute’s December 2015 publication, Key Trends Driving Change in the Electric Power Industry:

■ Transition to a clean energy future

■ A digital and distributed grid

■ Individualized customer services

These and other changes already affecting the industry have implications for:

■ Existing power generators and wires owners, as well as those who support them

■ Grid operators

■ New energy and energy service providers

■ Federal, state, and local regulators

■ Large and small electricity customers

Reports from any number of research firms also tout the rise of renewables, distributed energy resources (DERs), microgrids, and new grid and utility operating models. For example, highlighted in an early 2016 report by Deloitte, “Trends to Watch in Alternative Energy,” is this claim: “Alternative energy’s shift to the mainstream is largely complete and likely irreversible.”

Supporting that view is the U.S. Energy Information Administration’s (EIA’s) March Short-Term Energy Outlook projection that solar power—for the first time—will lead utility-scale capacity additions in 2016 with 9.5 GW, followed by gas and wind; in 2015 natural gas was followed by wind and then solar. The EIA notes that “This level of additions is substantially higher than the 3.1 GW of solar added in 2015 and would be more than the total solar installations for the past three years combined.”

If you prefer analysis and projections from the financial sector rather than an independent government agency, consider Warren Buffett’s 2016 annual letter to investors. After noting that, traditionally, “utilities were usually the sole supplier of a needed product and were allowed to price at a level that gave them a prescribed return upon the capital they employed,” he adds, “The joke in the industry was that a utility was the only business that would automatically earn more money by redecorating the boss’s office. And some CEOs ran things accordingly.”

“That’s all changing,” Buffett continues. “Today, society has decided that federally-subsidized wind and solar generation is in our country’s long-term interest. Federal tax credits are used to implement this policy, support that makes renewables price-competitive in certain geographies. Those tax credits, or other government-mandated help for renewables, may eventually erode the economics of the incumbent utility, particularly if it is a high-cost operator. [Berkshire Hathaway Energy’s] long-established emphasis on efficiency—even when the company didn’t need it to attain authorized earnings—leaves us particularly competitive in today’s market (and, more important, in tomorrow’s as well).”

Sizing Up Solar

In his opening remarks at the QER public stakeholder meeting, Tom Kimbis, vice president of executive affairs for the Solar Energy Industries Association, acknowledged that “solar is still small”—just 1% of the U.S. energy mix. He also noted, as EEI’s Thomas Kuhn had before him, that utility-scale solar represents 60% of installed solar capacity. Nevertheless, Kimbis observed, the distributed generation (DG), largely rooftop, portion gets more coverage and attention.

It’s not just the media (especially the non-power-industry media) that talk about distributed solar generation more than its contribution to our electricity system would seem to merit. Utilities, too, talk a lot about how just a little bit of DG sometimes requires them to conduct business and engage in planning differently. And, for all the criticism that could be leveled against utilities for being slow to recognize society’s appetite for renewable energy, they get it now.

The IEI’s Wood said they expect “exponential growth of solar.” By 2020, she said, solar will provide about 10% of U.S. generation.

One recent study by the National Renewable Energy Laboratory (NREL) is among others suggesting that utility-scale photovoltaics (PV) plus “grid-friendly” controls can actually make the variable renewable a net plus for system stability and reliability. The lab collaborated with AES, Puerto Rico Electric Power Authority, First Solar, and the Electric Reliability Council of Texas on a demonstration project involving two roughly 20-MW PV power projects, one in Puerto Rico and the other in Texas, to test their ability to provide ancillary services.

NREL says the demonstration “showed how active power controls can leverage PV’s value from being simply a variable energy resource to providing additional ancillary services that range from spinning reserves, load following, ramping, frequency response, variability smoothing and frequency regulation, to power quality. Specifically, the tests conducted included variability smoothing through automatic generation control, frequency regulation for fast response and droop response, and power quality.”

Although the effects of distributed PV generation on a distribution grid vary depending on the installation size, number of installations, and where on a feeder they are positioned, smarter distribution system controls are beginning to make management of small generators possible.

What Are DERs and Why Do They Matter?

Rooftop solar generation may get the most attention, but distributed energy resources include much more. Unlike central station generation, DERs can sit on either side of the utility meter and may be owned by a utility, a customer, or a third party (see sidebar “Between the Utility and the Customer: Community Resources”).

|

Between the Utility and the Customer: Community Resources POWER wrote about community solar installations—which offer customers a way to own solar without putting it on their rooftops (especially when they might not own those rooftops)—in the May 2015 issue. Such installations, which are smaller than today’s utility-scale solar projects, are often developed by third parties, but some utilities are getting into the action as well. In California, for example, the three big investor-owned utilities are all offering community solar programs in response to state renewables requirements. February brought an announcement about another, similar, concept: “community storage.” Like community solar installations, community storage might be owned by a utility, customers, or a third party. In this particular case, though, the National Rural Electric Co-operative Association was announcing the use by some of its utility members of aggregated electric hot water heaters as energy storage devices as part of a demand response program. |

For many years, the category mostly consisted of small-scale utility-owned diesel generators or gas engines strategically located to support distribution system operation. Today, DERs include small-scale energy storage, including batteries and flywheels, as well as small-scale solar, wind, and hydro generation. The reason for the moniker “resources” is that, as with energy storage, some of the resources are not primarily generating technologies or facilities that can only feed power to the grid. Also included in the DER category are distribution system management tools such as demand response.

Plus or Minus? The value of DERs depends on who is determining their economic, societal, and personal value. Several DER options—from rooftop solar to electric vehicle (EV) battery energy storage to demand response programs—enable even small customers to participate in energy markets, provided the utility has developed modern distribution technologies and enabling customer programs. But even without a monetary incentive, many customers derive personal satisfaction from adopting new technologies, whether they be the latest smart phone or an EV.

Utilities vary in how they view DERs—especially customer-sited varieties—depending on their location, political environment, role in power markets, and willingness to innovate.

From a purely technical standpoint, DERs can complicate distribution system planning and management or support it. Depending on where DERs are added to the distribution grid, the effects can be inconsequential or significant. Figuring out how to integrate, manage, and value all the new elements is one challenge utilities are facing (see sidebar “Avista Prepares for a More Distributed Future”).

Two places that have developed the most experience with DERs are California and Hawaii. Many stories have been written about the experiences both states have had with increasing amounts of renewable generation, net metering programs, and other technology and regulatory changes. These two states have, for reasons too numerous to address here, had somewhat different experiences, and two data points are indicative of those differences.

Largely in response to state regulatory initiatives, California has been a leader in supporting DERs. For example, Southern California Edison’s (SCE’s) June 2015 application for utility commission approval of its distribution resources plan notes that, although there are barriers to greater DER penetration (including integration and interconnection barriers and current distribution system capability to enable DERs), “foundational modernization investments” will potentially enable DERs “to defer or avoid future projects, driven by load growth, if the DER portfolios can provide similar levels of safety and reliability at lower costs.”

Elsewhere, DERs can create challenges. Hawaii aims to be 100% renewables powered by 2045, but the speedy growth in rooftop PV power has created challenges for grid management as a result of an even more pronounced “duck curve” (load curve) than is seen in California. A Hawaiian Electric Co. (HECO) official told Utility Dive that, as of March, more than 30% of single-family homes in its territory had rooftop solar. That volume has begun to pose grid-balancing problems. Better resource visibility and demand shifting are seen as part of the solution (see sidebar “Integration Assistance”).

|

Integration Assistance In recognition of the proliferation of distributed energy resources (DERs) and the challenges they can pose, the Department of Energy’s Advanced Research Projects Agency-Energy (ARPA-E) announced last December that it was granting a total of $33 million for 12 projects through its Network Optimized Distributed Energy Systems (NODES) program. NODES teams “will develop innovative hardware and software solutions to integrate and coordinate generation, transmission, and end-use energy systems at various points on the electric grid. These control systems will enable real-time coordination between distributed generation, such as rooftop and community solar assets and bulk power generation, while proactively shaping electric load. This will alleviate periods of costly peak demand, reduce wasted energy, and increase renewables penetration on the grid.” One project, for example, is focused on coordinating transmission and distribution via “a new approach for demand-side management called packetized energy management (PEM) that builds on approaches used to manage data in communication networks without centralized control and requires a high level of privacy. The PEM system will allow millions of small end-use devices to cooperatively balance energy supply and demand in real time without jeopardizing the reliability of the grid or the quality of service to consumers.” |

But add storage to solar, and the story changes. The island of Kauai (Figure 2), which is not served by HECO but by Kauai Island Utility Cooperative (KIUC), signed a 20-year power purchase agreement with SolarCity in September last year for what is believed to be the first U.S. utility-scale dispatchable solar energy. In addition to solar generation, the system will include a 52-MWh battery system provided by Tesla Motors. The rate, according to a press release, will be “only slightly more” than the cost of power from KIUC’s two existing 12-MW solar arrays and less than the cost of conventional fossil fuel generation on the island.

|

|

2. Solar powering Kauai. High amounts of distributed solar generation can create grid-balancing challenges, but partnered with energy storage, it can provide net benefits. Courtesy: Gail Reitenbach |

New Utility DER Ownership Models. By now, everyone expects utilities in places like California and Hawaii to be leading the way in terms of renewables, energy storage, and facilitating technologies. Less expected was a February announcement from Southern Company that it is acquiring PowerSecure, which Southern described as a “premier provider of distributed generation, energy efficiency and utility infrastructure solutions.” The company is also said to have built one of the largest fleets of microgrids.

“As energy technologies and customer expectations continue to evolve, the electric utility business model is increasingly expanding beyond the meter,” Southern Company Chairman, President, and CEO Thomas A. Fanning said in connection with the announcement. “Today there is demand for distributed infrastructure solutions that best meet each customer’s unique energy needs. With the addition of PowerSecure to Southern Company, we’re extending our commitment to create America’s energy future by tapping into industry-leading expertise to deliver cutting-edge solutions to energy consumers nationwide.”

Notice the mention of “nationwide.” Southern appears to be sharing a playbook with Duke Energy, which has been promoting microgrids-as-a-service beyond its traditional distribution utility service territory. (For more on microgrid developments, see “U.S. Microgrid Market Development” in this issue or at powermag.com.) These and other utilities are beginning to look at “energy service” options to diversify and grow their business models.

New Roles for DERs on the Grid. AES owns a 2-MW battery facility on the campus of grid operator PJM Interconnection and the 64-MW Laurel Mountain facility (sited with a 98-MW wind farm) also in PJM territory that together are estimated to save customers in that region $20 million a year, according to AES. PJM says the battery facility “helps PJM quickly balance variations in load to regulate frequency as an alternative to adjusting the output of fossil-fuel generators; it is capable of changing its output in less than one second.” (For more on the amount and location of U.S. energy storage, see “THE BIG PICTURE: Leading the Charge” in this issue.)

Some regions and states are already moving forward to integrate storage and other DERs more fully into both grids and markets since the U.S. Supreme Court’s January 25 opinion on Federal Energy Regulatory Commission (FERC) v. Electric Power Supply Association. It held that FERC Order 745, which directed wholesale markets to compensate demand response (DR) providers at the locational marginal price—the same price paid to generators—instead of at the locational marginal price less the retail rate for electricity, was not arbitrary and capricious.

ISO New England is moving forward with full integration of DR resources into that region’s wholesale market. It plans to implement the change by June 2018, which may make it the first U.S. grid operator to accomplish this. (For more on how system operators are responding to DERs, see “How Are Distributed Energy Resources Affecting Transmission System Operators?” in this issue.)

Then, on February 3, the California Independent System Operator (CAISO) Board of Governors approved several proposals that support improved integration of storage and DER in the wholesale electricity market.

A month earlier, California’s three big investor-owned utilities (SCE, Pacific Gas & Electric, and San Diego Gas & Electric) announced contracts with nine companies in the state’s first-ever auction for demand response, known as its Demand Response Auction Mechanism. The winners, as Greentech Media (GTM) reported, include companies that will provide aggregated behind-the-meter batteries—“one of the first times batteries and demand response have competed head to head to provide grid services.” They also include companies with the ability to aggregate at least hundreds of homes with smart thermostats as well as one that can aggregate at least 1,000 smart EV chargers. “All told, California’s three utilities have contracted for a collective 40+ megawatts of resources, according to the advice letters filed by each utility on [January 8],” wrote GTM’s Jeff St. John.

As St. John explained, starting in August, each of the winning DR providers “will be asked to begin responding to day-ahead markets from state grid operator CAISO, as well as meeting the terms of each utility’s resource adequacy (RA) requirements. That will require them to deliver the promised amount of reliable reduction in energy consumption from their aggregated resources, for up to four hours per day and up to three days in a row, during the state’s daily peaks in grid demand.”

Power Sharing—Ready or Not

In some regions, tensions are growing between utilities and their customers over ownership and appropriate compensation for customer-sited DERs. Many articles have covered the ongoing battles over net metering, but one thing is clear: Although, as noted, solar power currently accounts for only 1% of all U.S. generation, and though utilities own 60% of that sliver, customers large and small increasingly expect to play a role in deciding what sort of generation technology gets used, and where. That genie is out of the bottle.

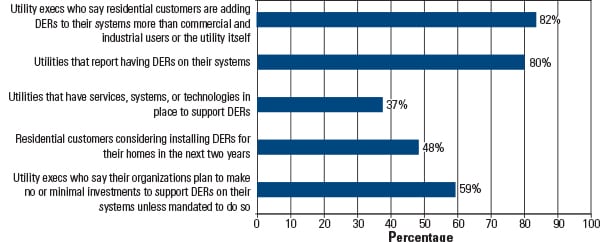

In January, consultants at West Monroe released results of a study of utility customers, executives and managers, and regulatory commission chairpersons and staff to assess attitudes toward DERs (Figure 3). They found that, although utilities and regulators see the shift to DERs and greater customer interest, many utilities and states are not prepared to accommodate them: “Factors from technology availability and cost, to public policy drivers, to pivoting business models, are contributing to the obstacles slowing DER penetration across the U.S.”

|

|

3. Mismatched distributed energy resource (DER) numbers. These results are from a late 2015 West Monroe survey of nearly 2,000 customers, 109 utility executives and managers, and dozens of regulatory commission staff in major U.S. markets. Source: West Monroe |

Utilities and regulators responding to the West Monroe survey agreed that solar would have more impact on future grid operations than EVs (Figure 4).

|

|

4. Plug and drive. Although interest in electric vehicles (EVs) is increasing, adding more EVs to the grid is expected to have less of an effect than adding more distributed solar generation. Courtesy: Gail Reitenbach |

Though most discussions about customer-sited DERs assume that the customer or a third-party installer owns the generation, some utilities, like Tucson Electric Power and Arizona Public Service, are getting into the business of installing and owning PV on customers’ roofs—typically in exchange for a lower rate (though not as generous as the retail net metering rate) for a set number of years. This shift to giving the utility more control is bad news for third-party installers, and may reduce the value for consumers, especially as many utilities are also considering higher fixed charges and other special charges for customers with rooftop solar generation.

Utilities, technology providers, customers, and regulators have sometimes competing interests in this new distributed energy arena. As technology options and costs continue to change, so too will the moves each stakeholder group is able to make.

Generation or Transmission: Who’s on First?

Depending on the type and size of generation capacity you’re talking about and where it’s sited, it may make sense to build transmission first. In reality, generation often takes the lead. That’s true for more than just rooftop PV systems.

During the QER public stakeholder meeting, North American Electric Reliability Corp. (NERC) President and CEO Gerry Cauley pointed out that you can build generation much faster than transmission. The latter can take 10 to 15 years. In the meantime, even utility-scale plants of any kind can be added to the grid, putting more pressure on existing transmission.

Jay Morrison, vice president, regulatory issues for the National Rural Electric Cooperative Association, noted that the Clean Power Plan makes the assumption that new transmission will be built to move new, clean power from wind farms to load centers, but even if states want to add new transmission, can it realistically be built as fast as it will be needed, he asked. NERC’s Cauley pointed to Texas, which had to strategically coordinate new wind generation and new transmission—and things worked out reasonably well.

Aside from the permitting and regulatory challenges facing new transmission, American Public Power Association President and CEO Sue Kelly offered another caveat. Be careful that you build new transmission that works under “a bunch of different planning scenarios,” she advised. Right now, she said, “there’s a rush to build transmission because it’s a regulated business” that will generate revenue for a long time.

From Grid to Grids

When folks talk about the power grid, they usually mean a combination of the transmission and distribution (T&D) systems, even though these are two separate systems under different regulatory regimes. Now microgrids are beginning to be seen as a third grid that is different not just in scale and control but also function and financing. The relative importance of the “T,” “D,” and “M” grids depends on regional variables, including generation siting options and load growth.

Increasingly, T&D grids are being forced into more complex and challenging service. The DOE notes in the QER briefing memo that transmission lines “can more easily accommodate two-way flows of electricity than the distribution network.” However, it’s at the distribution grid where an increasing number of unplanned-for DERs are being added.

The DOE also notes that “The electricity system across continental North America is already connected and highly integrated between the United States and Canada and could be increasingly so with Mexico.” That’s a massive grid. And it’s getting bigger. Among recent plans are those for multiple new transmission lines to move large-scale hydropower from Québec to New York and New England (Figure 5), including the Hudson Power Express, New England Clean Power Link Transmission Line, and the Northern Pass project.

|

|

5. First of many. The Québec–New England Phase II HVDC project, awarded by Hydro Québec and National Grid USA to ABB in 1986, was the first large multi-terminal high-voltage direct current (HVDC) system to be contracted. Since then, dozens more have been developed. Courtesy: ABB |

Also on the large scale, some reports, including the QER, have suggested development of high-voltage direct current (HVDC) transmission to move variable renewables from areas where they are abundant—including the Midwest and Southwest—to demand centers in other parts of the U.S.

HVDC is integral to a model of an even-more-integrated grid developed by the National Oceanic and Atmospheric Administration and University of Colorado, Boulder scientists. They used a “sophisticated mathematical model to evaluate future cost, demand, generation and transmission scenarios. It found that with improvements in transmission infrastructure, weather-driven renewable resources could supply most of the nation’s electricity at costs similar to today’s.” They found that within 15 years, by using HVDC (to minimize transmission losses) to move variable renewables from point of generation to point of demand, costs could be kept low while adding much more wind and solar generation.

Meanwhile, central generation, especially facilities fueled by coal, gas, and nuclear energy, will remain essential—even if, in some places, they are no longer dispatched first. The variability of wind and solar generation makes energy resource diversity a must.

A Hybrid Electric System

What do all these changes mean? Is the electricity system of the future likely to be bigger or smaller in scale? If you’re looking at the U.S., the answer is probably “both.”

More options mean greater complexity, requiring new management tools. At IHS CERAWeek, Andy Bennett, senior vice president infrastructure and energy for Schneider Electric’s U.S. operations, said in an interview with POWER that utilities are going to be managing a “federated grid.” In addition to traditional centralized generation, they’ll have microgeneration like rooftop PV as well as mid-size community generation and storage plus microgrids.

In his comments during the QER meeting, EEI’s Kuhn made a similar prediction. He sees the utility of the future as a “systems integrator and operator,” with the grid as the “central nervous system for the business” (see sidebar “Edison International’s Vision of the Utility of the Future”).

|

Edison International’s Vision of the Utility of the Future At IHS CERAWeek in February, Theodore (Ted) Craver, chairman, president, and CEO of Edison International, said his company wants to emphasize the delivery system. Because Edison International (a public utility holding company) buys most of its generation, “we’re indifferent as to whether it’s utility scale or distributed generation (DG) or storage,” he said. All of those resources require the distribution system to operate, and “that system needs to be modernized” to connect distribution and communication parts and make it all more efficient. Craver said Edison sees as much opportunity as threat in DG. He also noted that we are moving to an even more electrified system, so the distribution grid becomes even more important. Electricity systems, he said, have traditionally been built for a peak, and when you have unused capacity, you could have electric vehicles charging and then operate those grid-connected batteries as an aggregated mobile storage system. In terms of who pays for distribution grid upgrades, Craver said, it depends on how quickly you do things. If you modernize in “steps over time,” you focus on the circuits with the most DG first. Prioritizing upgrades can lower costs and even avoid costs for new generation and grid resources. He explained that the electric system was standardized to deliver reliability and low cost, but now some customers—especially commercial and industrial customers—want or need “highly customized electricity service” either for power quality needs or because they want renewables. How to provide that customization “will be a challenge.” On March 29, Edison International gave a more detailed preview of what its future might hold when it announced the launch of Edison Energy, a new business unit that will provide energy consulting services to large energy consumers across the country. (For more, see “Edison Moves Toward Energy as a Service” at powermag.com.) |

The IEI’s Wood predicted that DERs are going to continue to grow, and “in a big way.” At the same time, we’ll continue to have a grid, essentially creating what the DOE calls a “hybrid generation system.” Wood asked, “How do we make both things work?” and followed up with a request that the DOE help industry answer that question.

NARUC’s Powelson followed Wood with an appreciation for the DOE being on the “frontier of ideas” but opined that utilities shouldn’t necessarily have to adopt new technologies. Instead, he called for the DOE to provide tools and information but not requirements. And, he concluded, always ask, “Is there a cheaper… way to do this?”

As several speakers at the QER meeting noted, getting multiple stakeholders together regularly to discuss these gnarly issues is necessary. They won’t always have common interests, but they can at least share information for the good of the industry and consumers. ■

— Gail Reitenbach, PhD is POWER’s editor.