The Department of Energy (DOE) has released a Notice of Funding Opportunity (NOFO) providing up to $100 million in federal backing for projects focused on restoring and modernizing the nation’s existing coal plant fleet.

The Oct. 31–issued NOFO, administered by DOE’s National Energy Technology Laboratory (NETL) under the Office of Fossil Energy and Carbon Management, solicits proposals in three technical areas: advanced wastewater management, dual-fuel switching capability, and coal-natural gas cofiring systems.

The announcement follows DOE’s Sept. 29 declaration of a $625 million broader investment across multiple coal-related initiatives, including plant recommissioning, rural electrification projects, and related infrastructure support. The October NOFO represents a subset of that funding stream, with specific technical deliverables and performance milestones tied to demonstration-scale projects.

The funding opportunity emerges against the backdrop of the Trump administration’s formally declared national energy emergency in January 2025 and efforts to address a deterioration in resource adequacy. The DOE’s July 2025 Resource Adequacy Report found that the retirement of firm thermal generation had outpaced the deployment of replacement capacity capable of providing essential reliability services. In January 2025, Executive Order 14156 directed federal agencies to utilize all lawful authorities to “preserve and restore” generation capacity, ensuring reliability, affordability, and the security of supply. The administration suggests its strategy centers on the existing coal fleet because the DOE identified nearly 100 GW of operable coal-fired capacity as a near-term lever for stabilizing the bulk power system, particularly in regions facing constrained transmission, surging industrial demand, and reliability risks driven by cycling thermal units beyond their design parameters.

“The operational strain created by the increasing penetration of intermittent renewables, insufficient compensation in markets and onerous environmental compliance costs, has forced thermal units to cycle beyond their designed parameters, accelerating wear and raising the risk of forced outages and blackouts,” the NOFO reads. “This reliability emergency coincides with surging demand from national defense installations, semiconductor fabrication plants, Artificial Intelligence (AI) data centers, critical mineral processing, and industrial re-shoring, all of which require access to power.”

Three Strategic Topics: Wastewater, Dual-Firing, and Coal-Gas Cofiring

The purpose of the NOFO is to seek applications for demonstration-scale projects to “design, implement, test, and validate three strategic opportunities for refurbishment/retrofit of existing coal power plants.” The application deadline is January 7, 2026 by 5:00 PM ET.

TA1: Development and Implementation of Advanced Wastewater Management Systems

The DOE directs the largest share of funding—up to $50 million—toward wastewater systems that go far beyond compliance. The agency is targeting transformational treatment technologies capable of recovering water and other value-added byproducts from coal-plant wastewater streams. According to the NOFO, these systems must “reduce the use and manage the discharge of water in power plant operations” while improving environmental performance. The DOE is looking for technologies that can economically treat coal combustion residual (CCR)–related waste, cut O&M costs tied to regulated wastewater streams, and support coproduction of marketable byproducts to strengthen plant economics. Systems must demonstrate a path to meaningful water-recovery efficiencies, reduced discharge volumes, and integration with existing wastewater and ash-handling infrastructure.

TA2: Engineering and Implementation of Dual-Firing Retrofits

The DOE sets aside up to $25 million for dual-firing retrofits designed to increase the operational flexibility of the existing coal fleet. The agency wants retrofit systems that allow a unit to switch automatically between coal and natural gas without compromising emissions limits, Maximum Continuous Rating (MCR), heat-rate performance, or component life. As detailed in the NOFO, qualifying systems must demonstrate the ability to move from 100% coal to 100% natural gas (offline and under automatic control) while maintaining full emissions compliance. Required engineering elements include burner and overfire-air modifications, heat-transfer surface adjustments, potential emissions controls updates, and automated burner-management controls capable of safely handling transitions between fuels. The DOE notes that successful implementations should reduce exposure to gas-price volatility, cut emissions, and leverage existing infrastructure to extend plant life.

TA3: Development and Testing of Natural Gas Cofiring Systems

Another $25 million supports coal–natural gas cofiring systems that allow simultaneous combustion of both fuels at varying proportions. The DOE emphasizes that cofiring can drive proportional reductions in mercury, sulfur dioxide (SO₂), nitrogen oxides (NOₓ), particulate matter, and carbon dioxide (CO₂), while lowering the operating and maintenance (O&M) costs and auxiliary power consumption associated with coal-handling equipment. However, the agency also highlights the engineering challenges: natural gas and coal exhibit different flame shapes, heat absorption patterns, and emission characteristics, which often require significant boiler modifications—including changes to the burner, windbox, and heat-transfer surface, as well as upgrades to auxiliaries. Effective fuel mixing is critical, it notes, given that poor mixing can produce uneven heating, excessive ash deposition, temperature imbalances, increased auxiliary load, and higher furnace-exit gas temperatures. The DOE’s objective is to develop transformational boiler systems that automatically and smoothly control any proportion of cofiring, maintain Maximum Continuous Rating (MCR), and keep retrofit costs near $50/kW. Target systems should support 20–50% natural gas heat input, achieve 20–50% emissions reductions, meet ASME and NFPA 85 code requirements, and demonstrate reliable performance at a commercially relevant scale.

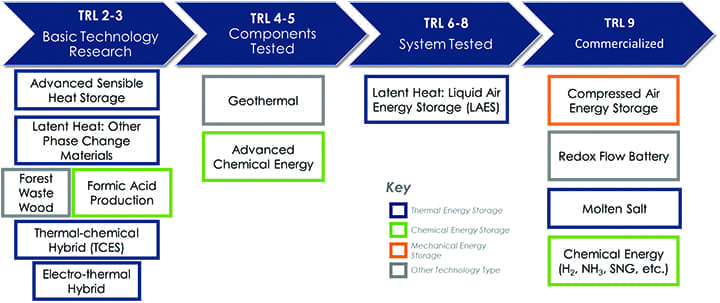

The agency is requiring projects to enter at Technology Readiness Level (TRL) 7, meaning the underlying technology has already been proven at full scale in a relevant environment. By the end of the effort, DOE expects projects to reach TRL 8, where a system is fully qualified for commercial use. The NOFO, notably, breaks work into a three-phase structure with competitive down-selects between each step.

Phase I (12 months) covers preliminary engineering, site selection, environmental review, and a Class 4 pre–front-end engineering design (pre-FEED) cost estimate. Applicants must line up a host site and commit to cost-share arrangements before they can advance. Phase II (12 months) moves into final engineering, detailed design, and the full front-end engineering design (FEED) study; applicants must also secure an engineering, procurement, and construction (EPC) contractor and complete review under the National Environmental Policy Act (NEPA). Phase III (up to 36 months) funds full implementation at a coal facility and requires testing at a commercially relevant scale—DOE’s threshold for demonstrating whether the technology can reliably perform under real operating conditions. Across all three phases, DOE positions the structure as a bridge to commercial uptake, using federal cost share to reduce risk for utilities and plant owners weighing whether these retrofits can help stabilize near-term reliability.

Why These Three Retrofit Pathways

The DOE argues these three retrofit pathways address the most immediate barriers preventing existing coal plants from contributing to near-term reliability needs. Wastewater treatment remains one of the fleet’s most persistent operating costs because CCRs and other regulated streams “often represent a significant operating and maintenance cost of coal-fired electricity generation,” the NOFO notes. Technologies that recover water and byproducts offer one of the clearest opportunities to reduce O&M burdens while improving environmental performance.

Fuel flexibility, meanwhile, will enable operators to switch rapidly between coal and natural gas, preserving the system’s dispatchable attributes while allowing plants to navigate volatile fuel prices and emerging emissions constraints. Cofiring builds on that logic by giving units the ability to displace a portion of coal heat input while maintaining full steam output, which the DOE says can reduce SO₂, NOₓ, mercury, particulate matter, and CO₂ “proportional to natural gas heat input,” while improving low-load performance and lowering auxiliary power consumption.

On Friday, in a press release, the DOE said the “effort will support practical, high-impact projects that improve efficiency, extend plant lifetimes, and improve performance of coal and natural gas use.”

Energy Secretary Chris Wright, however, suggested the effort was politically rooted. “For years, the Biden and Obama administrations relentlessly targeted America’s coal industry and workers, resulting in the closure of reliable power plants and higher electricity costs”, he said. “Thankfully, President Trump has ended the war on American coal and is restoring common-sense energy policies that put Americans first. These projects will help keep America’s coal plants operating and ensure the United States has the reliable and affordable power it needs to keep the lights on and power our future.”

Part of a Broader Strategy to Preserve Resource Adequacy

The October NOFO represents one facet of a broader DOE strategy aimed at preserving thermal generation capacity. Since May 2025, the agency has issued nine emergency orders under Section 202(c) of the Federal Power Act directing grid operators and utilities to maintain specified fossil and nuclear units. In May, the DOE issued separate orders to MISO to keep the J.H. Campbell coal plant in Michigan online, and renewed the order in August. Similar emergency directives have targeted Constellation Energy’s Eddystone generating units in Pennsylvania (orders issued in May and August, extended through November), Talen Energy’s Wagner station in PJM (orders issued in July and October, continuing through December), Duke Energy Carolinas units during extreme weather in June, and PREPA generation and transmission assets in Puerto Rico (orders issued in May and renewed in August, through mid-November).

However, the emergency orders have created immediate cost burdens and regulatory complexities, at least for Consumers Energy. The company disclosed in its latest earnings report that during the initial 90-day J.H. Campbell emergency-order period (May 20–Aug. 20, 2025), the utility incurred a net financial impact of $53 million after accounting for $67 million in MISO market revenues. For the second 90-day order period (Aug. 20–Nov 19, 2025) through Sept. 30, it reported a net compliance cost of $27 million after applying $17 million in MISO revenues.

To address cost allocation, Consumers filed a complaint at the Federal Energy Regulatory Commission (FERC) in June 2025 seeking modification of the MISO tariff to establish a regional cost-recovery mechanism. “Consistent with the Federal Power Act and the U.S. Department of Energy regulations, the order authorizes Consumers to obtain cost recovery at FERC,” the utility noted in its earnings disclosure. In August 2025, FERC granted the complaint and ordered MISO to submit a revised tariff. MISO filed its compliance proposal in September 2025, but FERC approval is still pending.

The cost-allocation dispute signals a brewing tension between emergency orders that mandate generation availability to address grid reliability, but do not automatically establish the tariff mechanisms or cost-sharing frameworks needed to make such mandates financially sustainable. Consumers noted that it cannot predict the “long-term impact” of the orders or potential litigation surrounding them, particularly as the utility pursues its stated clean-energy plan, which targets 60% renewable energy by 2035 and 100% clean energy by 2040. The utility also flagged the possibility of additional DOE emergency orders affecting J.H. Campbell or similar facilities.

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).