Carbon Trust: Marine Energy Has High Potential but Faces Several Challenges

In a an analysis released this May, nonprofit UK group Carbon Trust admits that there is “still considerable uncertainty as to whether wave and tidal systems will play a meaningful role in meeting global energy needs,” but it suggests, based on high and low scenarios, that up to 240 GW of marine capacity could be deployed globally by 2050. Roughly 75% of this capacity will come from wave and the remainder from tidal energy.

The UK, whose coastline harbors almost half of Europe’s wave resources and over a quarter of its tidal energy resources, could hold a quarter of the global marine energy market by 2050, generating nearly £76 billion (US$123.9 billion) if technology is successfully developed and deployed internationally and the UK builds on its existing lead. The industry will have to overcome several challenges, however, including technology verification, costs, and wider support in the form of public approval and grid upgrades.

Limited by cautious investment, the sector’s development has been inching ahead. Only a handful of marine energy systems are at full demonstration stage, and most are in the early demonstration or applied research phase.

Wave energy devices include oscillating wave surge converters, attenuators, overtopping devices, oscillating water columns, point absorbers, and submerged pressure differential devices. Globally, Carbon Trust estimates there are an estimated 70 to 80 wave energy devices; around 80% of these are in early research stage. Only UK-based Pelamis and Aquamarine Power and U.S.-based Ocean Power Technology are currently in full-scale sea testing phase, the organization claims. “The UK is home to arguably the most advanced concepts,” it says. “The U.S. is probably second.”

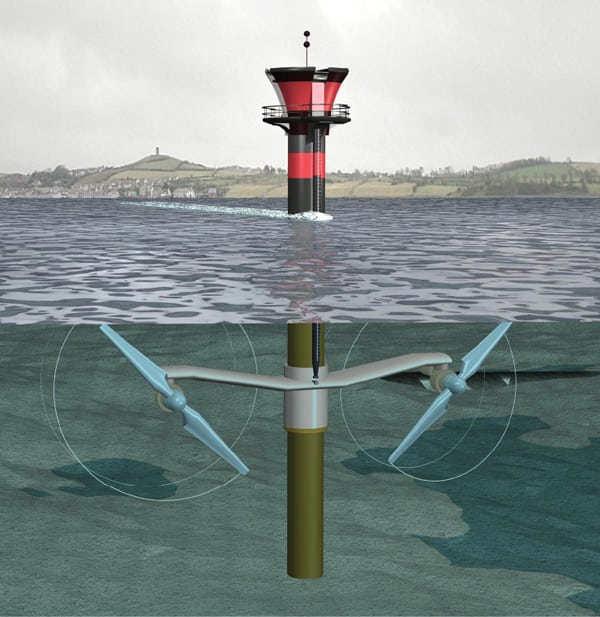

Tidal stream energy devices seek to harness the movement of water under the influence of the moon’s gravitational pull. Existing devices are horizontal axis two- or three-bladed concepts such as those used for wind power. Around 50 developers of tidal stream energy are active globally. Eight companies have or are building devices at full scale, but the majority of concepts are at a scale of a third or below, says the group. Leading concepts include Marine Current Turbines (Figure 7), Atlantis, Hammerfest Strom, Voith Hydro, Pulse Tidal, Tidal Generation, and Open Hydro. The UK leads with around 15 devices, Carbon Trust says, Canada has around seven devices, and the U.S. about five (see “New York City Backs Tidal Power” in the May 2011 issue at https://www.powermag.com).

|

| 7. Treading water. Marine energy has high potential but faces numerous technical and cost-related challenges, says UK nonprofit group Carbon Trust in a new analysis. Only a handful of marine energy systems are at full demonstration stage. One example is Marine Current Turbines’ SeaGen, a 1.2-MW tidal energy converter that was installed in Strangford Lough in April 2008. Courtesy: Marine Current Turbines |

“For both wave and tidal[,] attritions… at the early stage are high, and of the numerous concepts in the initial stages of R&D a proportion will be expected to fail,” says the group.

Conditions required for marine energy to reach large deployments include ensuring that technologies are “proven.” This will be the most challenging, according to the group. Proving technical viability requires full-scale demonstration and deployment of initial arrays, but these stages are capital intensive, and the private sector will require some sort of public sector support, the analysis says.

Marine energy will also have to reduce costs enough to compete with other low-carbon technologies, and this will “ultimately depend on the degree of targeted R&D that takes place and the degree to which it can drive accelerated cost reduction,” says the group. Other barriers include getting public approval for the potential environmental impact and sufficient development of the manufacturing supply chain. Today, the “most substantial barrier is the development of the electrical grid to accommodate the deployment of marine resources,” it says. Much of the deployment is expected to take place in remote locations such as the west coast of Scotland, where grid infrastructure is at present limited.

The sector can, however, expect to draw from established industry sectors such as offshore wind, it adds.

—Sonal Patel is POWER’s senior writer.