Pie in the Energy Sky

My late father was a mining engineer. He had lots of interactions with economists over his long career in government, the private sector, and academia. His take: “An economist is someone who goes from an unwarranted assumption to a foregone conclusion.”

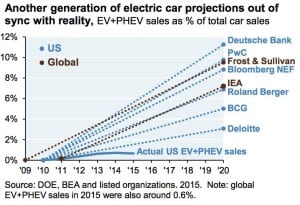

I was reminded of his view by a report in Electricity Daily of a study from Bloomberg New Energy Finance, predicting the beginning of the end for coal and natural gas in electric generation (peak fossil fuels) in 2025, extraordinary investment in wind and solar, widespread use of electric vehicles, and economic battery storage.

And if you believe that, I have a bridge for sale…cheap.

Let’s start at the top, with peak fossil fuels. Bloomberg says coal and natural gas will fade as generating fuels, despite low prices. “Around 2027, new wind and solar gets cheaper than running existing coal and gas generators, particularly where carbon pricing is in place,” says the report’s executive summary. The full report is not publicly available.

This post has some telling graphics, thanks to Michael Shellenberger.

That’s probably bogus, as carbon pricing regimes in effect so far produce carbon prices far lower than would drive a move away from cheap fossil fuels. But it’s a good unwarranted assumption.

Electric cars? Why would anyone buy an electric car when gasoline is cheap? Even in Europe, where gasoline prices are taxed to the roof, electric cars are not flourishing. In part, that’s because battery technology, after more than a century of research and development, is still not competitive with internal combustion. Another unwarranted assumption.

Then we move to batteries themselves, which, says Bloomberg, will see lower costs “through technology development, economies of scale and manufacturing experience. Cheaper batteries increasingly bring small-scale and grid-scale storage options into play.” “Technology development” is another magic wand assumption.

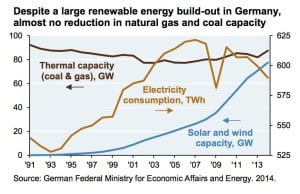

Finally, renewables. Here is where Bloomberg plays the “capacity game,” predicting huge increases in generating capacity from wind and, particularly, solar. Now, we all know that capacity and energy aren’t the same thing. All megawatts are not created equal. I suspect Bloomberg’s economists grasp that basic concept, but the executive summary does not translate capacity additions from intermittent resources into energy reductions through retirements of fossil plants.

The “capacity game” is frequently played by advocates of renewables and foisted off on inexperienced or credulous reporters to demonstrate how wind and solar are kicking fossil fuels off the planet. But it is a game, and a losing one at that.

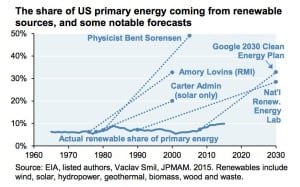

Call me skeptical, please. That’s my job. But I don’t view the current flood of reports about how the world is going to look in terms of energy usage in 15 years or more with any more respect than I looked at reports in the 1970s and 1980s about how the world was going to look in terms of energy in the 21st century. Those also featured lots of unwarranted assumptions reaching foregone conclusions. None were even close to correct.