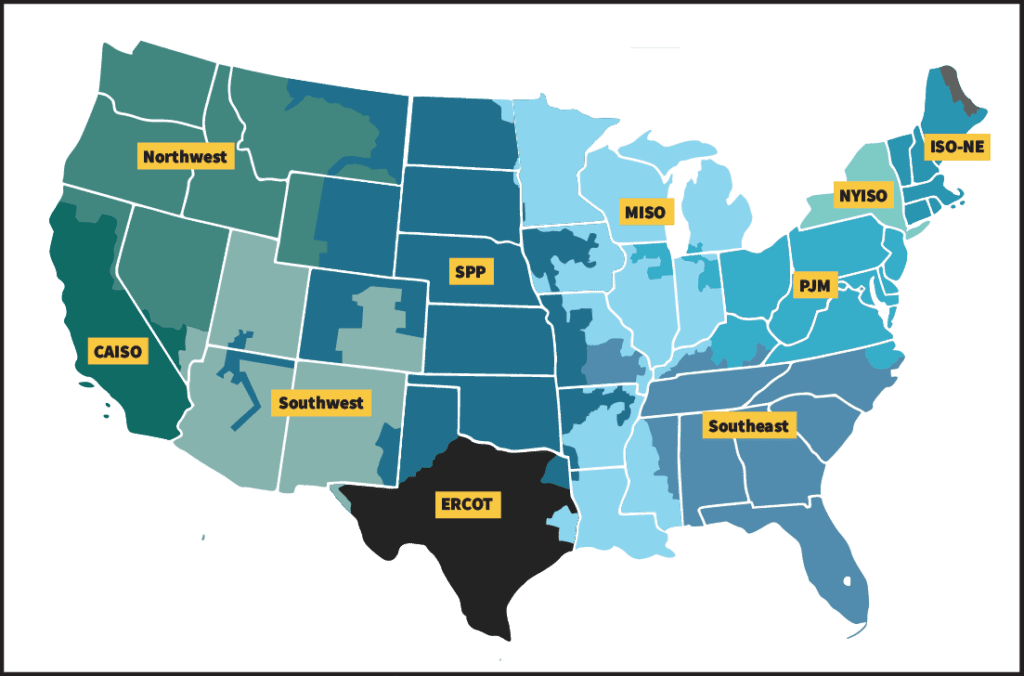

Vistra Corp. has executed definitive agreements to acquire Cogentrix Energy, a portfolio company of Quantum Capital Group, in a $4 billion transaction that will expand its generation footprint across the PJM Interconnection, ISO New England, and the Electric Reliability Council of Texas (ERCOT).

Announced on Jan. 5, 2026, the acquisition includes 10 modern natural gas generation facilities, with a combined capacity of 5,496 MW. It closely follows the Irving, Texas–based competitive power producer’s acquisition of seven gas plants—a combined 2,600 MW—from Lotus Infrastructure Partners in October 2025 for $1.9 billion.

A Major Gas-Fired Expansion

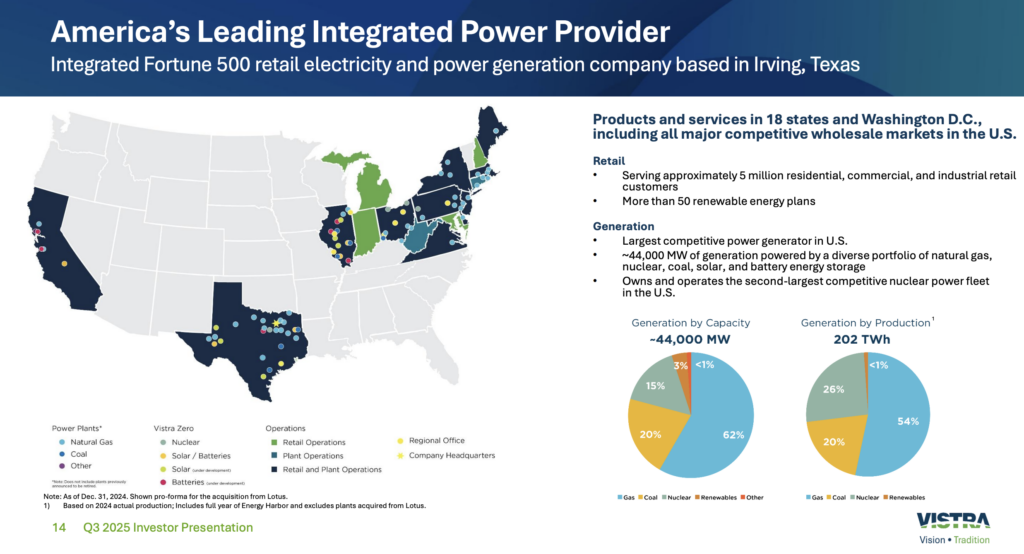

Combined, the two transactions could add more than 8.1 GW of modern gas generation to Vistra’s portfolio. According to Vistra’s November 2025 earnings report, the company operated approximately 43.7 GW of total capacity across its generation fleet, including 6,448 MW of nuclear generation (the second-largest competitive nuclear fleet in the U.S), about 26,000 MW of natural gas capacity across combined cycle, combustion turbine, and steam turbine configurations, 4,570 MW of coal generation, and 1,421 MW of solar and battery storage.

The transaction will include 10 natural gas–fired plants across PJM, ISO New England, and ERCOT, accounting for approximately 90% of Cogentrix’s generation portfolio. Cogentrix, however, will retain Cedar Bayou 4, a 550-MW gas-fired facility in Baytown, Texas that began commercial operation in 2021.

In PJM, the acquisition comprises a mix of combined-cycle and combustion-turbine assets for more than 3.1 GW of capacity. The portfolio includes the Patriot and Hamilton-Liberty combined-cycle plants in Pennsylvania, each rated at 881 MW and brought online in 2020, alongside the Lakewood combined-cycle facility in New Jersey (286 MW), which entered commercial operation in 2016. The PJM assets also include two combustion turbine facilities—Rock Springs in Maryland (740 MW) and Ocean in New Jersey (375 MW)—which were both placed into service in 2016.

The ISO New England portfolio comprises approximately 1.75 GW of combined-cycle capacity, all commissioned between 2016 and 2019. The assets include Newington in New Hampshire (624 MW), Bridgeport in Connecticut (558 MW), Tiverton in Rhode Island (297 MW), and Rumford in Maine (271 MW), providing baseload-weighted capacity across one of the region’s tightest power markets.

In ERCOT, Vistra is set to acquire Altura Cogeneration, a 583-MW natural gas–fired facility that entered commercial operation in 2021 and supplies both electric and thermal energy to industrial customers in the Texas market.

Vistra said it is acquiring 100% ownership of all plants in the portfolio, including the remaining 25% interest in the Patriot and Hamilton-Liberty facilities that Cogentrix did not previously own. The “Cogentrix portfolio is composed of a modern and efficient set of gas assets that adds baseload-weighted capacity, complements Vistra’s fleet, and enhances Vistra’s efficient generation capabilities,” the company noted. “The portfolio has an average heat rate of approximately 7,800 Btu / kWh and features the Patriot and Hamilton-Liberty plants, which are 2016 [commercial operation date] facilities with sub 7,000 Btu / kWh heat rates.”

The company also cited a geographic strategy, noting that the acquisition will expand Vistra’s footprint across some of the U.S.’s most capacity-constrained and fastest-growing power regions. Following the transaction, Vistra said its total generation portfolio will hover at 50 GW of capacity nationwide.

Last week, Vistra also said the transaction aligns with its disciplined capital allocation framework. The Cogentrix portfolio is expected to contribute mid-single-digit accretion to Ongoing Operations Adjusted Free Cash Flow before Growth per share in 2027, and high-single-digit average accretion over the 2027–2029 period, and it will be supported by cash flow from operations and transaction-related tax benefits. Vistra said it expects the deal to “exceed its mid-teens levered return target.”

“Successfully integrating and operating generation assets is a major undertaking, and our talented team continues to demonstrate that it is a core competency of our company,” noted Vistra President and CEO Jim Burke.

“Our diversified fleet, anchored on natural gas and nuclear generation, will play a critical role in the reliability, affordability, and flexibility of U.S. power grids,” Burke added. “The addition of this natural gas portfolio is a great way to start another year of growth for Vistra as we’ve completed, acquired, or developed projects in each of the competitive power regions where we operate. Vistra continues to look for opportunities that allow us to meet the growing demand of customers and meet our disciplined investment thresholds. We look forward to closing the transaction and welcoming new team members to the Vistra family.”

Still, Vistra’s Cogentrix transaction remains subject to regulatory approvals from the Federal Energy Regulatory Commission (FERC), the Department of Justice under the Hart-Scott-Rodino Antitrust Improvements Act, and certain state regulatory authorities, but the company anticipates the transaction will close in mid-to-late 2026.

FERC’s review under Section 203 of the Federal Power Act will examine competitive impacts, particularly in PJM and ISO New England, where the combined Vistra-Cogentrix fleet will hold significant generation capacity. The commission will also assess whether the transaction adversely affects competition, rates, or regulation, and whether it involves cross-subsidization of non-utility activities. Goldman Sachs & Co. LLC served as Vistra’s exclusive financial advisor, with legal counsel provided by Latham & Watkins LLP, Sidley Austin LLP, and Cleary Gottlieb Steen & Hamilton LLP. Evercore served as exclusive financial advisor to Cogentrix Energy, with King & Spalding LLP providing legal counsel.

As a reference for timing, Vistra’s acquisition of the Lotus Infrastructure portfolio—announced in May 2025 and closed in October 2025—took approximately five months from signing to completion. However, the larger scale and greater geographic concentration of the Cogentrix portfolio may extend regulatory review timelines.

Vistra Spearheading Growth Across Multiple Fuel Types

The Cogentrix agreement caps a rapid strategic shift for Vistra over the past 18 months, as the company moved from prioritizing shareholder returns to deploying growth capital at scale. In February 2024, CEO Burke described data center demand as being in the “early stages,” noting that no contracted large-load deals were reflected in the company’s long-range plans and that share repurchases would remain the preferred use of capital absent investments that met strict return thresholds.

By November 2025, however, Vistra had committed more than $5 billion to growth initiatives, reflecting the company’s perspective that accelerating data center and industrial load growth, particularly in PJM and ERCOT, has fundamentally altered power market economics and strengthened the case for shifting capital toward long-term, contracted revenue opportunities.

Beyond the Lotus acquisition completed in October 2025, Vistra in September 2025 announced plans to build new gas-fueled dispatchable generation in West Texas’s Permian Basin, an effort rooted in the next phase of its ERCOT capacity expansion to support grid reliability amid surging demand.

And in July 2025, the company received Nuclear Regulatory Commission (NRC) approval to extend the operation of its Perry Nuclear Plant—a 1,268-MW boiling water reactor located on Lake Erie, about 40 miles northeast of Cleveland—through 2046, in a measure that completes license extensions across all six of its nuclear reactors spanning Ohio and Pennsylvania. During its November 2025 earnings call, the company also announced it secured a 20-year power purchase agreement with an undisclosed customer for up to 1,200 MW at its Comanche Peak Nuclear Power Plant site near Glen Rose in Central Texas. “We believe this 20-year agreement, which enables our customer to energize up to 1,200 MW of new load ensures the Comanche Peak nuclear plant will continue to deliver power to Texans at least through the middle of this century,” Burke said on Nov. 6, 2025.

Days after announcing the Cogentrix acquisition last week, notably, Vistra unveiled agreements with Meta Platforms to support 20-year power purchase agreements covering 2,609 MW of nuclear capacity from its Perry and Davis-Besse plants in Ohio and Beaver Valley facility in Pennsylvania—including 433 MW of uprates across all three sites. The Meta partnership, which marks the largest corporate-backed nuclear uprate program in U.S. history, will provide financial certainty to pursue subsequent license renewals and extend operations at all three facilities for decades while adding more than 15% new capacity to the PJM grid, the company said.

To fund its expansion while preserving its investment-grade credit profile, Vistra has executed multiple capital markets transactions. The company in October 2025 priced $2 billion in senior secured notes—debt securities backed by pledged assets and ranked ahead of unsecured debt in repayment priority—across multiple maturity dates. In January 2026, concurrent with the Cogentrix announcement, Vistra priced an additional $2.25 billion in senior secured notes to support the transaction and general corporate purposes.

Another Big Move for Cogentrix

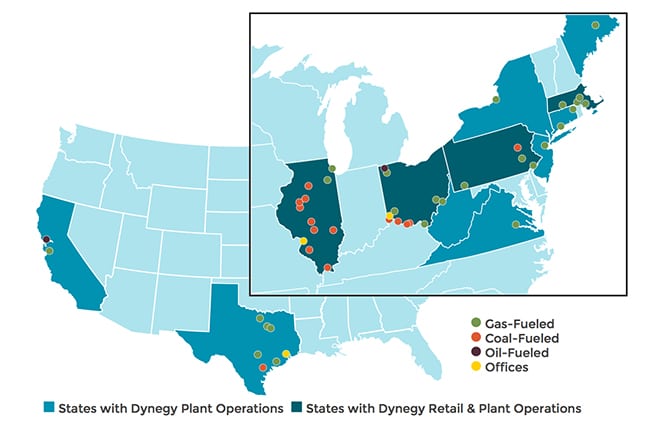

Cogentrix Energy, founded in 1983, is a leading independent power company that develops, acquires, and operates power generation assets across the U.S. The company owns about 5.5 GW of natural gas generation capacity positioned throughout PJM, ISO New England, and ERCOT.

However, since August 2024, Cogentrix has been owned by funds managed by Quantum Capital Group, a Houston-based private equity firm that has managed more than $32 billion in equity commitments since its founding in 1998. Quantum acquired the company from Carlyle Group for approximately $3 billion, citing rising demand for dispatchable power.

“We are at a critical juncture in the evolution of the domestic power market,” said Wil VanLoh, Founder and CEO of Quantum, when Quantum acquired Cogentrix in August 2024. “Electricity demand is rapidly increasing thanks to explosive growth in data centers and AI, the reshoring of manufacturing, and the electrification-of-everything. This growth is occurring at the same time our grid is becoming more unstable with additions of intermittent renewable power and continued retirements of coal-fired generation. Now more than ever, we need reliable and efficient power infrastructure. This is what the Cogentrix assets provide.”

Last week, VanLoh suggested the transaction reflected a similar strategy. “This highly successful partnership with Cogentrix highlights the scale and capabilities of the Quantum platform and our deep expertise across the gas-to-power space,” he said. “This transaction delivers a strong outcome for our investors and strategic partners in Cogentrix, including Williams, Trafigura Group, and Carnelian Energy Capital, and reinforces our long-standing belief in the critical importance of dependable power generation. We are pleased to become shareholders of Vistra and have strong confidence in Vistra’s ability to create long-term value through its industry-leading asset base and strategic execution.”

Jeff Ingraham, interim CEO of Cogentrix, said, “Our partnership with Quantum was instrumental in advancing the company and preparing Cogentrix for its next phase.”

A Race to Secure Gas Generation Assets

The Cogentrix acquisition, notably, follows significant consolidation activity in the competitive generation sector and a concerted industry-wide move to secure modern gas-fired generation assets. In January 2025, Constellation Energy—which operates the nation’s largest nuclear fleet—announced a $26.6 billion agreement to acquire Calpine Corp., the country’s largest natural gas fleet operator, creating a combined portfolio with about 55 GW. Constellation reported the deal was completed earlier this month.

In May 2025, NRG Energy announced a $12 billion agreement to acquire 18 natural gas-fired facilities (13 GW) from LS Power, roughly doubling NRG’s generation capacity across the Northeast and Texas. The transaction closed in early 2026 following regulatory approvals. Similarly, Talen Energy in July 2025 announced definitive agreements to acquire two combined-cycle gas plants in PJM—the 1,045-MW Moxie Freedom Energy Center in Pennsylvania and the 1,836-MW Guernsey Power Station in Ohio—for a net $3.5 billion. Both transactions closed in in the fourth quarter of 2025.

Meanwhile, municipal utility CPS Energy executed two major gas acquisitions in 2025: a $785 million purchase of Talen’s 1,710-MW Texas portfolio that closed in Q2 2024, and a $1.4 billion agreement to acquire four natural gas plants (1,632 MW) from PROENERGY that closed in September 2025.

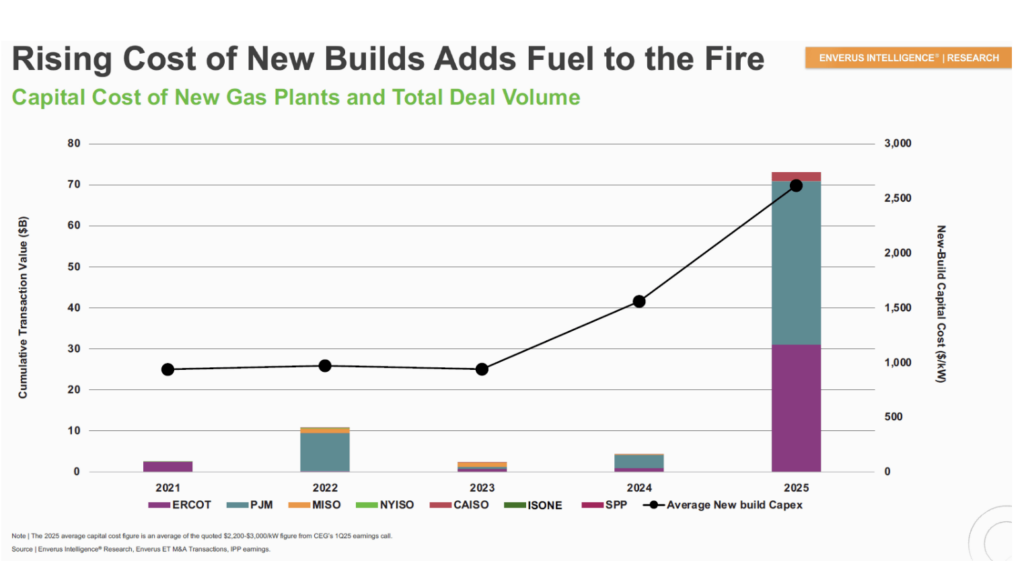

According to Enverus Intelligence Research (EIR), U.S. natural gas power sector merger and acquisition (M&A) valuations have doubled since 2024. Scott Wilmot, principal analyst at EIR, in an October 2025 briefing, suggested that accelerating data center growth, grid electrification, and rising capital costs and supply chain issues are driving “premiums for operating natural gas power plants and transforming valuation methodologies in competitive markets,” particularly in PJM and ERCOT.

Enverus said capital costs for new-build natural gas generation now average $2,200 to $3,000/kW, which reinforces the appeal of existing, high-efficiency combined-cycle assets with established interconnections and capacity market exposure. The firm also noted that investment strategies are increasingly focused on portfolios capable of capturing capacity revenues and favorable spark spreads, a factor it suggests marks a shift in valuation frameworks across competitive wholesale markets.

For now, the valuation premium for natural gas assets appears to be also reinforced by capacity market dynamics. PJM’s 2026/27 Base Residual Auction cleared at the federally mandated price cap of $329.17/MW-day, which represents a 22% increase from the prior auction. The organized wholesale market’s subsequent 2027/28 auction cleared at $333.44/MW-day, reflecting prices that would have reached approximately $530/MW-day without a temporary cap negotiated with Pennsylvania’s governor.

In the 2027/28 PJM auction, Vistra cleared 10,566 MW of generation capacity, securing approximately $1.3 billion in annual capacity revenue. Natural gas generation accounted for 43% of total cleared capacity in PJM, underscoring its central role in maintaining grid reliability amid accelerating demand growth.

Likewise, ISO New England capacity markets have attracted substantial investment. The grid operator reports that 1,928 MW of new resources have cleared Forward Capacity Auctions for delivery years 2025-2028. Grid operators across all three markets—PJM, ISO-NE, and ERCOT—project sustained load growth driven primarily by data center development.

—Sonal Patel is a national award-winning multimedia journalist and senior editor at POWER magazine with nearly two decades of experience delivering technically rigorous reporting across power generation, transmission, distribution, policy, and infrastructure worldwide (@sonalcpatel, @POWERmagazine).