The U.S. Nuclear Regulatory Commission (NRC) has completed its draft safety evaluation (SE) a month ahead of schedule—albeit with open items—for TerraPower’s Kemmerer Power Station Unit 1, a pioneering 345-MWe sodium-cooled fast reactor (SFR) under development in Wyoming.

| Editor’s note: This article was substantially updated on Feb. 27 at 11 a.m. CST to provide deeper insight into TerraPower’s timeline, supply chain developments, key project milestones, and the reactor’s advanced design features. |

The NRC’s draft SE was initially expected by March 2025, but productive engagement between the agency and TerraPower’s subsidiary, US SFR Owner, LLC (USO), allowed for earlier-than-anticipated completion, the NRC said in a letter on Feb. 26. According to the NRC, the final SE is now targeted for June 2026, two months ahead of the previous August 2026 timeline. The environmental review remains separately on track for completion in May 2026.

TerraPower has told POWER it anticipates receiving NRC approval in late 2026, which could allow nuclear construction to begin in early 2027—potentially sooner if processes move efficiently. The company is eyeing a 2030 date for fuel loading and commercial operation starting in 2031.

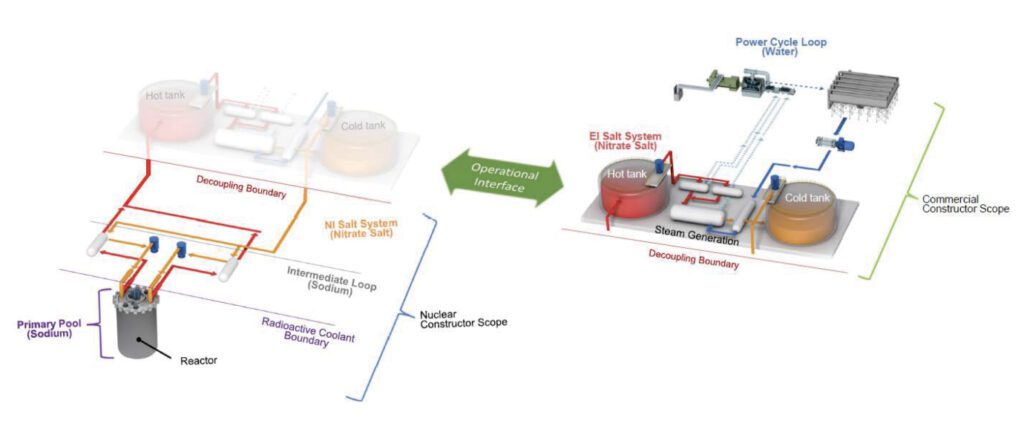

Kemmerer 1 is taking shape in Lincoln County, Wyoming, about 3 miles from PacifiCorp’s three-unit 604-MW coal and gas–fired Naughton Power Plant, furnished with up to $2 billion in authorized funding under the Department of Energy’s (DOE’s) Advanced Reactor Demonstration Program (ARDP). While the demonstration will be a fully functioning commercial power plant, it will showcase TerraPower’s first Natrium reactor, an 840 MWth pool-type Natrium SFR reactor. Kemmerer 1 will be a hybrid nuclear facility that will integrate the fourth generation reactor with a nitrate molten salt-based energy storage system that could boost the system’s output to between 100 MWe and 500 MWe of power for more than 5.5 hours when needed, ramping at 10% per minute.

While the NRC’s draft SE represents a crucial step in the licensing process—signaling the NRC’s thorough review of the Natrium reactor’s safety features and design—the agency has identified several outstanding issues that TerraPower must address. These include materials qualification for environmental compatibility, special treatment requirements for safety-significant structures, systems, and components, and the seismic/structural design approach for non-safety-related systems. The NRC has also requested additional documentation on the PRA’s use within the Licensing Modernization Project (LMP) and other licensing programs.

The LMP is designed to modernize the regulatory process for non-light water reactors by incorporating risk-informed approaches. The NRC’s request for further PRA documentation suggests that it is closely evaluating how TerraPower is applying risk insights to safety classifications and regulatory decision-making, a key factor in the licensing of first-of-a-kind (FOAK) reactors like Natrium.

When asked how the identified open items compare to issues typically encountered in licensing reviews for conventional nuclear plants, the NRC told POWER that open items are an expected part of draft safety evaluations, particularly for complex topics requiring additional analysis before final technical decisions. “The TerraPower application used the Licensing Modernization Project approach, which means some topics can apply to several review areas. When those topics are resolved, multiple parts of the evaluation will be addressed simultaneously. Issues such as materials qualification and PRA documentation have been open items in the past,” agency spokesperson Scott Burnell said.

The NRC noted the early draft evaluation stems from the agency’s extensive pre-application discussions and ongoing technical exchanges with TerraPower. Burnell added that the agency expects lessons learned during this review to “lead to efficiency improvements down the road, whether for additional TerraPower applications or other vendor submissions. For example, this continuous improvement effort bore significant results in completing review of the second Kairos construction permit application several months faster than the first Kairos review,” he said.

A Compact, Flexible, and Innovative Nuclear Solution

The regulatory milestone boosts the much-watched demonstration, which broke ground at its Wyoming site in June 2024—days after the NRC accepted US SFR Owner’s construction permit application (CPA) in May. As TerraPower noted, the groundbreaking made Kemmerer 1 the first advanced nuclear reactor project to move from design into construction in the Western Hemisphere.

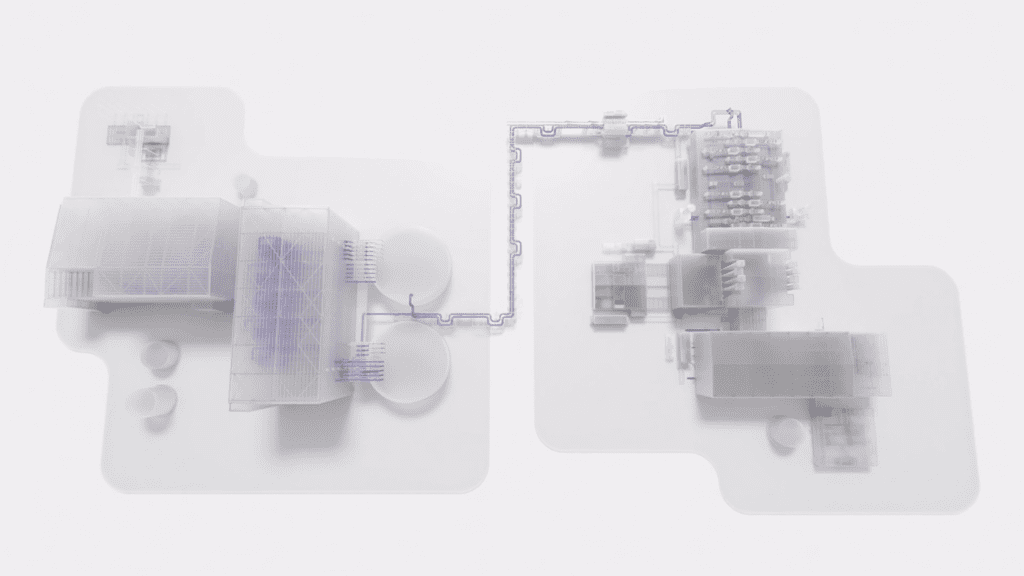

As POWER has reported in detail, the nuclear facility will mainly comprise a nuclear island (NI) housing the reactor (in a compact and simple safety envelope) along with its core and primary heat transport systems and an energy island (EI) containing the thermal energy storage tanks, steam generator, feedwater system, condenser, turbine, and supporting systems. The islands are designed to function independently with minimal interdependencies, connected only by the nuclear island salt system.

According to Jeff Miller, vice president of Business Development at TerraPower, 1,000 engineers are dedicated to the project, which he suggested could change the paradigm for new nuclear deployment.

“TerraPower is bringing a technology to market that can fit on the grid of today and the grid of tomorrow, and that grid is increasingly encumbered with renewables and evolving dynamically before our eyes,” he noted. “And our design philosophy for our Natrium reactor, our flagship program, is to have a design that’s simple, cheaper to build, safer, to operate, easier to maintain. Those are our core principles. We are bringing to market a 345-MWe sodium fast reactor with a patented integrated energy storage system that can output a flexible range of power to meet the demand of the grid and off-takers, and it’s designed to integrate seamlessly with renewable power.”

The plant’s design is distinctive with safety as a key focus. “Our reactor is all underground, and all of our components and most of the safety systems are inside the reactor under the ground.” The heat from the reactor is transferred from the nuclear side of our plant to a thermal energy storage system, which “we can call up that energy residing in the tanks to dispatch its power, steam, or heat when needed by the market and by our customers,” Miller said. “We borrowed that system from the concentrated solar industry and merged it with our nuclear technology—it’s our key innovation.”

The array of passive cooling and safety systems—aided by a low-pressure system, sodium as a coolant, and underground configuration—allows the Natrium plant to provide a “very small” emergency planning zone (EPZ) of just a quarter mile, he added. “I can’t emphasize enough what an incredible advantage that will be for us as we bring our technology to market in the early 2030s,” he said.

“It’s our fence line,” Miller explained. “It enables us to do several things, including site our reactors closer to population centers and industrial sites, so we have the capability to work with data centers, chemical companies, oil and gas, and utilities in many different configurations. We can put our power delivery side inside an industrial facility but have our nuclear side of the plant a mile away. There’s no other technology coming to market that can offer that benefit.”

The Natrium’s compact size and innovative architecture also translate to significant construction and cost advantages. As Miller highlighted, “Our 3D modeling proved without a doubt that we are very competitive, especially on quantities, 50% less concrete, steel, and on-site labor than our competitors, and it also helped us reduce risks for planning and construction.” It also means a Natrium plant can be quickly built.

“The first one in Wyoming is on a 38-month construction schedule, from nuclear concrete pour to fuel loading, but our Nth-of-a-kind construction schedule is 36 months, and up-and-down vetted with detailed engineering,” he said.

At Kemmerer 1, non-nuclear construction is already underway. Efforts are focused on a training facility with a simulator, and a test and fill facility, which will perform full-scope testing of key components. Energy island work is expected to start this year, Miller noted.

Like all nuclear projects, the bigger challenge has been to make licensing progress. TerraPower is pursuing licensing under the two-part 10 CFR Part 50 process for Kemmerer 1, a move that seeks to reduce regulatory risks for the novel power plant. The construction permit process has also been essential for building public trust and ensuring transparency throughout the regulatory review, Miller noted. “The benefit of the CPA is it allows for public, safety, and participation, and that offers multiple opportunities for stakeholder engagement and, most importantly, transparency—that’s very important in the nuclear industry.” The CPA approval process also provides “assurances to investors, which is very important, and contractors and other stakeholders—that the process has passed through detailed regulatory review that everyone can have confidence in. This is critical for securing funds, for raising capital, and ensuring that projects move forward with all necessary regulatory backing,” he said.

Beyond those milestones, TerraPower recently secured an industrial siting permit (ISP) from Wyoming’s government. “We’re not [just the only advanced generation technology] company to have successfully filed a [commercial] CPA, we’re the only one to have this ISP, and I can tell you right now it was not easy to get,” said Miller.

At the same time, TerraPower has also worked to engage with the community around the Wyoming site. “Relationships that are created around the deployment of nuclear power span many decades, and the best thing we can do is engage with the community and operate with transparency,” said Miller. “Another key factor is for companies to do what we say we will do,” he added, “It means meeting our milestones, moving forward on time, and being operational on time—something we are working very hard to achieve in Kemmerer, Wyoming. To do this successfully, you have to mitigate risks, have a strong strategy, and develop solid contingency plans. We know the stakes are high, and we know the world is watching as we progress with our reference plant.”

Cultivating a Robust Supply Chain

The Kemmerer 1 project, however, has not been without hurdles. A key sticking point has been to cultivate a supply chain for the first-of-a-kind project. “For us, supply chain is a critical aspect of advanced nuclear because it ties to market certainty, and that’s from the perspective of prospective clients and achieving our [end of project] costs and meeting the project timelines,” Miller said. “And there is an inherent chicken and egg supply chain problem here: Our supply chain partners want to see [work progressing] in order to invest in tooling and the capacity necessary for vendors like us to scale. But on the other hand, there’s the cost of materials and component manufacturing, and those prices will greatly factor into our ability to scale and to keep our first of a kind mega project costs in a reasonable range. And on top of this, you have to consider procurement processes, vendor, fabricator relationships, and the flexibility in producing components for new reactors that have a profound impact on how quickly these technologies like ours can be deployed at scale, and how cost competitive they can be in the marketplace.”

To resolve this, TerraPower is pursuing two supply chains—a nuclear supply chain and a commercial supply chain. “With only our nuclear island under NRC

jurisdiction, we’re free to develop our thermal energy storage and power and heat delivery supply chain without the same regulations that a typical plant would have, and we can begin construction on our commercial side of our plant much earlier, which provides great flexibility for us and for non-nuclear construction,” he said. Additionally, TerraPower is not limited to nuclear-qualified suppliers for key components, due to its low-pressure system, which differs from traditional light water reactors and some high-temperature gas reactor designs. That broadens its supplier options, reducing risks of supply chain bottlenecks and potential cost increases associated with relying solely on nuclear-certified vendors, he said.

However, so far, TerraPower has already secured all major nuclear island components for the Kemmerer project. It closed out a critical 18-month procurement period on Feb. 13—marking another momentous milestone. As the company scales its technology, it expects greater vendor participation to enhance competition in both U.S. and global markets.

| Supplier | Component/Service |

|---|---|

| Bechtel | Engineering, procurement, and construction partner for the Natrium Demonstration Project |

| BWXT Canada | Intermediate Heat Exchanger design |

| Curtiss-Wright | Training Simulator (TSN), Distributed Control Systems (DCS), Nuclear Island Control System (NIC), Energy Island Control System (EIC), Reactor Protection System development |

| Doosan Corporation | Core barrel, guard vessel, internal supports |

| Equipos Nucleares SA (ENSA) | Reactor head |

| Framatome US Government Solutions LLC | Design of Ex-Vessel Fuel Handling Machine and Bottom Loading Transfer Cask |

| GERB Vibration Control Systems Inc. | Design, testing, and supply of seismic isolation equipment for reactor support structure |

| Global Nuclear Fuel | Fuel supply (planned Natrium Fuel Facility) |

| HD Hyundai | Reactor vessel |

| Hayward Tyler, Inc. | Design, fabrication, testing, and qualification of Primary and Intermediate Sodium Pumps |

| James Fisher Technologies (JFT) | Sodium Cover Gas (SCG) and Test and Fill Facility (TFF) Filter Skids, injection casting furnace system |

| Marmen | Rotating plug |

| Mirion Technologies, Inc. | Radiation Monitoring System (RMS), Nuclear Instrumentation System (XIS) |

| Numerical Advisory Solutions (NAS) | Owner’s Engineering support services and start-up support services |

| Premier Technology | Sodium-air heat exchanger (AHX), air stack structures and equipment (ASE) |

| Teledyne Brown Engineering | Design, fabrication, and testing of In-Vessel Transfer Machine (IVTM) |

| Thermal Engineering International (USA) Inc. | Design and fabrication of Sodium-Salt Heat Exchanger |

| Western Service Corporation (WSC) | Software platform and engineering services for the Natrium engineering simulator |

Table 1. Publicly announced suppliers involved in developing the TerraPower Natrium Reactor Demonstration Project in Kemmerer, Wyoming. These companies provide critical components and services necessary for the construction and operation of the advanced nuclear facility. Source: POWER/TerraPower

As the company scales its technology, it expects greater vendor participation to enhance competition in both U.S. and global markets. TerraPower already has an agreement with the government of Gyeongsangnam-do Province in South Korea to support the advancement of nuclear manufacturing capabilities in the province. Gyeongsangnam-do is a key hub in Korea’s industrial sector, known for its large-scale production and cutting-edge manufacturing centers. Under the memorandum of understanding (MOU), the province will provide administrative and financial support to assess local facilities for nuclear plant equipment design and manufacturing, including the potential construction of a research and development center for nuclear component testing.

However, like many other advanced nuclear firms, TerraPower is racing to secure adequate supplies of high-assay low-enriched uranium (HALEU), a specialized nuclear fuel the SFR reactor requires. While the ARDP originally required the demonstration project to begin operations in 2028, TerraPower last year said a 2030s start date was more feasible, citing a lack of HALEU availability.

In July 2023, the company announced a memorandum of understanding with Centrus Energy to “significantly expand their collaboration” to ensure the demonstration reactor will have access to HALEU to meet the 2030 schedule. In October 2024, it also signed a term sheet with ASP Isotopes to develop a high-assay low-enriched uranium (HALEU) enrichment facility in South Africa and secure fuel supply for its Natrium reactor. Earlier last year, it partnered with Framatome to design and develop a pilot line for HALEU metallization, a crucial deconversion process, at Framatome’s nuclear fuel manufacturing facility in Richland, Washington. “There’s a lot happening in the fuel markets right now—we have a war in Ukraine that has really impacted a lot, but we’re working with the Department of Energy on our fuel, and we have a path there for supply, which is going to be fabricated in the U.S,” said Miller.

The Road Ahead: Positioning for a Burgeoning Market

Meanwhile, the company’s business prospects have begun to soar. Since PacifiCorp, an Oregon–headquartered regulated utility that is owned by Berkshire Hathaway Energy, in 2023 unveiled an integrated resource plan (IRP) including two additional Natrium plants for its generation mix by 2033, TerraPower has entered a series of strategic collaborations designed to overcome deployment challenges, attract investment, and strengthen market confidence in Natrium’s potential.

Earlier this month, TerraPower and power project developer nVision Energy laid the groundwork for a multi-unit Natrium deployment strategy, combining TerraPower’s reactor and energy storage technology with nVision’s expertise in project development, financing, and execution. The effort speaks to the power industry’s shift toward portfolio-based reactor deployment models, which promises to drive down costs, accelerate licensing, and create repeatable, scalable reactor builds—key factors for economic viability in the post-light-water reactor era. At the same time, TerraPower is tapping into surging data center demand through a collaboration with Sabey Data Centers (SDC). The partnership will explore using Natrium reactors to power hyperscale data centers, with initial focus areas in the Rocky Mountain region and Texas.

Globally, TerraPower has an MOU with the Emirates Nuclear Energy Corporation (ENEC), signaling interest in deploying Natrium in the UAE, a country that has rapidly expanded its nuclear fleet through its Barakah plant and is now evaluating advanced reactor options to diversify its energy mix beyond conventional gigawatt-scale units. Meanwhile, TerraPower’s expanded partnerships with Japan Atomic Energy Agency (JAEA), Mitsubishi Heavy Industries (MHI), and Mitsubishi FBR Systems (MFBR) suggest a strategic alignment with Japan’s sodium fast reactor development program. Finally, it has a collaboration agreement with SK and KHNP, potentially strengthening a foothold in South Korea.

According to Miller, TerraPower is eyeing specific markets for future expansion. “We want to enable the Rocky Mountain region. That’s number one. So Kemmerer Unit 1 can be the anchor, and then we’re looking at opportunities in that region, and we’re also looking across the U.S., on the east coast, southeast, Midwest, to scale our technology,” he said. Texas and Louisiana are also priority markets for TerraPower, he noted.

“We’re looking at a multi-unit build program, so we have a number of discussions right now. We are in discussions with utilities, data centers, and industrials, and we would expect to make some announcements as soon as practical,” he said.

Miller said the timeframe for scale-up relies on several factors, including the transmission queue, the regulatory environment, and alignment with potential customers. “We’re telling potential clients, whether it’s a data center or a utility, that we’re going to be early 2030s in terms of our scaling program, so we’re not misaligning their expectations and ours,” he said.

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).

Updated: This article was significantly expanded from a previous version that focused solely on the NRC’s milestone. The updated version, published on Feb. 27 at 11 a.m. CST, now includes in-depth coverage of TerraPower’s timeline, supply chain developments, key project milestones, and the reactor’s advanced design features.