DOE Launches Nuclear RFP for Uranium Enrichment to Expand Domestic HALEU Chain

The U.S. Department of Energy (DOE) has issued a request for proposals (RFP) for uranium enrichment and storage services as part of a measure aimed at stimulating a domestic supply chain for high-assay, low-enriched uranium (HALEU). The action follows an RFP released in November 2023 for services to deconvert enriched uranium into metal, oxide, and other forms for advanced reactor fuel.

The agency’s formal issuance of an RFP for uranium enrichment services on Jan. 9 opens the selection process for Indefinite Delivery/Indefinite Quantity (IDIQ) contracts geared toward the DOE’s acquisition of HALEU as uranium hexafluoride (UF6), which will be domestically enriched up <20% by weight as uranium-235 (U-235).

If selected, contractors will be required to store the HALEU UF6, as well as provide transportation of the material to deconversion facilities, if not co-located at the enrichment facility. In addition, the “feed uranium for enrichment to HALEU UF6 must have been mined and converted, and not come from a source that was recycled or reprocessed. However, the use of tails will not be restricted,” the agency noted.

The DOE’s Office of Nuclear Energy on Tuesday said it plans to award one or more contracts to produce HALEU from domestic uranium enrichment capabilities. HALEU enrichment contracts will have a maximum duration of 10 years, and the government will “assure” each contractor a minimum order value of $2 million to be fulfilled over the term of the contract. The total contract ceiling for the IDIQ contract is $2.7 billion for all task orders cumulatively awarded under the RFP, the DOE said.

Building Out the Domestic HALEU Supply Chain

The measure marks the newest step by the Biden administration to expand the domestic HALEU supply chain for advanced commercial reactors. While the existing U.S. fleet runs on uranium fuel enriched up to 5% with uranium-235 (U-235), HALEU is a nuclear material enriched between 5% to 20%. The material has several uses in fuel for advanced reactors, including molten salt reactors or tristructural isotropic (TRISO). HALEU may also be used in operating reactors (enriched between 5% and 10%), offering better performance.

While Russia remains the world’s only commercial supplier of HALEU, the DOE in recent years has taken critical steps to build out a U.S. HALEU front-end supply chain. Domestic HALEU production is currently dependent on “downblending,” which involves blending existing or recovered highly enriched uranium (HEU) to form uranium of a lower enrichment. However, the DOE has said limited HEU stocks are available for downblending beyond those obligated to the National Nuclear Security Administration (NNSA).

Uranium enrichment involves “enriching” the U-235 isotope in a multi-step process. Mined uranium consists of about 99.3% U-238 and 0.7% U-235, which is fissionable when enriched to beyond 3% (as well as less than 0.01% of U-234). At a conversion plant, uranium oxide is converted from powder into a UF6, a gas whose fluorine element does not contribute to the weight difference while separating U-235 from U-238. Honeywell recently reopened Metropolis Works plant in Metropolis, Illinois—the U.S.’s sole uranium conversion facility.

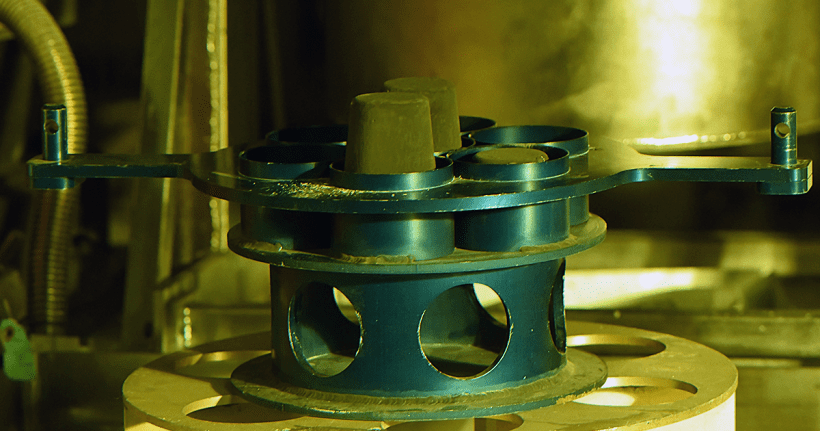

During enrichment, the UF6 gas is separated into two streams, one with more U-235 than before and the other with less. Centrus Energy and Urenco, which host the nation’s only enrichment capacities, utilize gas centrifuge technology. The technology utilizes many rotating cylinders connected in long lines to create a strong centrifugal force. After enrichment, the UF6 must be “deconverted” to a uranium form (to include oxides, metal and alloys, and nitrides and carbides) suitable for fuel fabrication. As POWER has reported, a HALEU supply chain will require deconversion processes that accommodate different fuel forms for advanced reactors.

Over the near term, the DOE has been working to provide small quantities of HALEU from recycling, though these are limited to DOE inventories. The DOE also plans to leverage HALEU enrichment capabilities demonstrated by Centrus under a DOE contract. Centrus in October 2023 kicked off enrichment operations at its American Centrifuge Plant cascade in Piketon, Ohio. In November 2023, the company announced the production of its first 20 kilograms (kg) of HALEU. Under its contract with the DOE, the facility is slated to produce 900 kg for a full year.

The DOE will own HALEU produced from the demonstration cascade, and Centrus will be compensated on a cost-plus-incentive-fee basis. Centrus has said, however, that the contract also gives the DOE options “to pay for up to nine additional years of production from the cascade beyond the base contract.” However, “those options are at the Department’s sole discretion and subject to the availability of Congressional appropriations,” it notes.

A Longer-Term Vision

To establish a commercial HALEU supply in the U.S. over the longer term, the DOE in June 2023 issued two draft requests for HALEU acquisition proposals (RFPs). The measure is furnished by $700 million allocated by the 2022 Inflation Reduction Act (IRA) to support activities under the HALEU Availability Program (which Congress established in the Energy Act of 2020). Both draft RFPs, which will leverage up to $500 million from the IRA funding, have now been finalized.

The first RFP, issued on Nov. 28, 2023, focuses on deconversion activities to convert enriched UF6 gas into metal or oxide forms, which can be used to fabricate fuels needed by several advanced reactor developers. Proposals are due on Jan. 30. The RFP issued on Tuesday focuses on acquiring services for the enrichment and storage of HALEU material. Proposals are due on March 8, 2023.

The DOE is in tandem also finalizing a transportation funding opportunity announcement that will provide a Nuclear Regulatory Commission (NRC) pathway for HALEU transportation packages. Additionally, the DOE is preparing an environmental impact statement that will analyze the impacts of a DOE-proposed action to facilitate the domestic commercialization of HALEU production and acquire HALEU for commercial use on demonstration projects, including those demonstrations under the Advanced Reactor Demonstration Program (ARDP).

The first two ARDP demonstrations, spearheaded by TerraPower and X-energy, will require about 22 metric tons of HALEU for their initial cores. X-energy’s fuel manufacturing process requires HALEU in the oxide form while TerraPower’s requires HALEU in the metal form. Construction on TerraPower’s Natrium project in Wyoming, notably, has been delayed until 2025, owing to a lack of HALEU availability.

In mid-December, Dr. Michael Goff, principal deputy assistant secretary for the DOE Office of Nuclear Energy, revealed the agency is also developing a “novel technologies funding opportunity announcement that will focus on lowering energy inputs, lowering capital costs, and developing technologies that will provide significant economic advantages to the front end of the fuel cycle.”

The DOE has so far established a “HALEU Consortium,” a public-private coordination effort to help inform activities by the DOE to stimulate domestic HALEU demand. “The roles of the HALEU consortium of which HALEU recipients need to be a member, include providing HALEU demand estimates, carrying out demonstration projects, and developing a schedule for cost recovery for commercial use,” Goff noted.

While the DOE’s efforts are aimed at establishing a domestic HALEU supply chain, it noted the U.S. is collaborating with Canada, France, Japan, and the UK to “catalyze public and private sector investments that will expand global uranium enrichment and conversion capacity over the next three years and establish a resilient uranium supply market that is free from Russian influence.”

The five countries— which are collectively responsible for 50% of the world’s uranium conversion and enrichment production capacity—on Dec. 7 announced plans to mobilize $4.2 billion in government-led investments to develop a secure, reliable global nuclear energy supply chain. The investments are geared to enhance uranium enrichment and conversion capacity over the next three years “and establish a resilient global uranium supply market free from Russian influence.”

Earlier this week, the UK’s Department for Energy Security and Net Zero announced a £300 million ($382 million) investment to support HALEU production as part of a program that would support its goals to expand its nuclear capacity to 24 GW by 2050.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).