Gas-Electric Integration “Swamps” All Other Issues

Panelists at the ELECTRIC POWER 2013 Keynote and Roundtable Discussion in Chicago in May were consumed by the need to ensure future reliability by more closely integrating the gas and electricity markets. Acknowledged less directly were distortions created by renewable energy subsidies and mandates, onerous regulations affecting coal, and “irreversible” demand destruction caused by the success of energy efficiency and demand management programs. The elephant in the room was the continued demise of electricity markets.

Ten years ago, the observation that a $1/MMBtu swing in natural gas prices would lead to a $4/MWh swing in electricity prices (in PJM in this case) would have been hailed as market volatility for merchant generators in robust electricity markets to capitalize on. Today, it’s a measure of unwanted instability in the reliable delivery of electricity to customers. What a difference a decade makes.

The broad solution for ironing out that instability is greater integration of gas and electricity markets, the theme that emerged from the State of the Industry Keynote talks, moderated by David Wagman, POWER’ s executive editor and the event’s content director, and the Industry Leaders Roundtable, titled “Reliability at What Cost and Who Pays?” moderated by Dr. Robert Peltier, editor-in-chief of POWER. Another integration issue—intermittent renewable energy—captured the attention of the panel and audience. And if integration was the word of the session, the dis -integration of coal-fired generation wasn’t ignored, nor was the destruction of electricity load demand.

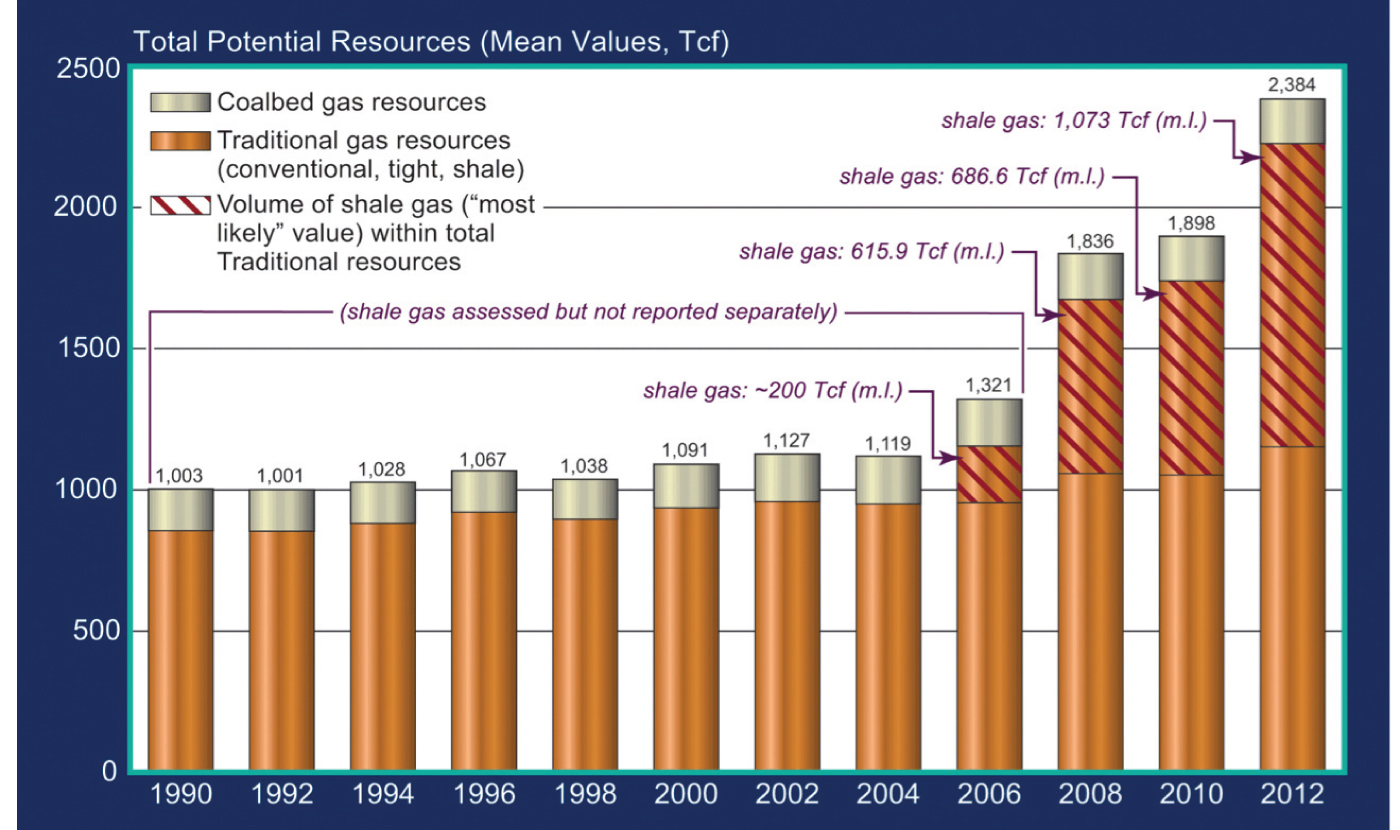

Unlike past years, no one questioned the shale gas resource estimates (Figure 1), just the ability to get it to a power plant when needed. If the writing on the wall about the impact of the domestic shale gas bonanza was visible to these industry leaders before, in this session it glowed in neon against the darkened sky of high winds, a fading spark spread, little if any dark spread to support new coal, and continuing threats to a critical zero-carbon option, nuclear power.

1. Gas glut grows. The domestic shale gas resource is “incredible,” though it is important to realize potential resources (shown in this slide) are called “unproven” resources. Courtesy: AEP

The “market” doesn’t value capacity, was one refrain, and certainly not baseload capacity. Another critical observation was that a just-in time (JIT) natural gas delivery system is clashing with the JIT electricity delivery system.

Overlay onto that clash “must take” highly intermittent wind- and solar-generated electricity, plus demand destruction through energy efficiency, plus demand side programs. With all that volatility, today’s electricity business should be a free marketer’s dream. But that was oh so 1990s.

Gas Prices Rising

David Wagman teed up the keynote talks by noting that natural gas prices have “disadvantaged coal,” even Powder River Basin Coal (PRB) so cheap that rail transportation cost overwhelms its price. However, the “competitive advantage has swung back to coal in recent months,” Wagman cautioned, underscoring the need for flexibility. The industry expects 50,000 MW, a mini-boom, of gas-fired plant construction through 2015.

Mark McCullough, executive VP, generation, American Electric Power (AEP), then expanded on the gas theme, noting that proven gas reserves have doubled in recent years, and potential reserves “are incredible.” The nation’s annual burn is 25 tcf, while the future resource is 2,700 tcf. McCullough described a ceiling of $4–$6/MMBtu for gas prices. However, it doesn’t take much movement in the gas price to change things up (Figure 2). “A $1/MMBtu move in [gas] price really affects dispatch,” he said. Then he posed the question: “How do you contract for fuel [in this environment]?”

2. Coal makes a comeback. In the span of one quarter, AEP’s coal-to-gas ratio changed significantly in coal’s favor, although the change was more dramatic in some AEP regions than in others. Source: AEP

AEP’s analyses show that gas will be 50% of PJM’s capacity in 2020, while 5,000 MW of coal will get retired. “With less coal generation, gas has to do much more.” One of McCullough’s fundamental points was that higher dispatch of gas plants doesn’t square very well with interruptible gas supply contracts. “Less than 20% of the gas plants in PJM are on firm gas supply.” He explained that the day-ahead bidding system for electricity requires that plants also submit their nominations for gas supply. “Interruptible supply could get bumped from the queue,” he cautioned.

Gas power station owner/operators also have to adapt their thinking about their role in ensuring reliability, noting, as one example, that the North American Electric Reliability Corp. requires, among other things, a quarterly checklist concerning batteries. He then amplified the capacity-value conundrum. Wind and solar may be experiencing favorable pricing trends, but neither brings capacity to the grid, only energy. Other capacity must be there to support the renewable energy. Embedding these costs in the rate base puts more and more pressure on those “favorable” renewable energy prices.

McCullough posed the question: Are we in danger of becoming a “one-fuel industry?” It’s somewhat of an unreal scenario. Even at 50% gas capacity, there is still fuel diversity in the grid. No one talked about a one-fuel industry when coal was 50% of the generation. But it’s the trajectory McCullough was referring to. “Baseload coal and nuclear are threatened by their respective risk profiles,” he said, “we need to promote balance in the portfolio, and we need a discussion at the national level about this.”

Swamping Other Fuels

Federal Energy Regulatory Commission (FERC) Commissioner Philip Moeller amplified the one-fuel note, stating that gas is “swamping” other fuel options, for five reasons:

- It’s easier to build and finance a gas plant.

- It’s easier to add gas capacity near load than to build transmission.

- Gas plant ramping is a solution to intermittent renewable energy. (He called the ramping in California that takes place many afternoons “amazing.”)

- Coal faces a regulatory tsunami, with Mercury and Air Toxics Standards (MATS) at the center of it.

- Gas prices appear to be relatively stable.

The last bullet point was especially notable given that only six years ago, gas prices registered as high as $14/MMBtu at peak times. However, Moeller noted, shale reserves “didn’t even show up seven years ago, and technology will allow finding and extracting even more.” The resource will still be there even if “society poses additional restrictions on it.”

FERC is taking gas-electric integration seriously, especially in light of a February 2011 outage in the Southwest when thousands lost gas and electric supply because of interdependencies. An official proceeding was opened on the subject and five planned technical workshops considered regional issues. Moeller called the situation in New England “acute.” Electricity suppliers apparently are bidding in without knowing whether they’re going to get gas. Aligning the gas and electricity trading days is important, he said.

Moeller acknowledged that efforts 10 years ago to align the trading days failed. Another challenge is the legal issues surrounding the two sides talking to each other during times of stress on the system, he conceded, referring to gaming the market to unfair advantage. The fact is, though, there isn’t a “90-day supply of coal sitting outside a gas plant.” He described the gas market as not particularly liquid and as more of a JIT delivery system.

The notion of JIT gas and electric is not quite accurate. The wholesale side of the gas industry has significant amounts of storage. However, it is mostly set up for seasonal, not daily, fluctuations. The electricity industry also has around 2% of its capacity in pumped hydroelectric storage (PHS) and one compressed air energy storage plant, plus a smattering of small-scale storage demonstration devices that don’t register in terms of capacity. PHS has demonstrated great flexibility in helping grid operators smooth out hourly and even several-minute fluctuations between electricity supply and demand. There are those who often state that the electricity industry has plenty of storage—it’s in the gas pipeline and storage system. But Moeller’s message was that it’s the business side that has to be aligned with electricity, not necessarily the physical.

Gas Swamp Examples

McCullough and Moeller were then joined by four other industry leaders who offered prepared introductory remarks (Figure 3).

3. Popular industry roundtable. Participants in this year’s industry rountable addressed a full house. Source: POWER

David Mohre, executive director, Energy & Power Division, National Rural Electric Cooperative Association (NRECA) noted that, of the 56,000 MW of cooperative utility capacity nationwide, only 26,000 MW is coal, or 46%. Historically, that figure has been 80%. Since 2007, 15,000 MW of new capacity has been added, 75% of it natural gas. Mohre did express reservations about gas supply and price volatility but said the problem was deliverability. The resource “looks robust.”

Mohre also observed that a $1 shift in gas prices moved the PJM market by $4/MWh. What happens to price if the country, as some have forecasted, starts to export up to 5 tcf annually? Bottom line, according to Mohre: The industry is not properly valuing long-term firm capacity, which is necessary to support power plant and pipeline construction.

Joe Nipper, senior VP, government relations, American Public Power Association (APPA), made the same point as Mohre but in a different way. APPA’s members represent 9% to 10% of the country’s generating capacity. The historical 70:30 split between coal and gas is now flipped. Nipper argued that gas-electric integration doesn’t necessarily require legislative changes, noting that the Senate Energy & Natural Resources Committee was holding hearings on the issue, but it does need changes from FERC. He called the storage piece for gas “critical.”

Enter Renewables Advocates

After Nipper concluded, gas issues took a back seat to renewable energy during the roundtable. While Mohre noted that his member utilities own and operate substantial renewable energy facilities, the really vocal advocates were yet to come.

Michael Polsky, president & CEO of Invenergy LLC, took a decidedly contrarian tack, stating that “renewables are stable.” They may be subsidized and high cost, but they have to be judged fairly, which is to say “the electricity comes free in the long-term.” On that basis, he argued, even discounting the production tax credit (PTC)—he omitted the investment tax credit (ITC) and the renewable portfolio standards (RPS) imposed by the majority of states—wind energy still imposes the lowest cost on the system. As an example, he said Illinois ratepayers have saved $177 million because of renewable energy. “Recognize that renewables are here to stay,” he said.

In a sense, Ron Binz of Public Policy Consulting and former chair, Colorado Public Utilities Commission (PUC), split the difference between gas and renewables. The only panelist to claim that the primary industry driver will be carbon regulation, not gas prices, he called wind energy “a fuel hedge with probably no equal.” He also proposed that building a wind farm and a gas plant is better than building a wind plant alone. Colorado has 16% renewable energy, and its dominant utility, Xcel Energy, has become expert in balancing the system.

The Value of Long-Term Planning

In a moment of irony, Polsky, who referenced his time at the University of Chicago—known for its unwavering and unapologetic defense of free market principles—said it flat out: “The free market does not work for long-term planning; electricity is not an open market.” If you don’t have policy decisions, you gamble every day, he said. One could argue that the free market is risk-informed gambling.

It is also true, as Mohre pointed out, that just because the government mandates something, it doesn’t mean it will stick. Mohre cited the Fuel Use Act, passed in 1979 and repealed in 1987, which barred the burning of natural gas in power plants. In that context, and to illustrate the paradox of government policy, it is also worth mentioning that the Public Utilities Regulatory Policy Act (PURPA), passed in the same year, allowed natural gas firing for cogeneration, but because the requirement for thermal output was minimal, many gas-fired power plants came to be known as PURPA machines.

Many of the questions from Dr. Peltier and the audience had to do with long-term planning. Peltier asked about the utility business model, the strategy, for the next two decades. McCullough again repeated that renewable energy doesn’t bring capacity, and so “how do we recover the cost of the capacity?” Technical advancement in storage is one route, he said, but he noted that AEP’s “experiments in home and community storage have not gone so well.”

Mohre also alluded to the discrepancy over renewable energy costs: “We [cooperatives] know a lot about the cost and operational issues with wind.” Later, Polsky tossed out the number $25/MWh as the typical cost for wind. Mohre shot back, “We know what wind costs, and it is not $25/MWh!”

Polsky continued to bait the utility leaders, saying, “utilities fight everything, but it’s a losing game; they’re in denial.” Binz called the utility of the future an “orchestra conductor,” referring to the need to balance the variations of supply and demand. Utilities have always had to “conduct,” but Binz appeared to refer to the need to do this with ever-greater variations on shorter and shorter time scales. Binz also cited the need to “think beyond the five years of low natural gas pricing” and return to long-term gas supply contracting, while Mohre stressed the need to value long-term firm resources.

Innovation is often part of a long-term business strategy. Peltier noted the collapse of the venture capital market for cleantech, which he said dropped 54% last year. “What is the prospect for long-term return?” he asked.

Polsky insisted that the cleantech venture capital sector did not understand the industry. “High tech is not like electricity,” he said. It takes much more capital to commercialize, and it’s difficult to scale to the needs of this industry. He and Binz agreed that utilities will likely innovate on the customer side of the meter. “Utilities are looking to get into the rooftop PV business,” Binz said. Moeller mentioned storage, but that FERC is limited by jurisdiction on what it can do with new technologies.

What Value Coal?

Most of the panelists addressed coal-fired resources indirectly by lumping them into the need for a balanced resource mix. But in response to a direct question from the audience, “What is the ongoing model for coal to stay in the business?” Polsky said coal “faces extinction.” Binz referred to “cap and innovate,” implying that capping carbon dioxide emissions will force innovation in carbon capture and storage (CCS), which he said “is key” to coal’s future. McCullough, based on AEP’s direct experience with CCS demonstration, agreed with Binz but added the caveat, “at what cost?” The parasitic load for a 1,300-MW unit with CCS is 300 MW. Polsky countered that coal with CCS will not be the low-cost option.

Mohre offered the issue that everyone was happy to ignore. McCullough noted that the coal industry is exporting lots of coal, making up for lower consumption in the U.S. Mohre later asked, “How right is it to ship 100 million tons of coal and burn it in other countries?” That lower consumption is occurring because, stressed McCullough, 60 to 70 GW of coal will be retired because of MATS. Much of that coal capacity, he added, is providing ancillary services, in part to address renewable energy integration.

The Real Enemy?

It’s always easy to skewer the option that isn’t represented at the table. Rooftop photovoltaics (PV) certainly took some hits. At the top, Wagman noted that “DG [distributed generation] and microgrids are disrupting the industry,” while Peltier referenced one utility CEO who said that companies installing solar panels are going directly to the customers and another utility CEO who considers this a threat to the utility business model. Polsky advised, “utilities should deal with the real threat, which is rooftop PV.” “CHP [combined heat and power] and rooftop PV will grow significantly,” Binz echoed, adding that utilities need to be compensated and share in the rooftop PV revenues. Moeller called the $30,000 solar tax credit to install rooftop PV “poor ratepayers subsidizing affluent ratepayers.”

Polsky called the solar tax credit “unfair.” For a CEO of a company developing wind farms with a $23/MWh PTC (along with ITCs), that was an interesting characterization, to say the least. Binz added that the wind PTC is roughly equivalent to a carbon value of $30/ton. No one ventured an estimate of the value of a state-level RPS to a wind farm developer.

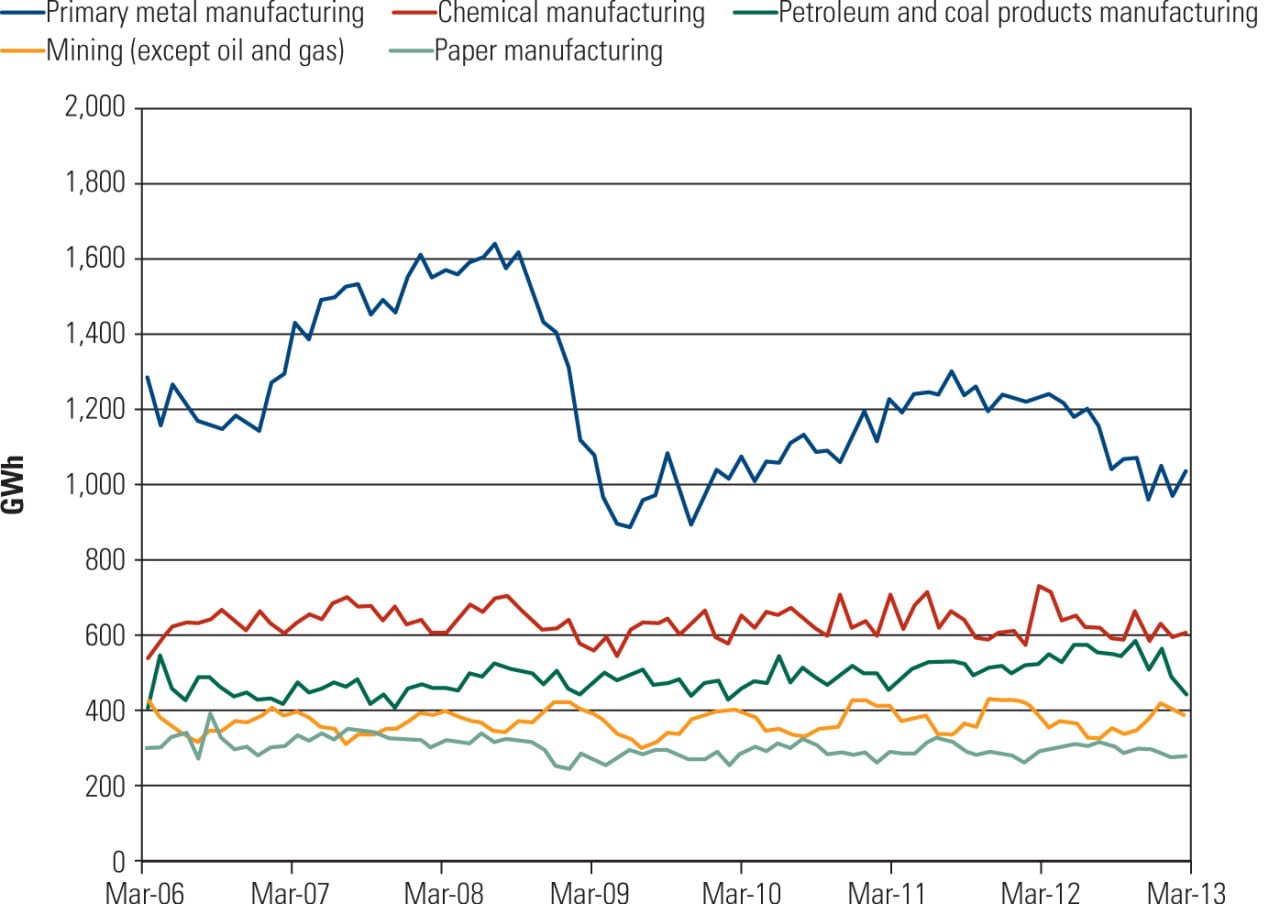

Rooftop PV is only one component of the real enemy of the utility business model going forward, which is weak electricity demand. McCullough showed graphs of dropping industrial load in AEP’s considerable service territories (Figure 4). On the bright side, he also acknowledged that shale gas processing and delivery needs electricity to run pumps, compressors, and other machinery. He said load is probably not going to grow substantially because of demand side technologies and behaviors. “Energy efficiency is real.”

4. Load loss continues. Industrial load growth has declined for three quarters in a row in AEP’s service territory. Source: AEP

How real was underscored by other panelists. A 1% rise in gross domestic product used to lead to a 1.6% rise in electricity demand, he said. Today, the associated demand figure is 0.3%. Light bulb replacements and appliance efficiency standards, to name two factors, have reduced cooperative utility load.

Nipper also stressed the importance of “utility-customer partnerships” in implementing energy efficiency improvements. Lots of projections show demand going down, echoed Moeller, so customer relationships with utilities will be very different. In this context, Polsky was more conciliatory: Customers still need the utility as a backup.

Binz gave the example of a state-of-the-art refrigerator that uses less electricity than a 75-watt light bulb! “Ten years ago, the same refrigerator would have consumed four to five times that wattage.” But efficient appliances are only part of the story. Binz observed that no panelist had yet used the phrase “smart grid,” adding that the smart grid is a digital mesh that will provide services in the background. He noted that in the UK, the standard “rate of return” is no longer the benchmark for setting electricity rates. “PUCs need to incorporate more concepts of risk.” This loss of load is “irreversible,” he concluded.

“Lowest cost is not necessarily the solution,” Polsky said. An option selected may not be the least cost today but will be over time.

One audience member said, “Diversity comes from long-term resource planning.” Then he asked, “Do we need to re-introduce long-term strategic planning, central planning, for public infrastructure?” In different ways, the panelists answered yes, even if they undoubtedly had different ideas of the percentage of each resource that would constitute “diversity.”

In closing, think about this. Global petrochemical and manufacturing companies are making decisions whether to invest in multi-billion-dollar facilities to take advantage of domestic shale gas. The investment horizon is similar to that of a power plant. They will have to contract for raw materials for the front end and compete on price for their products. They will have to meet as many, if not more, environmental and product quality and safety regulations. There will not be a regulated rate of return on that investment. Nor will there be a PTC, ITC, RPS, carve-out, or other subsidy.

— Jason Makansi (jmakansi@ pearlstreetinc.com) is president of Pearl Street Inc., a technology deployment services firm.