DOE Awards Civil Nuclear Credits to Diablo Canyon

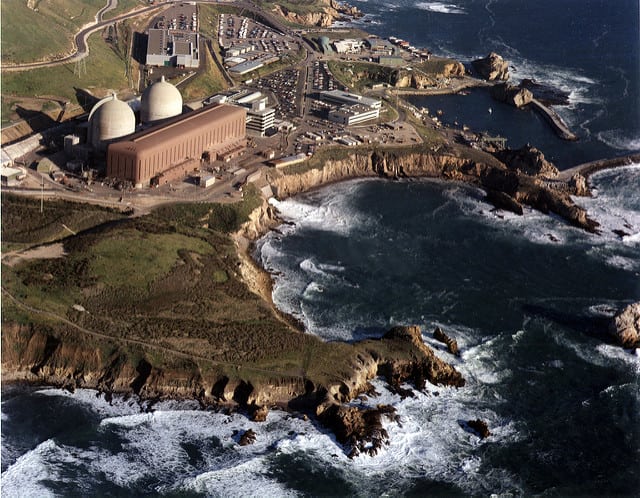

The Department of Energy (DOE) will award credits under its Civil Nuclear Credit (CNC) program to bolster the continued operation of Diablo Canyon Power Plant (DCPP) Units 1 and 2, Pacific Gas and Electric Co.’s (PG&E’s) 2,240-MW nuclear plant in San Luis Obispo County, California.

A record of decision published by the agency’s Grid Deployment Office on Jan. 2 effectively awards credits to PG&E to help DCPP continue operations under existing Nuclear Regulatory Commission (NRC) licenses and programs. “Payments of credits are expected to occur annually beginning in 2025 and will be paid retroactively to compensate PG&E for DCPP operations in the prior year(s),” the action says.

Bolstering Diablo Canyon’s Continued Operation

DCPP, California’s only operational nuclear power plant, conditionally won up to $1.1 billion in credits from the CNC’s first round of funding, which the DOE unveiled in November 2022. The CNC, a $6 billion federal funding mechanism designated by the November 2021–enacted Infrastructure Investment and Jobs Act (IIJA), is designed to keep open commercial nuclear reactors that are at risk of closure owing to economic reasons.

Under the CNC program, an owner or operator of a certified nuclear reactor whose bid for credits is selected by DOE becomes eligible to receive payments from the federal government in the amount of awarded credits—so long as the nuclear reactor continues operation over the four-year award period. For DCPP, that timeframe spans January 2023 through December 2026.

PG&E submitted its application for certification and a bid for credits to the DOE in September 2022. In November 2022, the DOE said the total credit award value designated for DCPP would be contingent on the completion of an environmental review and negotiation of terms of a redemption agreement, which essentially specifies a megawatt-hour production commitment for four award years (2023–2026). DCPP was set to receive a maximum credit value of up to $269 million in 2023, $267 million in 2024, $276 million in 2025, and $289 million in 2026.

PG&E in June 2016 formally announced it would shutter the 1,138-MW DCPP Unit 1 and the 1,151-MW Unit 2 upon the expiration of the reactors’ operating licenses—November 2024 for Unit 1 and August 2025 for Unit 2. The units, both Westinghouse pressurized water reactor units, began operation in 1985 and 1986, respectively.

At the time, PG&E cited challenges of managing “over-generation and intermittency conditions under a resource portfolio increasingly influenced by solar and wind production,” as well as potential costs for retrofits so the station could comply with a May 2010 California Water Resources Control Board policy restricting once-through cooling (OTC) systems for all the state’s water consuming power plants. Nuclear experts at think tank the Breakthrough Institute, however, suggest PG&E negotiated an agreement with anti-nuclear environmental groups based on a flawed study that until recently was broadly accepted by California’s legislators and regulators.

In September 2022, California’s government enacted Senate Bill 846 (SB 846), enshrining efforts to keep the plant open as a crucial pillar to bolster the state’s energy security. The measure effectively authorized the $1.4 billion loan from the Department of Water Resources to keep Diablo Canyon open until at least 2030. As a final step in the extension of DCPP, the California Public Utility Commission (CPUC) on Dec. 14 voted to approve the ratemaking design and new retirement dates for DCPP 1 and 2, which are now 2029 and 2030 respectively.

In October 2022, meanwhile, PG&E filed a letter with the NRC, officially requesting that the agency review the utility’s 2009-submitted license renewal application (LRA)—which PG&E withdrew in 2018—for DCPP 1 and 2. In March 2023, the NRC made a “categorical exclusion determination,” granting DCPP an exemption to the power plant from the NRC’s timely renewal requirements, so long as PG&E submitted its license renewal application by Dec. 31, 2023. PG&E submitted its license renewal application for both units on Nov. 7, 2023. The NRC on Dec. 19 determined the LRA is sufficient for its review, a crucial action that allows PG&E to continue operating the DCPP units past their current licenses while the LRA is under review.

The NRC has said an LRA review typically lasts 22 months. “The NRC will continue its normal inspection and oversight of the facility throughout the review to ensure continued safe operation. If granted, the license renewal would authorize continued operation for up to 20 years,” it noted.

Because DCPP has not completed a license renewal process with the NRC, the DOE, in its record of decision published Tuesday, acknowledged it completed its National Environmental Policy Act (NEPA) process—required for awarding credits—through a review of existing NEPA documentation, including NRC NEPA documents and other reports.

“DOE’s review and adoption of the NRC NEPA documents covers only the period that DCPP’s current operating licenses remain in effect,” the agency said. “That is to say, so long as the DCPP operating licenses continue in effect by operation of law, DOE will continue to pay credits during the four-year award period.”

The DOE’s review considered several factors, including changes to the affected environment, which it profiled in a final environmental impact statement issued in July 2023. The agency indicated “that while deployment of renewable energy generation would continue, partially driven by existing State laws and policies, natural gas generation and the associated carbon dioxide and nitrous oxide emissions would increase if DCPP were to cease operations.” Three independent studies the agency cited “project that a substantial proportion of DCPP’s lost generation between 2024 and 2030 would be covered largely by increased utilization of gas-fired units rather than newly constructed renewable electric sources,” it noted. “DOE found nothing to refute that emissions would increase during the credit award period were DCPP to cease operations.”

More Incentives Brewing for U.S. Nuclear Industry

The DOE is now readying for the second CNC award cycle, for which it released guidance in March 2023. While the first round was limited to nuclear plant owners and operators that had announced intentions or retirement within the four-year award period, the second round, which closed on May 31, 2023, was extended to reactors “at risk of closure” by the end of the four-year award period (Jan. 1, 2024, through Dec. 31, 2027). This includes reactors that cease operations after November 15, 2021, as well as applicants who have publicly announced intentions to retire.

The CNC also extends to reactors that receive payments from state programs (such as zero-emission credits or clean energy contracts). The agency says it also expects that some reactors may be eligible for the CNC as well as the production tax credit (PTC) under Section 45U (the Zero-Emission Nuclear Power Production Credit) of the Inflation Reduction Act (IRA).

The Treasury Department is soon expected to issue a final rule on the 45U PTC, a first-of-its-kind PTC that is expected to support existing nuclear plants and prevent their premature closure. The IRA’s Section 45U provides a two-tier credit (0.3 cents “base”/1.5 cents maximum, adjusted for inflation) per kWh of electricity produced at a qualified nuclear facility and sold to an unrelated party after 2023 and before 2033.

The Treasury’s recently issued proposed regulations and guidance on 45V, a tax credit for the production of “clean hydrogen,” notably stirred up disappointment from the power industry, as POWER has reported. The Nuclear Energy Institute (NEI) last week said that though the rules explicitly allow 45U, the nuclear power PTC, to be claimed in conjunction with 45V, the clean hydrogen PTC, “the authors of the IRA made clear that existing nuclear facilities are eligible for the H2 Credit.” However, NEI was “disappointed to learn the administration plans to adopt a requirement that only new generation adding incremental capacity to the electric grid could be used to produce clean hydrogen for purposes of the [hydrogen (H2) credit],” it said.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).