Chile Plans for Growth with "All the Options" Energy Mix

A special report from Global Business Reports and POWER

Chile was considered a world leader for reforming and liberalizing its power sector as early as the 1980s. However, 25 years later, Chile is at a crossroads in terms of developing future capacity. With an estimated GDP growth rate of 2% to 3% during the current global financial crisis, a highly competitive economy, an established democracy, and a stable macroeconomic environment, Chile is considered a premium destination for foreign investment.

Chile has developed into a leader of the Latin American economy, boasting a gross domestic product (GDP) per capita of $14,300 — one of the highest in Latin America. This productivity, coupled with Chile’s position as the most business-friendly Latin American country, according to the World Economic Forum’s The Global Competitiveness Report 2009 – 2010, means that Chile is seen as an ideal location for the investor looking to target South America. However, despite countercyclical government policies, Chile remains dependant on the mining sector for its exports and, in turn, much of its energy demand is intrinsically linked to the price of copper and any fluctuations in that price.

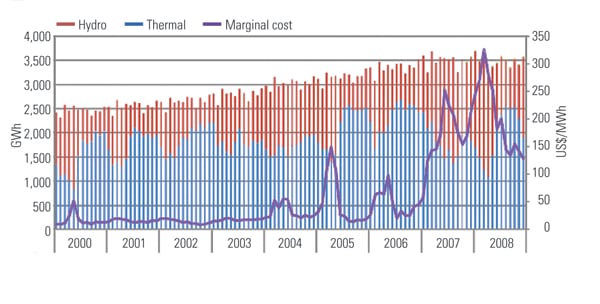

As Figure 1 shows, the price of power increased about tenfold in Chile over the past three years, resulting in decreased industry competitiveness. For example, Claudio Ramirez of EDYCE, a large-scale steel producer, explained that the high cost of energy in 2008 forced his company to temporarily cancel its night shift. However, high marginal prices, together with low barriers to entry, made energy projects more attractive and helped to encourage a rush of investment into the energy sector.

1. Price spike. The cost of power in Chile increased roughly tenfold between mid-2006 and early 2008 due to the combination of droughts, gas reductions, and high oil prices. Source: CNE

Chile needs to boost its power generation capacity by 12,000 MW by 2020 to meet its expected growth in demand. This report, compiled after months of on-the-ground research, examines the challenges that need to be tackled for Chile to fully achieve its potential.

A Brief History of Power in Chile

Chile was seen as a torch bearer of liberalization and privatization in the energy sector. Under the military dictatorship of Augusto Pinochet the first steps were taken to shift the balance from state to private ownership, a path continued under subsequent civilian governments. The formerly state-owned monopoly, ENDESA, was privatized beginning in 1987 and sold first to Spanish investors and, more recently, to Italian investors.

Chile’s first steps were to unbundle the generation, transmission, and distribution sectors and then privatize them. Currently, apart from the CNE ( Commission Nacional de Energia), which is responsible for central planning and tariff regulation, the whole sector is private. This model has been exported to other Latin American countries such as Argentina, Peru, and Columbia.

As Minister Marcelo Tokman explained in an interview (see sidebar), although Chile does have a minister for energy, it is just now in the process of putting together a Ministry of Energy. At the time of writing this report, important responsibilities were divided between the Ministry of Mining, the Ministry of Public Works, and the Ministry of Economy. For example, the DGA ( La Dirección General de Aguas), headed by Rodrigo Weisner, which grants the water permits needed for hydro plants, lies within the Ministry for Public Works. A bill currently going through parliament will attempt to centralize the majority, but not all of these responsibilities, within a unified Ministry of Energy.

Unlike some of its neighbors, Chile isn’t rich in traditional fossil fuel resources. This lack of fossil fuels, together with Chile’s unique topology, has resulted in a very strong hydro sector. Chilean engineering and expertise in this area are among the best in the world. This specific strength has enabled Chilean energy companies to offer services and develop the hydro sector throughout South America.

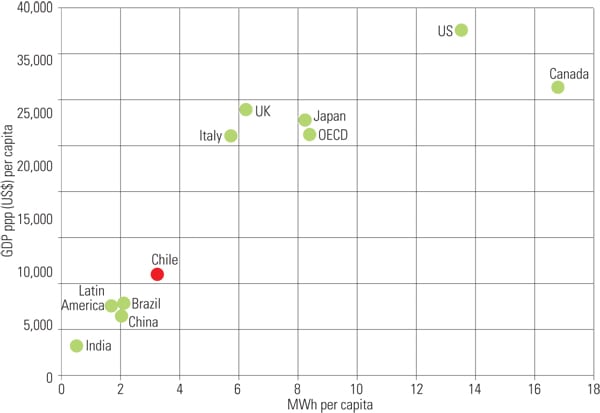

As Figure 2 shows, Chile is still at an emergent stage in terms of energy consumption. The country currently has 12,000 MW of capacity and intends to reach 25,000 MW by 2020.

2. GDP per capita vs energy consumption. As Chile’s economy grows, so will its energy consumption. Source: International Energy Agency, 2006

Chile faces a difficult challenge to both expand and diversify its power portfolio. During the 1990s and the start of this decade, the power industry as a whole shifted using imported natural gas. This led to overcapacity and a subsequent drop in prices. This movement to gas was to be short-lived, as political changes left Chile’s gas supplies hugely reduced. Imports currently stand at less than 10% of the 22 million cubic meters that were originally agreed upon with Argentina. Argentina’s withdrawal of natural gas in 2004 left a devastating scar on Chile’s power landscape and has pushed many opinion-makers toward the idea of energy independence.

Alfredo Zamorano, CEO of Proyersa Energy, an engineering and project management company, argues: "When the Argentineans stopped exporting gas, all development stopped and the industry was in a state of shock. Other projects were reactivated very speedily as the industry tried to look for an alternative to gas. The projects we have now are not enough to satisfy the level of demand for energy in Chile. We need to build more plants."

Chile’s challenge is to determine which route it will take to make up for its power deficit. Colbún and ENDESA, which jointly own HidroAysén, believe that this huge hydro project located in the south of the country is the answer. Other voices, such as Jaime Vela, executive vice-president of SW Consulting, argue for a return to fossil fuels: "We believe that coal is the future," he says, highlighting the competitiveness of this fuel source. Still others, including José Ignacio Escobar, general manager of the Chilean section of Irish renewables company Mainstream, believe that with certain regulatory adjustments, the renewable sector could play a significant role. Escobar says, "There are certainly improvements which we believe the government could implement which could really benefit the renewables sector."

Chile’s Attractiveness as an Investment Location

Chile is generally considered to offer one of Latin America’s most business-friendly environments, as the table indicates. It is an associate member of MERCOSUR, the South American regional trade organization, and is an ideal location for regional headquarters. Since 1992 it has had an investment grade bond rating and in March 2009 (in the middle of the financial crisis) the ratings agency Moody’s actually upgraded the government’s foreign currency bond rating to A1. Moody’s Vice President – Regional Credit Officer Mauro Leos stated at the time that "Chile’s fundamentals are supported by solid institutional and policy frameworks."

Enviable ranking. Chile ranks highest of all Latin American countries and #30 in a field of 133 countries in global business competitiveness, according to a 2009–2010 World Economic Forum report. Source: World Economic Forum

Its relative cash-rich position convinces analysts that it is well positioned in comparison to its Latin American neighbors to weather the current crisis. Indeed, in a recent competitiveness stress test by the prestigious Swiss business school IMD, Chile was ranked highest in the whole of the Americas — one place above Canada.

Javier García of CORFO, the state investment body, argues that three factors make Chile a good place to invest in the energy sector: a developed legal framework, stable political conditions, and a strong platform from which to launch Latin American activities.

Edwin Chávez, country head of Siemens Chile, believes, "It is a very interesting time for the energy sector in Chile. I feel that there are opportunities for investments."

Edwin Chavez, Siemens, Chile

Regulatory Framework

Chile was one of the first countries to privatize its power generation and distribution system, which is now the global norm. These reforms stem from the 1982 Electricity Reform Act, which was designed to break up the state monopoly, ENDESA. Renato Agurto, one of the architects of the Chilean energy sector, argues: "I believe that this process of privatization and liberalization in Chile was successful. From the very beginning, in the 1980s, the government was involved almost 100% in generation and transmission, while it had 80% of the distribution market. Almost the entire power sector was state-owned."

Now critics argue that Chile has ventured too far in the opposite direction. All of the sector is in private hands, and the government lacks the tools necessary to direct the private sector in a sustainable direction. The high price of power acts as a break on other sectors of the economy, most notably the mining sector. The cost of power constitutes some 20% of the cost of copper, Chile’s primary export.

When Salvador Allende’s socialist government was overthrown by the military junta headed by Augusto Pinochet, Chile’s whole economy, including the energy sector, was under state control. After the coup, state-controlled companies were either privatized or returned to their previous owner. One of the primary steps in this process was to separate the generation, transmission, and distribution sectors. ENDESA, the former state monopoly, was split into 14 different companies, including six generation companies and six distribution companies. The transmission section was initially maintained in-house. These privatizations earned considerable hard capital for the government, and Agurto — now working for Synex, an energy consultancy — argues that these reforms were the basis for considerable growth and investment in the sector.

As demonstrated by Figure 3, between 1982 and 2008, installed capacity that fed into the Central Interconnected System (SIC), which supplies 90% of Chile’s population, increased from 2,713 MW to 10,226 MW, while capacity on the Northern Interconnected System (SING), which supplies the north of the country and many of the mining companies, increased from 428 MW to 3,581 MW. To date these two grids are not interconnected. Chile also has two smaller systems, the Aysen Interconnected System and the Magallanes Interconnected system, but these two service a very small percentage of the population.

3. Taxing transmission. Chile’s two major grids have had to respond to an enormous increase in capacity over the past 26 years. The two grids are not connected. Source: CDEC-SIC, CDEC-SING

Despite this period of restructuring and growth, ENDESA remained the dominant player, controlling the majority of the generation sector, all of the transmission sector, and (following its takeover by Enersis) a controlling stake in Chilectra, the largest distribution company in Chile. Transelec has since been spun off into a separate company; however, critics have argued that the deregulation process didn’t go far enough, and the sector remains monopolistic.

The next significant change in the regulatory framework came in 1999 in the aftermath of the 1998 – 99 droughts. A new law was designed to address the lack of incentives for long-term investment in the energy sector. However, the law was seen as poorly implemented and resulted in a vast reduction in investment in generation. Dr. Hugh Rudnick, director of Systep, an engineering and design consultancy, explained to us that the risk exposure to generation companies was too great, and there followed a general halt in investment and contracting in the generation section.

The " Ley Corta" or Short Law, passed in January 2004, was seen as a milestone by many in the energy industry. The Short Law’s reforms included a revision of the charges for transmission, a modification of node prices, and a reduction in the eligibility category for unregulated users from 2 MW to 0.5 MW.

Christian Arnolds, general manager of Chilquinta, a distributor in the 5th region of Chile, argues that this regulatory change allowed the distributors to get together and enter long-term agreements with the generation companies. The security that the power generation companies experienced due to this reform allowed the long-term investment that was necessary to increase generation capacity in Chile. The new contracts consisted of a bidding process whereby distribution companies bid for energy. Importantly, however, the bid prices were linked to the underlying commodity — be it gas, coal, or anything else — rather than a fixed cost. This meant that the risk was passed from the generation company to the end user.

Christian Arnolds, Chinquinta

Since the Short Law, investments in generation, transmission, and distribution have significantly increased, helped by the strong rate of economic growth and high copper prices. Gaston Fontaine, country head of SANTOS CMI, an Ecuadorian engineering, procurement, and construction (EPC) provider now moving back into the Chilean market, argues: "In Chile we had a gap of investment for 10 years. We didn’t have any clear rules as to how investments could take place. Now we do."

Later, Short Law II was passed, affecting the transmission sector. Andrés Kuhlmann, general manager of Transelec, argues of the Short Law I and II: "These laws made possible a huge increase in investment that wasn’t possible previously." Sergio Correa, general manager of Besalco Construcciones, one of the three largest construction firms in Chile, says that his company entered the Chilean energy market due to this change in the law.

As this report is being written, given all of the aforementioned changes, the power generation sector is technically a competitive sector. Final prices reflect the marginal cost of production, and the Chilean government does not prevent new competitors from entering the market. As per the international standard, generation companies in Chile will receive payment for both their power capacity and the power that they supply. Generators can also enter an internal market and purchase power surplus capacity in order to meet their obligations.

Generation Ownership

The power generation sector is dominated by three companies: ENDESA, Colbún, and AES Gener. Together they control around 65% of the market. If the controversial HidroAysén project were to go ahead (a joint venture between ENDESA and Colbún), this figure would increase.

ENDESA is the formally state-owned giant that was fully privatized in 1989. Upon privatization it went through an ambitious period of expansion throughout South America. ENDESA has around 4,800 MW in installed capacity within Chile and around 8,500 MW of installed capacity throughout South America, including Peru, Brazil, Columbia, and Argentina. ENDESA is the central figure in the Chilean energy sector and, despite frequent changes of ownership, it remains at the top.

ENDESA’s portfolio is made up of a mix of gas-fired and hydro plants. The company also owns ENDESA Eco, its renewables subsidiary, which is developing a 60-MW wind farm in Canela, the largest wind farm under development in Chile to date. ENDESA also controls Ingendesa, an EPC company, created when ENDESA was taken private. Ingendesa doesn’t just supply services for ENDESA but also is a vibrant player in the national market. Rodrigo Alcaino, the general manager of Ingendesa, states: "We stand ready to offer our expertise to the market."

Colbún is the second-largest player in the market, with around 2,500 MW in installed capacity, and is the only major generator remaining in Chilean hands, being controlled by the Matte family. Currently, around 50% of Colbún’s capacity is hydro, with the other 50% coming from thermal sources. Colbún is currently working on a 144-MW hydro plant in San Pedro at a cost of $202 million. It is also developing a 350-MW coal-fired plant in Coronel. In addition, it is planning some smaller, nonconventional renewable projects, the most advanced of which is a 7-MW project in San Clemente.

AES Gener is the smallest of the three big players. It currently has around 2,500 MW in installed capacity but has no involvement in the HidroAysén mega plant. AES Gener suffered a severe setback when the environmental permit for its 270-MW coal-fired plant Campiche was invalidated by the Chilean Supreme Court.

Compañia General de Electricidad (CGE) is a vertically integrated energy group holding stakes in generation companies, distribution companies, and even transformer manufacturer TUSAN. Founded in 1905, it has acquired businesses from various areas over its lifetime.

One of the biggest criticisms of the generation market concerns market control. Rodrigo Danús, managing director of SW Consulting, argues: "The main challenge is to increase competition and help the new entrants in the market." He argues that the position of these three companies makes it extremely difficult for new companies to establish themselves and gain a foothold. The large companies have the contacts, the relations with the government, and a monopoly of expertise on the ground, which makes it difficult for a new entrant to aggressively enter the market. Consequently, most of the new market entrants are niche players focusing on wind or hydro power.

The three large companies also hold the vast majority of water rights, 80% of which are currently unused, meaning that the more lucrative possibilities are already taken.

Chile has an open bidding process when it comes to the energy market, but critics have argued that the government needs to play a greater role to encourage competition. Alexandre Keisser, CFO of GDF Suez Latin America and CEO of GDF Suez Andino (GDF’s Chilean holding company), states that they are "ready and willing" to develop small and midsize hydro plants, but that "the crucial issue for us is to gain access to water rights in order to develop" plants. Keisser observes: "The challenge for the regulatory system is ensuring that if water rights are given, that they are then developed," though he is keen to clarify that this does not mean he is advocating the compulsory reauctioning of unused rights.

Bernardo Larrain, general manager of Colbún, believes that the level of competition in the sector is determined by the number of new entrants: "I would say that the generation sector is open and competitive. We can’t forget that the sector used to be just ENDESA. Colbún was a marginal player when we first began. We occupied a tiny percentage of the market, and since then we have vastly increased our share. In the current market there are an abundance of new players such as Pacific Hydro and SN Power, Mainstream, and Suez."

Bernardo Larrain, Colbun

Christian Arnolds of Chinquinta, a distributor, says that new competition in the market would be ideal, advantageous to the end consumer, and reduce the cost of energy. However, in Chile there is still some way to go: "I would love to see more competition in the market; it would be ideal for companies like us."

Generation Mix

Chile’s generation technology portfolio consists largely of combined-cycle plants, now mostly running on imported diesel, and hydro resources located in the Andes. The country has some coal-fired plants (mostly in the north) dating from the pre – natural gas days, as well as a few new ones being built.

Chile’s strong hydro sector is what distinguishes it from most other countries, but it is a sector that still has some distance to go before it reaches maturity. Ricardo Quezada, general manager of DESSAU INGENTRA, a specialized EPC firm, argues: "Chile has a lot of potential in hydroelectric energy which has not been exploited yet."

To date, the country only has a very small amount of nonconventional renewable projects, although there are considerable numbers under consideration. Wind and geothermal are the two most advanced nonconventional renewables in the market.

The administration of President Michelle Bachelet has made tentative steps to explore the nuclear option but has made it clear that any final decision must be made by the next government. This attitude has become something of a tradition in Chile, which first established a nuclear commission in 1965 but, 44 years later, has yet to actually authorize the construction of a commercial reactor. In mid-2009 the Commission for Nuclear Energy stated that a public-private model would be adopted should nuclear generation be added to the mix, and it appears that the current administration is keen to demonstrate that it is preparing the ground for a decision to be made. Given the long lead in times for nuclear — 10 to 15 years — and the political establishment’s dawdling track record on the issue, it is likely to be many years before Chile gains a nuclear reactor.

In the next sections we look in greater depth at the main energy sources for power generation.

Turning Off the Gas

The withdrawal of Argentinean gas in 2004 had a huge effect on the Chilean energy market, which still resonates today. One of the more interesting stories is that of GasAtacama, which owns a 740-MW combined-cycle plant designed to work with natural gas.

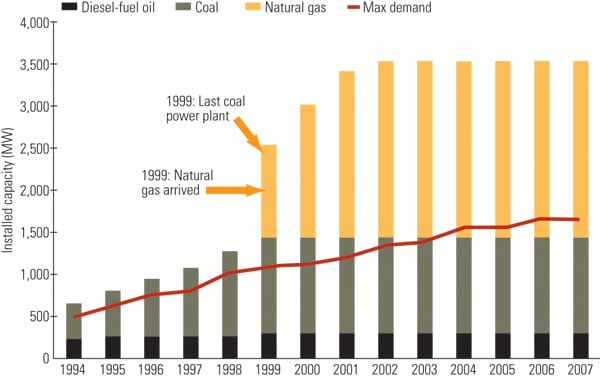

Rudolf Araneda, general manager of GasAtacama, explained to us that the basis for his company’s investment was the legal agreement between Chile and Argentina that allowed for the export of natural gas to Chile. In fact, this natural gas largely originates in Bolivia, but due to historical differences, it was routed via Argentina. As Figure 4 shows, the arrival of gas resulted in a huge increase in capacity. Greater capacity led to a corresponding decrease in price. Araneda observed that "The legal agreement between Chilean and Argentinean partners was made on a nondiscriminatory basis; there would be no price difference between Chilean and Argentinean companies for this Argentinean gas. The distribution of gas should be to both markets; any reduction in supply would be for both markets. This set the incentives for both parties to come to the table to fix any problem which might arise."

4. Gas explosion. This chart shows how the availablilty of natural gas profoundly affected the mix of generation technology on the SING grid. Source: CDEC SING

This low price of energy, assuming a nondiscriminatory agreement, provided the basis for vast expansion in the mining sector, where energy costs constitute about 20% of the final price of copper.

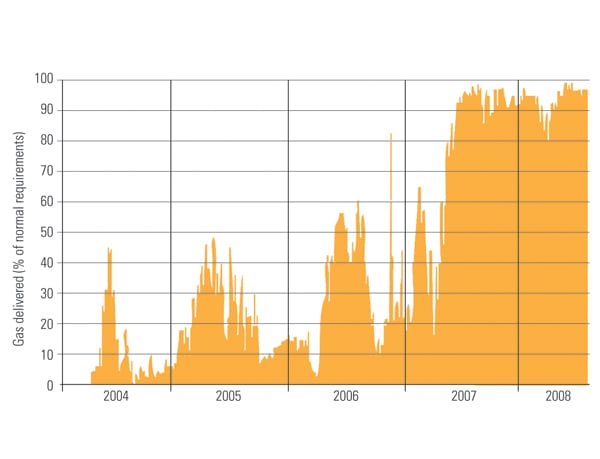

In 2002, Argentina suffered from well-documented economic problems, and the government moved to fix energy prices and, as a consequence, demand soured for gas. As Araneda put it, "In 2004 the Argentinean government decided it needed to take action on this energy problem and unilaterally declared that they wouldn’t follow the terms of the agreement as they wanted to serve the local market first." Figure 5 shows how restricted the gas supplies were for several years thereafter.

5. Gas shutoff. Significant restrictions in the supply of natural gas shipped from Argentina created problems in Chile’s energy market. Source: CNE

These stoppages in gas exports had substantial effects on the industry as a whole. Guillermo Noguera, president of EDIC Ingenieros, an engineering consulting firm specializing in hydro and geological projects, said, "This movement was a serious blow for the generation companies, but for service providers focusing on the hydro sector it was a great opportunity, as building hydro plants returned to fashion."

Generation companies, such as GasAtacama, had signed long-term agreements with clients based on a low price of gas. When gas was no longer available, they had to replace it with considerably more expensive diesel. Consequently, the cost of generating electricity for GasAtacama grew from $12/MWh to between $120 and $200/MWh, resulting in losses of around $1,000,000 per day. GasAtacama was forced to go to the mining companies and arrange a pass-through of the energy costs, which of course meant the mining companies had to pay more.

As a result of the Argentinean decision to turn off the gas tap, and the high price of diesel, the energy market in Chile entered a substantial period of growth to fill its energy gap. The largest and most controversial of its projects is HidroAysén, a joint venture between Colbún and ENDESA.

Huge Hydro

The HidroAysén Project (Figure 6) involves the construction of five electrical power stations in the Aysen region of Chilean Patagonia. The proposed mega-project would produce 2,715 MW, which would be carried through 2,000 kilometers (km) of transmission lines to be distributed on the SIC. The scheme is currently projected to cost $3.2 billion. It would tap the power of two "virgin" rivers — the Pascua and the Baker — with three dams on the former and two on the latter.

6. Future home of huge hydro. The HidroAysén project’s five planned hydropower plants are expected to have a capacity of 2,750. Two plants would be built on the Baker River and three on the Pascua River (pictured). The project is jointly owned by Colbún and ENDESA. Source: SANTOS CMI

The project was first mooted in the 1950s; by 1975 a new proposal involving the flooding of 30,000 hectares was floated. In 2005 the project was reinitiated by the current consortium; their initial proposal was for the flooding of 9,300 hectares, which — after public consultation — was reduced to 5,910 hectares, of which 1,900 are natural riverbed.

The HidroAysén scheme will be highly efficient in terms of output relative to dam area: 2.15 hectares per MW. The HidroAysén company submitted its Environmental Impact Assessment to the Aysen Region National Environmental Commission in mid-2008, and the evaluation process was still under way as this was written.

Hernán Salazar, managing director of the HidroAysén company and the man charged with realizing the project, described it to Global Business Reports as "the most important energy project in the history of Chile."

Hernán Salazar, HidroAysén

For Salazar, there are three key reasons why HidroAysén must be built. The first and most obvious relates to greenhouse warming: Chile needs extra capacity, and if it does not come from hydro, the only viable alternative is thermal. Given that Chile has virtually no hydrocarbon reserves and cannot rely on regional sources of piped natural gas, these plants must be fired by coal or liquefied natural gas (LNG) imported from beyond the continent, further adding to Chile’s carbon footprint.

Second, as previously noted, Chile is pursuing a vigorous campaign to build its nonconventional renewables generation capacity. Wind farms, solar plants, and many run-of-river hydro projects generate an unpredictable and intermittent power flow that requires additional backup capacity. Dam-fed hydro turbines can be online within minutes and are by far the best counterweight to other renewables.

The third of Salazar’s points relates to the strategic security of energy supply: "The fact that Chile depends on imported fossil fuels clearly sacrifices the country’s independence and leaves us exposed to the price volatility of these products. As long as a country uses the resources found in its sovereign soil, it is independent. The only energy technology in Chile that is offering to substantially lower the country’s dependence on foreign suppliers is hydroelectricity." Salazar notes that, "in Chile we take advantage of 25% of our hydro electric potential at present. This is difficult to understand when you consider that 72% of our primary energy is generated from fossil fuels and that Chile only produces 4% of the fossil fuels it consumes."

Minister for Public Works Sergio Bitar (see sidebar) told us that the main issue regarding the project is that of the transmission infrastructure. HidroAysén is extremely far from end users and requires 2,000 km of new transmission lines — more than any high-tension line currently in operation. The lines would cut through a number of national parks and areas of natural beauty and, as such, are highly contentious. It is likely that HidroAysén’s transmission partner, Transelec, will have to employ submarine cables and other less-visible but more expensive forms of transmission for certain parts of the route if permission is to be granted. Within the Aysén region itself it is likely that the construction process and associated infrastructure will open the door for further development and industrialization. The scheme has drawn criticism from environmental organizations around the world as well as nationally and locally.

Within the industry the issue is also divisive, though because the project will be a competitor for some and a client for many, this is to be expected. Rodrigo Danús of SW Consulting, one of HidroAysén’s competitors, who favors a movement to carbon-fueled generation, argues: "My opinion is that the project will have a substantial impact on the environment. I’m not against hydro facilities in general, but I am against this kind of investment, which is bad from an environmental point of view for Chile. We are publicly saying that Chile needs to look for an alternative and not to proceed with HidroAysén."

Many argue that greenhouse gas emissions, which per capita are less than one-third of the G-7 average, should not be the main determinate of Chile’s energy future. Assuming the nonconventional renewables threshold is met and rises to 10% as intended, and that Chile’s generation capacity does grow to 25,000 MW by 2020, there will only be 2,500 MW of nonconventional power in the mix. Given that Chile already has double this figure of installed hydro capacity, some argue that the wind and solar counterbalance argument should not be allowed to influence the outcome of the HidroAysén debate.

Like all power plants, HidroAysén has many pros and cons. The outcome of the application will, however, help determine the future of the generation sector in Chile and will help shape both future hydro policy in the country and investors’ attitude toward hydro projects.

Smaller Hydro

There are several other, slightly less controversial hydro projects taking shape in Chile (Figure 7). One new player, Pacific Hydro, gained entry to the market by buying two Codelco-owned properties in the north of the country. Currently, the company has 550 MW of projects under development, the first of which to come online will be the Chacayes Hydro Project in 2011. José Antonio Valdés, CEO of Pacific Hydro Chile, also told us that his company would potentially look at making investments in wind.

7. Run of the river. The Ralco Plant, a two-unit 690-MW hydroelectric plant commissioned in 2004 and the largest hydroelectric plant in Chile, is owned by Empresa Nacional de Electricidad S.A. The Bio Bio River supplies water to the 1,200 million cubic meters, man-made reservoir. Courtesy: Enersis

Pacific Hydro is also working on a joint venture, Tinguiririca Energía, with Norwegian company SN Power. This joint investment shows how multinationals have been attracted to the Chilean market. Tinguiririca Energía has two plants under construction at the moment: a 155-MW run-of-river project located in La Higuera, which involved more than $300,000,000 of foreign investment, and another in La Confluencia. SN Power Chile has made a considerable number of investments in the country, including several large investments in the Trayenko region. Nils Huseby, vice president of SN Power Chile, explained his company’s interest in Chile: "We identified Chile as a principal market and as an ideal destination to invest in. South America plays a key role in SN Power’s ambitious growth plans towards 2015." He went on to state that his desire is to become the fourth- or fifth-largest generator in Chile, focusing on large hydro projects but also developing wind projects in the future.

The Combined-Cycle Contribution

Another of the newcomers, SW Consulting, has moved from the energy consulting business to developing its own projects via subsidiaries.

SW Consulting started out providing advice and assistance to international players. The company has now moved into the generation business itself and has been developing a 180-MW combined-cycle plant in the 8th region of Chile via its subsidiary Campanario. Like similar plants, due to the gas restrictions, it will be largely run on imported diesel. This plant is being built in conjunction with investment group Southern Cross.

Given the expense of imported diesel, SW Consulting intends to focus on coal plants in the future.

Liquefied Natural Gas

Chile is currently making substantial investments in building LNG terminals designed to increase its energy independence. This movement originates from the cuts in gas supplied by Argentina in 2004. These cuts, as explained above, resulted in Chilean generators being forced to rely on much more expensive fuel sources and highlighted Chile’s reliance on foreign supplies.

The principal LNG port is being built in the central part of Chile by GNL Quintero, a joint venture between ENDESA Chile (20%), ENAP (20%), Metrogas Chile (20%), and BG Group plc (40%). The main attraction of the project is that it will be able to use the existing Chilean infrastructure of combined-cycle plants that were designed for gas rather than needing once again to radically change the nation’s generation technology. The intention is that LNG will act as a direct substitution for Argentinean gas, and as the LNG will be bought mainly on the free market, this will reduce Chile’s energy dependence. A second terminal and plant being developed by Suez Energy International and state copper company Codelco, is located in Mejillones (Figure 8), in the north of the country.

8. Building the future. This new coal-fired power plant in Mejillones, on the Pacific Ocean, will use circulating fluidized bed technology, which will enable the burning of biomass and other fuels. When it goes online in 2010, it will be the first coal unit in Chile’s SING interconnection. This project, along with the LNG import and regasification terminal in Mejillones, and the Horniots thermoelectric power station, will contribute decisively to fuel security and diversity on the SING network. That enhanced security will benefit residential customers as well as mining, industrial, and services activities in Chile’s Norte Grande region. Courtesy: SalfaCorp

Although the GNL Quintero LNG terminal has started receiving its supplies, largely from Trinidad and Tobago, Egypt, and Equatorial Guinea, among other sources, there are still some doubts over its long-term future. Some critics have argued that the LNG terminal cannot compete on prices with existing sources, for example hydro projects and, in particular, HidroAysén, should it go ahead. Transelec’s Kuhlman explained to us the pros and cons of the project: "LNG is mainly a solution for the Argentinean gas, which has since disappeared. We have invested considerable amounts of capital in gas-fired plants, and this infrastructure remains today. LNG is a more expensive solution to our energy problems but allows the existing infrastructure to be used. This doesn’t have an impact on transmission, as the infrastructure will already be there."

Renewables in Chile

Although Chile has a very strong hydro sector, nonconventional renewables aren’t yet a large contributor to the market. All of this is expected to change in the near future due to the implementation of Law 20.257, which compels all power generators that have a total installed capacity of above 200 MW to produce at least 5% of their output from nonconventional renewable sources. That percentage will rise beginning in 2014 by 0.5% increments until it reaches a ceiling of 10%.

Unlike many other countries, Chile has no subsidies on the delivered price of renewable power and no price guarantee. Incentives are limited to fully or partially releasing nonconventional renewables stations with power outputs of less than 20 MW from transmission tolls, ensuring that a minimum percentage of the demand for nonconventional renewables energy comes from regulated customers, and altering the rules regarding the connection of plants smaller than 9 MW to facilitate the connection of small, nonconventional projects to distribution grids. The new renewables legislation obliges generators to meet the targets or face fines.

Renewables offer Chile a way to gain its long-sought-after energy independence, which other potential sources don’t. The LNG terminal being built in Quintero and the movement to coal in the north merely diversify the risk, whereas renewables offer Chile a way to reduce its dependence on foreign suppliers.

Generators do not have to generate power from renewable energy sources directly, and are free to purchase from a third party or pass on the obligation to their nonregulated clients, subject to the terms of the specific power purchase agreements (PPAs). As a consequence, smaller, niche players are entering the market, and mining companies are being put in the unlikely situation of becoming wind farm developers. This is a nascent market, and deal history is scarce. How the market evolves is still very much open to debate.

Juan Carlos Jobet of Asset Chile argues that it is not natural for mining companies to develop and own alternative energy plants, and that new companies specializing in renewables will enter the market and seek to sell their power directly to mining clients: "Mining companies are being forced by generators to come up with a solution to comply with the 5% renewable target. Energy generation is of course not part of their core business, so this is a big challenge for them."

Alexandre Keisser, GDF Suez’s man in Chile, notes that renewables are capital intensive, and that capital is not cheap in Latin America.

Alexandre Keisser, GDF Suez

Wind. Wind is seen as one of the strongest prospects in the renewables sphere, and the technology that is closest to reaching market potential. Chile is attracting investment from major and niche international players. GDF Suez is developing the 38-MW Monte Redondo Park, 300 km to the north of Santiago. The park consists of 19 2-MW V90 Vestas turbines and signals the company’s return to the central SIC grid. ENDESA Eco completed the Canela I 11-unit, 18-MW wind farm and is constructing a follow-on 60-MW Canela II project. (Figure 9).

9. New wind farm under construction. Endesa Chile’s subsidiary Endesa Eco installed the first of 40 wind turbines at the Canela II wind farm project located in the Region of Coquimbo in July. Each of the 1.5-MW wind turbines, supplied by Acciona Windpower S.A., is 79 meters high and can turn at a maximum speed of 15 rpm. Courtesy: ENDESA Eco

Julio Friedmann, country head of French service company Alstom, sees great potential in renewable projects, specifically wind. He calculates that in the long term, 10% of revenue will come from renewable sources. He explained that the two main drivers behind this focus on renewables: the government’s long-term plan to enforce generation companies to produce 10% of their revenue from renewables and the consistent demand from the export-orientated mining sector.

Mainstream, the Irish renewables company, has started the development of Leguna Verde, a 37-MW farm due to begin construction in 2010. Mainstream was founded by Eddie O’Connor, who was the CEO of Irish renewable company Airtricity before moving on to focus on his own investments. As Mainstream was deemed to have experience and a strong financial basis, it has entered the global market feet first.

José Escobar, CEO of Mainstream Chile, sees the potential in Chile: "Chile was one of the first countries which Mainstream looked at for investment," though Mainstream intends to use Chile as a base from which to work in other South American countries as well. He explained Mainstream’s business model in Chile: "We conduct all of the greenfield activity, all of the feasibility studies, we conduct the engineering, and we build and develop the project. Once the project is developed and operational, we sell the assets to a fund which would take this low-risk asset, and we then use the capital to invest into further developments. We would also receive maintenance, operations, and trading contracts to ensure we have a steady cash inflow for the asset investor."

Alfredo Solar, of Acciona Energy, part of the Spanish conglomerate, advised that "Wind energy could be of interest to the mining community," as it offers steady energy prices, allowing mining companies to plan their costs in advance rather than having to rely on fluctuating resources. It has been pointed out, though, that because Chile doesn’t have any kind of manufacturing base, all the equipment for wind generation needs to be imported at great expense.

Geothermal. Chile is generally thought to have considerable potential in the geothermal area. Though the technology is still advancing, Liam Smith, geothermal expert at SKM Minmetal, said, "Financially speaking, some of these projects do make sense."

GGE, an American geothermal company known as Geoglobal LLC in the U.S., is just entering the Chilean market with the intention of operating Chile’s first geothermal plant. Rüdiger Trenkle, GGE’s country head, said, "Chile needs to do more to diversify its matrix." He sees geothermal as one strong solution. Geothermal technology is seen as one of the more advanced forms of renewables, given its usage in the U.S., New Zealand, and Italy. GGE sees Chile as a "tier 1" market, where potential is extremely high.

In Chile geothermal concessions are bid for in auctions. Once a private company gains a concession, it then has two years for exploration (which can be extended) before it transforms into a exploitation concession. One of the main drawbacks of geothermal — not just in Chile but worldwide — is the hit-or-miss nature of the technology. Companies need to be dedicated and well financed, as drilling can be capital intensive because there is a high geological risk that drilling will not find an effective energy source. Trenkle believes that, especially with the addition of carbon credits, geothermal is competitive.

Unlike other areas, geothermal concessions remain under the supervision of the Ministry of Mining and are in their infancy. There have been concerns that if the concession process were to move to the newly created Energy Ministry, the concession process could slow down due to the lack of expertise. Another criticism is that certain speculators are bidding for concessions, inflating the price, while having no intention of developing any project.

Small Hydro. Law 20.257 distinguishes between large- and smaller-scale hydro projects on the basis that large hydro is an already well-established part of the generation equation and also perhaps reflecting a widely held belief that large hydro projects have more of an impact on local environments than their smaller cousins.

Law 20.257 states that only hydro plants below 20 MW will be considered nonconventional renewables and count toward the 5% target. The law also fails to distinguish between run-of-river and conventional dam hydro schemes. Many in the industry feel that the 20-MW ceiling is too low and that it reflects misperceptions of the impact hydro projects have on the local environment.

Alan O’Brien, global managing director of renewable energy at the international energy-to-mining consultancy Hatch, notes that a 200-MW run-of-river scheme need only have a very limited visual impact on its site. The law does not prohibit larger-scale projects, but generators are going to struggle to meet the 5% target, and therefore it is inevitable that there will be some form of premium attached to energy generated from nonconventional renewable sources. By placing the bar so low, attention will be shifted away from the numerous midsize opportunities that exist in Chile.

Alan O’Brien, Hatch

Due to Law 20.257, small hydro and the wider energy crisis in Chile has been attracting interest from across the globe and considerable recent investment. O’Brien said that Hatch has experienced a surge in interest for its hydro services recently in Chile. The tight current supply of electricity, combined with the need to fulfill the 5% target, has resulted in some healthy reported returns on investment.

Santiago Castro, head of power at the energy, mining, and manufacturing consultancy Golder Associates Chile, notes that returns on small and midsize hydro, the company’s core market in Chile, have risen from approximately 10% to 15%. Capital values, driven by widely expected growth in demand and the long lead in times required for large-scale thermal and hydro plants, are also expected to grow for smaller hydro plants.

Perhaps the biggest barrier to entry for small hydro projects is their location. Most of the potential for small hydro projects is in the mountains, far away from central transmission lines. If these projects are undertaken, they suffer problems accessing the grid. The cost of building extensive transmission lines for a project of less than 20 MW is considerable, making it difficult for small hydro projects to go forward. Pedro Matthei of APEMEC argues that micro-hydro will become a significant market player once the problem of connecting small, remotely located plants to the grid has been solved.

Solar. From a physical and environmental perspective, Chile has among the world’s greatest potential in terms of solar power. The Atacama Desert in the north of the country is the world’s most arid desert and among the world’s sunniest locations. It is also the location of the world’s two largest copper mines and at the center of Chile’s mining industry. The combination of abundant supply and demand appears a near perfect catalyst for the development of a significant solar industry.

Yet, despite the hype and much discussion of the region’s potential by the government, there are few signs of actual investment. One reason for this may be the mismatch between the supply characteristics of solar energy and the demand patterns of industrial consumers. Mines tend to operate 24 hours a day and, needless to say, solar plants do not. As the northern grid is yet to be connected to the central grid (which serves the majority of Chile’s domestic consumers) solar energy cannot be exported to the bulk of its natural clients: household consumers.

Perhaps the most important factor in the solar equation is the technology’s infancy. Outside of Germany, Spain, South Africa, and the U.S., solar has yet to take off. In terms of cost, the complicated nature of the technology and its low efficiency levels mean that in Chile it cannot compete on price with traditional thermal energy or alternative nonconventional renewables (see sidebar). The general impression of the market is that Chile has great solar energy potential, but the technology isn’t yet ready to compete here or elsewhere.

Transmission Challenges

The Chilean transmission sector is facing a great challenge. Transelec’s CEO Kuhlmann explains: "Our challenge was to take this technically well-managed business and adapt it to the new climate."

Since it was spun off from ENDESA in March 1993, Transelec has remained the dominant, though not monopolistic, player in the market. The transmission sector mainly consists of three interlinking sectors: the trunk system, which is 100% owned by Transelec and permits the transmission of electricity across the majority of the country; the sub-transmission systems that connect the main grid to areas of the distribution commissions; and the transmission facilities, designed to supply nonregulated customers, mainly mining and large industrial users. Transelec retained 100% of the market for 500-kV transmission lines. It has 46% of 220-kV lines, and competition from the distribution companies leaves just 6% for Transelec at the 154-kV level. Since the "Short Law" was implemented, Transelec bids have won three out of five transmission contracts.

Chile benefits from a dynamic industry that services the transmission sector. PROINGESA, a multidisciplinary engineering company based in Concón, has gone through a rapid period of growth based on its focus on the transmission sector. CEO Ivan Rivero explained, "This is a market that has seen explosive growth. Our company grew 100% every year for the past three years." Samual Jerardino, associate director of KAS Ingeneria, a engineering and consultancy company, said, "There are many opportunities for niche players such as ourselves."

Transelec’s Kuhlmann believes that the most difficult challenge has been the change in the generation mix: "When Chile was importing gas from Argentina, one of the advantages was that the combined-cycle units used to generate electricity could be built close to the points of consumption. So for example, if your end customer is based in Santiago, there is nothing stopping them from building a combined-cycle plant in a close, convenient location. With other technologies this kind of approach just isn’t possible. The hydro plants are located near to the resource, which can be anywhere in Chile! The coal-fired plants would preferably be located near to the sea, as the pollution factor is extremely important. When we could no longer rely on Argentinean gas, we had to look at these other technologies, which wouldn’t be located close to the consumption point and would mean a more sophisticated transmission grid." Given the challenges that the transmission sector faces, and the opportunities in supplying the unregulated market (mainly mining companies) Transelec can’t afford to fail (Figure 10).

10. A Transelec substation. AREVA constructed a major substation for Transelec, Chile’s main transmission company. Located in Charrua, 520 km south of Santiago, the 500 kV/220 kV substation is designed to incorporate the nearby Ralco 570-MW hydro power plant, and is a key element of a project to strengthen Transelec’s 500-kV transmission system. Courtesy: Transelec

As mentioned previously, to date the central SIC is not connected to the northern SING system. This means that Chile does not have one national system whereby deficits in one area can be complimented by excesses in the other. Instead, it has a consumer-dominated central system and an industry-dominated northern system. This means that, although Chile has a wealth of hydro resources in the center and south of the country, should industrial demand pick up again, these cannot be exploited. Instead, future generation on the northern grid is likely to be fossil-fueled.

Chile’s distribution networks are split into concessions with permanent licenses granted to operators. These licenses are transferable with the price of energy in the regulated market (>0.5-MW consumers) being determined nationwide by a simple node price plus operator’s commission (or value-added distribution allowance). The distribution market is inherently monopolistic by design. As holder of four concessions, SAESA Group CEO Francisco Mualim observes that distributors can only add value by improving efficiency and the quality of services and reducing outages. Where there is population growth, the distributor stands to gain, especially if it can accurately predict the location of this growth and develop the requisite infrastructure accordingly.

The distribution licenses make for extremely attractive investments. The stability of the country, market transparency, and security of these regulated but private monopolies combine to offer a low-risk investment with relatively predictable returns. It is testament to Chile’s risk profile and the distribution concessions that SAESA was purchased in mid-2008 by The Morgan Stanley Infrastructure Fund and the Ontario Teachers’ Pension Plan. Teachers’, not known for making rash investments or expecting rapid returns, has publicly stated that it hopes to hold its 50% stake in SAESA for 70 years.

Market Risks

Critics have argued that Chile doesn’t have an energy generation problem; instead, it suffers from an efficiency problem. Instead of focusing on increasing its capacity, it should increase its efficiency, in both the generation and mining sectors. Alfredo De La Quintana, development head of Conecta, an energy solution provider, told us of the opportunities for generation companies: "If I can manage a 1% of improvement in the efficiency of a generator, we would be talking of millions of dollars."

Maria Gonzales, director of energy efficiency company, Energetica, told us that her company can help regulate energy demand in Chile by restructuring companies so they use as little as possible electricity during peak hours, thus reducing strain on the grid.

Claudio Ramirez, commercial manager of EDYCE, suggests that there are too many power plants being built. With the reduction in demand due to the cancellation of or delays in mining and industrial projects, when these power projects eventually come online, there will be an oversupply and resulting price reductions.

Due to the global financial crisis, energy demand has dropped and projects in the influential mining sector have been pushed back (see sidebar). Industrial output has fallen 8.3% year over year, while copper production is down 2.2% year over year. Critics argue that although Chile certainly needs to invest in new generation, perhaps it needs to focus and predict exactly what it needs. If it fails to do so, once the current range of projects come to fruition, it will have considerable overcapacity.

It was in 2007 that the Chilean energy crisis came to its head, when a combination of drought, gas reductions, and high oil prices brought the industry to its knees. The industry is in agreement that there wasn’t enough investment in the energy sector, but when all of the new projects that the crisis inspired all come online, some losers will emerge.

Given the current tight financial conditions, another challenge that entrants and potential entrants find is the difficulty of financing projects, particularly renewable energy projects. Francisco Aguirre of Electroconsultores, a boutique contractual consultancy, explains that PPAs have changed to allow the investor to pass on the cost of any fluctuation in fuel prices to the end customer, which should encourage investors.

Roberto Morrison, general manager of Soletanche-Bachy, a French-owned multinational focusing on foundation works, argues that "The financial crisis has pushed back some projects as demand has been reduced," but that due to the long-term contracts that Soletanche-Bachy has, his company is well positioned to weather the crisis.

SN Power’s Huseby explained, "Market conditions have tightened up considerably over the past year in terms of project financing, both in terms of availability of credits and the conditions of credits and covenant costs, but SN Power has not been having problems with financing in Chile. However, it is more difficult than before and it is also taking longer to obtain credit. Banks are considerably more inaccessible in terms of the process that you have to go through, so you need to take that into account when executing your projects."

Carlos Lobos, country head of Wärtsilä, the Finnish service company, argues that the financial crisis "was new opportunity for companies like Wärtsilä." He went on to say that he intends to move aggressively in the Chilean market with the intention of becoming a market leader.

Carlos Lobos, Wärtsilä

Edwin Chavez, county head of Siemens Chile explained: "I believe the crisis did not affect everyone in the same way or to the same effect. Some of us view it as an opportunity to grow. Sixty percent of our income comes from the mining sector, and we weren’t sure what kind of impact the financial crisis would have on them and how that would affect their operations. We were surprised that they stopped some of the larger projects they had planned for the next five to 10 years. As we saw, though, they halted these projects just for a few months. At the current time of speaking, as the copper price has recovered, so the situation has improved."

Beyond the issues caused by the recent financial crisis, the lack of credit is due to the difficulties financiers face modeling spot energy prices in Chile and the resulting problems that arise when trying to accurately value proposed projects. The spot energy issue is compounded by the extreme volatility of historic price data caused by the gas crisis and the global increase in fuel prices during 2007 and 2008.

Juan Carlos Joblet, who heads up investment bank Asset Chile’s power services, noted that a strong PPA is key to securing finance. For the generator looking to supply the northern grid (SING), this should not present a problem, as over 90% of demand is from mining and industrial clients.

Indeed, Raoul Soto Mayor, partner at the investment fund Southern Cross (which holds a 50% stake in Gasatacama and owns generator Campanario), argues that "The Chilean mining industry can probably provide longer-term contracts than any other sector in the world, which, given the stability of the country, is highly attractive to investors."

José Sánchez, country head of Atlas Copco, a well-established mining service company that is seeking opportunities in the energy sector, said that one of the main attractions of his company as a partner are the financing opportunities that Atlas Copco can offer: "We believe this gives us an advantage over our rivals."

The problem of funding is particularly acute for the nonconventional renewables sector. Not only do investors and financiers have to deal with volatile spot prices, but in Chile there also are no top-ups or guaranteed base prices for renewable energy. For the European or North American investor, used to markets structured to encourage renewable generation and generous state subsides for construction and operation of "green" plants, this can be difficult to deal with.

Environmental Concerns

The huge expansion of projects that Chile is now experiencing doesn’t come without consequences to both the environment and the local population. Chile has moved from combined-cycle plants, which can be built in a number of locations because the fuel is imported, to coal and hydro plants, which need to be located either near the sea or near the natural resource. This has resulted in greater resistance toward new projects. Local populations argue that these plants threaten water supply for human and agricultural consumption, change the priorities of the local government, and adversely affect the local environment together with the tourism economy, which many of these local communities are built on.

Under the current legal framework, once a company has the water rights to a project, it can force local residents to sell their property (subject to reasonable compensation) in order to begin developing a property. Certain exceptions are made for indigenous populations. Though there are certainly environmentalists who are adamantly opposed to all developments, and there have been suggestions that local pressure groups are being organized by international nongovernmental organizations, there can be no doubt that many local indigenous people are being asked to sacrifice a lot for little in return. Chilean companies and environmentalists remain far apart.

SN Power’s Huseby believes that the biggest challenge upon entering Chile is persuading the locals who are affected by a project that the investment is good for the country and good for them. He claims: "If you do it right, projects can become an important catalyst for development locally. You can implement training programs to engage the local population in the projects you are leading, you can have plantations of forests, develop forest management, and develop greenhouses. There are many ways to involve communities in the projects. Another measure is to manage the local provision of food. All of the foods consumed at our constructions are locally produced. There are lots of things you can do if you start thinking about it. The way to do it is to start consultation early on and find out what is important to the residents of a local community. It is a long process and it takes time, and in many cases you need to win trust, so you may need to do some preliminary work to build trust with people."

Manufacturing for the Power Industry

Chile is not known for its manufacturing industry. Its small population and relatively high labor costs have made it less attractive as an outsourcing location compared to Asian countries or Brazil, and local efforts have been focused on the mining and processing sectors. Felipe Andrews, General Manager of HBSE, which provides solutions to the electricity sector, argues: "We have noticed that most companies which have the experience of manufacturing complicated, sophisticated products will base their operations in Brazil."

Chile does, however, have some well-established and technologically advanced manufacturers in the energy sector. The same principles of economic liberalism that define energy legislation apply to the wider economy, and there are few trade barriers to protect Chilean manufacturers. Chile is probably the most pro-market economy in South America, and numerous trade agreements have forced energy components manufacturers to sink or swim.

Pablo Neuweiler, commercial manager of Chile’s largest transformer manufacturer, Rhona, notes that: "We have no import barriers like Brazil or Argentina, which forces us to be competitive. We are used to it." Carlos Rojas of engineering company Proingesa, says, "This type of market forces us to be more competitive, to improve our management and strategic running of the company."

Though transmission and generation companies tend to view cheap components as a false economy in light of the significant financial implications of shutdowns, Chilean companies are still reviewing their businesses in order to meet emerging competition from Asia. Augusto Wiegand, general manager of the transformer manufacturer TUSAN noted: "We need to start manufacturing highly technological items because the cheaper ones will be produced in China, and we will be left unable to compete in the global… economy." The major Chilean transformer manufacturers are increasingly focused on differentiating themselves from the international competition through after-sales services and their ability to adapt rapidly to the needs of local clients. Wiegand predicts: "We shall evolve into a services company."

Domestic components manufacturers are forced to offer high-tech products as their local clients normally procure supplies using international tenders and, according to the local head of Tyco Electronics’ Energy Division, Juan Darritchon, the energy distributors cooperate on many parts tenders in order to ensure conformity across the country’s grids.

Perhaps the area where Chile needs to invest the most, but seems to be focusing the least, is the area of innovation. In order to effectively compete in the global economy, Chile needs to move forward and do things better rather than doing them cheaper. Chilean companies are dynamic and aggressive in moving to larger markets, but they need to find their competitive advantage. EDYCE, the domestic leader in steel structures, is an example of how when a Chilean company invests in improving processes and in research and development, it can become not only a domestic leader but also a regional leader.

Multinationalism and Chilean Exports

A notable feature of Chile is its growing intra – South American trade and investment model. As well as having representation from the full range of multinationals present in most countries around the world, Chile also hosts various South American multinationals. An example of a foreign company that has aggressively and dynamically moved into Chile is SANTOS CMI. The Ecuadorian EPC offers a different solution than most companies in the market. Unlike its competitors, it comes from a construction background rather than an engineering background. Gaston Fontaine, country head, said, "Our engineers are practiced and experienced in the field, and that gives us a relative advantage in the market."

Another South American multinational is WEG, the Brazilian service company. Fernando Cardozo, WEG’s country head, told us why WEG decided to enter the Chilean market: "Financially, Chile is absolutely secure. It is an extremely competitive market in spite of its size. I could say that in terms of the way it operates it is very similar to bigger countries, like the United States, for example."

Some Chilean companies have built, or are in the process of building, substantial overseas operations. The open market culture in Chile, something lacking in many other Latin American business communities, has aided this process as Chilean businessmen throughout the power value chain are use to dealing with foreign clients and meeting their tendering processes and standards. Pablo Bosch, general manager of BBosch, explained that through consistent annual growth of 13% to 16%, his company has grown from a simple erector and maintainer of transmission lines into the tower fabrication sector. BBosch is now a Latin American leader in the fabrication business and has galvanizing plants (serving sectors beyond power) in Chile and Brazil. For Bosch, a keen free trade and globalization advocate, building his export business is essential: "I know I can not depend only on my Chilean customers." Therefore BBosch is "developing the network and engineering capacity to sell structures all over the world." The company, which had a turnover of approximately $100 million last year, sells to Peru, Brazil, and Costa Rica and is even bidding on a project in the Arctic.

Chilean companies are gaining market penetration in other Latin American markets because they have built strong relationships with European and North American EPCs, and their clients are confident that they will meet their requirements regardless of the location of the project. BBosch was a key subcontractor on the SIEPA project to build an international Central American grid because of this reality.

Fernando Zuñiga, energy head of SalfaCorp, explained his strategy for expansion: "Presently, we are the biggest construction company in Chile. Two years ago we acquired a company in Peru. We have been present two years now in the Argentinean market and we have recently opened an office in Colombia. To be able to reach those countries you need investments or to buy domestic companies."

Although many Chilean service companies are moving into foreign markets, there is considerable confidence in the domestic market. This is due to the rising demand for energy and the fact that the many of the new plants coming online are typically located far from the load and therefore require more transmission infrastructure than the gas-fired plants built in the early part of this decade. Local operators are building relationships with foreign manufacturers in order to service the Chilean market. Sergio Palacios, general manager of transformer engineering and service company Jorpa, said, "We have a strategic alliance with an Argentine company called Los Conce S.A., which is starting to produce transformers, and we have a contract to distribute and represent their products here in Chile."

Alfredo Zamorano, CEO of Chilean EPC Proyersa Energy insisted: "We do not discard the international market…. right at this moment the domestic market is the most important [for us]."

Human Resources

Industry chiefs are keen to emphasize that the Chilean service sector is a sophisticated market with a labor force as skilled as in any Western market. For example, Kipreos — a low-, medium- and high-voltage transmission line erector — has developed a substantial helicopter operation in order to undertake complex operations in some of the world’s most adverse terrain (Figure 11). Chilean companies are focused on developing the knowledge base of their employees and adding value through transferring their expertise to their clients. Oscar Jimenez, general manager of the precision instruments distributor Intronica, believes that "What we have to do is add value by training the users."

11. High-level teamwork. Kipreos is a low-, medium-, and high-voltage transmission line erector that has developed sophisticated helicopter operations for erecting transmission lines in challenging terrain. Courtesy: Kipreos

Due to its topography and well-established hydro sector, Chile has strong, established expertise in this field. Though the ill-conceived regulatory changes of 1999 effectively stifled new hydro developments and triggered a brain drain as engineers emigrated to more promising markets, it also forced Chilean engineering companies to enter new foreign markets. The 2004 revision of the law reopened the gates to new hydro developments and has put Chilean EPCs in a strong position.

Ricardo Quezada, DESSAU INGENTRA

Executive Vice-President of Chilean/Canadian EPC DESSAU INGENTRA Ricardo Quezada claims: "DESSAU INGENTRA is set to expand through all of Latin America. We currently have projects in Central America, in the Dominican Republic to be more specific, and also in Peru." DESSAU INGENTRA is one of the huge beneficiaries of this growth within the hydro sector, which advanced company growth at a rate of 300% over the past three years. Quezada reckons that the level of experience within his company is the driving force behind this growth.

Fernando Vivanco is commercial manager of Mas Errázuriz, a specialized EPC company working in Chile as well as expanding overseas. It is another shrewd operator that has been quick to take advantage of this growth in projects: "These projects need companies with expertise in subterranean construction, and we have it," he said.

Chile at a Crossroads

Chile faces a great challenge to diversify its power generation sector, maintain its environment, and achieve energy independence. Chile suffered greatly from energy supply security in the last few years; its key mining sector was handicapped, and its reputation as an entry point for South America was damaged. The main actors in Chile are aware of the seriousness of this situation and have shown increased interest in the energy sector as a result. The removal of natural gas from Chile’s energy mix leaves a gaping hole, and it is important that Chile doesn’t repeat its mistake and attempt to fill this round hole with a square peg.

Chile certainly offers great opportunities for investors, but there is still uncertainty as to how its generation sector will develop. A great volume of new projects are planned or under construction, but the lack of governmental control over the wholly privatized sector makes it difficult for any specific solution to be pushed.

Chile likely will look to hydro projects and coal-fired plants for the next generation of power plants. Hydro, most prominently HidroAysén in the south, will service the SIC. In the north, the SING will rely on coal-fired plants. The two LNG terminals being built will diversify Chile’s portfolio, but it remains unclear whether LNG plants can financially compete in the Chilean market. The lack of subsidies for renewables means that it is unlikely Chile will become a regional leader in this area.

Should Chile manage to reconcile with one of its neighbors and begin importing natural gas again, doing so could change all of this once again. The world will be looking at Chile with great interest to see which path it takes.

—Ramona Tarta ([email protected]), Mark Storry ([email protected]), and Oliver Cushing ([email protected]) are reporters for Global Business Reports ([email protected]).