A Wrap-Up of the Energy Union's Second Year

Two years after the Energy Union was launched as a strategy to help the European Union (EU) provide secure, sustainable, competitive, and affordable energy, the 28-member bloc is seeing a precipitous drop in renewables investments, though it remains on track to meet 2020 targets.

The second “State of the Energy Union” report released this February outlined several trends and policy observations. The most prominent of these were that the EU as a whole is making “good progress” on delivering the Energy Union’s 10 objectives, particularly as they relate to the 2020 energy and climate targets. In 2015, greenhouse gas (GHG) emissions in the EU were 22% below the 1990 level and continued to fall. Based on 2014 data, the EU’s share of renewables reached 16% of the gross final energy consumption, slightly short of the 20% goal for 2020. In 2014, meanwhile, renewables generated 27.5% of the EU’s total power, a figure that the European Commission anticipates could climb to 50% by 2030.

The EU also made progress to successfully decouple economic growth from GHG emissions. “During the 1990–2015 period, the European Union’s combined Gross Domestic Product (GDP) grew by 50%, while emissions decreased by 22%,” the report says. “This decoupling is expected to continue under current trends and projections.”

In line with the bloc’s general ambitions to move away from an economy dependent on fossil fuels, the EU also ratified the Paris agreement and implemented key proposals to deliver on the 2030 climate and energy framework, including for sectors covered by the EU’s Emissions Trading System, and outside of it. It also proposed a binding EU-level target of 30% for improving energy efficiency by 2030. Over the past year, meanwhile, work was launched on integral interconnection projects such as the Trans Adriatic Pipeline, and financing agreements were signed for gas interconnectors between Finland and Estonia as well as for a gas pipeline through Bulgaria, Romania, Hungary, and Austria.

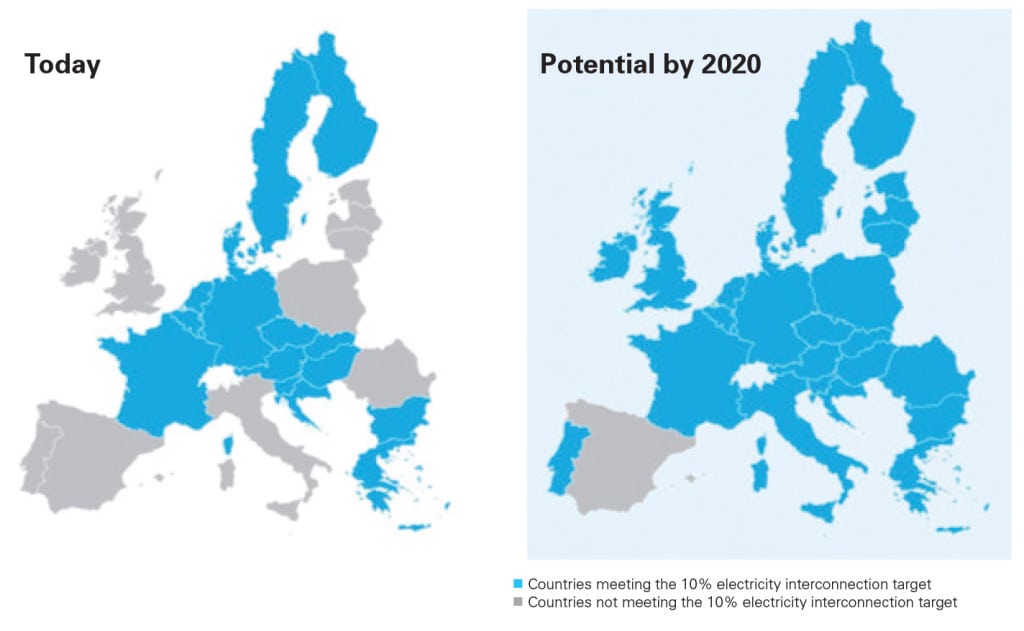

But the EU still suffers from bottlenecks due to missing or underused infrastructure, the report says. “Interconnections and, where relevant, internal lines are still needed to further integrate the internal electricity market in South Western Europe and in Northern and Eastern Europe (e.g. Germany, Poland and the Czech Republic) and the management of these interconnections must be improved.” It also notes that work towards the synchronization of the Baltic States with the European electricity system should continue (Figure 3). “The 15% electricity interconnection target for 2030 should ensure, provided that this capacity is made available to the market, that the European Union can make optimal use of its renewable resources, ensure security of supply and market integration.”

Member states made good progress in opening up wholesale markets to competition, but many of them have not fully implemented necessary rules that “allow for competitive and liquid markets,” the report also notes. At a regional level, largely driven by falling coal and gas prices, and the gradual penetration of renewables as well as subdued demand, wholesale power prices decreased in most states.

The report urges strengthening cybersecurity and physical protection of energy sector installations, as well as addressing reliability concerns.

Significantly, it calls on member states to use public resources “smartly,” granting subsidies only “if in line with the long-term energy policy of the European Union.” It said that will avoid stranded assets and “carbon lock-in”—a situation where the amount of fossil-fuel capacity could exceed the levels that correspond to the EU’s long-term decarbonisation objectives.

Finally, the report highlights lagging investments in the sector. European investment in renewables has dropped by half since 2011 to €44 billion, the report says. That compares to global investments in renewables, which have increased to more than €260 billion.