Global Water Outlook for Power Generation

Water and energy are intimately linked. Water is necessary for the production, distribution, and use of energy. Energy is needed for the withdrawal and delivery of water. The two are inseparable. Several recent reports contain important information for the power sector about water availability and usage trends.

In last year’s Department of Energy (DOE) report, The Water-Energy Nexus: Challenges and Opportunities, U.S. Secretary of Energy Dr. Ernest Moniz wrote: “Water resource scarcity, variability, and uncertainty are becoming more prominent both domestically and internationally. Because energy and water are interdependent, the availability and predictability of water resources can directly affect energy systems. We cannot assume the future is like the past in terms of climate, technology, and the evolving decision landscape. These issues present important challenges to address.”

The report suggested that the urgency to act is being driven by three trends. First, it noted that climate change is already affecting precipitation and temperature patterns in the U.S. Next, it said that population growth and regional migration trends indicated that arid areas, such as the southwestern U.S., were likely to continue growing, which would affect management of energy and water systems. Lastly, it suggested that new technologies in the energy and water domains might shift water and energy demands, while policy developments could introduce additional complexities.

But the problem is not isolated to the U.S. In The United Nations World Water Development Report 2014, Ban Ki-moon, secretary-general of the United Nations, noted that in order to provide modern, affordable, and environmentally sound energy and drinking water services for all, a sustainable approach is needed for the management of both freshwater and energy resources.

U.S. Water Use Is Down

Every five years, the U.S. Geological Survey (USGS) collects data from counties all over the U.S. for the national water use report. The document provides water resource managers and private citizens with accurate information on how much water is being used in specific places for a wide variety of purposes. In the case of this report, “use” is withdrawal rather than consumption.

Often, there is public confusion about how water is used by thermoelectric power generation facilities. Much of the water withdrawn by power plants is returned to its source without being consumed. The majority of this water is used as a cooling medium to condense steam, exhausted from steam turbines, back to a liquid, for pumping and efficiency purposes. According to National Renewable Energy Laboratory estimates, only about 2.5% of U.S. thermoelectric power plant withdrawals is evaporated, that is, consumed in this process. However, withdrawal amounts matter when water availability is a concern, because lack of water availability can result in generation curtailment or shutdown.

In November, the USGS published its most recent report, which includes data from 2010. The numbers showed that water use across the country reached its lowest recorded level in nearly 45 years. Even as the U.S. population continues to grow, an emphasis on conservation and improvements in water-use technologies and management resulted in a 13% reduction in water use from 2005.

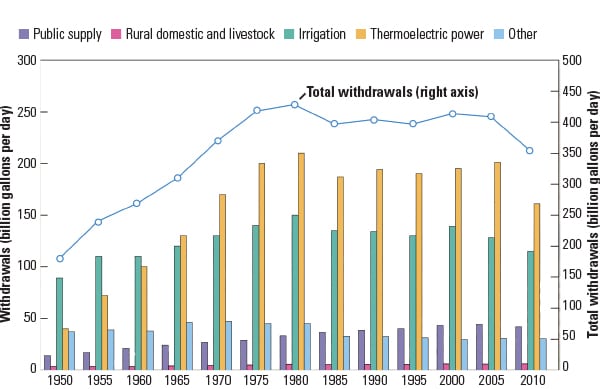

Thermoelectric power continued to withdraw the most water nationally, as it has since overtaking irrigation in 1965, accounting for 45% of all water usage—more than 160 billion gallons per day—but the total was 20% less than in 2005 (Figure 1). A number of factors contributed to the reduction, including the use of more efficient cooling technologies, reductions in withdrawals to protect aquatic habitat and environments, power plant closures, and a decline in coal-fired generation.

|

| 1. Water withdrawals. The chart displays water usage by category. Source: U.S. Geological Survey |

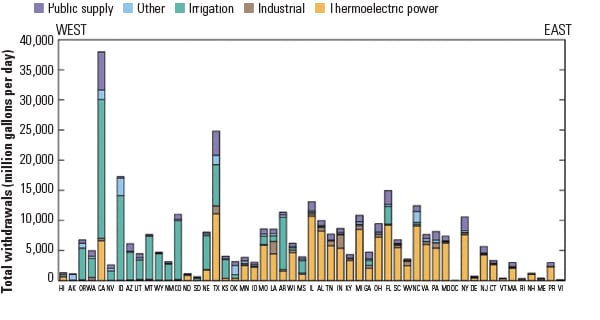

But water risk is ultimately a local and regional issue. California, for example, is the largest user of water, but the majority of its freshwater goes to agriculture. It uses 10 times more saltwater than freshwater for thermoelectric power withdrawals. Texas and Illinois, on the other hand, feed the most freshwater to thermoelectric power generation (Figure 2).

|

| 2. State totals. The chart displays water usage by state. Source: U.S. Geological Survey |

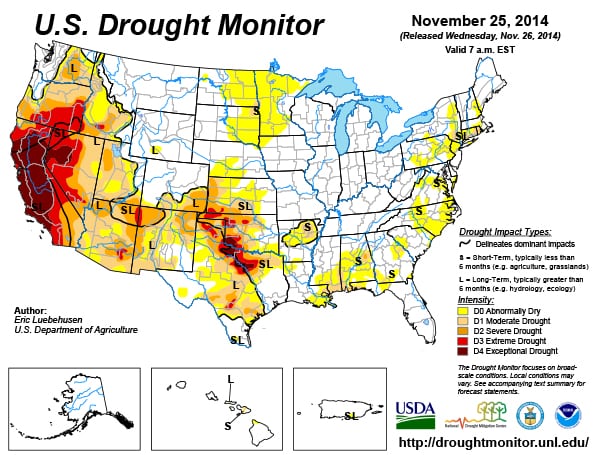

Drought stress—a big factor in water risk—is not shared equally across the country. According to the U.S. Department of Agriculture drought monitor, most of California and a large portion of Texas were experiencing “exceptional drought” at the end of November, while much of the Midwestern U.S., including all of Illinois, was drought free (Figure 3).

|

| 3. Got water? The map shows drought conditions as of Nov. 25, 2014. Source: U.S. Department of Agriculture, et al. |

Concerns Worldwide

The DOE report noted that severe drought affected more than a third of the U.S. in 2012, constraining the operation of some power plants. Of the 12 major reservoirs that the California Department of Water Resources Data Exchange Center offers daily condition reports for, levels at eight of them were 28% or less on Dec. 1 (Figure 4). The U.S. is not alone. Lack of rainfall in South America has left some of Brazil’s water reservoirs dangerously low (see “Drought Stresses Brazilian Electricity Market” in the November issue).

In addition to water quantity issues, water temperatures can also pose problems. The DOE report mentioned that the Millstone Power Station—a nuclear facility located in Connecticut—shut down in the summer of 2012 due to high intake water temperatures. And in August 2014, the Turkey Point Nuclear Generating Station required the approval of an emergency order allowing it to divert water from the South Florida Water Management District’s canal system to help moderate unusually high temperatures and salinity in the plant’s cooling water system.

According to Christopher Gasson, publisher of the magazine Global Water Intelligence ( GWI), water risk for power plants is growing. “Power plants take a lot of water out of nature, but they also put a lot of that water back where it came from. It means that while power plants are not a big overall burden on water resources, they are at risk if there is simply not enough water around,” Gasson said in an interview with POWER.

Gasson noted that the places facing the greatest water challenges are in the southwestern U.S., northeast China, India, and the Middle East. He suggested that the switch from coal to gas in the U.S. will probably make things easier from a water perspective, but that China and India will remain big coal users in the future.

“China has a particular problem with its strategy to develop its [coal-to-chemicals] market in Inner Mongolia and other parts of the northeast where there isn’t much water: they need to think about [zero liquid discharge] and recycling,” said Gasson.

In India, he said, the next generation of power plants will probably be built on the coast, which might require seawater desalination. The Middle East is decoupling power and water as a result of the transition from thermal to membrane desalination technology, which does not require steam to work.

Placing a Price on Water

A new financial modeling tool, developed by Ecolab USA Inc. and Trucost PLC, offers a way for businesses to incorporate water risk into business decisions. The “Water Risk Monetizer” is designed to quantify water-related risks, so a business can understand the full value of water to its operations.

The tool calculates a water risk premium using algorithms derived from scientific studies on water scarcity and in-stream water values. Such things as local groundwater recharge, waste assimilation, wildlife habitat, and recreational activities are used to correlate a facility’s water use with local scarcity conditions.

The water risk premium can be added to the plant’s water bill to quantify the value a business should place on water based on real and future risk related to water scarcity. Placing a monetary value on risk helps businesses set priorities.

The tool is free to use, but it does require creating a user profile. According to the website, all information entered is kept confidential and is not available to anyone other than the individual who enters it. Visit waterriskmonetizer.com for more information and to try the tool.

GWI is seeing some U.S. generators considering “water insurance,” that is, paying a regular premium to senior water rights owners, so that if a bad drought occurs, they can exercise an option to buy water at a pre-agreed-upon price. “The main priority for the power industry must be to secure access to water, rain or shine,” said Gasson.

Unique Solutions

Power and water can complement each other. Water is difficult to transport, but easy to store. Electricity is easy to transport, but difficult to store. Gasson believes the two are quite fungible, especially where power is needed to make water.

“You could probably avoid the massive build out of power plants in the Middle East if you used water generation and storage to manage the peaks. For example, instead of needing to build more and more ‘peakers’ to cover the air conditioning demand in summer and in the middle of the day, you could just have a series of baseload plants and switch production to [desalination] production when demand is low and supply to the grid when demand is high,” he said.

Another distinctive water solution is offered by POWER’s first Water Award winner (see “Jeffrey Energy Center’s Constructed Wetland Treatment System” in the August issue). In that case, Westar Energy developed an innovative solution to a common problem: the economic and environmentally responsible disposal of flue gas desulfurization (FGD) wastewater.

“FGD waste is horrible,” said Gasson. “The best solution for it is zero liquid discharge, but this is very expensive. There is more opportunity for new technologies on the wastewater side, where regulations are getting tougher and there is more interest in recycling. New zero liquid discharge technologies, such as membrane distillation and forward osmosis, are beginning to provide lower cost alternatives to thermal evaporation systems.”

While these solutions cannot be used at every plant or in every region of the world, the examples show that thinking outside of the box can potentially solve a variety of water challenges. GWI’ s complete report, Global Water Market 2015: Meeting the world’s water and wastewater needs until 2018, is available for purchase at: bit.ly/11BA4zI. ■

—Aaron Larson is a POWER associate editor.