The Resurrection of Underground Coal Gasification

News this past November that Australian company Cougar Energy had begun developing a pilot project to generate power from coal still underground has reignited interest in the 100-year-old alternative energy technology. The company’s planned A$8 million program — expected to be started in the first quarter of 2010 — will be conducted 10 kilometers south of Kingaroy, in southern Queensland. If it is successful, it could lead to the establishment of a 400-MW baseload power station, Cougar Energy officials say.

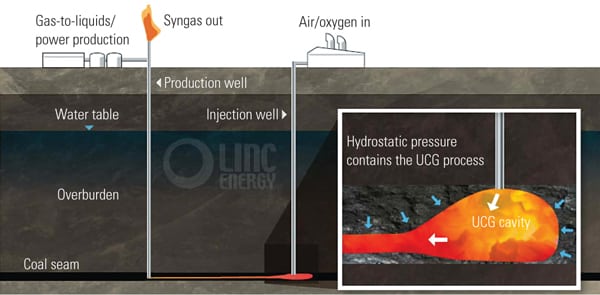

Essentially, the plant will use underground coal gasification (UCG) technology to convert coal buried deep underground into synthesis gas (or syngas) through the same chemical reactions that occur in conventional above-ground gasification plants (Figure 1). This typically requires constructing vertical wells to inject oxygen and water into a coal seam and discharging a mixture of production gases — such as carbon monoxide, hydrogen, methane, and carbon dioxide — to the surface.

1. Subsurface conversion. Underground coal gasification (UCG) technology is seeing a global revival. The basic process involves drilling two vertical boreholes into the coal, one for injection of the oxidants (water/air or water/oxygen mixtures) into the coal seam and another to draw the syngas out. The coal at the base of the first well is heated to temperatures that would normally cause it to burn. But through careful regulation of the oxidant flow, the coal instead separates into syngas. The process seems deceptively simple, but control of the gasification process has been at the heart of UCG development over many years. Courtesy: Linc Energy

But Cougar Energy’s pilot program won’t be unique — nor the first in Australia. Conceived in Britain in the 1890s, UCG was first developed in the former Soviet Union in the 1920s, until it lost out to cheaper Siberian natural gas. During the oil embargo years of the 1970s and 1980s, several UCG tests were conducted by the U.S. and in Europe. In the 1990s, China began UCG research and development — and it continues this effort, with some 30 UCG projects in different phases of preparation. India and South Africa, too, are heavily invested in the technology, owing to their vast coal resources. The World Coal Institute claims that India plans to use UCG to access an estimated 350 billion metric tons of coal, while South Africa’s state-owned utility Eskom and global petrochemical group SASOL have both initiated pilot facilities. In 2007, Eskom even said that the results had been so positive that it was considering building a 2,100-MW combined-cycle power plant run entirely on UCG gas.

In Australia, Linc Energy has been running a 10-year-long UCG demonstration in Chinchilla, about 300 km from Brisbane, and it claims it has gasified 35,000 metric tons of coal so far — more than in any other UCG trial. In October 2008, a gas-to-liquids demonstration plant and laboratory was also commissioned on that site and began producing the first liquid hydrocarbons. Meanwhile, in November 2009, Cougar Energy’s announcement was tailed by a similar claim from competitor Carbon Energy, which confirmed that a 5-MW UCG power station was under development at Bloodwood Creek in Queensland, that it would be operational in December, and that it should be producing power for the local grid by January 2010.

According to Chris Cothran, an upstream analyst from energy research and consultancy group Zeus Development Corp., the technology’s revival is primarily being driven by coal-to-liquids project developers looking to find innovative ways to manage carbon, prompted by greenhouse gas emission concerns. But, he says, UCG’s role in power generation is also growing in importance. "Both pulverized coal and [integrated gasification combined-cycle] plants require mining the coal from surface or underground mines, which is expensive and energy intensive," Cothran says. "If UGC developers can perfect their technology, the cost of mining and transporting coal as well as building the reactor for IGCC to gasify the coal will disappear."

UCG technology offers a host of other advantages. According to the U.S.-based National Coal Council, foremost among these is the possible 300% to 400% increase in recoverable coal reserves — because UCG would allow for the use of coals that are unmineable. Then, because most of the ash in the coal stays underground, it could avoid the need for additional syngas cleanup and the environmental issues associated with ash storage. The council also points out that production of some criteria pollutants (SO2 and NOx) would be virtually eliminated, and others, such as mercury and particulates, would be greatly reduced — and thus easier to handle.

The technology’s advantages are nevertheless outweighed by a list of limitations and potential concerns, the council admits. Siting and operation of UCG, for example, could have environmental consequences, including groundwater impacts and ground subsidence. Many deep seams could also be limited by geologic and hydrologic hazards.

Among several technical setbacks is the consideration that UCG operations may not be controlled to the same extent as conventional gasifiers: Important process variables, such as the rate of water influx, the distribution of reactants in the gasification zone, and the growth rate of the cavity could only be estimated from measurements of temperatures and product quality and quantity. And overarching all those concerns are cost considerations. UCG economics appear promising, the coal council says, but uncertainties in capital and operating costs are likely to persist until a reasonable number of UCG-based power plants are built and operated.

— Sonal Patel is POWER’s senior writer.