Power in Mexico: A Brief History of Mexico’s Power Sector

Mexico Balances Central Control with Flexibility in Its Power Sector

A special report from Global Business Reports and POWER

Courtesy: CFE

Courtesy: CFE

Mexico, one of the few countries in Latin America that has resisted the tide of liberalization, retains a monopolistic state player in the electricity market. In treading its own path by maintaining the government’s predominance in the sector, Mexico has an important question to answer: Is this path sustainable?

The Mexican electrical sector is federally owned, as is required by the constitution, with Comisión Federal de Electricidad (CFE) directly responsible for around 70% of all electricity produced in Mexico. Following its recent takeover of Luz y Fuerza del Centro (LyFC), the CFE controls 100% of the transmission and distribution network in the country. Few countries have maintained this level of government control over the industry. Private companies can only participate in specific tenders offered by the CFE.

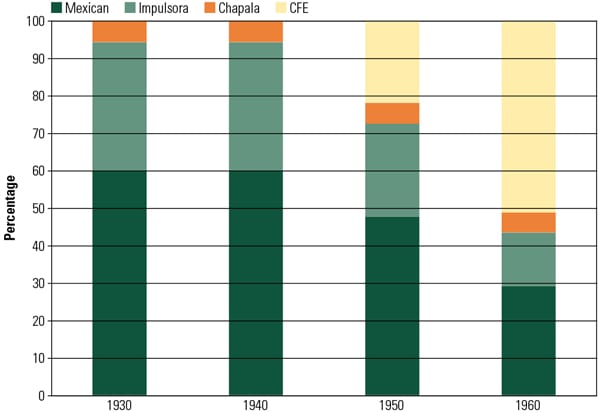

The structure of Mexico’s power sector reflects Mexico’s radical revolutionary past and the dominance of the Partido Revolucionario Institucional (PRI), which came into existence under the guise of the Partido Nacional Revolucionario in 1929. This party was formed as an attempt to keep the various factions of the Mexican revolution together and to unite the country. The coalition comprises a wide variety of interests and political opinions, including a strong left-wing element. This left-wing influence led to the creation of the CFE in 1934 with the mandate of regulating the private vertically owned energy monopolies and also of supplying the areas that the private sector neglected due to their being perceived as unprofitable (Figure 1).

1. Percentage of new capacity by firm, 1930–1960. Source: SENER

Throughout the 1940s and 1950s, the CFE slowly and steadily acquired regional concessions throughout the country. On September 27, 1960, under the administration of Adolfo López Mateos, the government fully nationalized the sector, and constitutional arrangements were enforced, making the state the sole producer, provider, and distributor of electricity in Mexico.

The concentration of the sector within state hands allowed for considerable planned expansion of energy supply during the 1970s. This expansion was fueled by the availability of fuel oil from Petróleos Mexicanos (PEMEX), which was provided at subsidized prices to the CFE. PEMEX’s vast profits from high oil prices in the 1970s fueled the CFE’s investments.

The final piece of the social puzzle involved subsidies on the price of electricity for the end user. Though these tariffs supplied relief to many lower-income families, they inadvertently subsidized higher-income households too. The thinking at the time, which continues today, is that electricity is a basic need and, as such, the state has an obligation to provide it at an affordable rate to its population. During the 1970s the CFE was very successful at expanding the reach of electricity to rural areas, and the number of households with access to electricity roughly doubled. Nevertheless, an estimated 6 million Mexicans remain unconnected to regular electricity today.

During the 1980s, Mexico, following the global trend, allowed increasing private participation in its economy; but electricity, together with hydrocarbons, remained firmly in the hands of the public sector. In 1992 the government allowed for the introduction of independent power producers (IPPs) with the reform of the Ley del Servicio Público de Energía Eléctrica as well as cogeneration and self-supply schemes. According to the Mexican energy regulatory commission, Comisión Reguladora de Energía, around 30% of the electricity currently produced in Mexico is by private sources, be that through autogeneration, cogeneration, or by IPPs.

Mexico’s energy challenge is twofold. First, it must determine whether the state can continue to be the dominant energy provider or whether radical reform is needed in which the private sector takes a more prominent role. The second concerns the role of renewables within the Mexican energy mix. Mexico’s unique structure means that the CFE has an obligation to obtain energy from the cheapest source, and as renewables are in an incipient state of development and therefore expensive, this obligation makes it difficult for the IPPs to develop such projects and leaves the CFE itself little reason to encourage them.

—Written and researched by Clotilde Bonetto ([email protected]) and Mark Storry ([email protected]) of Global Business Reports.