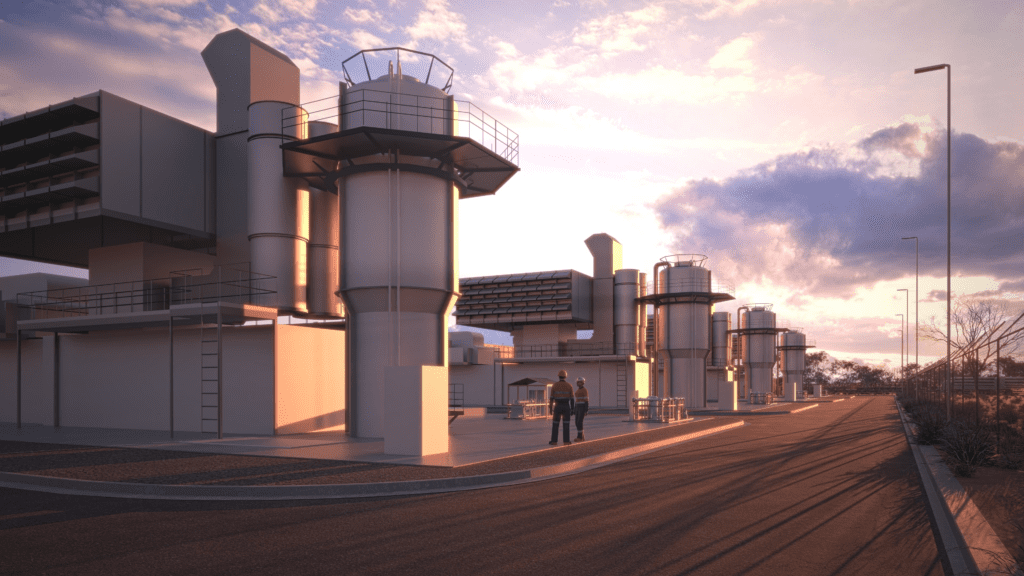

In late 2024, a first-of-a-kind, fully functional project spearheaded by Duke Energy, GE Vernova, and Sargent and Lundy could begin demonstrating the commercial peaking capabilities of an integrated hydrogen power-to-power system at Duke Energy’s DeBary power plant in Florida.

In an exclusive interview, project partners revealed details of the potentially trailblazing installation, which is slated to become the first in the nation and among the world’s first power plants to produce and use renewable hydrogen to power a gas turbine for peaking power applications.

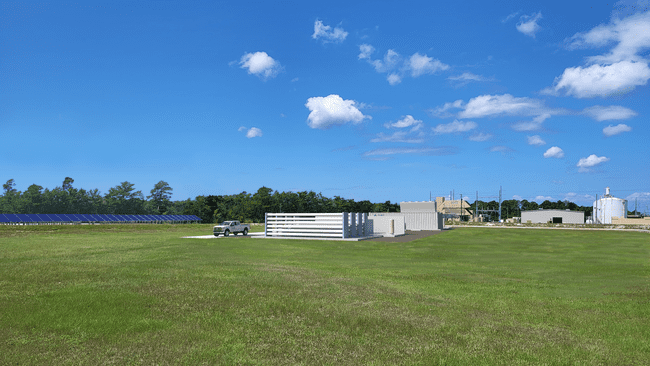

While formally unveiled on Oct. 27, planning and development for the DeBary Hydrogen Project have been underway for several years, and its one-year construction is poised to begin later this year. The “end-to-end” energy system will be co-located at the DeBary plant in Volusia County. The Duke Energy Florida plant currently comprises a 74.5-MW solar PV plant, opened in 2020, and a 692-MW gas power plant driven by six GE 7B and four GE 7E gas turbines, which were commissioned in 1975.

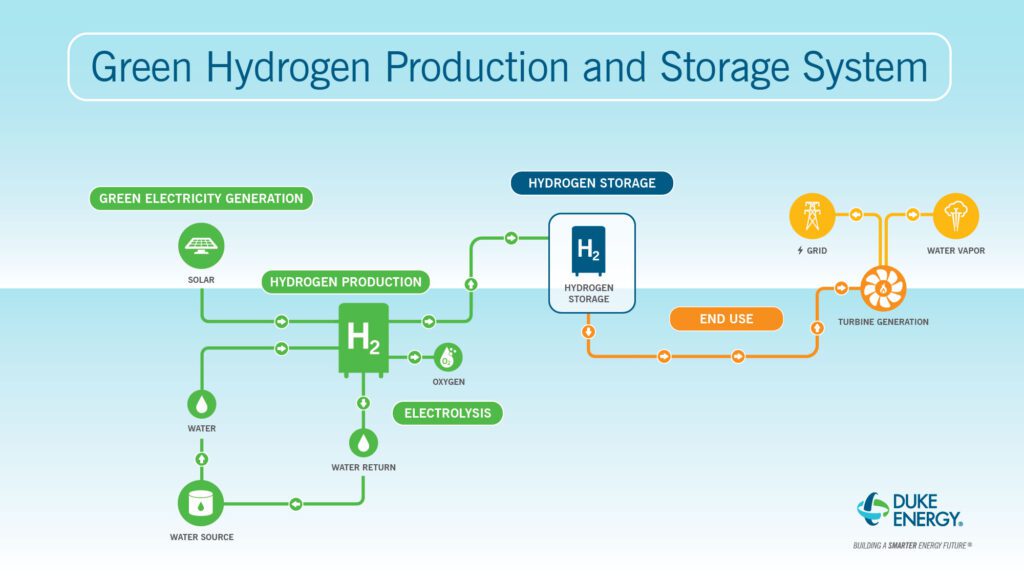

The companies told POWER that the hydrogen demonstration will leverage excess solar generation during peak generation and low demand times from DeBary’s 300,000-panel solar PV array to split water, utilizing two 1-MW proton exchange membrane (PEM) electrolyzers Duke Energy will procure from Plug Power. Featuring an efficiency of about 65%, the electrolyzers are slated to produce about 36 kilograms (kg) of hydrogen per hour.

That hydrogen will then be stored onsite in tanks capable of holding 2,500 kg of compressed hydrogen. As part of the project, GE Vernova will, during the third quarter of 2024, upgrade one of DeBary’s four 83-MW GE 7E gas turbines, enabling it to combust up to 100% hydrogen (by volume) to cater to periods of peak demand—making it GE’s first commercial demonstration of an E-class machine running at 100%. At ambient Florida site conditions, the turbine will have an output of 75 MW, Jay Bryant, GE Vernova senior product manager—7E Gas Turbines, told POWER.

“We’re pretty happy with the 2,500 kg because we’re looking at a runtime of between about 30 minutes to three hours, depending on the percent hydrogen blend,” said Clift Pompee, Duke Energy’s managing director of Generation Technology. “The three hours is important because [the gas] units typically dispatch for about three hours—they are peaking units, so when they do dispatch, they only run about three hours during peak times in the evenings,” he noted.

However, the project’s more considerable prowess will be to show an “existing gas turbine can be retrofitted cost-effectively to go up to 100% hydrogen and a system that can be integrated end-to-end,” Pompee added. Duke Energy has pointedly developed DeBary as a smaller-scale project. The benefit, he suggested, is that it is well-suited to serve as a practical case study for future utility-scale integrated hydrogen power deployments, which must consider economics, scale, and application.

“I think that’s going to give people a lot more confidence to make investment decisions on either smaller or larger projects,” he said. “That’s what we want—we want the industry to continue moving forward. We’ll be part of that, and this our first [effort].”

A Small But Potentially Influential Project

When it comes online in 2024, the DeBary Hydrogen Project may be soon followed by the 300-GWh Advanced Clean Energy Storage Hub (ACES Delta), whose construction is underway in Delta, Utah, and is slated to begin operating in 2025. However, ACES Delta will start running its Mitsubishi Power M501JAC gas turbines with a hydrogen fuel blend of 30% before eventually ramping up to achieve a 100% hydrogen combustion volume. Another much-watched project, HYFLEXPOWER, is underway at a converted ENGIE 12-MWe combined heat and power (CHP) plant in France. The industrial-scale integrated hydrogen power-to-power demonstration featuring a Siemens Energy SGT-400 gas turbine recently powered its gas turbine with 100% renewable hydrogen.

While on a smaller scale, DeBary is an industry-led effort and will be commercially applicable, Pompee underscored. While Duke Energy’s team “wanted to do more,” it considered current market demand and risks—including inflation and wild card costs, he noted. “The limitation on the runtime has nothing to do with the hardware. It has nothing to do with the technology,” he said. “It has to do with just how much storage we have on-site,” he stressed.

Groundbreaking, marking the project’s first significant milestone, will follow nearly three years of meticulous planning and development, during which the project was rigorously shaped and refined to align with Duke Energy’s stringent standards for air permits and safety regulations, ensuring its compliance and adherence to environmental and safety norms.

According to Pompee, the project’s origins trace back to even before Duke Energy formed its Generation and Transmission Strategy segment, a business division now instrumental in steering the nation’s largest utility toward its ambitious net-zero goal announced in 2019. Its early stages were modestly supported by Duke Energy’s Vision Florida initiative—a program committed to exploring groundbreaking projects like microgrids, battery storage, and floating solar.

“As we started working more and more on the project, we really found some excellent project partners, including GE and Sergeant Lundy,” Pompee said. And as the project’s development progressed, its role in Duke Energy’s larger decarbonization roadmap became clearer.

The virtue of launching a demonstration—not just a pilot—also became clear, Pompee said. “We have some learnings that we’re trying to get out of the project,” he added. However, and “more importantly, the assets that we put into service will stay in service and will continue to add value to our fleet,” he noted.

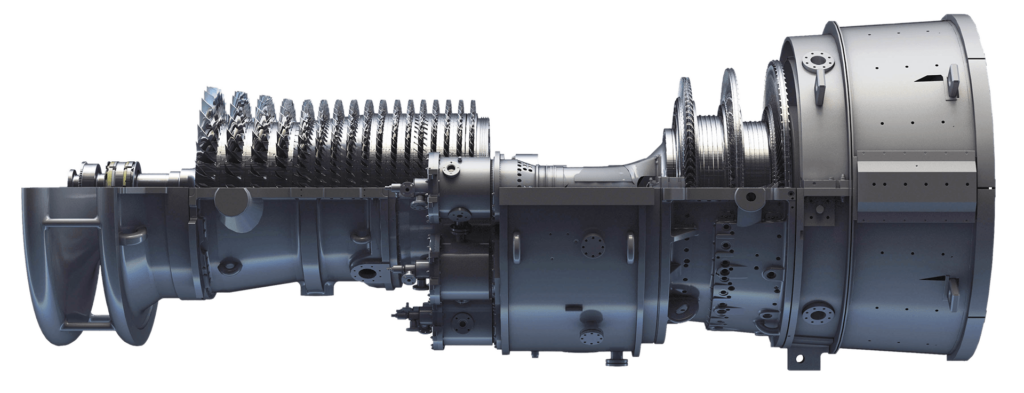

Getting an E-Class Ready for Decarbonized Peaking

Because the DeBary project will operate commercially—demonstrating market viability from its outset—its most significant undertaking will be successfully integrating modifications to the 7E gas turbine.

While GE Vernova has in recent years marked a series of notable hydrogen “firsts” as part of customer projects to test hydrogen combustion on H-class, F-class, and aeroderivative gas turbines, its industrial fleet—6B, 7E, and 9E gas turbine models—feature combustion systems that make them already technically capable of combusting 100% (by volume) hydrogen when blended with natural gas, Bryant explained. For example, the 7E in focus at DeBary uses a multi-nozzle quiet combustor (MNQC), a diffusion-based combustion system that has been implemented since the 1980s in turbines running on syngas and other low-BTU fuels.

“And so, they’re starting out with a gas turbine that has a tremendous amount of innate hydrogen capability,” he noted. “We just need to add some features to it.” The upgrade will integrate the fuel-blending skin, valves, and piping that can handle 100% hydrogen by volume and provide the operational flexibility needed to maintain plant reliability, he said.

As pivotally, the upgrade will transform the 7E “from a dual fuel unit with natural gas and distillate” capabilities to a “tri-unit” fuel unit, “where it could go natural gas, distillate, or hydrogen, or a blend of hydrogen and natural gas,” Bryant said. “We have this capability today, but there’s a few modifications needed to take it to 100% hydrogen, [such as] leak prevention gasket sealing, and a little bit better grade of metal to guard against embrittlement that occurs at these levels of hydrogen,” he said.

The installation “will be in commercial operation,” Bryant stressed. “It is not where we’re putting some temporary hardware on there and running it for a few hours. “This is going to be the configuration of the unit going forward, so they’ll have full fuel capability to play with however they need to go forward,” he said.

To ensure smooth project execution of the upgrade, GE says it has leveraged experience from “multiple engineering and consulting teams” worldwide. It notes it began working with Duke Energy as part of a hydrogen plant readiness assessment in 2021. GE has so far conducted testing at its combustion lab in Greenville.

“We’ve done a couple of rounds of testing, and we work together to demonstrate things—like nitrogen oxide (NOx) levels and water injection levels—to show that we can maintain everything that Duke has today from a permit compliance standpoint while running on the high production,” Bryant said. However, the demonstration will still offer valuable lessons both from a “control standpoint and a turbine operation standpoint,” he said.

A Key Objective: Optimal, Cost-Effective Operation

Among the project’s most prominent objectives is pinpointing a “sweet spot” for optimal operation.

“When we talk about the energy loss to electrolyze water to hydrogen, everybody understands it’s not a sustainable strategy to just pump energy in and electrolyze hydrogen because the energy loss doesn’t make sense,” said Pompee. However, he underscored that DeBary will utilize curtailed solar power sourced onsite, a factor that could contribute to the project’s pricing and convenience. “We’re not using power that would generally be going out into the grid,” he said.

And, when Duke Energy commissions the unit, it will test different fuel blends with specific testing criteria to determine how to run the project best, Pompee said. That may entail bringing in additional hydrogen to have longer runs. “And as we run it more, we’ll find the right blend that makes sense economically for the unit in terms of how quickly we’re able to generate hydrogen, in terms of how much curtailed power we have, and how often the unit gets dispatched,” he said.

“How to best dispatch the electrolyzers” will also be a crucial part of the “learning,” Pompee said. All these factors, however, underscore why running a full-scale integrated hydrogen system demonstration will be valuable, he noted.

Courtesy: Duke Energy

Defining a New Role for Gas Power: Decarbonized Peaking

The DeBary Hydrogen Project’s launch arrives as power markets ramp up their quest to seek decarbonized yet dispatchable assets that could bolster renewable energy integration cost-effectively. As the world’s power profile transforms, the power industry is increasingly concerned about reliability vulnerabilities during evening peaks. While influenced by a complex array of factors, some grids are already struggling to cover diminishing solar resources at sunset—particularly during periods of high demand.

Gas generation has typically provided the necessary short-term rapid ramp-up of dispatchable power to meet demand spikes. Most of the 1,000-plus peaker plants in the U.S., a combined 260 GW utilized to meet infrequent peaks in demand in the U.S., are fueled by natural gas, owing to their low capital costs. However, some estimates suggest 20 GW of peaking capacity may be needed over the next decade as power systems absorb more renewables.

Energy storage installations show promise as a decarbonized peaking alternative but suffer lifespan and efficiency limitations and prohibitive costs. As the National Renewable Energy Laboratory (NREL) explains in a recent technical report, storage plant peaking capacity offers two primary value sources: providing physical capacity to meet peak demand and time-shifting (or arbitrage), where energy is stored as low-cost off-peak energy and then utilized during periods of highest demand. By the end of 2022, about 90% of the 9 GW of energy storage added to the grid since 2010 had a duration of four hours or less, and 99% were lithium-ion batteries. Meanwhile, “The combination of the 4-hour capacity rule and the shape of the arbitrage value curve result in little economic incentive for deploying durations beyond 4 hours in many locations,” NREL noted.

That’s why hydrogen power-to-power appears so lucrative, Jeff Goldmeer, GE Vernova’s global Hydrogen Leader, suggested. “The value of hydrogen storage is it gives you the ability to time-shift renewables,” he said. “And if you have excess renewables, you can store the electricity as electricity,” he told POWER.

Duke Energy could accomplish this “with a lithium-ion battery to some degree,” he acknowledged, “but you really don’t want to have lithium-ion batteries replace every single gas turbine because of the scale of battery you need. If you have the ability now to time-shift renewables—not for two or four hours, but days or weeks or months—and do so at grid scale using existing assets, that’s a real win,” he said. “So it really does create this great opportunity for Duke and their rate base.”

A Broader Importance for the Future of Hydrogen Power

Decarbonizing gas power, however, has been elusive. In the U.S., the power industry has fiercely pushed back against a proposed Environmental Protection Agency (EPA) rule that sets limits on specific gas-fired combustion turbines that could apply within a decade. Industry has cited practical misgivings, including technology gaps, technical limitations, and, prominently, that clean hydrogen’s production and availability are currently severely limited.

The Electric Power Research Institute, for example, suggests that assuming a 75% capacity factor, the nation’s combined cycle gas fleet of around 160 GW presumably affected by the rule (which would be required to fire a 30% volumetric-based hydrogen blend), would need a combined 7 million metric tons. (Domestic hydrogen production in 2021 hovered at 10 million metric tons, and 95% was not clean hydrogen.) And even if water electrolysis becomes an established production method, more than 200 GW of new renewable power may be needed by 2030 to support demand, industry has pointed out, citing the Department of Energy’s (DOE’s) own estimations.

To address the crucial hydrogen supply gap, the DOE recently unveiled seven hydrogen hubs that will receive $7 billion in Bipartisan Infrastructure Law funding. Notably, it passed over the Southeast Hydrogen Hub, a proposal submitted by Duke Energy and five other utilities. While disappointed the hub was not selected, Duke Energy said it would “continue to seek opportunities to partner with DOE, peer utilities, and other stakeholders to advance clean hydrogen in ways that will benefit our customers and our communities.”

Meanwhile, the power industry remains skeptical about the widespread adoption of hydrogen combustion, mainly because the handful of hydrogen test burns have been limited to lower volumes and span a short duration. In comments to the EPA this August, major gas generators across the nation bluntly said hydrogen combustion still fell far short of “adequately demonstrated.”

Some, including Duke Energy, lambasted the EPA for failing to distinguish between “capability” and “feasibility.” “EPA’s expectation that the supply and infrastructure to support the new standards will be in place in less than a decade is an illogical interpretation of the term ‘adequately demonstrated,’ as it ignores costs, permitting and interconnection challenges, and siting issues while jeopardizing the reliability and affordability of the nation’s generating fleet,” the utility told the agency.

Costs, in particular, remain a significant concern. Utilities—which typically operate conservatively with reliability and customer affordability as paramount priorities—have suggested that units equipped to burn hydrogen may not be dispatched for power until a hydrogen technology and market have been developed, costs for electrolysis and storage have fallen, and enough carbon-free energy surpluses become available to allow adequate hydrogen production.

A Flagship Demonstration for Duke Energy

But for Duke Energy, waiting for an industry breakthrough is not an option. The utility holds 21 existing combined cycle units—including several affected by the EPA’s proposed rule—that rely on fuel oil as a backup fuel source, especially during winter peaks. This August, it stressed to the EPA that “to accommodate hydrogen, manufacturers would have to provide a burner for combustion turbines that can burn three fuels”—hydrogen, oil, and natural gas. It noted to date that “Only one of three major gas turbine manufacturers has a proven burner design to accommodate three fuels.”

Meanwhile, as part of its net-zero ambitions, Duke Energy is already navigating the largest coal retirement in the industry, aiming to achieve a total coal phaseout (currently 17% of its generation mix) by 2035. To meet its 2050 goal while continuing to serve electricity demand—which could surge as electrification expands—the company is pursuing expanding its renewable fleet, seeking to own, operate, or contract 30 GW of regulated wind and solar by 2035. At the same time, it estimates it needs 40 GW of new dispatchable, zero-emitting load-following resources.

That’s another reason DeBary is poised to become a flagship demonstration for the company, Pompee suggested.

While DeBary’s precise replicability is limited—given the 7E’s niche combustion system—the project could model new approaches that provide optionality, he said. He noted that Duke Energy holds a large 7E fleet and is active in 7E and 7F user groups. “So any of those units with the right combustion system could be upgradeable, in the same way we’ve done with [DeBary],” he said.

However, “Our plans today are that we don’t have any plans to expand this particular facility now,” he said. “But our plans are to learn as much as we can for the peaking unit.”

Along with DeBary, Duke Energy is evaluating other hydrogen options. It is, for example, currently testing a GKN metal hydride hydrogen generation, storage, and electricity production unit, which consists of an electrolyzer, hydrogen storage, and fuel cell in one containerized solution.

“And then we have other projects that we’re evaluating for a baseload unit,” Pompee said. “We will start to learn—because they are different in how you dispatch them, how you operate them, and how you integrate the systems and everything else. And then we intend to stay leaders, engaged in the hydrogen space, and when the cost of hydrogen and electrolyzers really start to come down, then we start to dispatch more hydrogen, we start to put in more hydrogen projects,” he said.

Still, “those plans are in the future, and even though we have decarbonization plans today, they’re really fluid,” he said.

Ultimate Value: Flexibility, Seasonal Storage, Avoided Stranded Assets

Both GE and Duke Energy told POWER that DeBary’s most significant contribution to industry efforts lies in the opportunity to assess an integrated system as a whole—and in a real-world setting. “It’s the ability to have all these systems onsite to examine their operation together, all the way up to 100%,” Goldmeer emphasized. “It gives Duke Energy not just the flexibility, but it gives them the ability to do the carbon reduction all the way down to near-zero carbon reduction when running on 100% hydrogen,” he said.

“It’s not clear to me what other power plant facility in the world will have that ability to produce power on demand with zero-carbon emissions, based on running 100% hydrogen,” he added. “That makes us incredibly unique.”

Goldmeer also noted DeBary is a larger power plant with room to grow. “There’s more than one unit at the site. As solar becomes more available, as more storage becomes available, Duke can scale up.” That capability arms Duke Energy with “more competencies,” he noted.

Pompee agreed. “We think of hydrogen essentially as storage as opposed to fuel,” he said. But the DeBary project is almost “kind of splitting the difference between, like your traditional battery and this chemical storage, which we understand,” he said.

An inherent benefit is having the capability to store excess solar generation during the shoulder months [in spring and fall] and then deploy it as dispatchable generation in the winter. “You can’t do seasonal storage with batteries,” he said.

It’s true that in “today’s world, for a few hours of generation, you’re better off to deploy lithium-ion,” Pompee acknowledged. “But this project isn’t meant to compete with lithium-ion,” he said. “It’s meant for us to start our journey toward decarbonization,” with the view that “there are gas assets that we have in our fleet that will continue to operate beyond 2050 when we are at net-zero, and our net-zero strategy calls for those dispatchable resources to be fired on hydrogen.”

“That’s where we see the value: it’s avoided stranded assets as well as seasonal storage,” he said.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).