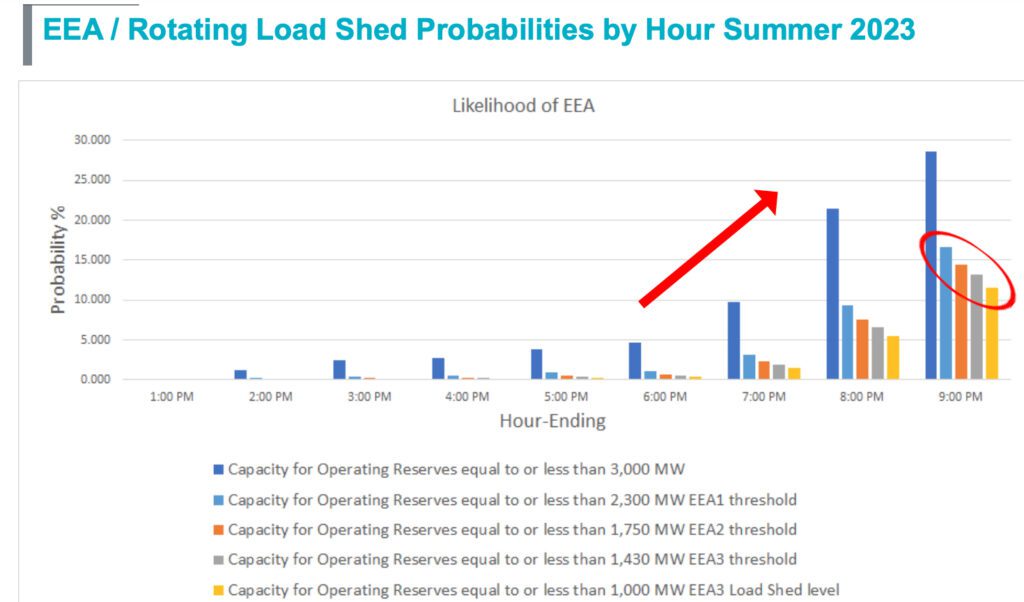

ERCOT’s Energy Emergency Risk Has Shifted from Late Afternoon to Early Evening

Modeling from the Electric Reliability Council of Texas (ERCOT) suggests an 11% probability of having a load shed issue on a peak day this summer, an official said during a reliability committee meeting on June 19.

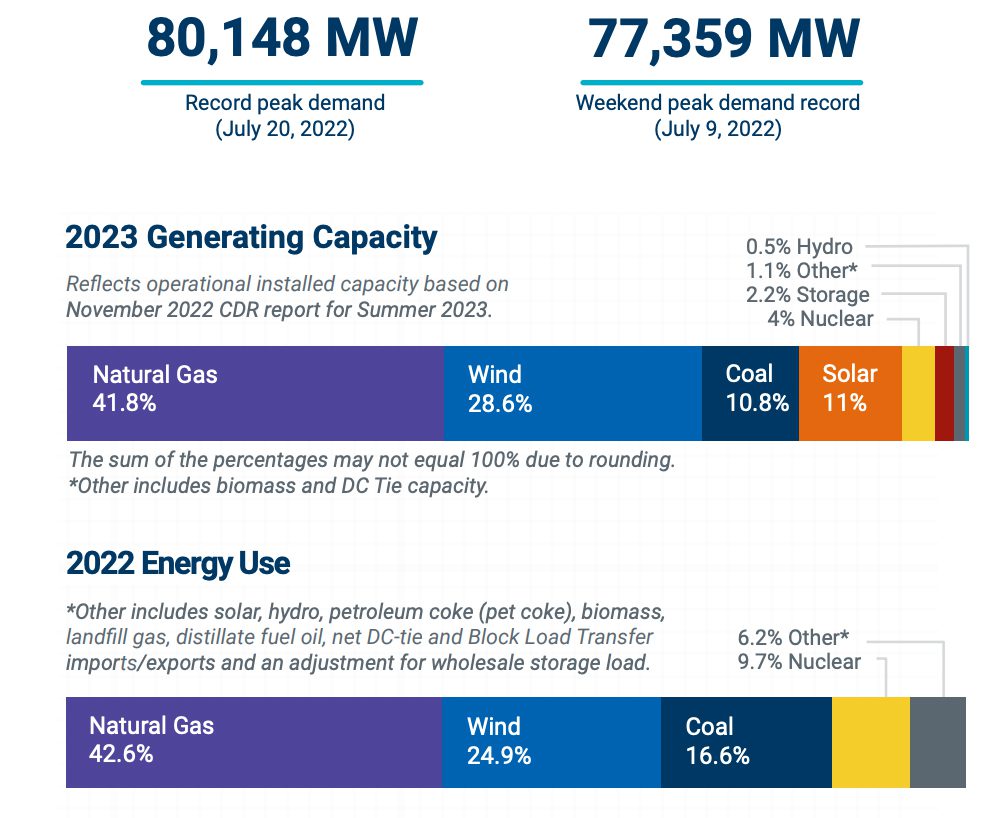

The Texas grid, which was tested this week by a record-breaking heat wave, issued a weather watch and a voluntary conservation notice. On Monday, peak demand at ERCOT stood at 79,304 MW, far surpassing last June’s record of 76,718 MW, and inching close to the grid’s current all-time record of 80,148 MW, which was set on July 20, 2022. The grid operator noted that it set 11 new peak demand records during the summer of 2022.

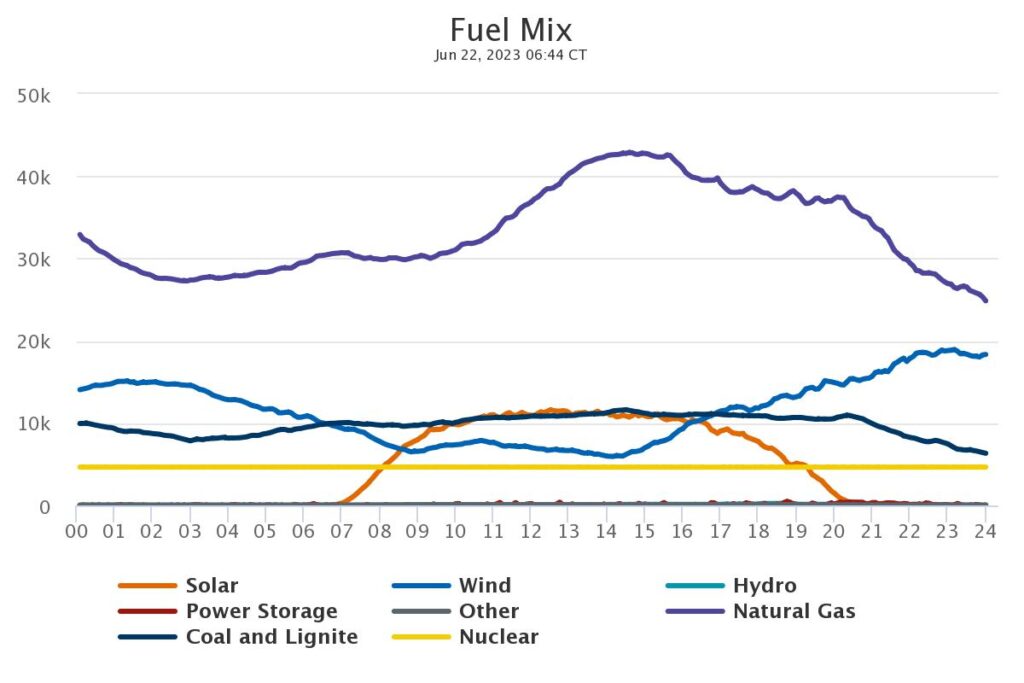

According to Woody Rickerson, vice president of ERCOT System Planning and Weatherization, new internal modeling—the Probabilistic Reserve Model (PRM)—suggests the grid’s profile for load shed risk dramatically ramps up after 7 p.m., when the sun sets and its solar generation diminishes.

Predicting Reliability Amid Several Risk Variables

The PRM uses Monte Carlo simulations, a model that predicts a variety of outcomes based on an estimated range of values versus a set of fixed input values. It essentially performs simulations of future “capacity available for operating reserves (CAFOR)” for a seasonal peak load day. “The model generates 10,000 CAFOR outcomes for a range of summer peak day hours—from 1 p.m. to 9 p.m.—rather than just the single peak load hours like the [Seasonal Assessment of Resource Adequacy (SARA)] report,” Rickerson explained.

Variations in CAFOR outcomes are sourced from a random sampling of probability distributions for peak demand, unplanned thermal outages, wind output, solar output, and other resource risk variables. “Based on the range of hourly [CAFOR] outcomes, the model reports the probability that capacity is not going to be enough to cover load,” he said.

Significantly, the model also accounts for resources available prior to and after Energy Emergency Alerts (EEAs) have been declared. “When you declare an EEA, there are some additional resources that you have access to. It does include those as well,” Rickerson added. The model, an extension of ERCOT’s SARA analysis, will be incorporated into the grid operator’s future Monthly Operational Reliability Assessment, he said.

But for this summer, the model suggests that the likelihood of an EEA is especially elevated between 8 p.m. and 9 p.m., particularly when the capacity for operating reserves is less than 3 GW. Referencing the figure below, Rickerson noted the yellow bar—which represents a load shed—hovers at an 11% probability. “If we had this model and ran it three years ago, the bars would have peaked at 5 p.m.,” he said.

“What’s changed in the last three years has been this huge influx of solar. Solar has taken [most of] the risk out of 4 p.m. and 5 p.m.” But risks ramp up once the sun sets, he said.

ERCOT noted that wind power production will continue “to be important for maintaining sufficient reserve capacity during the afternoon and evening hours.” The simulation, meanwhile, also includes 720 MW of batteries available at a given hour, Rickerson noted. “We’re really in a learning process on batteries right now,” he added. “But the idea is that energy from batteries will start showing up to make up for when the sun goes down and that solar ramp happens.” Ultimately, “the more of those we get, the better off that will be,” he said.

Dependent on Wind. ‘That’s Just Where We Are.’

During an ERCOT Board of Directors Meeting the following day (on June 20), Rickerson underscored that for now, ERCOT expects sufficient resources to serve demand under “normal” summer conditions. Forecasts suggest that while half the state could see near-normal or below-normal temperatures, the other half will endure above-normal temperatures. Temperatures, however, may not be “not as extreme as 2022” in part due to a developing El Niño, the grid entity projected.

However, along with heightened shortage risks after sunset, “tighter conditions are possible with some combinations of low wind/solar and high thermal outages at times of high demand,” Rickerson warned. “The assessment of resource adequacy for high-demand days is going to be very dependent on wind,” he added. “That’s just the reality of where we are.”

ERCOT’s base peak demand forecast for summer 2023 is 83,414 MW, including 1,105 MW of large flexible loads (which may reduce their consumption under demand response mechanisms). The current planning reserve margin for summer 2023 is 23%—on par with summer 2022. The May 3–released SARA for summer 2023, meanwhile, estimates total resources of 97 GW, including 10.4 GW of wind, and 12.6 GW of solar.

But the projections are wary of several wildcards, including forced generator outages. “If you have more than 5,000 MW [of forced outages], that could be a problem.” A “low wind or a low solar day” could also be a problem. Another precarious risk is sustained high demand. “If we were to maintain over 80,000 MW after the sun goes down, then you have a pretty significant load shed number there of –3,000 MW,” Rickerson said.

A Changing Resource Profile

Rickerson on Monday also highlighted an emerging “trend” that suggests more battery energy storage systems are being connected on the distribution level. “I think that seven to 10, 12 to 15, those kind of numbers are going to be showing up [for operational modeling] every single month,” he said.

“Those aren’t going to be very big because they’re at the distribution level. But it does show that these new resources are showing up at the distribution level, which means that ERCOT and [transmission system providers and distribution system providers] are going to have to spend more time working together to get that accounted for in our operational and planning models.” Batteries already made up 66% of ERCOT’s generation interconnection queue over the last 60 days, he noted.

Looking ahead, ERCOT expects its summer 2024 reserve margin will be much higher—34.1% (though it is lower than the 39.9% margin projected in ERCOT’s November 2022 Capacity Demand, and Reserves Report). The higher margin projects a ramp-up of solar capacity additions, much of which have been delayed from prior years.

The grid entity is also currently studying a new reliability standard that could set an official reserve margin, Rickerson noted. In the past, ERCOT has operated with an unofficial 13.75% flat reserve margin.

In addition, on June 10, it began procurements for the ERCOT Contingency Reserve Service (ECRS), the first “daily procured ancillary service” the grid operator has introduced in more than two decades. ERCOT said the ECRS “will complement and provide support to” the four procured Ancillary Services ERCOT currently uses: Regulation Up, Regulation Down, Responsive Reserve Service and Non-Spin Reserve Service. The ECRS can provide “additional capacity that can ramp in 10 minutes to respond to short-term net load ramps,” it added.

In tandem, the grid operator is validating its physical responsive capability (PRC) and dispatch capability through timely resource telemetry and current operating plan changes (NPRR 1085). This measure is designed to improve the quality of PRC, particularly when generating units cannot follow dispatch or provide reserves.

Federal Environmental Regulations Posing Fresh Uncertainty for Texas Grid

What the grid operator’s future resource mix will look like, however, remains uncertain given a spate of recently finalized and proposed federal environmental regulations.

While the Environmental Protection Agency’s (EPA’s) Good Neighbor Plan (GNP) would have required generators in the state to comply with nitrogen oxide (NOx) restrictions starting this summer, Texas in May secured a stay of the EPA’s denial of its final state implementation plan (SIP) at the Fifth Circuit. On June 1, the EPA issued a memo acknowledging the stay of the SIP “precludes application” of the rule in Texas until the stay is lifted. Texas earlier this month also filed a lawsuit challenging the rule. “It’s highly unlikely that GNP will apply in Texas in summer 2023,” Chad Seely, ERCOT senior vice president, general counsel, and corporate secretary, said on Tuesday.

However, the EPA is “in the process of adopting a number of new rules that will impact gas and coal generating facilities in the near-term and in the longer-term,” he noted. These include the EPA’s May 2023–proposed Greenhouse Gas Rule. That rule “has a longer-term impact, but it’s very aggressive,” Seely said. “We’re in the process of evaluating that as well.”

In addition, the EPA in April proposed a Texas Regional Haze Federal Implementation Plan (FIP) intended to improve visibility in national parks and wilderness. The rule would affect 6.7 GW from nine units: Martin Lake 1 to 3; Fayette 1 and 2; WA Parish 4 to 6; and Coletto Creek 1 (which is slated to retire in 2027).

Proposed revisions to the 2012 Mercury and Air Toxics Standards (MATS) could also require compliance. Finally, the EPA’s April-proposed Tailpipe Rule could impose greenhouse gas emissions reductions on light, medium, and heavy-duty vehicles with model-years of 2027 and later. “EPA estimates a 67% adoption rate for electric vehicles (EVs) by 2032 under the rule compared with the current 6% adoption rate,” said Seely. While ERCOT doesn’t expect to comment on the rule, it is watching it carefully because it could have a “significant impact on future system load, requiring adjustments to expected EV growth scenarios,” he said.

Seely noted ERCOT coordinates with the Public Utility Commission, the Texas Commission on Environmental Quality, and when necessary, the attorney general’s office. “But most importantly, we have to engage the generators to understand what the direct impact is,” he said. “They are really in the best position to tell us what the overall impact is.”

For now, the cumulative impact of the environmental rules will be “difficult to ascertain because depending on the fleet, the timing, and the overall economics, it’s going to have a different impact on what that means long-term. So that’s going to be very difficult to do an overlay of what all these EPA regulations mean to tie it to our dispatchable fleet,” Seely said.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).