U.S. Unveils Seven Regional Hydrogen Hubs, Awards $7B to Kickstart National Hydrogen Network

Seven regional hydrogen hubs spanning Appalachia, California, the Midwest, the Gulf Coast, the American heartland, the Mid-Atlantic, and the Pacific Northwest are poised to receive $7 billion in Infrastructure Investment and Jobs Act (IIJA) funding under the Department of Energy’s (DOE’s) Regional Clean Hydrogen Hubs Program (H2Hubs).

The selections, unveiled by the Biden administration on Oct. 13, are now expected to enter into award negotiations with the DOE’s Office of Clean Energy Demonstrations (OCED). OCED on Friday noted that selection for award negotiations “is not a commitment by DOE to issue an award or provide funding.” Before awards are issued, the DOE and its applicants “will undergo a negotiation process, and DOE may cancel negotiations and rescind the selection for any reason during that time,” it said.

The DOE said the seven hubs vying for the lucrative billion-dollar opportunity first introduced in September 2022, were selected for their technical merit, financial and market viability, proposed speed of deployment, project management, and community benefits.

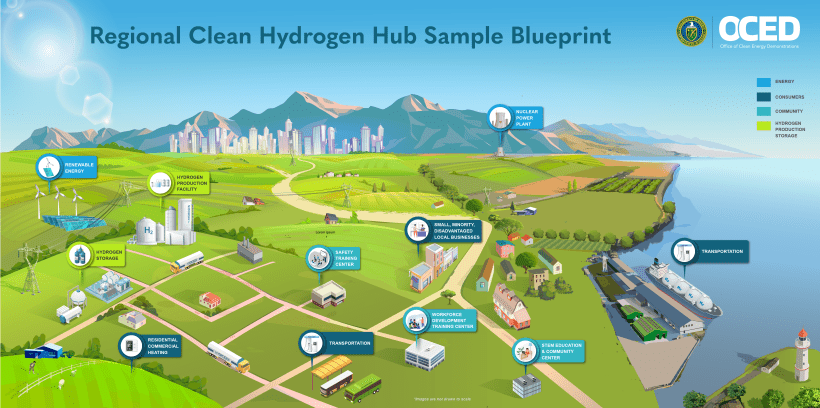

The hubs are expected to form the foundation of a national clean hydrogen “network” that could demonstrate the production, processing, delivery, storage, and end-use of hydrogen. The White House on Friday said that combined, the seven hubs could produce more than 3 million metric tons of “clean hydrogen” per year, achieving nearly a third of the U.S.’s 2030 clean hydrogen production goal.

A Major Step for the DOE

The DOE on Friday suggested the awards conform to federal guidance for what constitutes “clean hydrogen.” Clean hydrogen, it said, “refers to hydrogen produced through electrolysis—separating liquid water into hydrogen—using renewable or low-carbon emissions energy sources, such as wind, solar or nuclear. Clean hydrogen can also refer to hydrogen produced using steam methane reforming with carbon capture and permanent storage (CCS) technologies that reduce greenhouse gas emissions.”

The DOE said its hub selections followed “rigorous reviews of eligible submissions” conducted by internal and external reviewers who are “experts in the subject matter of the funding opportunity announcement.” Selection officials “considered the recommendations of the reviewers with respect to individual proposals, but also applied a portfolio approach to ensure the selected projects satisfied all of the statutory requirements with respect to feedstock diversity, end-use, and geographic diversity,” it said. “In this last regard, the seven hydrogen hubs selected represented seven different regions of the country.”

The selections now move the program to the second phase of the four-phase DOE H2Hubs program. Phase 2 will finalize engineering designs and business development, site access, labor agreements, permitting, offtake agreements, and community engagement activities. Phase 3 is slated to focus on implementation necessary to begin installation, integration, and construction activities, and it will be followed by Phase 4, which “ramp-up the H2Hub to full operations including data collection to analyze the H2Hub’s operations, performance, and financial viability,” the DOE said.

Each finalized H2Hub will be required to provide a minimum of 50% non-federal total project cost. Hubs will be executed over a broad timeframe of about 8 to 12 years (or sooner), “depending on the size and complexity of the H2Hub, the DOE said.

Here’s a brief overview of the projects selected, ordered by the DOE’s announced federal cost-share for each project.

| Project Name | Region | Selectee/Prime Contractor | Federal Cost-Share Amount |

| California Hydrogen Hub | California | Alliance for Renewable Clean Hydrogen Energy Systems (ARCHES) | Up to $1.2 billion |

| Gulf Coast Hydrogen Hub | Texas |

HyVelocity H2Hub/GTI Energy |

Up to $1.2 billion |

| Midwest Hydrogen Hub | Illinois, Indiana, and Michigan | Midwest Alliance for Clean Hydrogen (MachH2) | Up to $1 billion |

| Pacific Northwest Hydrogen Hub | Washington, Oregon, and Montana | PNW H2 | Up to $1 billion |

| Appalachian Hydrogen Hub | West Virginia, Ohio, and Pennsylvania | Appalachian Regional Clean Hydrogen Hub (ARCH2)/Battelle | Up to $925 million |

| Heartland Hydrogen Hub | Minnesota, North Dakota, South Dakota, Montana |

Heartland Hub (HH2H)/Energy & Environmental Research Center (EERC) |

Up to $925 million |

| Mid-Atlantic Hydrogen Hub | Pennsylvania, Delaware, and New Jersey | Mid-Atlantic Clean Hydrogen Hub (MACHH) | Up to $750 million |

Up to $1.2B for the California Hydrogen Hub

The state of California’s proposed hub, led by the Alliance for Renewable Clean Hydrogen Energy Systems (ARCHES), is expected to provide a “blueprint for decarbonizing public transportation, heavy-duty trucking, and port operations—key emissions drivers in the state and sources of air pollution that are among the hardest to decarbonize,” the DOE said. “In particular, the California Hydrogen Hub will introduce clean hydrogen to heavy-duty transport through cargo handling equipment and drayage to support the eventual conversion of maritime equipment at ports and prepare the port for the potential export of hydrogen.”

Notably, along with enabling new hydrogen-power transportation potential, the hub will launch the use of hydrogen for power generation.

Up to $1.2B for the Gulf Coast Hydrogen Hub

Centered in Houston, the Gulf Coast Hydrogen Hub covers much of the Texas coast. The hub, spearheaded by prime contractor HyVelocity Inc., plans large-scale hydrogen production for industrial decarbonization using natural gas and carbon capture, and renewable-powered electrolysis.

To help lower the cost of distribution and storage and reach more hydrogen users, the Gulf Coast Hydrogen Hub plans to develop salt cavern hydrogen storage, a large open access hydrogen pipeline, and multiple hydrogen refueling stations,” the DOE said. It will use “hydrogen for fuel cell electric trucks, industrial processes, ammonia, refineries and petrochemicals, and marine fuel (e-Methanol).”

The hub will leverage “the world’s largest concentration of existing hydrogen production and end-use assets in Texas and Southwest Louisiana,” HyVelocity said on Friday. The industry-led hub notably includes seven core industry partners—AES Corp., Air Liquide, Chevron, ExxonMobil, Mitsubishi Power Americas, Ørsted, and Sempra Infrastructure. HyVelocity is administered by GTI Energy. It also includes a wide array of organizations, including organizing participants, the University of Texas at Austin, The Center for Houston’s Future, and the Houston Advanced Research Center.

Asked about power generation project specifics, GTI Energy on Friday told POWER it will provide more information as it gets guidance from the DOE and corporate partners “in the coming weeks.” The first phase of the DOE program includes “several months of planning and project refinement” where these end-use applications will be further defined, it said.

GTI Energy noted, however, that “HyVelocity has multiple end-use applications in its proposed portfolio, which may include power generation using hydrogen/natural gas blends and it also may include on-site power generation via fuel cells. Other end-use applications include the production of clean ammonia, marine fuel, and hydrogen for heavy-duty vehicle fueling.”

Up to $1B for the Midwest Hydrogen Hub

Led by the Midwest Alliance for Clean Hydrogen (MachH2), the Midwest Hydrogen Hub covers Illinois, Indiana, and Michigan. The hub is located in a “key U.S. industrial and transportation corridor,” the DOE said. It will “enable decarbonization through strategic hydrogen uses including steel and glass production, power generation, refining, heavy-duty transportation, and sustainable aviation fuel.”

After announcing its bid and initial concept paper in November of 2022, MachH2 received a letter of encouragement from the DOE in December of 2022. In February, MachH2 announced it had joined forces with the Indiana-led Midwest Hydrogen Corridor Consortium as a single hub.

“MachH2 will use the rich diversity of existing and new clean generation resources including nuclear and renewables in Illinois and Michigan, and blue hydrogen utilizing carbon capture and sequestration in Indiana,” MachH2 told POWER on Friday.

Power industry entities affiliated with MachH2 include Ameren Illinois, Big Rivers, Bloom Energy, BP, ComEd, Constellation, Exelon, Holtec, Invenergy, NiSource, and Plug Power.

Constellation Energy, the largest producer of nuclear energy in the U.S., on Monday, said it plans to use a portion of the MachH2 funding to build “the world’s largest nuclear-powered clean hydrogen facility” at its 2.3-GW LaSalle Clean Energy Center in Illinois. “The project will produce an estimated 33,450 tons of clean hydrogen each year and create thousands of good-paying jobs. Constellation estimates its LaSalle clean hydrogen facility will cost about $900 million, with a portion of the MachH2 award offsetting the project’s cost.” The project will “employ lessons” learned from Constellation’s 1 MW demonstration-scale, nuclear-powered clean hydrogen production facility at the Nine Mile Point Clean Energy Center in Oswego, New York.

Up to $1B for the Pacific Northwest Hydrogen Hub

The Pacific Northwest Hydrogen Hub (PNWH2), spearheaded by the Pacific Northwest Hydrogen Association, covers Washington, Oregon, and Montana. It plans to “leverage the region’s abundant renewable resources to produce clean hydrogen exclusively via electrolysis,” the DOE said.

The hub’s key priority is to vastly develop and use electrolyzers to fuel a hydrogen fuel cell vehicle expansion in heavy-duty trucking. “This will help enable the development of a West Coast freight network that addresses refueling gaps and further clean transportation expansion. Other hydrogen uses include agriculture (fertilizer production), industry (generators, peak power, data centers, refineries), seaports (drayage, cargo handling), and aviation (regional, drones), where it will serve to decarbonize some of the highest emission drivers in the region,” the DOE said.

The PNWH2 hub’s developer Pacific Northwest Hydrogen Association on Friday said it is eligible to receive up to $1 billion in federal funding over four DOE-defined development phases spanning nine years, with $20 million allocated for Phase 1. “DOE will evaluate the hub’s activities and deliver go/no-go decisions at each phase,” it noted. PNWH2 will begin negotiating final funding and scope for the hub “beginning this fall.”

Several companies have proposed projects as part of the hub, it noted. Power industry entities include Air Liquide Hydrogen Energy US LLC, ALA Renewable Energy LLC, Mitsubishi Power Americas, Inc., Portland General Electric Company (PGE), Puget Sound Energy (PSE), PUD No. 1 of Douglas County, Regis Solar, LLC, USA Fortescue Future Industries, Inc., and Williams Field Services Group, LLC.

Other entities involved in the hub include Amazon.com, Inc., Atlas Agro, Centralia College, Northwest Seaport Alliance, NovoHydrogen Development, Inc., PACCAR Inc., Synchronous LLC dba First Mode, and Twin Transit.

Up to $925M for the Appalachian Hydrogen Hub

The DOE said it chose the Appalachian Hydrogen Hub (ARCH2), proposed by West Virginia, Ohio, and Pennsylvania, given its “strategic location” and development of hydrogen pipelines, multiple hydrogen fueling stations, and permanent CO2 storage. These facilities, located in a coal- and gas-rich region, have the potential to drive down the cost of hydrogen distribution and storage, the DOE said.

Lead project development partners under ARCH2 include Air Liquide, The Chemours Company, Clearway Energy Group, CNX Resources Corp, Dominion Energy Ohio, Empire Diversified Energy, EQT Corporation, Fidelis New Energy, First Mode, Hog Lick Aggregates, Hope Gas Inc., Independence Hydrogen Inc., KeyState Energy, MPLX, Plug Power, and TC Energy.

Battelle, a key national laboratory contractor, will serve as the prime contractor for the hub. ARCH2 was formed through a partnership with the State of West Virginia, EQT Corporation, the nation’s largest natural gas producer; Battelle and GTI Energy; with expertise executing clean energy programs for the federal government; and Allegheny Science & Technology (AST), a leading West Virginia energy technology consulting firm.

Up to $925M for Heartland Hydrogen Hub

Spanning North Dakota, South Dakota, Minnesota, and Montana, the Heartland Hub will decarbonize the agricultural sector’s production of fertilizer. The Heartland Hub, led by the Energy & Environmental Research Center (EERC), also plans to use hydrogen for power generation “in a manner that may catalyze co-firing hydrogen in utility-owned generation across the country,” the DOE said.

The hub includes Xcel Energy, Marathon Petroleum Corp., and TC Energy, in collaboration with the University of North Dakota’s Energy & Environmental Resource Center.

Up to $750M for the Mid-Atlantic Hydrogen Hub

The Mid-Atlantic Hub (MAHH), which spans the Delaware River and includes Pennsylvania, Delaware, and southern New Jersey, is expected to repurpose historic oil infrastructure and using existing rights-of-way. The hub will also develop “renewable hydrogen production” facilities from renewable and nuclear generation using “both established and innovative electrolyzer technologies.”

The overall challenge to hydrogen production is cost. DOE’s Hydrogen and Fuel Cell Technologies Office is focused on developing technologies that can produce hydrogen at $2/kg by 2026 and $1/kg by 2031 via net-zero-carbon pathways, in support of the Hydrogen Energy Earthshot goal of reducing the cost of clean hydrogen by 80% to $1 per 1 kilogram in 1 decade (“1 1 1”).

Power industry entities affiliated with MAHH include Baltimore Gas and Electric, BHE GT&S, Competitive Power Ventures, Constellation Energy, Delmarva Power, Dominion Energy, Exelon, Independence Hydrogen, Inc., Pepco, Port of Virginia, Washington Gas.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).

Editor’s Note: This is a developing story that is actively being updated. As this story continues to unfold, POWER magazine remains dedicated to delivering comprehensive updates. Please check back for further details as they become available. Last updated: Oct. 19, 10:00 a.m. CST