Offshore Wind Surge Threatens Merchant Generator Profits

Two recent project announcements indicate that the U.S. offshore wind sector is burgeoning, bolstered by falling prices and ramped-up political support. A credit ratings agency warns, however, that the sector’s growth could increasingly pressure profit margins of merchant generators in New England, New York, and New Jersey.

On March 14, Danish offshore giant Ørsted and New England transmission builder Eversource jointly announced their Bay State Wind project became the first and only offshore project to be covered under Title 41 of the Fixing America’s Surface Transportation Act, a federal law signed by President Obama in December 2015. Title 41 of the law (42 U.S.C. § 4370m et seq.), referred to as “FAST-41,” created a new governance structure, set of procedures, and funding authorities to improve the federal environmental review and authorization process for covered infrastructure projects, the developers said.

The developers propose to locate the 400-MW to 800-MW project 25 miles off the Massachusetts South Coast, and 15 miles off the coast of Martha’s Vineyard. Bay State Wind’s participation in the FAST-41 permitting process will not only encourage greater efficiencies and time savings in navigating the federal permitting process, but it will also provide greater confidence that the permitting schedule identified in its bid is reasonable and achievable, the developers said.

Bay State Wind is one of the nation’s first utility-scale offshore wind projects, but the speed at which it has progressed is notable. The companies submitted a bid for the project in December 2017 in response to Massachusetts’ first request for proposals for offshore wind energy. “Last year we were the first to receive approval of an offshore wind Site Assessment Plan, and our pursuit and recent designation of FAST-41 underscores Bay State Wind’s credentials as the most experienced, dependable partner to help Massachusetts realize its ambitions of becoming the hub for offshore wind development in North America,” said Ørsted North America President Thomas Brostrøm.

California Floating Offshore Project Buoyed by Selection

On April 3, meanwhile, the Redwood Coast Energy Authority (RCEA)—which is a local government joint powers agency in California—said it selected a consortium of companies comprising Principle Power Inc., EDPR Offshore North America LLC, Aker Solutions Inc., H. T. Harvey & Associates, and Herrera Environmental Consultants Inc. to enter into a public-private partnership to pursue the development of an offshore wind energy project off the northern California coast. The consortium was one of six respondents to a request for qualifications issued by the authority on February 1.

The proposed project is a 100-MW to 150-MW floating offshore project planned about 20 miles off the coast of Eureka that will use Principle Power Inc’s WindFloat technology, a floating wind turbine foundation that allows developers access to transitional and deepwater offshore wind sites, opening up new markets and potentially decreasing the cost and risk of offshore wind projects.

“The project will pave the way for offshore wind energy off the West Coast and may be the first project to unlock the extraordinary value of offshore wind energy for California,” RCEA and project developers said in a joint statement.

The developers have both offshore wind lease application and permitting experience, a mature and cost-competitive floating wind technology suited to Humboldt County’s unique geography, and the capacity to develop, finance, operate, and build a supply chain to support this project as well as future projects.

RCEA and consortium participants will now work to negotiate and finalize a partnership agreement in the coming weeks, working toward the goal of submitting a lease application later this spring.

U.S. Offshore Wind Poised for Rapid Growth

The two developments are significant for the offshore wind market in the U.S., which to date has put online only one wind farm: The 30-MW Block Island project in Rhode Island. That project, a POWER magazine 2017 Top Plant, features five 6-MW GW Haliade wind turbines, each towering 560 feet.

For now, the U.S. continues to lag far behind a number of countries. In its March-released annual Global Wind Statistics, the Global Wind Energy Council (GWEC) said a total 18.8 GW of offshore wind capacity was installed at the end of 2017 worldwide—a jump from the 14.5 GW installed at the end of 2016. Most is in the UK (6.8 GW), Germany (5.3 GW), China (2.8 GW), Denmark (1.3 GW), and the Netherlands (1.1 GW). Growth in these countries is in part due to prices that have plunged over the past five years. For example, while the UK’s Hornsea I project tendered at $182/MWh in 2014, results of the co-located Hornsea II tender in the fall of 2017 came in at $76/MWh—about 40% lower.

As noteworthy are European projects that have recently bid without subsidies, anticipating that technological advances will make offshore wind competitive. These companies include Ørsted and EnBW Energie Baden-Wuerttemberg AG. In March, Vattenfall subsidiary Chinook C.V. secured a Dutch permit to build and operate a 700-MW offshore wind farm based on a subsidy-free bid.

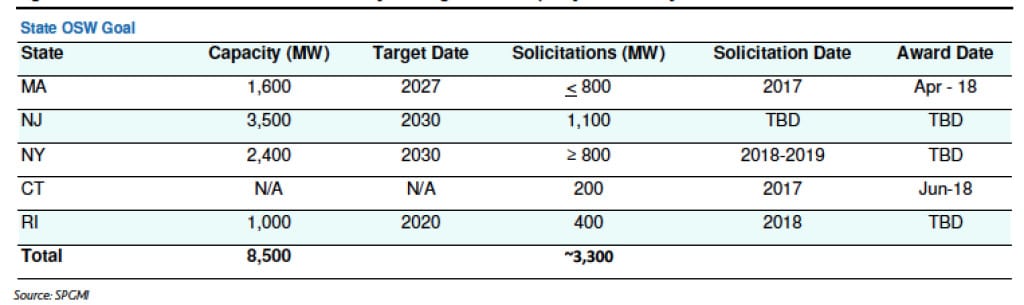

According to Moody’s Investors Service, however, the U.S. offshore wind market is poised to grow dramatically—though not until after 2020. In a March 29 report titled “Offshore Wind Is Ready for Prime Time,” the ratings agency noted that more than 13 GW of offshore wind is under development in the U.S., buoyed by political and regulatory support in states like Massachusetts, New York, and New Jersey, which have established a legislative or offshore wind policy target supporting the development of 7.5 GW of generation capacity by 2030.

Ill Winds from Offshore Forecast for Merchant Generators

New England, New York, and New Jersey, specifically, could lead the offshore charge because they benefit from good wind speed, relatively shallow waters, and demand centers—but also because they have similarities with northern Europe, such as “a scarcity of natural gas supplies, geographical constraints and ambitious renewables goals,” the agency said.

Another significant consideration is that U.S. offshore wind prices have plunged over the past few years. “The power purchase agreement for Block Island, the first operational U.S. [offshore wind] project, was priced at $244/MWh for a 2016 operational date, while the Maryland-based Skipjack and Ocean City projects secured long-term procurement contracts at $132/MWh in 2017,” Moody’s noted. “Industry forecasts costs declining to $80/MWh in select regions longer term.”

Moody’s, which provides credit ratings, research, and risk analyses, concluded that offshore wind is a credit positive development for companies sponsoring projects in the U.S., because it gives them a “first mover advantage as the technology grows.” Such companies include Avangrid, which has secured leases for up to 3.3 GW of offshore wind; Eversource, which has leases of up to 2 GW; and National Grid, which is participating in the 400-MW Revolution Wind project and plans to build a 1,600-MW undersea cable to connect it to shore if selected as part of Massachusetts RFP process.

Developments may not be without risks. “Although the development and construction of these plants carry greater risks than onshore wind, once they become operational, offshore wind farms will benefit from long-term, contracted cash flows with highly rated utility counterparties,” it said. “Moreover, [offshore wind] is likely to produce higher and more consistent capacity factors than comparable onshore wind owing to turbine size, wind speed, and lower wind variability.”

However, the sector’s development may be bad news for power generators and power projects with exposure to the New England, New York and New Jersey regions, where the bulk of initial offshore wind development is taking place. Increased adoption of offshore wind could especially place margin pressure on independent power producers like Dynegy and Calpine, along with diversified companies that own merchant generation in the Northeast, like Exelon.

Meanwhile, though Public Service Enterprise Group (PSEG) stands to benefit from leases for up to 1 GW of capacity, the company owns substantial merchant generation in New Jersey which could be negatively affected by lower power prices owing to offshore wind. Moody’s said that Dominion Energy, too, may experience a similar dynamic.

“Like other renewable sources, [offshore wind’s] fuel and operational costs are significantly lower than those of conventional fuel generation assets, and can bid into these premium wholesale markets at very low rates, depressing the attractive energy prices that existing participants have been enjoying. In addition, [offshore wind] has the potential to reduce capacity prices in the NE-ISO, NYISO and potentially within the PSEG capacity zone of PJM in New Jersey,” it added.

“While it is difficult to predict the actual movement of capacity prices in any given year, incremental supply of capacity in an environment of low-to-zero load growth could result in marginal downward pressure on capacity prices.”

—Sonal Patel is a POWER associate editor (@sonalcpatel, @POWERmagazine)