GE Power Falters on Underperformance of Alstom Investment

Weak earnings associated with General Electric’s (GE’s) underperforming $10.1 billion investment in Alstom have prompted the giant conglomerate to rejigger its power business and lean more heavily on other segments.

GE Power, the company’s long-standing and lucrative business unit that has installed 1.6 GW of the world’s installed capacity over its 125-year history, has also suffered costly operational misses owing to softer markets for new capacity and an energy transition unfolding worldwide, company executives said in a November 13 investor call.

While the GE Power franchise remained “good,” even in the face of a “tough market,” GE had “exacerbated the market situation with some really poor execution,” GE CEO John Flannery said.

GE, a company renowned for technology breakthroughs will now seek to reinvent itself with a number of broad changes, including shrinking its board from 18 to 12, shaking up leadership, and shifting its focus to cultivate more earnings for shareholders.

At GE Power, specifically, the changes relate to costs, capital allocation, working capital and operations, governance, and culture. It will involve “right-sizing” for market structure, simplifying its portfolio, revamping its supply chain, and resetting its supply base by 2020, Flannery said.

A Swirl in the Waters of a Deep History

GE Power’s announced changes came just days before Siemens said it would cut 6,900 jobs over the next several years and consolidate three power-related divisions owing to a number of factors, including flagging orders of large gas turbines.

At GE, however, changes have long been expected. The company signaled it would firm up weak revenue after John Flannery replaced Jeff Immelt, who served as GE’s CEO for 16 years. In June, Russell Stokes replaced Steve Bolze as president and CEO of GE Power. Flannery noted on November 13 that more leadership changes had since occurred, and about 40% of its executive team is “new.”

Also in June, GE Power combined with GE Energy Connections, the company’s electrification and automation solutions arm. More recently, the company has also moved to divest some businesses. This fall, GE Power completed the $3.4 billion sale of its lucrative water and process technologies division to multinational water management firm SUEZ less than a week after GE struck a $2.6 billion deal with ABB for GE’s electrification business.

The changes are notable in the context of GE’s long history. GE has been a flagship name in the power generating business since 1896, when it became one of the first companies listed on the newly formed Dow Jones Industrial Average. By 1901, GE had successfully developed a 500-kW Curtis turbine generator, and in 1948, it installed a pioneering heavy-duty gas turbine for power generation at the Belle Isle Station in Oklahoma. Then in 1957, the company connected the first nuclear reactor to a commercial electricity grid. GE’s contributions to power generation technology have continued in a steady stream over the decades.

In 2015, the company marked another major milestone as it took over competitor Alstom in a $10.6 billion deal, and integrated the giant global equipment firm’s products into its portfolio. Just a year before, meanwhile, it launched the HA heavy-duty gas turbine, a new gas turbine technology that was last year leveraged to achieve a 62.22% combined cycle net efficiency (Figure 1). In the backdrop, to boost revenues and cement the company’s future, former CEO Immelt invested $4 billion over half a decade to transform the firm into a “digital industrial” company.

Last week, however, Flannery reset the company’s course toward an “industrial company.” The decision to revamp was drawn from an existential consideration of GE’s purpose during his first 100 days, he said.

During the company’s 125 years, GE has tackled the world’s biggest challenges, including power, flight, and health, all “absolute underpinnings of the modern world,” he said. “Even with all of these incredibly positive impacts on the world—strong franchises … lots of strengths—we have not performed well for our owners,” he said.

Going forward, “we really just have to focus on how we can create the most value—and the portfolio of assets that we have for our owners—and we’re going to do that with a very dispassionate eye, very critical, analytical, dispassionate eye,” he said. “At the end of the day, we really exist to deliver outcomes for the customers, performance for the owners, and have an environment where our employees are motivated by, excited by, rewarded for delivering on those two things,” he said.

Dim Expectations

While the transformation will be companywide, a strong revamp effort will be focused on the overall power business, which Flannery said was “challenged.”

GE’s focus on the renewables business, which offered a “strong growth curve” amid “a lot of disruption,” will shift to pushing down production costs and ensuring GE’s April 2017 $1.7 billion acquisition of LM Wind Power pays off. At GE Power, meanwhile, “It’s a heavy lift to turn around, but its fundamental assets, strong franchise in an essential infrastructure business, [those] we can improve a lot in the next one year or two years,” Flannery said.

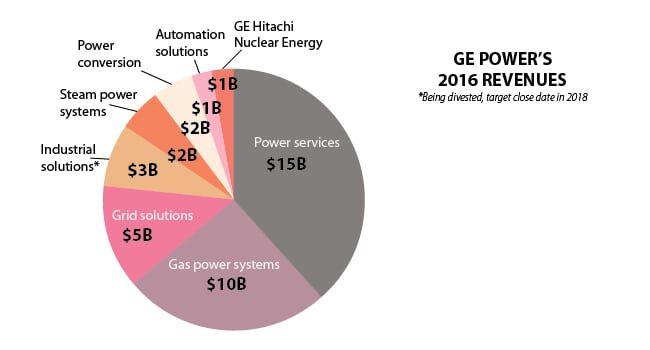

GE Power is made up of several lucrative business segments, which brought in a combined $26.8 billion in revenue for GE in 2016 (Figure 1). The sizable earnings are about 22% of the total $123.7 billion GE drew in last year from all its business units, but GE Power was GE’s highest-earning unit (followed closely by the Aviation business at $26.2 billion). At GE Power, meanwhile, the segments that bring in the most revenue are those dedicated to power services and gas power systems.

According to Stokes, the business’ challenges were rooted in shaky optimism about customer gas turbine utilization and upgrades. Recent electricity market changes also made an impact on earnings. For example, PJM Interconnection’s capacity payment rates in 2015 were about $167, but in 2017 they decreased to $154. “And so the value proposition around some of our upgrades changed significantly for customers, and so the return just wasn’t there for them to do the investments at the levels that we had originally anticipated.”

Over the past two years, meanwhile, GE Power’s gas equipment business margins declined “partially tied to the launch of the HA product,” he said. While the company was admittedly “late to the game” in the H-class space of heavy-duty gas turbines, and it struggled with initial launch issues, some recent reports suggest GE has since captured 50% of all awarded orders, Stokes said. GE is now looking to up the turbine’s net efficiency to 65% going out to 2025.

However, in the near-term, the company still expects “pricing challenges in the marketplace given to the overcapacity,” Stokes said. He also said that this year the market softened for convertible and aeroderivative products. “Some of this [was] just given market conditions, the complexity of doing some of those deals in some of the global markets, financing requirements that are needed,” Stokes said.

Looking forward, GE Power will “reset” its volumes for 2018 to where the market is, including halving expectations to sell 160 Advanced Gas Path upgrades. However, he also announced the division would target a $1 billion structural cost-out, and veer toward “growth in income orientation” and a leadership culture that encourages more candor, debate, and transparency. Plans also include “sweating every dollar” GE Power spends, including slashing capital expense spending by 45% in 2018, and resetting its supply base.

Even with all these measures, operating profits for GE Power, which are poised to fall 20% in 2017 compared to 2016, are expected to plunge another 25% in 2018, Stokes said.

Stokes, however, offered some optimism for the long term. “I do believe that gas will continue to be a baseload option, especially as we look at the reductions in coal plants, potential retirements in nuclear and to stabilize the renewable power that’s going to be coming onto the grid, given some of the intermittency nature that it still has,” he said, though he noted that how it will contribute to future growth is varied. Renewables will make another sizable contribution, “and we do realize that’s here to stay,” he said. GE was also taking note of energy storage advancements, he said.

The services landscape also offered a glimmer of hope. GE Power’s services backlog grew from $44 billion in 2014 with a retention rate of 96% to $63 billion in the third quarter of 2017 with a retention rate of 99%. Yet, Stokes noted a number of challenges that segment could face owing to a laxer U.S. market, tough pricing dynamics, overcapacity of service vendors, and lower outages of steam utilization based on the retirement of coal plants.

Buoyed by Digital, Burdened by Alstom

Last week, meanwhile, Flannery acknowledged that GE’s digital industrial capability had flourished, noting that GE’s diagnostic center in Atlanta is currently tracking conditions at 900 different power plants based in 60 countries. “We are still deeply committed to it, but we want a much more focused strategy,” he said. In 2018, at least, GE will spend about $400 million less on it digital division, but it will hone in on Predix applications that drive customer outcomes, including Asset Performance Management, Operations Performance Management, and ServiceMax.

It will also focus spending on Predix platform differentiation, investing on its asset model, Edge-to-Cloud, and Digital Twin offerings. Ultimately, GE will now look to sell “focused platform and application things to our installed base,” only a small percentage of which GE has so far penetrated, Flannery said. “Accelerating traction in that area” could reap big returns, he said. GE’s Predix product, for example, is expected to double revenues in 2018 to about $1 billion.

For Flannery, one of GE’s deepest business concerns is the variation of returns stemming from capital allocation in its mergers and acquisitions. “Smaller transactions closer to home in terms of industries, less integration risk, supply chain deals, [and] bolt-on deals” are where the company will be focusing going forward, he said.

He pointed specifically to the acquisition of Alstom, which he said “has clearly performed below our expectations.” GE bought the French company for four reasons: its installed base; a broad product line in steam and power islands, which GE anticipated it could cross-sell; synergies across operations, costs, and revenues; and the talent of Alstom’s personnel, which ultimately paid off. But GE was hurt by a “market clearly dramatically lower than what we underwrote in that business,” Flannery said. The long closing process, along with losses from some projects, also hurt Alstom, especially as renewables and the grid were concerned, he said.

However, he noted that the Alstom asset likely had a long life attached to it—up to 40 years. That’s why he said he had asked key GE Power executives to “just work the hell out of it right now.”

—Sonal Patel is a POWER associate editor (@sonalcpatel, @POWERmagazine)

Editor’s note (Nov. 26, 2017): Corrects story to note that GE’s 1948 gas turbine installation at Belle Island was pioneering—but not the first. The first known commercial gas turbine unit was a 4-MW simple-cycle gas turbine designed and constructed at Neuchatel, Switzerland, by Brown Boveri—the precursor of modern global conglomerate ABB and Alstom, which was partially acquired by GE. For more, see our new interactive history of power page.