China: A World Powerhouse

It’s no surprise that China leads the world in recent power capacity additions. What may surprise you is the precise mix of options this vast country is relying upon to meet its ever-growing demand for electricity. As a result, this ancient civilization is fast becoming the test bed and factory for the newest generation and transmission technologies.

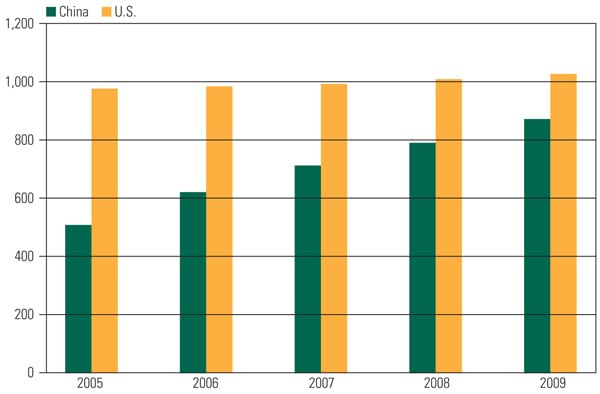

Last May, Zhang Guobao, head of China’s freshly formed National Energy Administration (NEA), told attendees at a national work conference discussing the elimination of backward production capacity (that is, small and inefficient boilers and furnaces) that the country’s installed power generation capacity would surpass 900 million kW—900 GW—by the end of 2010 (Figure 1). Fueled by massive capacity additions in hydro and thermal power, the estimate had been revised progressively upward over the past five years. Today, China has almost doubled projections for 2010 that were made in 2006, when 2010 installed capacity was expected to be 560 GW and 2020 capacity was expected to be 950 GW.

|

| 1. Runaway capacity. China’s installed power capacity has nearly doubled in the past five years, signifying exponential growth of its power sector. Installed capacity for 2010 is estimated to exceed 900 GW. For comparison, the installed capacity of the U.S. as of June 2010 is approximately 1,030 GW. Sources: China Electricity Council, State Grid Corp. of China, U.S. Energy Information Administration |

Zhang went on to chronicle other stunning achievements made during the 11th five-year state planning period (2006–2010): By mid-2009, China’s national grid (lines 220 kV and above) had expanded to 375,000 kilometers (km), taking from the U.S. the title of the world’s largest transmission network. The grid was also the most sophisticated—and efficient: Four ultra-high-voltage (UHV) lines, spanning some 6,000 km, had been completed or were under construction. (Note that China and some industry sources define “ultra-high voltage” as anything over 800 kV. In China, one 1,000-kV UHV AC circuit has been completed, and three 800-kV DC circuits are under construction.) This year alone, generating units with nameplate ratings totaling 70 GW are expected to begin construction, including 45 GW of thermal power projects. These would join projects worth 178 GW already under construction at the end of 2009.

In another world-first, China started building 23 nuclear power units and has more than 30 more in the pipeline.

Annual wind power generation doubled for three straight years to 26 GW, 14 GW of which was added in 2009 alone, on the back of new standard that called for renewables to make up 15% of the country’s total generation profile by 2020.

This overall growth was accompanied by massive investment, Zhang said: According to statistics by the China Electricity Council (CEC), ¥755.84 billion (US$110.67 billion) had been poured into power construction in 2009, ¥371.13 billion for power supply, and ¥384.71 billion to update the grid. And though investments in the thermal power industry shrank from 71.1% of the national total in 2006 to 40.2% in 2009 (at ¥149.21 billion), new projects included units outfitted with supercritical, ultrasupercritical, and carbon capture and storage technologies.

The breakneck pace of development in China’s power sector is directly linked to the country’s booming economy: In 2006 and 2007 the country recorded gross domestic product (GDP) growth of more than 11%, and despite a global economic crisis, its recorded year-on-year GDP increase for the final quarter of 2009 was 10.7%. Yet, the world’s most populous country recorded an average per capita power consumption of 2,332 kWh in 2007, according to the U.S. Central Intelligence Agency’s The World Factbook —five times lower than that of the U.S. (13,652 kWh) and nearly three times lower than South Korea’s (8,502 kWh), Japan’s (8,474 kWh), and Russia’s (6,317 kWh).

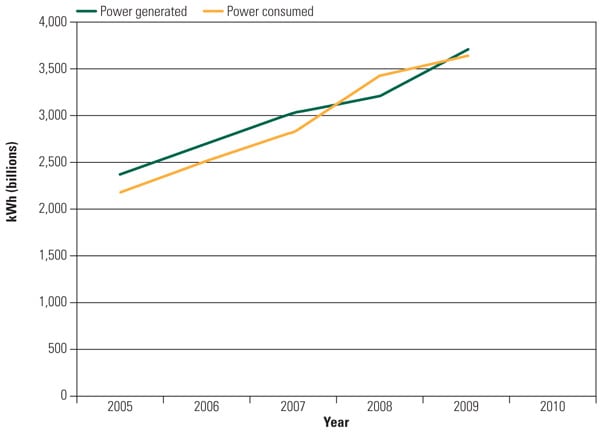

This is just the beginning, according to industry sources. In 20 years, China’s power consumption is expected to double, surging to nearly 8,472 TWh (Figure 2), and its power generation capacity is expected to rise to 1,775 GW—almost equal to the current total power capacity of the U.S. and the European Union combined. Consensus is that China is poised to supersede the U.S. as the world’s largest energy-consuming nation.

|

| 2. Who consumes China’s power? China’s power consumption shot up 6% last year, compared to 2008, to 3.643 trillion kWh, spurred by a ¥755.84 billion (US$110.67 billion) investment (nearly 20% more than the year before). By the end of 2009, the country’s installed power generation capacity, shown here, was 874.07 GW, an annual increase of 10%. Already in the first four months of 2010, increased consumption (on average 25% per month year-on-year) has been met by increased oil- and coal-fired generation. Officials point out that this not only indicates that the economy is rebounding but also that industrial activity has rebounded. Boosts are particularly attributed to a stimulus-incented increase in public works construction, which requires much steel and cement. Sources: China National Energy Administration, National Bureau of Statistics |

Change and China’s Electricity Sector

China hasn’t always been a powerhouse. The structure, governance, and institutional framework of China’s power sector has been significantly transformed in a long, drawn-out process that began in the 1980s, within the context of wider economic reforms to promote growth and economic development.

The first set of reforms in the mid-1980s opened up generation to investment by third parties outside the central government (mainly provincial and local governments, but also some domestic and foreign companies). Power plants built and purchased by these investors—sometimes called independent power producers (a term that is misleading in the Chinese context because most are government-linked private companies)—now account for over half of China’s total capacity. By the end of 2002, China had dismantled its single, vertically integrated utility—the State Power Corp. (SPC), which by then had 46% of the country’s generating capacity and 90% of transmission capacity—into 11 separate generation, transmission, and service units.

Today, the sector is dominated by five state-owned holding companies, namely China Huaneng Group, China Datang Group, China Huandian, Guodian Power, and China Power Investment. These companies generate the remaining half of China’s electricity. The transmission and distribution sectors continue to be heavily state-controlled, however. During the 2002 reforms, the SPC divested all of its electricity transmission and distribution assets into two new companies, the Southern Power Co. and the State Power Grid Co. The government plans to merge SPC’s 12 regional grids into three large power grid networks by 2020: a northern and northwestern grid operated by State Power Grid Co. and a southern grid operated by the Southern Power Co. The sector is regulated by the State Electricity Regulatory Commission, a body also established in 2002.

China continues to reform the sector, seeking to separate power plants from power-supply networks, privatize a significant amount of state-owned property, encourage competition, and revamp pricing mechanisms. At the same time, it is looking to better coordinate and formulate strategic energy policy. This May, for example, the government established the National Energy Commission (NEC), an overarching “super-ministry” that will be headed by Premier Wen Jiabao and be responsible for drafting national energy development plans, reviewing energy security, and coordinating international cooperation.

The agency will comprise 21 members, including ministers from various organizations such as the National Development and Reform Commission (NDRC) and the Ministry of Finance as well as a representative from the central bank. Among that agency’s foremost priorities is to reach the hefty goal set last year of reducing the intensity of carbon dioxide emissions per unit of GDP by 2020 by 40% to 45% from 2005 levels, a feat that officials say requires coordination with different ministries.

A Power Generation

Besides the accelerating economy, a major factor that drives booming energy consumption (Figure 3) is China’s immense population growth rate of around 7 million a year. The country’s population of 1.34 billion could peak at 1.5 billion—an increase of nearly 200 million—before growth trends show a decline. At the same time, China is in a stage of rapid urbanization.

|

| 3. Chinese generation vs. consumption. Demand for power has soared in recent decades, particularly in the past five years, driven by an accelerating economy and tremendous population growth. Sources: China Electricity Council, State Grid Corp. of China |

So how does the country plan to provide power for this growth?

Heightening Hydropower

China, a country traversed by several massive rivers, especially in the southwest, is the world’s largest producer of hydroelectric power. The nation currently has 197 GW of hydropower generating capacity—a jump from 170 GW installed in 2008. In 2009, China inaugurated several units of the 22.5-GW Three Gorges project along the Yangtze River. When fully complete in 2011, that project, comprising 32 separate 700-MW generators, will be the largest power project in the world (Figure 4). Even larger projects could be in the pipeline: The UK’s Guardian newspaper reported this May that blueprints were being drawn up for a gigantic 38-GW dam in the Yarlung Tsangpo River in Tibet—despite concerns that the project could pose water conflicts and environmental issues for nations downstream, like India and Bangladesh.

|

| 4. A great wall of China. The 22.5-GW Three Gorges Dam, which is under construction along the great Yangtze River in China’s Hubei Province, is the world’s largest power project—and its most controversial. Costing some ¥180 billion to build, the dam is said to have displaced 1.2 million people and has been plagued by corruption, spiraling costs, and technological problems. Yet similar—possibly even more massive—projects are in the works: The China Three Gorges Corp. announced this May that China had acquired the ability to independently design and manufacture 1,000-MW hydroelectric turbine generating units. Courtesy: Alstom |

According to the NEA’s Zhang, new hydropower will be critical if China is to meet its clean energy development goals by 2020. “Considering current hydropower capacity, projects under construction, and building cycles, China needs to start building around 120 [GW] of hydropower projects in the six years through 2015,” said Zhang in published comments this May, as he called for faster project approval. The official, who is also deputy head of the NDRC, refuted allegations that hydropower construction in drought-hit regions had worsened water shortages, or that it had caused environmental damage. “Every energy source has positive and negative effects and cannot be viewed only from the negative side… and should be weighed in an overall way,” he said.

Fossil Fuels Predominate

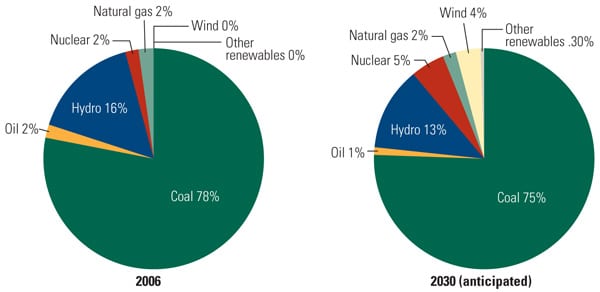

Coal remains the dominant fuel for power generation in China, accounting for more than 70% of the nation’s total generation portfolio. The country consumed about 3.1 billion metric tons (mt) of standard coal in 2009, and it’s expected to consume 3.3 billion mt in 2010, according to a recent report by the state-run Xinhua news agency. And, though the 11th five-year plan calls for the country to increase its share of natural gas and other technologies—and the government has announced plans to shut down some 31 GW of small and inefficient power plants—coal will continue to serve as the country’s energy backbone for years to come (Figure 5).

|

| 5. King Coal to hold reign. Coal will continue to serve as the country’s energy backbone through 2030 and beyond. Sources: China Electricity Council, U.S. Energy Information Administration, International Energy Outlook 2009 |

One reason is that the government plans to replace smaller units with more efficient, midsize and larger units of 300 MW and larger (see sidebar, “China’s Quest for Cleaner Coal”). Another is that China wants renewable energy sources like wind to meet 15% of its energy needs by 2020—but its transmission network isn’t able to absorb that rate of growth. Additionally, officials want new coal-fired capacity in reserve so demand can be met when the wind doesn’t blow. As Shi Pengfei, vice president of the Chinese Wind Power Association, told The Wall Street Journal last September: “China will need to add a substantial amount of coal-fired power capacity by 2020 in line with its expanding economy, and the idea is to bring some of the capacity earlier than necessary in order to facilitate the wind-power transmission.”

Natural gas, which plays a smaller but significant role in China’s thermal power mix, may see the greatest percentage rise in installed power capacity over the next decade, the U.S. Energy Information Agency (EIA) forecasts. Examples of combined-cycle plants under construction in Guangdong Province include the 1,170-MW Huizhou power plant. Some 20 gas-fired power plants are in operation or under construction, and several coal-fired and oil-fired plants are being converted to run on natural gas in that province.

Nuclear on the Fast Track

Most westerners are aware of the great pace at which China is building coal-fired plants. What is less well known is that China has put its nuclear power plans on a fast track, kicking off a construction frenzy worth billions of dollars. The latest government blueprints place China’s nuclear power capacity target at 70 GW by 2020—a nearly 50% jump from an earlier goal. That means the nation, whose 11 reactors (Figure 7) currently produce a combined 9 GW at capacity (or about 1.3% of the nation’s total power), must add about 44 new reactors by 2020—or four reactors every year.

|

| 7. Nuclear juggernaut. The 2,000-MW Guangdong Daya Bay Nuclear Power Station, built in 1994, was the first commercial nuclear power station on the Chinese mainland. To increase power supply and meet environmental goals, China has fast-tracked nuclear power plant construction, working to increase installed nuclear capacity to 70 GW by 2020, and possibly 200 GW by 2030. Courtesy: CLP Power Hong Kong Ltd. |

As of May 2010, 23 reactors were already under construction and another 34 were firmly planned—but these are only the beginning. They are part of China’s 10th economic plan, which calls for 25 new reactors to start operations between 2010 and 2016. Another 18 have been ordained by the more recent 11th economic plan; these should come online between 2014 and 2017. Plans will only get grander: Reports indicate that China could increase nuclear capacity targets to a stunning 86 GW by 2020. And if China sticks to plans announced in April 2010 by the China Nuclear Energy Association, it could source about 200 GW from nuclear power by 2030.

The technology base for future reactors remains officially undefined, though two designs are predominant in construction plans: the CPR-1000, or “improved Chinese Pressure Water Reactor,” a French-derived three-loop unit with 157 fuel assemblies, and Westinghouse’s AP1000. High-temperature gas-cooled reactors and fast reactors also appear to be priorities.

China has also considered and set up solutions for nuclear waste management. It already has a closed–fuel cycle strategy for spent fuel, and it has built a centralized spent fuel storage facility with a capacity of 550 mt, which can be doubled. (See the May 2010 POWER cover story at https://www.powermag.com for a history of the failed U.S. attempts at developing centralized spent fuel storage solutions.) In addition to hosting a pilot reprocessing plant using the PUREX process, the country has also signed an agreement with AREVA to determine if it is feasible to set up a reprocessing plant for used fuel and mixed-oxide (MOX) fuel fabrication. This 800 mt/year facility will likely be in Gansu Province, and it will be operated by AREVA from 2025 onward. (See our August 2008 story, “How to Solve the Used Nuclear Fuel Storage Problem” for more details about the PUREX and MOX processes.)

Wind Power Reaches for the Sky While Solar Stands in Its Shadow

China’s installed nameplate wind capacity has skyrocketed over the past two years, bringing capacity installed by the end of 2009 to 25.9 GW. According to the Global Wind Energy Council, last year alone, the country installed nearly 14 GW. The country won’t be slowing down installations anytime soon: Beijing intends to make the most of its wind energy resources, which are so abundant that researchers from Harvard and Beijing Tsinghua University say China could meet all of its electricity demands from wind power through 2030.

Despite serious challenges, such as bottlenecks in the national grid, by the end of 2008, 12 provinces in China each had a wind power capacity of 200 MW—and in Heilongjiang, Jilin, Inner Mongolia, and Hebei, wind power nameplate capacity exceeded 1 GW. Some installations are gargantuan: China has started construction of a 10-GW wind farm in Jiuquan, Gansu Province. Construction of large farms is also planned for Jiangsu, Inner Mongolia, Xinjiang, and Hebei.

The growing market demand for wind power generation has greatly encouraged domestic industries for manufacturing wind generators and components. As of June 2010, China had more than 70 complete-set manufacturers, more than 50 turbine blade manufacturers, nearly 20 generator manufacturers, more than 10 converter manufacturers, and nearly 100 turbine tower manufacturers. These developments suggest that China could become the world’s leading wind power equipment manufacturing country by 2015.

At the same time, the country is steaming ahead with offshore developments. In June 2010 it was scheduled to begin operating the 102-MW Shanghai Donghai Bridge offshore wind farm (Figure 8)—not just the country’s first offshore project, but also Asia’s first, and the first outside Europe. With a coastline stretching 18,000 km, China isn’t stopping there: Four more offshore wind projects with an estimated combined capacity of 1 GW are being prepared for bidding.

|

| 8. Coastline power. The Shanghai Donghai Bridge Wind Farm, China’s first offshore wind farm, uses 34 Sinovel SL3000 (3-MW) wind turbines. Each SL3000 contains a set of core electrical components from American Superconductor Corp. Courtesy: AMSC |

In comparison, solar power in China has a much smaller profile—even though the country dominates the world’s solar panel manufacturing sector with more than 400 photovoltaic companies. At the end of 2008, the solar power capacity attached to the national grid was under 100 MW. A rapid expansion is planned to grow solar capacity to 1,800 MW by 2020, however. One official told attendees at a solar conference in 2009 that the plan could be expanded even more, possibly reaching as much as 10 GW by 2020.

Turning up Transmission

A highly efficient, unified national grid system ranks high on the government’s stack of reform priorities. Lack of transmission interconnection between provinces has in the past spurred construction of many regional coal-fired plants to meet localized peak electricity demand, and a more robust grid is expected to reduce the number of these plants going forward. Also, it is expected to link key load centers to the country’s abundant coal and hydro resources.

To that end, China has planned as many as eight long-distance high-voltage lines by 2015 and as many as 15 by 2020. After it put into operation a 600-km 1,000-kV UHV AC circuit in late 2008, the government announced that it had plans to build 17,600 km of lines by 2012. Meanwhile, last December, grid operator China Southern Power Grid put into operation the first pole of a transmission link between the southern Chinese provinces of Yunnan and Guangdong, a 1,418-km UHV DC system. That line has a transmission capacity of 5 GW, and it operates at a voltage of 800 kV—a world record. The Yunnan-Guangdong line will transmit power from giant hydropower plants under construction in southwestern China to rapidly growing southeastern industrial cities like Shenzhen and Guangzhou in the Pearl River delta of Guangdong Province.

A second 800-kV DC project has been planned between the Xiangjiaba hydropower plant, located in southwest China, and Shanghai, 2,071 km away. That line—which will possibly be the longest power transmission link in the world when operational later this year—will transmit 6,400 MW of power for its owner, State Grid Corp. of China.

By 2020, the capacity of the UHV network is expected to be 300 GW, of which hydropower will account for 78 GW and wind power from the north will constitute another significant portion.

The Implications of Technology Transfer

China has been cited as the “factory of the world” because it eventually absorbs various technologies. This sort of “technology transfer” is especially apparent in the country’s nuclear dealings with foreign component and reactor makers.

In its ambitious plans to increase nuclear plant capacity to 160 GW by 2030, China is driving companies to manufacture equipment domestically. This strategy seems to be paying off: The country kicked off its 21st nuclear project, Ningde 3, in January, and for the first time, 80% of the project’s components were sourced from Chinese suppliers, including the digital control system. The Ningde facility will comprise four CPR1000 reactors, indigenous 1,080-MW versions of an AREVA-designed pressurized water reactor. Also in January, the State Nuclear Power Technology Co. (SNPTC) said it had selected 10 Chinese equipment manufacturers to accelerate the country’s deployment of domestically developed third-generation nuclear power technology.

Technology transfer will also reportedly play a role in contracts between the SNPTC and Westinghouse for that company’s AP1000 reactor design. While in the U.S. and in Europe that design is slowly moving through federal certification processes, at least four Westinghouse AP1000 reactors are currently being built at Sanmen and at Haiyang. At least eight more are being planned after them, involving substantial technology transfer, with about 30 more proposed to follow. China is expected to own the intellectual property rights for those designs, which could mean, as the World Nuclear Association concludes, that the AP1000 is to be the main basis of the country’s move to Generation III technologies.

This type of “technology diffusion” is a positive aspect of technology transfer, and it could bode well for addressing climate-change mitigation, suggests an August 2009 study from nonprofit and nonpartisan research group Resources for the Future. That study separately evaluated the diffusion and deployment of supercritical and ultrasupercritical and natural gas combined-cycle technologies as licensed to Chinese equipment makers Harbin, Shanghai, and Dongfang. It found that among 713 supercritical and ultrasupercritical plants planned, constructed, or operated in the world in 2008, 38% were in China. And in 2006, combined-cycle plant operating capacity was about 10 GW, while capacity in planning or construction was 21.8 GW. Existing units made in China even exceeded those manufactured in Japan or Europe, it found.

Moreover, it said, even if Chinese manufacturing companies imported key components from foreign firms, construction costs for supercritical plants per kilowatt-hour were about 20% of costs in Japan, while combined-cycle costs were 25% of those in Japan. The group noted, though, that the comparison does not adequately reflect the differences in specifications for environmental equipment: “If Chinese power plants were required to satisfy as stringent environmental standards as Japanese plants do, construction costs in China would be much greater.”

One negative impact of technology transfer is that quality may be sacrificed in some cases, the study found. But even this could change, according to Resources for the Future, as Chinese manufacturers “trade up” to maintain export markets and to satisfy higher quality standards set by other governments. Finally, it adds that intellectual property rights will not likely be a barrier for technology transfer. The study suggests that license fees could cause price increases, but “price reduction by local production has been so steep that it seems the price increment by licensing is almost canceled out.”

How to Fuel China’s Growth?

China is the largest consumer and producer of coal in the world, holding an estimated 114.5 billion short tons of recoverable coal reserves—the third-largest in the world, after the U.S. and Russia. Deposits are spread out over small and large coal mines in 27 provinces, with northern China, especially Shanxi Province, holding most of the easily accessible coal. Coal in the southern provinces tends to be higher in sulfur and ash. In 2008, China consumed an estimated 3 billion short tons of coal, representing about 40% of the world’s total—and a 129% increase since 2000. According to the EIA, coal consumption—split between the non-electricity and power sectors—has been on the rise in China over the past eight years.

But plagued by transportation issues, typhoons, and widespread pit closures, the sector frequently has to deal with an unreliable coal supply. Shortages often strike provinces in the winter, resulting in blackouts or brownouts. In January 2010, for example, five provinces suffered rationing during cold weather—Shanxi, Shandong, Henan, Hubei, and Chongqing—forcing governments to move local populations to “safer” places.

To alleviate its predicament, the Chinese government promotes two remedies: encouraging energy conservation efforts and expanding energy supply capacity. China has primarily relied on domestic energy resources to develop its economy, and the rate of self-sufficiency has been above 90%—much higher than that in most developed countries. Increasingly keen to keep more of its coal at home, the government has also been considering importing to protect domestic supplies. In 2009, for example, coal imports (primarily from Vietnam and Australia) jumped to 130 million mt, 2.1 times the amount imported a year earlier, with the average price being $84 per mt.

Beijing takes a similar approach with uranium—a commodity whose importance has shot up in recent years. This January, China imported roughly 3,337 mt of uranium, with 57% coming from Kazakhstan and smaller volumes from Russia, Namibia, and Uzbekistan. In March it set its sights on Australian yellowcake stocks. Import volumes were up more than 10 times year-over-year. Yet, government officials suggest this may be the tip of the iceberg: State-run Guangdong Nuclear Power’s annual uranium needs will jump to 10,000 mt in 2020 from 2,000 mt in 2009, as Zhou Zhenxing, chairman of the company’s uranium-supply unit, told The Wall Street Journal in November.

The Emissions Spin

Two weeks before the Copenhagen climate summit last December, China unveiled its first firm goal for limiting greenhouse gas emissions. Beijing said it would aim to reduce its “carbon intensity”—or the amount of CO2 emitted for each unit of GDP—by 40% to 45% by 2020, as compared to 2005 levels. Observers hailed the target as ambitious, though many pointed out that meant that China’s carbon emissions would not necessarily fall.

Many noted that the country could meet the target by either using energy more efficiently or increasing the proportion of energy derived from low-carbon sources such as wind and nuclear. It could also, however, produce goods of higher value without changing the nature of energy production and use—that is, it could raise GDP while leaving emissions unchanged.

But in China, the target—any target—is deemed costly. Organizations like the Chinese Academy of Social Sciences and Tsinghua University, after drawing up scenarios and evaluating what could happen if China set a goal of reducing carbon emissions by 33%, 40%, 45%, or 50% in 2020 compared to 2005 levels, said that the country would need to increase its investment by $30 billion in the next 10 years. In particular, they found that any target over 40% would cause costs to sharply increase.

Meanwhile, officials argue that economic development will continue to be a priority for the nation peopled by nearly 1.3 billion. As Su Wei, director of the NDRC’s climate change department, told attendees at the International Cooperative Conference on Green Economy and Climate Change this May, the “high carbon” characteristic rooted in China’s energy infrastructure would not be fundamentally changed in the short term, as the development and use of clean energy sources such as wind and solar power started late in China. An unreasonable industrial structure and relatively backward industry technology also made the nation’s carbon emissions reduction drive difficult, he said.

Nevertheless, besides setting up an accountability system for energy conservation and emissions reduction, and investing more in new energy industries, China has been improving policies related to low-carbon development, accelerating research on low-carbon and environmentally friendly technologies, and expanding international cooperation to contain emissions in some key sectors, he said.

“I personally think the emissions reduction goal China just released is a little high,” Pan Jiahua, director of the Urban Development and Environment Institute under the Chinese Academy of Social Sciences and member of the State Climate Change Expert Committee, told The People’s Daily this December. This official noted, as have many others, that China’s average carbon emissions per capita had reached the world’s average of about 5 tons—but was still about a fourth that of the U.S. level. “However, since China has made a commitment to the world, we must try our best to realize the goal,” he said.

—Sonal Patel is POWER’s senior writer.