Temporary power may be the most widely distributed “distributed” generation worldwide, and its distribution is spreading, thanks to its ability to quickly meet urgent needs not only for event, construction, and post-disaster emergency power but also for fast-growing economies and stressed grids. That’s making it a serious competitor for “permanent” power in some situations.

When “temporary power” supplies nearly a quarter of a grid’s demand, is it still temporary power? How about when a project lasts 10 years?

Those questions were prompted by an announcement on Mar. 31 that temporary power provider Aggreko was increasing its grid-connected generation capacity on Bali to 170 MW—representing 23% of the island province’s total electricity demand. The appeal of power rental in Bali is directly connected to an economy that is growing at roughly 9.75% per year, according to Scotland-based Aggreko, which has been in business for more than 50 years.

As for the 10-year-long project, that was a Cummins contract at a gold mine in Bulghah, Saudi Arabia, located hundreds of miles from the country’s electrical grid, that produced 82,000 ounces of gold per year using what Cummins calls its “Prime Power System.” The project was particularly challenging, Cummins General Manager for Rental Projects Rick Duncan said, due to the environmental challenges associated with ambient temperatures of 55C (131F) and excessive dust levels.

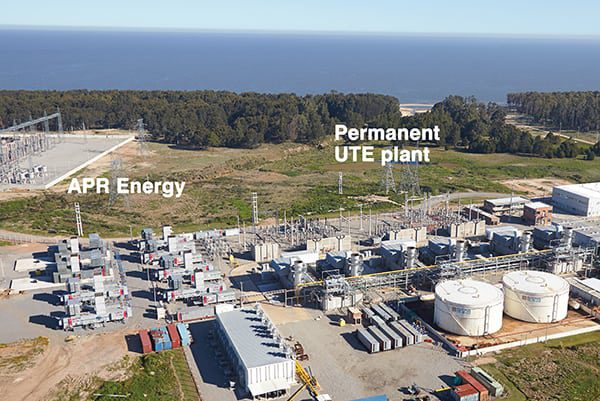

APR Energy Chief Operating Officer Brian Rich directly addressed the shifting focus of the major players in this sector when he commented, “We view many of our plants to be semi-permanent in that they can integrate seamlessly into existing permanent infrastructure (Figure 1), using the same technology [gas turbines], and run reliably for many years if needed, just as permanent infrastructure would. Many of our customers are running our plants as a baseload operation, where we are supplying a significant portion of the country’s electricity and providing power to millions of people.”

A somewhat newer but ambitious player, 10-year-old Saudi Arabia–based Altaaqa, explained that its business, too, is responding to the “continuously increasing” gap between supply and demand, especially in light of significant economic development in specific regions. “This increase in demand that sometimes cannot be catered for by the available grid is causing temporary power solutions to have longer timeframes, and the term ‘temporary’ can sometimes extend to several months or even years,” said Andrew Keddis, business development manager.

Defining “Temporary”

Calling power service temporary doesn’t quite capture all of its distinguishing attributes. It’s temporary rather than permanent, rented rather than owned, and mobile rather than fixed. It’s also modular and easily scalable. Ask some of the major companies in the power rental space how they define temporary power, and some even shy away from that term because their projects run six months or longer and range up to 450 MW in size.

APR Energy’s Rich explained, “When we think of ‘temporary’ power, we think of short-term rental contracts, typically of a year duration or less, including event power. APR Energy has removed ‘temporary power’ from our vernacular. Rather than focus on short-term rental projects, we instead work to develop long-term, larger-scale power projects that bridge customers until their permanent infrastructure is in place.”

Cummins’ Duncan told POWER, “In the past, temporary power mainly constituted ‘mobile’ power, which was required to be made available quickly and for very short duration. Today temporary power also includes long-term requirements by utilities whose capital constraints make investment in permanent sources of energy difficult.”

Renting vs. Building

There’s no question that when speed is of the utmost importance, temporary power has the edge even over relatively easy to site, permit, and construct gas-fired peakers. In an interview with Utilities-me.com last October, Altaaqa Managing Director Steven Meyrick noted that it took 23 days from contract to plant commissioning at Aden, Yemen—reportedly the fastest installation of a temporary power plant in Yemen. Another project—a 24-MW temporary peaking power plant including district cooling for the Sultanate of Oman—took four days to complete.

Even when new capacity isn’t needed on very short notice, power rental offers an advantage to utilities worldwide. Cummins’ Duncan noted: “Utilities typically leverage temporary power in a couple of different ways. Many leverage temporary power where they have a significant gap between supply and demand, typically while they are investing in expanding grid capacity or to supplement existing capacity if they are capital constrained. There are also utilities, particularly in the Middle East, who leverage temporary power to address seasonal shifts in demand, effectively acting as additional capacity during peak periods.”

Compared with building new grid-connected generation—even distributed solar or wind generation—renting power (and, often, distribution infrastructure) offers far faster deployment. It also eliminates maintenance headaches. As Keddis noted, even when grid power isn’t an option over a longer term, customers may opt to continue renting rather than purchasing the power supply because they can count on a specialized provider to handle operation and maintenance.

Venkie Shantaram, Aggreko’s group business development director, also noted that global mobile power providers are selling not just power but also reliable operation: “One day a generator can be found at a cement factory in the United Arab Emirates having to withstand 50C-plus heat, and the next the same generator is providing power to a gas production plant in Russia’s Arctic region,” so providing consistently reliable power despite the environment is critical.

But what about costs of power compared with power from traditional fossil plants? As with permanent generation sources, costs vary not only by country and region but also in response to fuel costs, regulatory environment, size of installation, and other factors. But, according to GE’s Dan Kempf, general manager, LM2500 and Small GT Program, as with all onsite generation, line losses, up to 5%, are saved, so “[t]his can result in the temporary power units having a higher overall efficiency than centralized/remote power generation.”

And in many cases, cost comparison is moot, because, as Shantaram noted: “The consequences of power interruptions for utility-related companies responsible for the timely delivery of electricity could run into millions of dollars’ worth of penalties in a very short amount of time, with no respite until the disruption is fixed. At the end of the day, our customers’ main concern is having access to guaranteed reliable power so that they can get on with the task at hand, be that repair of onsite permanent equipment, refurbishment, replacement, or new builds.”

An Expanding Market

According to an April power rental market research report by MarketsandMarkets (M&M), the global power rental market is expected to grow from “an estimated $7.8 billion in 2012 to $17 billion in 2017 with a compound annual growth rate of 17% during the same period.” Global power rental market revenue—generator rental plus revenue from the temporary power plant—was estimated at $6.4 billion in 2011. Roughly half of that revenue derives from peak load installations, with prime load and standby service making up the other half.

To put those numbers in perspective, Aggreko, the largest player in the market, says that in 2013 it served customers in about 100 countries and had revenues of approximately $2.5 billion.

There’s good reason to be skeptical of market report figures, in part because, as Altaaqa’s Keddis noted, the barriers to entry in this industry “are fairly low,” especially for local, small-scale generation rental. “Also, this business is very dynamic with high transaction rate. The combination of these factors, in addition to the lack of transparency in many countries, makes the industry extremely difficult to track and size.”

And, as Cummins’ Duncan noted, the size and location of the market varies from year to year. He said market studies he’s seen estimate that the temporary power opportunity is in the region of $5 billion globally; this can vary significantly by year, with large opportunity existing in North America, Europe, Middle East, Africa, and Asia Pacific. When looking at market opportunity, it is important to distinguish between local hire (short-term rental) and power project markets (longer-term rental) because the market drivers, applications, and geographical presence are significantly different, he added.

The most familiar uses of temporary power are for construction sites, events, disaster recovery, off-grid mining operations, and the like. But utilities are also major customers. These days, according to Aggreko, the largest provider of temporary power, aging infrastructure, grid instability, seasonal peak shaving, transmission and distribution limitations, planned maintenance, weather events, and unplanned outages are all driving the market. (See “Shifting Sands: The Middle East’s Thrust for Sustainability” in this issue.)

The M&M report found that the utility sector is the largest user of temporary power, followed by the oil and gas industry and the industrial sector. Utilities and the event industry are the fastest growing markets.

Geographically, according to M&M, the largest markets are, in order: North America, Middle East, and Asia-Pacific. However, the report also found that the Middle East is the fastest growing market.

At country level, the report finds that the U.S. accounts for the largest revenue share, followed by China, India, and Canada. That list shouldn’t surprise anyone, as it includes the two largest industrializing nations and the two countries experiencing unprecedented shale resource exploration and development. In fact, just last year, Aggreko opened new service centers in Saskatchewan and Texas to be closer to its oil and gas mining customers.

And although temporary power is the primary focus here, some firms also offer related services, such as cooling and heating equipment, compressors, heat exchangers, and remote monitoring—markets that are also growing.

Changing Project Profiles

Temporary power has long been a staple in the global resource development industry, and that remains the case. But at least for the market leaders, both the sizes and types of projects have expanded recently.

Size. One of the biggest changes in the industry over the past decade or two is the scale of installations. Previously, GE’s Kempf noted, they were small by necessity, but “electricity has become more and more critical to sustaining the modern way of life. The world’s economy is electrifying and urbanizing, creating large potential demand for temporary power on short notice.”

GE has handled projects in excess of 600 MW in a single order, with first power put to the grid within 60 days, Kempf said.

APR Energy’s largest installation to date was more than 450 MW across six sites in Libya in summer 2013, but its largest single-site installation was 200 MW in Uruguay, part of an overall 300-MW project (see Figure 1). The plants installed as part of these two projects are still in operation.

New Roles for Temporary Power. GE’s Kempf identified two major trends his company is seeing that were not part of the business just 10 or 20 years ago:

■ Emerging economies that are attempting to electrify and are challenged to meet near-term power needs and get ahead of anticipated growth.

■ Rapid and unexpected needs driven by natural disasters.

Another newer role that Cummins is heavily involved in is providing prime power to U.S. military bases in war zones like Iraq and Afghanistan. Cummins’ largest installation to date was at Victory Base Complex-East, Iraq, a 74-MW Prime Power Plant. The project consisted of a new 54-MW plant designed and constructed by Berger/Cummins (a joint venture between Cummins Power Generation and The Louis Berger Group), an integrated and previously existing 20-MW plant, an electrical infrastructure upgrade consisting of a new 100-MW bus/switchgear, 40-MW substation, six new 11-kV overhead distribution feeders, and a fuel farm constructed to supply the power plant.

According to Duncan, the plant resulted in the removal of 103 spot generators, resulting in a savings of millions of dollars a year in fuel and operation and maintenance expenses for the U.S. military. At the time, this plant was the U.S. military’s largest expeditionary prime power plant serving a military base.

Like other global players in this market, Cummins also provides temporary power solutions to public utility companies where projects are awarded for terms of three years or more. “A couple of decades ago, customers relied more on ‘spot’ generation, which involved placing small generators near a place of power demand. This was quick and easy, but resulted in fuel consumption inefficiencies, lower reliability, and high cost of equipment. The trend now is to have consolidated ‘prime power plants,’ where a central power plant is leveraged and power is supplied through a distribution network. This has resulted in high plant load factors, high plant utility factors, and high reliability, driving down capital costs as well as operation and maintenance costs.”

Keddis told POWER that in Saudi Arabia, the type of power demand is driven by the “change in socioeconomic trends and government spending. For example, we have noticed a significant increase in Saudi Arabia’s entertainment industry business that we didn’t have few years ago. Furthermore, new types of projects such as railway and metro projects are starting in Saudi Arabia and are using Altaaqa’s services; supplying power to tunnel boring machines for metro projects, for example, is a unique new experience for Altaaqa. Saudi Arabia is working towards diversifying its economy from being heavily dependent on petroleum to other sources of revenue such as mining, petrochemicals and other industries. That in turn reflects on the diversity of projects requiring power.”

Altaaqa is the official Caterpillar partner for power rental and temporary power solutions in Saudi Arabia, and all Altaaqa services are provided by CAT diesel engines. Its longest-running project is a 16-MW temporary power station supplying a mall in Jeddah, Saudi Arabia, that has been operating for six years.

Another type of new playing field is the multinational one. Aggreko is producing and delivering cross-border power to three utility companies in Southern Africa (Figure 2). Shantaram explained that the 232-MW temporary power site “uses natural gas from the Temane gas fields as a fuel source and is located on the Mozambique and South African border at Ressano Garcia. The project is producing and delivering power to Electricidade de Mozambique (EDM), Eskom, and NamPower (the Namibian power utility). This is thought to be the first project by a private company to supply power to multiple utilities in Southern Africa, underlining the potential benefits that can accrue to countries sharing resources.”

|

| 2. Cross-border power delivery. Aggreko’s 232-MW temporary power project on the border of Mozambique and South Africa supplies power to both countries as well as Namibia. Courtesy: Aggreko |

Technology Trends

Shantaram noted that Aggreko’s basic business of “delivering flexible power solutions anytime, anywhere” hasn’t changed much over five decades, but the technology has. “Today we have generators that range from 10 KW right up to 1 MW, and deliver our solutions in stackable, 20-foot containers for efficient transportation by road, rail, ship, or plane.”

Diesel-powered internal combustion engines have been the go-to technology in this part of the generation world. However, gas gensets and turbines are becoming much more common.

APR’s Rich argued that one of the biggest innovations in this sector has been the use of mobile turbines: “Before 2011, utilities were forced to use smaller-MW reciprocating engine power modules because that was the only feasible fast-track solution. As mobile turbine technology has developed and become available, utilities have turned to them rapidly…. Since 2011, turbine share has grown rapidly, from zero in 2010 to a 35% share of the 100-MW+ deal space in 2013. Approximately 20% of all fast-track power deals since 2012 have been for gas turbines. Utilities prefer the grid stability and power density that turbines provide, and it is a technology that they understand.”

He also noted that the aeroderivative turbine technology used in many APR plants is the same technology used in many permanent plants; “the only difference being that it is mobile and can be moved if needed.”

Another advantage of mobile gas turbines Rich mentioned is that they are “opening doors to new markets and opportunities in developed countries, where emissions and scale are of importance.”

In fact, in October 2013, APR Energy announced it had agreed to acquire GE’s power rental business, which will tie it even more closely with gas turbine technology. Today, APR Energy’s fleet is about 55% mobile gas turbines and 45% gas or diesel power modules—primarily GE and Caterpillar equipment, as the company currently has a strategic alliance with GE and a global agreement with Caterpillar.

Even non-utilities are turning to gas turbines. In September 2005, when Hurricane Rita flooded and caused the shutdown of the Valero Energy Corp. refinery in Port Arthur, Texas, and when utility power was unavailable, Valero looked for a quick yet simple option. GE’s Aeroderivative Gas Turbine business provided the refinery with a TM2500 gas turbine (Figure 3), a blackstart diesel generator, and an automatic transfer switch. The 22.5 MW supplied was, according to a GE press release, “more powerful and much less sprawling than a cumbersome string of diesel generator sets.” Six days after Valero signed the temporary power contract, the unit was fully installed and delivered auxiliary power for three months until the utility could resume supplying permanent power.

Typically, Kempf said, units can be ready to enter commercial operation in about 30 days. GE has also supplied its trailer-mounted, mobile aeroderivative gas turbines in other countries. For example, two of the four dual-fuel (gas and diesel) TM2500+ units involved in a $135 million project for General Electricity Co. of Libya were installed and commissioned within six weeks after site selection in December 2013. The project will provide more than 100 MW for the summer peak by expanding the Zawia and W. Tripoli power plants. GE notes that the mobile units can be moved anywhere in the country to supply emergency backup power or as a “base-load bridge to permanent power installations.” The TM2500+ can produce more than 26 MW of power—a 31% increase over the TM2500, GE says.

GE also offers gas engines from 300 kW to 10 MW. Kempf said, “A containerized gas engine solution, for fast installation/relocation, can be supplied up to 4.4 MW and with efficiencies up to 46%.”

Whatever the prime mover, squeezing maximum efficiency out of the technology is key. Aggreko, which manufactures its own equipment, last year launched the G3+, a 1-MW engine that the company says provides customers with up to 14% more power and 12% lower cost per MW than previous models. Aggreko says it believes its G3+ reciprocating engine is the most efficient engine on the market “and provides fuel efficiencies surpassing that of mobile turbine technology.”

Fuel Options

Because it is available almost everywhere, diesel has been the traditional fuel of choice for temporary power (see sidebar). However, it’s not the most cost-effective, so the global players are adding alternatives.

| Clean Diesel?Diesel engines—whether in vehicles or stationary power systems—have a reputation for dirty emissions. But when it comes to the latest generation of technology, that reputation is becoming outdated.The Diesel Technology Forum (DTF), a U.S. industry group formed in 2000 that promotes the use of “clean diesel,” says that today’s diesel generators “emit 26 times less particulate matter than those manufactured 10 years ago.”

Diesel generators used for other than emergency use are subject to a variety of federal, state, and local regulations in the U.S. and abroad. “In 2006, the EPA finalized the first national emission standards for new stationary diesel engines under the New Source Performance Standards (NSPS),” the DTF notes. “The NSPS requires all new diesel engines to be certified to emission standards that generally follow EPA’s non-road or marine mobile emissions standards which generally require over 90 percent reduction in emissions of particulate matter and nitrogen oxide.” The DTF notes that “[o]ver the 2011–2015 period, EPA requirements will mean that emissions for all non-emergency diesel generators regardless of horsepower rating will be approaching a near-zero level.” It adds that, since October 2010, most diesel fuel used in diesel-powered generators has been ultra-low-sulfur diesel (ULSD) fuel (no more than 15 ppm sulfur). Using ULSD in existing units reduces particulate matter emissions by 10% to 20%, and when cleaner fuel is used in today’s new technology lower-emissions engines, the DTF says that particulate matter will be reduced by 90% compared to engines made before 2011. “Clean diesel,” is appears, is more than just a catchy slogan. |

“We were the first company to develop and produce in volume 1-MW gas-fired generators in 20-foot containers, and we now have over 900 MW on rent in our Power Projects business—far ahead of any competitor,” said Shantaram. In the second half of 2013, gas-fueled plants generated 35% of Aggreko’s Power Projects rental revenue, “having grown at a compound growth rate of over 55% between 2007 and 2013. Utilities using our gas technology are enjoying all-in costs per kilowatt-hour from our plants, which is often cheaper than some of their permanent capacity, and far below diesel-fueled power plants.”

Aggreko has been investing heavily in the development of temporary power generation that can use natural gas and heavy fuel oil (HFO). In 2010, Aggreko began looking for a fuel that was cheaper than diesel but more easily available than gas. “The answer was HFO, which is widely used for both power generation and shipping, Shantaram said. “We overcame some significant engineering challenges to develop an engine capable not only of running off HFO, but of doing so inside a 20-foot container, and launched our new product in March of 2013. Customer reaction has been very favorable, as we are able to save them millions of dollars in fuel cost—we believe that this product will become a very important part of our portfolio over the next five years.”

Cummins has also delivered natural gas and biogas turnkey power plants for dedicated installations. The company has seen increased demand for gaseous fuels over the past five years, particularly natural gas and biogas. As Duncan noted: “Two factors influence the viability of this as an option; firstly, there has to be a reliable source of fuel available locally, either via pipeline or through local production. Secondly, the contract length has to be long enough to justify any additional infrastructure investments required to support these fuels.”

“There may be long-term potential in dual-fuel technology,” he said, “which could allow operators to minimize operating costs by changing fuel substitution rates to most effectively respond to fuel price economics. Currently, up-front technology choices are significantly influenced by capital cost, and the economic viability of these options often mean that substitution rates are constrained, limiting potential fuel saving upside.”

APR Energy has plants running on both natural gas and diesel fuel. Rich said customers choose and provide the fuel. As APR Energy’s mobile turbines are dual fuel, “they can operate on either diesel or natural gas with the ability to change at the flip of a switch. We also offer power modules that use either diesel or gas.”

“Fuel is the most expensive part of the kilowatt-hour,” Rich added. “So fuel efficiency improvement is the main focus. The flexibility to operate with dual fuel is vital, and in this market only the turbine can deliver that ability.”

Both Supporting and Competing with Grid Power

Estimating what percentage or capacity of temporary power is grid-tied generation for traditional utilities is difficult because of the temporary nature of the market and because plant deployments can change overnight. However, it’s clear that—especially in regions with fast demand growth or unreliable infrastructure or fuel supply—temporary power can be an important utility partner.

One example is Uruguay, where the electricity sector is largely based on domestic hydropower, leaving the country vulnerable to seasonal rainfall patterns. To help bridge the gap between supply and demand, APR Energy supplies a total of 300 MW of mobile turbine power for peaking and backup generation. The semi-permanent plants (see Figure 1) integrate seamlessly into national utility UTE’s existing infrastructure and utilize demineralized water solutions to comply fully with Uruguay’s strict emissions standards.

Another is Saudi Arabia, where demand increases significantly in the summer, “it becomes very difficult for the grid to cope with that change,” explained Keddis. “On an annual basis, Altaaqa re-enforces the Saudi Arabian grid during the high season with an average of 250 MW to 300 MW in different parts of the country.” In fact, its largest project to date at a single site, currently under development, is 95 MW in Al-Kharj, Saudi Arabia, for Saudi Electric Co. (Figure 4).

|

| 4. Powering growth. This photo shows Altaaqa’s largest single temporary power plant, 95 MW, being installed in May 2014 in Al-Kharj, Saudi Arabia. Courtesy: Altaaqa |

And in May, Aggreko announced that it is providing 30 MW of power to a hydro site located 3,423 meters above sea level. That project will provide continuous power to the Santa Teresa Hydroelectric site, located in the Cusco region 715 miles from Lima, Peru (Figure 5). High altitudes affect generators by reducing their output. According to Aggreko, the derating typically results in a production loss of 10% for every 1,000 meters of altitude. Aggreko says its engines provide a minimum reduction of power at 3,400 meters, with just 10% loss, according to a company press release. Aggreko says it mobilized the equipment in just five days, using trailers specially designed for loads of up to 26 tons.

|

| 5. Supporting hydro. A 30-MW project for a hydro site in Peru, shown here during delivery, was mobilized in five days using trailers specially designed for loads of up to 26 tons. Courtesy: Aggreko |

Another factor behind the growth in the power rental market that Cummins’ Duncan mentioned is growing interest in microgrids to meet temporary (and more permanent) power needs. A microgrid consisting of multiple distributed energy resources feeding single or multiple electrical loads, and operating as an autonomous/island grid can provide its operator with the flexibility to leverage different technologies with complimentary characteristics. “One example is using solar power with diesel generators, providing the fuel savings and emission benefits associated with renewable energy, but addressing the challenges of intermittency and energy density by leveraging the reliability and power density associated with diesel generators.”

Depending on who is contracting for the microgrid, this scenario could either support a utility or steal potential load growth from it.

Surmountable Challenges

As in the permanent power world, regulatory issues were the most frequently mentioned challenge. Aggreko’s Shantaram noted that even though the company’s expertise is in working across borders, “challenges can present themselves when having to adapt to local regulations or requirements that differ from country to country.” However, with “over 50 years’ experience working in almost every country and in every industry… we can obtain permits whether it be in Mozambique, Romania, USA, or Brazil.”

APR’s Rich noted that “The nature of today’s market is that our contracts are often in developing countries, which typically makes them challenging from the start, particularly in terms of logistics, labor, and security.”

GE’s Kempf pointed out that in “bridging” solutions, the time required for power purchase agreement negotiation in many regions can create challenges to rapid deployment. “Fuel handling, transportation, and other issues can also present challenges at times, but solutions are almost always available.”

Then there’s weather. Temporary power is often the only option in remote areas, and those areas are often “remote” for obvious reasons of climate or terrain. Temperature extremes and poor or absent infrastructure present challenges for logistics and operation. Luckily, temporary power plants are mobile and modular, so any damaged equipment can be replaced quickly. ■

—Gail Reitenbach, PhD is POWER’s editor (@GailReit, @POWERmagazine).