UK's First SMR Nuclear Project to Showcase Four Westinghouse AP300 Reactors

Community Nuclear Power (CNP), the UK’s only independent small modular reactor (SMR) development company, will spearhead a project to build four Westinghouse AP300 small modular reactors (SMRs) in North Teeside, Northeast England, anticipating commercial operation by the early 2030s.

Nuclear technology powerhouse Westinghouse on Feb. 8 said it signed a memorandum of understanding (MoU) with CNP to develop the 1.5-GW nuclear project. CNP, in a LinkedIn post on Thursday, said it had also “secured an agreement” for the site. “This means the component parts and agreements needed to make this ground-breaking proposition happen—land, capability, technology, private capital funding, and community demand—are in place,” the company said.

CNP now expects to work with strategic partners, including engineering firm Jacobs and Interpath Advisory, to develop the “fully licensed site” for the project” by 2027, it said.

A Solid Prospect for Westinghouse’s Newly Launched AP300

If completed, the project could become the first SMR deployment in the UK. It could also mark Westinghouse’s first deployment of the AP300, an SMR model it launched in May 2023. In addition, the project is “the first privately funded project deploying SMRs anywhere in Europe,” CNP noted. “And our goal is to be generating clean energy within 10 years’ time.”

CNP said the company’s confidence to begin the project was based on “finding like-minded companies and communities with whom we can work.” CNP CEO Paul Foster on Thursday suggested the company chose the AP300, given Westinghouse’s “proven technology and mature supply chain.” Those attributes complement CNP’s “depth of expertise in nuclear program delivery in a region that is transforming its industrial landscape,” he said.

As POWER has reported in detail, the 300-MWe/900-MWth AP300 is a “downsized” version of the company’s flagship AP1000 Generation III+ pressurized water reactor (PWR) technology, and it will leverage learnings from AP1000 reactors already in operation or under development. Westinghouse on Thursday noted the AP300 SMR is also under consideration by other customers in the U.K., Europe and North America. Westinghouse has previously signed MoUs with Energoatom in Ukraine, JAVYS in Slovakia and Fortum in Finland and Sweden to explore AP300 deployment.

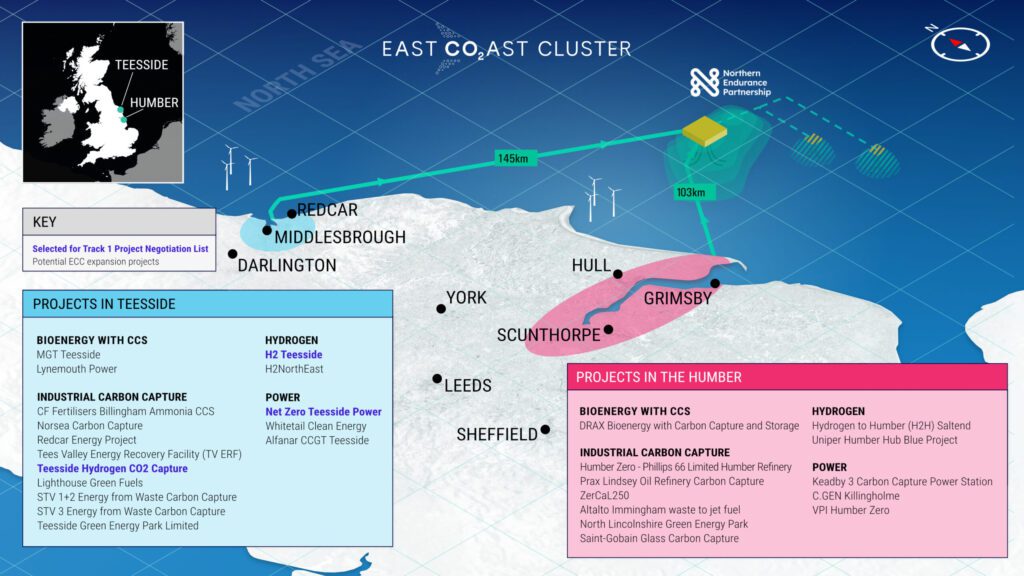

CNP’s selection of North Teeside was also strategic. North Teeside encompasses part of the larger Teeside area, which is known for its significant industrial heritage. The region notably hosts the Teeside Cluster, which comprises more than 60 industrial facilities with infrastructure and services to support its existing chemical industries and former steelworks. Teeside has made quick progress in developing a net-zero industrial hub, featuring several carbon capture and hydrogen projects— including five power projects. In 2021, the Teeside hub teamed up with a neighboring industrial hub in Humber to form the East Coast Cluster.

CNP’s proposed site is in the North Tees Group Estate, a 540-acre reclaimed and regenerated industrial land in the North Tees. CNP noted, “There is mature market-led demand in Teesside for clean, reliable energy—in this instance, a program to build a specialized site that provides green sustainable power for the region.” The project will also support “the development of a Green Energy and Chemical Hub on the North Tees Group Estate, with the ambition of producing power to liquids (e-fuels and e-chemicals) through an offtake ecosystem on the north bank of the River Tees, near Stockton-on-Tees,” it said.

David Durham, Westinghouse president of Energy Systems, suggested the AP300 SMR was suited to these applications given the reactor’s designed versatility. “Our AP300 SMR is ideally suited not just to support grid generation but also for industrial sites for generating clean and secure energy and the ability to produce hydrogen, e-fuels, desalination, and district heating,” he said.

CNP has said it “will work in partnership with local business and the regional authorities to enhance the growth opportunities on and around the site.” It adds: “Securing local agreements to utilize this power and heat will materially enhance the long-term prospects for the project and create a baseload supply to drive future investment, protecting private off-take customers from fluctuations in the energy markets.”

A Strategic Choice for Nuclear Innovation

Westinghouse on Thursday noted the privately developed AP300 project “is in accordance” with the UK’s January-issued consultation to solicit feedback from the nuclear industry and local communities on how the government can support investment in advanced nuclear technologies.

In its 43-page consultation document, the UK government sought views on the potential role of enabling new uses and testing for advanced nuclear. It lays out potential regulatory pathways and funding options for research and development in the sector. The consultation document also pivotally discusses ways the government can support private developers, financial mechanisms, and business models for advanced nuclear. Slated to close in April 2024, the consultation is expected to inform the government’s future policy options for new nuclear.

The UK’s Civil Nuclear Roadmap issued on Jan. 11 also emphasizes a significant role for private development as the country races to meet its ambitious goals to quadruple its nuclear capacity by 2050. The roadmap sets out a series of goals and actions that could enable the delivery of 3 GW to 7 GW every five years from 2030 to 2044.

In the roadmap, the UK describes a commitment to allow investors and new project developers to engage with the government on the suitability of Contract for Difference (CfD) and Regulated Asset Base (RAB) financing models.

Over the near-term, the UK is banking on the completion of two EPR reactors at the 3.2-GW Hinkley Point C plant in Somerset, southwest England, as well as Sizewell C, a proposed replica EPR project in Suffolk, eastern England. However, EDF, which is building Hinkley Point C—a non-government project—in January suggested the project will suffer new heavy delays of up to three years.

The delays will extend the in-service timeframe from 2027, as was recently anticipated, to 2031. EDF now estimates costs of completing the project will hover between £31 billion and £34 billion in 2015 values. Adjusted for inflation (using the Bank of England’s inflation calculator), that amounts to a cost estimate of between £40.98 billion ($52 billion) and £44.95 billion ($57 billion).

The government’s support for SMRs and “advanced modular reactors” has also mostly been investment-based. In October 2023, Great British Nuclear (GBN), an entity launched to bolster the UK’s energy security strategy, unveiled six nuclear designs that will advance to the next phase of the UK’s SMR competition, a fast-track measure that could result in a government contract by summer 2024 as part of a strategy to deliver operational SMRs by the mid-2030s.

Westinghouse’s AP300 made the competition shortlist, along with designs from EDF, GE-Hitachi Nuclear Energy, Holtec Britain, NuScale Power, and Rolls Royce SMR. In the next phase of the competition, GBN will choose successful technologies that could be ready to enable a final investment decision (FID) by 2029.

CNP Leading Proposed Rolls-Royce Cumbria Nuclear Project

CNP, notably, has also been working through an affiliate, Solway Community Power, to bring new nuclear power to West Cumbria in northwest England. In November 2022, Roll-Royce said Solway selected its SMR, a “home-grown” 470-MW PWR, as its preferred nuclear technology provider for a site owned by the Nuclear Decommissioning Authority.

Then, Foster, as head of Solway, had said: “The critical pieces already exist, such as land that could be suitable, interest from investors, and of course, the modular solution from Rolls Royce SMR. Our job at Solway is to pull it all together—and we’ll be working closely with our community, who have an enduring stake in both its development and its decades of operation.”

CNP, on its website, suggests the “Cumberland UK” project is planned to enter power production in “year 10” and will provide 940 MW for a period of 60 years. “The goal is to utilize around 10% of the Moorside site opposite Sellafield, leaving the remainder for any future publicly funded projects,” it notes. The Cumbria project, “100% private sector funded, will materially reduce the cost and risk for those SMRs that follow—including any potential Treasury-funded project,” it adds.

Rolls-Royce SMR in April 2023 progressed to Step 2 of the Generic Design Assessment (GDA), a non-mandatory process that allows the Office of Nuclear Regulation (ONR) to begin assessing the safety, security, safeguards, and environmental aspects of new reactor designs before site-specific proposals are brought forward. The process serves as a first step to reduce project risk, providing confidence that a proposed design can be built, operated, and decommissioned in the UK under existing standards.

To date, ONR has completed GDAs for the EDF and AREVA UK EPR, the Westinghouse AP1000, the Hitachi-GE UK ABWR, and the CGN/EDF/GNI UK HPR1000 designs in 2012, 2017, 2017, and 2022 respectively.

Westinghouse on Thursday said its AP300 SMR will utilize “AP1000 engineering, components and supply chain, enabling streamlined licensing and leveraging available technical skills.” These factors provide “confidence that the first operating unit will be available in the early 2030s.”

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).

SMR, Westinghouse, AP300, Community Nuclear Power, UK, North Teeside, private sector funding, nuclear technology, advanced nuclear, clean energy, Civil Nuclear Roadmap.