Westinghouse, Fortum to Study Possibilities for AP1000, AP300 Nuclear Reactors in Finland and Sweden

Westinghouse Electric and Finnish utility Fortum will cooperate to explore developing and deploying AP1000 and AP300 reactor projects in Finland and Sweden.

The companies on June 7 signed memoranda of understanding (MOUs) to establish a framework of collaboration “for detailed technical and commercial discussions and explore cooperation on the next steps” to implement Westinghouse’s advanced reactors in both countries.

According to Fortum, the MoUs are related to Fortum’s two-year Nuclear Feasibility Study, which the Finnish utility launched in November 2022. As part of the study, Fortum is examining commercial, technological, political, legal, and regulatory conditions for small modular reactors (SMRs) and conventional large reactors in Finland and Sweden.

The study is also exploring partnership “constellations”—formal ventures formed between a variety of stakeholders, such as nuclear generators, district heating companies, industrial power and heat off-takers, and utilities. “In addition to Westinghouse Electric Company, Fortum has made cooperation agreements with Korean KHNP, British Rolls-Royce SMR, French EDF, Swedish Kärnfull Next, and Finnish Outokumpu and Helen,” Fortum noted on Wednesday.

Following Disruptions, Fortum Refocusing on Nordic Power Generation Business

Fortum, which fully divested Uniper to the German government last year following a fuel crisis related to Russian gas, has set out to refocus on clean Nordic power generation as its core business. The company in 2022 relied on nuclear power for 53% of its total 44.2 TWh power output, followed by hydropower at 43%. Most of its 8.6-GW generating fleet is located in Sweden (4.4 GW), followed by Finland (4 GW), but it also owns combined cycle power plants in Denmark (9 MW) and Poland (145 MW).

In Sweden, Fortum jointly owns the Forsmark 1,2, and 3 nuclear reactors with Vattenfall, as well as Okliluoto 1, 2, and 3 with TVO, and in Finland, it holds full ownership of the 1-GW, two-unit Loviisa power plant, which began operation between 1977 and 1980. The company in March 2022, notably, announced it would apply for new operating licenses for the Loviisa power plant extending through 2050.

Fortum also held seven thermal power plants—a combined 4.7 GW—located in Russia’s Ural region and Western Siberia and a portfolio of wind and solar projects, but Russia seized control of those assets in April 2023. Fortum has since the start of the Russia-Ukraine war pushed for a controlled exit of all business with Russia. While the company still procures nuclear fuel from Russian firm TVEL, Fortum in November 2022 announced an agreement with Westinghouse for the design, licensing, and supply of a new fuel type for the Loviisa power plant. The new fuel type is based on “British Nuclear Fuel Limited’s fuel that was supplied to the Loviisa power plant from 2001-2007 and used in parallel with the fuel supplied by the Russian TVEL in the early 2000s,” the company notes. Fortum says that it intends to use the new fuel after Loviisa’s current fuel agreement with TVEL expires alongside the nuclear plant’s current operating licenses in 2027 and 2030.

During an investor presentation on May 26, the company noted the Nordic region is characterized by an “extremely competitive” market for clean energy. The company projects that Nordic power demand will be driven by decarbonization and electrification, in particular by “energy-intensive industrials seeking out significant amounts of clean power.” These industries include green steel and battery producers, data centers, and green fuel producers, it said.

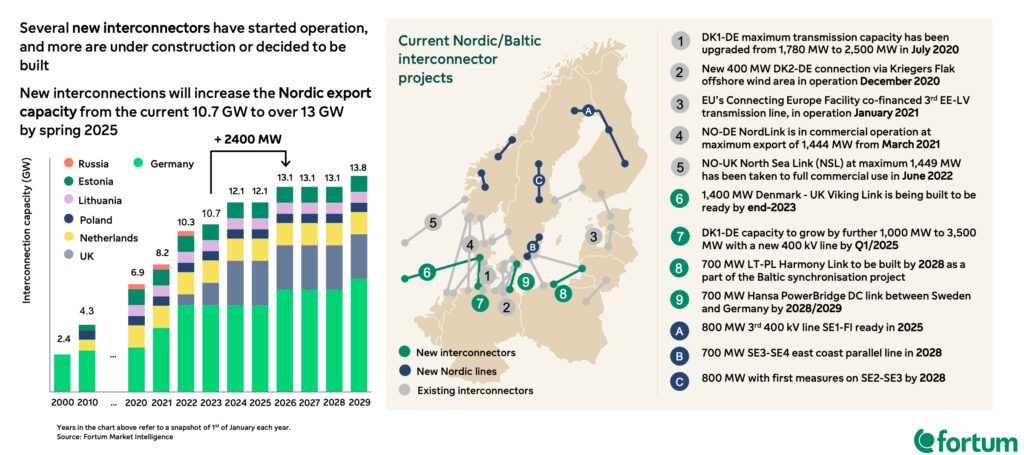

Another key driver is that Nordic, Baltic, continental European, and UK markets appear to be integrating. Fortum Market Intelligence estimates that interconnection capacity in these regions will grow, potentially increasing Nordic export capacity from the current 10.7 GW to more than 13 GW by spring 2025. While Fortum is cognizant of the volatility and uncertainty that currently characterizes European power markets face, over the mid-term, these uncertainties will increase the value of flexible assets, officials suggested.

Promising Markets for AP1000, AP300

David Durham, president of Westinghouse Energy Systems, on Wednesday highlighted market potential in Finland and Sweden for its AP1000 and AP300 SMR reactors. “Fortum is a leader in providing safe, clean and reliable nuclear energy for the people of Finland and Sweden, as well as an important customer for our fuels and services businesses supporting Fortum’s existing operating plants,” he said.

Four Westinghouse AP1000 reactors are already operating in China. In the U.S., one AP1000 unit recently began producing power for the grid while the second is preparing for initial fuel load. A Westinghouse AP1000 is also under development in Poland, spearheaded by a Westinghouse-Bechtel consortium. On May 25, state-owned Polish entity Polskie Elektrownie Jądrowe (PEJ) said a potential construction contract could be signed by 2025 in a bid to meet Poland’s goal to begin nuclear power generation in 2033. The AP1000 also has been selected for nine units in Ukraine and is under consideration at multiple sites in other countries in Central and Eastern Europe, and the UK, Westinghouse has said.

Since Westinghouse in May 2023 launched its AP300 SMR, a “downsized” version of the company’s flagship AP1000, the company has begun pre-application regulatory engagement with the U.S. Nuclear Regulatory Commission. “The AP300 SMR is the only small modular reactor based on an Nth-of-a-kind operating reactor,” the company noted on Wednesday. “Westinghouse is targeting design certification for the AP300 SMR by 2027 and for construction to begin by 2030. The first operating unit would be available in 2033.”

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).