UK's Drax Eyes U.S. for Bioenergy CCS Expansion Drive

The 2.6-GW Drax Power Station in northeastern England—once Western Europe’s largest coal-fired power plant—is poised to pioneer bioenergy with carbon capture and storage (BECCS), a negative emissions technology. In a move to establish a stronghold on emerging prospects for BECCS, Drax Group has now set out to launch an independent business unit to develop and build new BECCS plants in the U.S.

The move is a remarkable step for Drax Group, a company established in 1967. After the discovery of the Selby coalfield—a deep underground resource in North Yorkshire—the UK’s state-owned Central Electricity Generating Board commissioned Drax Power Station (Figure 1), and the plant, comprising four 660-MW units equipped with Babcock and Wilcox subcritical boilers, was completed in 1975. The Drax plant doubled its capacity in 1986 to 4 GW, and in 1988, it pioneered flue gas desulphurization (FGD) in the UK. After a series of ownership shuffles following the privatization of the UK power sector in the 1990s, Drax Group was founded in 2005.

The plant was subsequently outfitted with more environmental controls, including boosted-over-fire-air (BOFA) technology to ensure compliance with the European Union’s Large Combustion Plant Directive in 2008. But in 2009, an engineering team successfully adapted the plant’s boilers to combust wood pellets, proving co-firing.

“When converting a generating unit, the steam turbine and generator itself remain the same. The difference is all in the material being delivered, stored, crushed, and blown into the boiler and burned to heat up water and create steam,” the company noted (Figure 2). In April 2023—after 50 years of power generation from coal and a decade after the first unit was converted to biomass—the Drax plant officially converted the station to run wholly on biomass pellets, ending its use of coal.

An Evolution From Coal to Biomass to BECCS

At the end of 2023, the plant’s four biomass units had a 2.6 GW capacity, representing 4% of Britain’s dispatchable capacity. At times of tight margins, the plant has consistently provided up to 11% of the UK’s total generation, the company notes. Drax has since added the 600-MW Cruachan Power Station to its portfolio—a flexible pumped storage facility within the hollowed-out Ben Cruachan mountain in Scotland. Drax stresses that the two assets form a crucial renewables dispatchable resource for the UK, producing on average 19% of the UK’s renewables at peak demand across the year and up to 70% on certain days.

Meanwhile, Drax Group also manages a lucrative pellet production business. While initially developed to bolster Drax’s fuel supply pipeline, the company has 18 operational and development sites that produce biomass pellets of around 4.8 million tonnes per annum (Mtpa). The pellets, made of sawmill and forest residuals, and low-grade roundwood, are sourced from the U.S. Southeast and Western Canada. Drax is currently targeting a production capacity of 8 Mtpa by 2030 to double sales of biomass pellets to third parties via long-term contracts, aiming for a market presence in Asia and Europe.

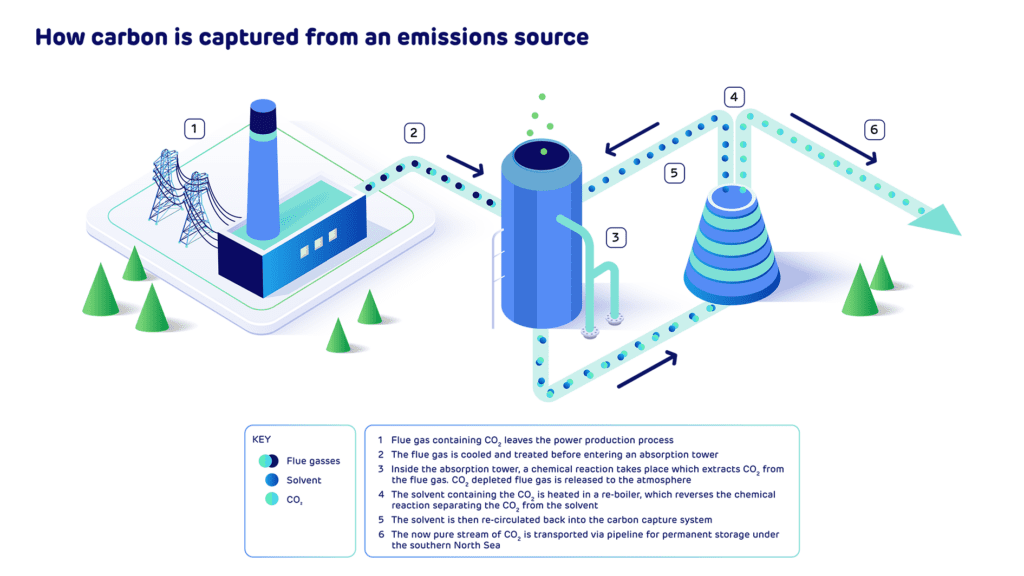

But alongside its ambitions for an expanded biomass supply chain, Drax has actively fostered the development of BECCS, a technology that pairs post-combustion carbon capture with biomass generation. The company’s efforts began in 2018 with a six-month-long BECCS pilot at a Drax Power Station unit to capture a tonne of CO2 a day using a proprietary solvent developed by UK firm C-Capture to isolate carbon dioxide from flue gas released when biomass is combusted.

Drax in 2020 initiated a second, 12-month pilot at the plant’s “CCUS Incubation Area” to test two Mitsubishi Heavy Industries (MHI) solvents: the commercial KS-1 solvent (which is in use at Petra Nova, one of the world’s largest power generation carbon capture projects) and KS-21, a newer technology designed with improvements, including lower volatility, greater stability against degradation, and lower running costs. KS-21 was commercialized in 2021 at the Technology Centre in Mongstad, Norway. The successful pilot at Drax captured around 300 kilograms of CO2 a day, leading to a long-term contract between MHI and Drax in 2021 to license the Advanced KM CDR process, which uses KS-21.

Drax has now embarked on a project to outfit two of Drax Power Station’s four units with BECCS (Figure 3) using MHI’s technology and potentially remove approximately 8 million tonnes per year (Mtpa) of CO2 per year when both units are fully operational in 2030 (with the first unit slated to begin operating in 2027). The CO2 would then be transported via pipeline to the North Sea and injected into geological formations below the seabed. While the company expects to make a final investment decision to begin construction this year, in January, it garnered a crucial development consent order (DCO) from the UK government, giving it the government’s green light.

The government’s DCO, notably, is confident that the proposed project can achieve a 95% capture efficiency and that it is “reasonable to treat the biomass combustion emissions as zero-rated.” That confidence is founded on multiple factors, including a conclusion by the “examining authority,” comprising two UK government inspectors, that “over the whole life of the proposed development, there would be negative [greenhouse gas] emissions due to the carbon captured in the operational phase.”

BECCS: A Crucial Integration for Decarbonization

If completed, the Drax project would be the world’s first carbon-negative power station, serving as a flagship BECCS project that integrates—on a large scale—the myriad benefits of carbon dioxide removal (CDR) with energy production.

CDR—otherwise known as negative emissions or carbon drawdown—has gained quick prominence of late, given its potential to address emissions from hard-to-decarbonize sectors while removing legacy CO2 emissions. Because mitigation—progress to rapidly cut global GHG emissions—appears to be faltering, CDR is being recognized as a critical component to achieving ambitious climate goals. Only a handful of technology-based CDR solutions exist so far, however, including BECCS and direct air capture (DAC).

BECCS, like DAC, has been making progress, albeit slowly. The International Energy Agency (IEA) suggests around 2 Mt CO2 per year is currently captured from biogenic sources, and less than 1 Mt CO2 is stored in dedicated storage, but most—90%—is captured in bioethanol facilities. The largest operating BECCS project to date is the Archer Daniels Midland (ADM) ethanol plant in Decatur, Illinois, which has a capacity to capture 1 Mtpa. And while many other projects have been announced since January 2022, the IEA suggests BECCS could reach just under 50 Mt CO2/year by 2030—which falls far short of the approximately 190 Mt CO2/year removed through BECCS by 2030 in the Net Zero Emissions by 2050 (NZE) Scenario.

The Drax Power Station BECCS project, by comparison, is slated to remove 8 Mtpa—including 4 Mtpa of negative CO2—but it would also generate 2 TWh and support approximately 1,000 jobs, according to a report issued by Baringa earlier this year. And while Drax’s captured carbon is set to be sequestered, the power plant is uniquely situated within Zero Carbon Humber. The industrial hub hosts several other prominent carbon capture and hydrogen projects, including seven power projects.

An Ambitious Effort to Extend BECCS to the U.S.

For now, Drax is already executing ambitions to expand BECCS. In a move that capitalizes on its belief that BECCS will play an integral role in global power sector decarbonization, the company in January unveiled plans for a new independent business that will oversee the development and construction of BECCS new-build power plants internationally.

The new business, slated to be headquartered in Houston, Texas, will focus primarily on building and operating BECCS power plants in the U.S., likely starting with the U.S. Southeast, Raj Swaminathan, Drax Group senior vice president, told POWER.

“We’re targeting something around the 250-MW net output range, though obviously site-by-site they may differ. Each would capture 2.5 Mtpa to 3.0 Mtpa that would be sequestered.” The new business, notably, will kick off with an ambitious goal to remove at least 6 million tonnes of carbon dioxide from the atmosphere annually, he said.

Drax is already looking at several sites, Swaminathan noted. “Our initial target in the U.S. is to have two of these plants in the 2030s timeframe,” he said. The timeframe is still unclear, given that BECCS plants require “multiple years of planning and multiple years of construction,” he noted. However, ultimately, Drax will target building many more BECCS plants both in the U.S. and Canada, he said.

The effort builds on Drax’s long legacy as a major producer, supplier, and user of biomass, as well as its 20 years of activity in all areas of the supply chain, Swaminathan explained. The new business considers proximity to sustainable biomass “fiber,” which Drax currently sources primarily from North America, he said. “Given Drax has a presence in the U.S. and Canada, [the model] looks at locating BECCS power plants right at the source of where the biomass is coming from.”

But rather than sourcing fuel for the new builds, Drax will leverage collaborations with partners along with its own expertise in developing and building BECCS facilities. “What we’re doing right now is setting up partnerships with [firms] to supply a large portion of the biomass needed for this, and it has to be sustainably sourced,” he said.

On Jan. 31, for example, the company announced an agreement with Molpus Woodlands Group that will provide Drax with an option to purchase up to 1 million green tons per year of sustainably sourced woody biomass to fuel its U.S. Southeast BECCS operations. Molpus’s fiber, Swaminathan noted, is sourced from low-grade roundwood, including forest thinnings and timber harvesting residues. It meets Drax’s high sustainability standards, and it will enable the production of CDR credits that can be purchased on the voluntary carbon market, he said.

Carbon captured from the plant will be delivered to another partner who will then store it, he said. Drax’s primary market focus on the U.S. Southeast is also driven by sequestration options in the region, he said. The prospect will also offer economic benefits, including power plant jobs and jobs related to biomass collection, equipment maintenance, and chip mills.

A ‘Perfect Storm’ of Elements

Drax has noted the U.S. makes an ideal starting point because it has evolved into an attractive carbon capture and storage (CCS) market, given regulatory support, commercial potential, technology, and public acceptance. The 2022-enacted Inflation Reduction Act (IRA) also supports BECCS through 45Q credits for carbon sequestration. Yet another driver is the emergence of a voluntary CDR credit market, which is reportedly becoming substantial. CDR.fyi, the largest open data platform dedicated to monitoring CDR transactions, suggests the BECCS purchases are soaring, with transactions dominated by oil and gas firms and big tech.

“It’s like a perfect storm of elements that make it ideal because you’ve got the fiber, you’ve got the pipeline that is existing, you’ve got the ambitious climate goals and carbon capture incentives,” Alex Schott, Drax Group vice president and head of North America Communications, told POWER. “The IRA was really a game-changer, so you really see all those elements coming together to make it a very attractive investment and then to achieve the goals of being a net-zero company.”

Asked how BECCS plants will remain competitive within power markets dominated by an influx of cheap wind and solar, Swaminathan suggested the alternatives posed little competition. While a plant needs to be competitive to be dispatched in competitive markets, BECCS typically relies on several streams of revenue, including power sold, carbon captured, and CDR revenue, he said. “If you look at the CDR market right now, the primary competition is from DAC, and frankly, we believe the price of CDRs needed to make them viable is far higher than what would be necessary to make BECCS viable,” he said.

Customers are “showing a ton of interest in the CDR side,” Swaminathan added. One reason is that purchasers want to know where their CDRs are coming from to ensure they are sustainable and low risk. On the power side, a recent study published by specialized consultancy firm Foresight Transitions (and commissioned by Drax) suggests that, like nuclear power, BECCS could provide valuable support for intermittent renewables as a baseload generator.

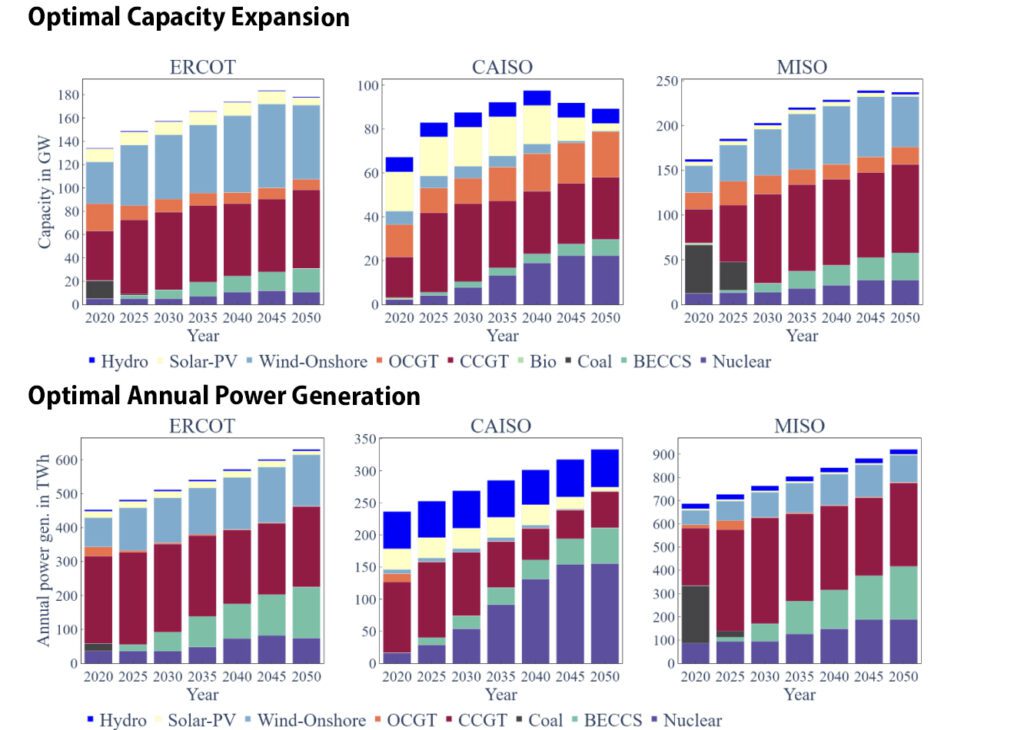

The study evaluated BECCS’ potential role in three competitive markets—California Independent System Operator (CAISO), Midcontinent Independent System Operator (MISO), and Electric Reliability Council of Texas. It found that the inclusion of BECCS in the capacity mix could dramatically reduce the overall cost associated with net zero, an attribute that could make power cheaper. “Additionally, BECCS provides valuable time to mature technology supply chains, reduce technology risks, and improve commercial confidence,” it says.

That consideration is especially important given that the study also found that recent federal bills, including the IRA and the Bipartisan Infrastructure Law, remain “insufficient” to incentivize a net-zero or net-negative power system. “We found that simply increasing the 45Q tax credit to $100–150/[per metric ton of carbon dioxide (t CO2)] provides little value to the system as it enhances the economic viability of coal-CCS. In contrast, a specific negative emissions credit of $40/t CO2 is required to facilitate a net-negative power system by 2050, largely delivered by BECCS,” it says.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).