Shifting Gears: How Diesel and Gas Engines Are Thriving in the New Power Paradigm

As the global power industry pivots toward decarbonization and decentralization, major manufacturers of diesel and gas engines are strategically adapting to change.

While large power plants frequently garner the world’s attention, the growing emphasis on decarbonization and decentralization is elevating the role of smaller-scale power generation solutions.

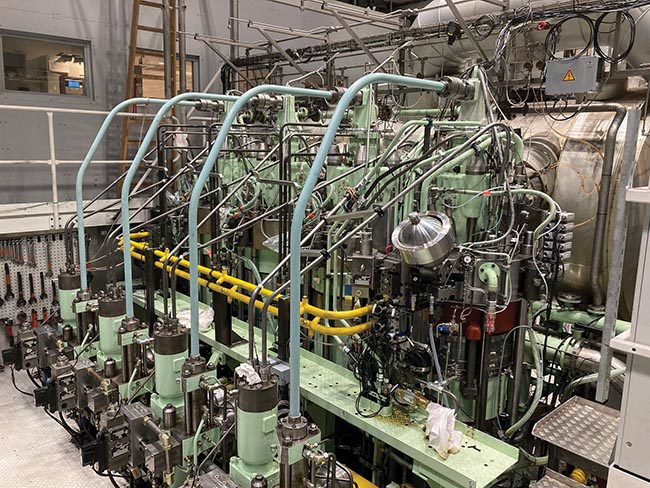

Traditionally, diesel and gas engines have secured a foothold in niche applications to generate power as both baseload and peak load power sources, with integral applications for standby or emergency power sources in critical or industrial facilities. While they are also routine choices for stationary remote and off-grid power generation applications, such as for mining operations, oil rigs, and remote infrastructure projects, their size and flexibility have made them ideal for mobile power generation or temporary power needs at construction sites, outdoor events, and disaster relief efforts. The power transition and emerging factors like urbanization and industrialization have ushered in new demands for power generation, affording the diesel and gas engine sector new prominence, including as critical components of combined heat and power facilities and dual-fuel conversions.

However, despite their versatility, scalability, and rapid deployment capabilities, the diesel and gas engine sector, like other power sources, is facing challenges related to environmental concerns and evolving market dynamics. Along with evolving regulatory pressures for increased emissions reductions, the sector is grappling with stiff market competition driven by advancements in renewable energy technologies, energy storage systems, and emerging technologies, like small modular reactors. Fluctuating fuel prices, geopolitical uncertainties, and gas grid connectivity also pose challenges.

Spearheading an Evolutionary Approach

Still, for the most part, key players in the diesel and gas engine sector told POWER their outlook for power generation is optimistic. At least over the near term, “The integration of increasing shares of fluctuating renewable energies to the power grid is still a challenge,” noted Ulrich Vögtle, head of Business Development, Power & New Energies at MAN Energy Solutions, a Germany-headquartered engineering firm that specializes in gas and diesel engines.”How do you ensure a secure power supply at all times when the sun doesn’t shine and the wind doesn’t blow? Here, gas engine power plants are an ideal match to close the gaps in the energy supply.”

Jim Rummel, director of Category Small Engines PS at Kohler, a company whose generator lineup extends from 9 to 4500kVA and 15 kW to 4 MW, pointed to a wave of technology advancements. Kohler, which serves a range of customers from the retail sector to mission-critical sectors like data centers, hospitals, and utility plants, is especially committed to an “evolutionary” approach, he noted.

“Diesel and gas engines are becoming cleaner and more efficient through continued system advancements,” he said. “Let’s look at the mission-critical sector in particular. Significant efforts have been made to optimize internal engine design and encourage the adoption of exhaust gas after-treatment, including diesel oxidation catalysts, diesel particle filters, and selective catalytic reduction. As a result, these advanced engines offer powerful performance with the lowest emissions to date.”

The Quest for Alternative Fuels

Underscoring a trend that has gripped the larger power generation sector, the diesel and gas engine sector is also prominently exploring alternative fuels, including hydrogen, biogas, and synthetic fuels, to minimize their environmental impact.

In a much-reported recent triumph, an industry consortium last year demonstrated fuel blends of up to 25% volume of hydrogen mixed with natural gas in Wärtsilä reciprocating internal combustion engines (RICEs) has launched at WEC Energy Group’s 56-MW A.J. Mihm power plant in Michigan.

Caterpillar, an equipment manufacturer whose lineup of diesel and gas engines serves small generators to large industrial applications, has made significant strides in this area. The company already offers commercial gas generator sets capable of operating on natural gas blended with up to 25% hydrogen by volume (with power nodes ranging from 600 kW to 2.5 MW for 50 or 60 Hz continuous, prime, and load management applications). Its diesel generator sets can also run on biofuels and have accommodated the use of biodiesel and hydrotreated vegetable oil (HVO) “for over a decade,” it notes. Among the company’s much-watched efforts is an ongoing demonstration to assess 100% hydrogen and hydrogen blended at 25% at a 2-MW District Energy St. Paul combined heat and power system.

Caterpillar is notably also exploring the viability of hydrogen fuel cells in backup systems. This January, it successfully demonstrated the 48-hour operation of a Ballard Power Systems of a 1.5-MW hydrogen fuel cell that was integrated into a Microsoft data center via a Caterpillar Microgrid Controller that was used to operate two Cat Power Grid Stabilization 1260 battery storage systems.

MAN Energy Solutions has also embraced the potential of alternative fuels. Vögtle told POWER the company’s gas engines can run on fuels like biogas and synthetic natural gas derived from green hydrogen. MAN’s 35/44G TS, 51/60G, and 51/60G TS gas engines are also “already ‘H2-ready’ and can be operated with a hydrogen proportion of up to 25% by volume in the gas mixture,” he noted.

“At the same time, we are working on future concepts that will enable hydrogen fueling of up to 100% as soon as hydrogen becomes available in large quantities.” A key driver for MAN’s capabilities to accommodate alternative fuels is ensuring its customer’s investments are “future-proof,” he said. “MAN Energy Solutions also takes a life-cycle approach to engine design,” he said. “This means our gas engines are easy to retrofit for alternative fuels. For example, MAN gas engines already in operation can be retrofitted for hydrogen admixture by upgrading the automation and adding adaptive combustion control sensors.”

To ensure similar prospects for the smaller engine space, Kohler is exploring HVOs, a renewable fuel. Kohler diesel engines are already compatible with slot-in hydrotreated vegetable oil (HVO). “It is a synthetic paraffinic fuel that meets the ASTM 975 standard. HVO is produced from raw materials of renewable origin, such as cooking oils, waste animal fat, or tall oil,” Rummel explained. “It is a straight-chain paraffinic hydrocarbon free of aromatics, oxygen, and sulfur and has high cetane numbers. Crucially, HVO can be adopted without any modification to existing generators. So, it is an economical way to reduce greenhouse gas emissions by up to 90% without investing in other equipment.”

A Key Priority: Boosting Efficiency

Along with fuel flexibility, boosting efficiency is a key priority for several key players. “Already now, CHP based on reciprocating engines offers the highest fuel efficiency both in electrical and overall efficiency,” MAN’s Vögtle said. “The next level is to decarbonize the operation of reciprocating engines. Here green hydrogen and other synthetic fuels will pave the way to net-zero CHP plants.”

Looking ahead, most manufacturers are also considering the integration of diesel and gas engine sets with other forms of generation as part of hybrid configurations. “Hybrid strategies are essential—because when it comes to power generation, there is no ‘one size fits all’ solution, with multiple options enabling each customer to choose what is exactly right for them,” Kohler’s Rummel noted.

Kohler, notably, is spearheading a 2-MW trigeneration project that integrates an INNIO Jenbacher natural gas engine (distributed by Kohler company Clarke Energy) with an 860-kW solar photovoltaic park at Kohler’s historic Reggio Emilia facility in Italy, a global hub for diesel engine production. Waukesha-based INNIO, another major engine manufacturer, is also notably spearheading interesting applications. Austrian utility RAG Austria AG recently announced it picked a 1-MW INNIO Jenbacher engine to power a cogeneration plant in Gampern, Upper Austria, that will leverage renewable hydrogen stored in a 4.2 GWh porous underground reservoir.

Like other engine manufacturers, INNIO has stressed the need for flexibility and investment security. Last October, the company became the first company to receive an “H2-Readiness” certification from TÜV SÜD for its Jenbacher engine power plant concept based on Jenbacher Type 4 and 6 product lines. According to Ferdinand Neuwieser, CEO of TÜV SÜD Industrie Service GmbH, the certification guideline is an industry attempt to provide engine manufacturers, plant operators, and insurers with a standardized and transparent evaluation framework. The certification covers “a complete engine power plant with all relevant subsystems.” Pivotally, however, it also “defines a roadmap for retrofitting existing plants—from gradual admixing to pure hydrogen operation,” INNIO noted.

Digitalization’s Immense Impact

As with other sectors in the power space, the diesel and gas sector is also integrating profound technology insights from digitalization. Manufacturers are augmenting offerings with advanced control systems, artificial intelligence (AI), and other digital tools to enhance their performance and efficiency.

Caterpillar, for example, recently introduced Cat ECS, a suite of integrated, connected, and scalable controllers to allow customers to manage energy needs ranging from a single generator set to cohesive, full-site microgrid solutions linking multiple assets. “These are specifically engineered for increasingly complex power systems that utilize multiple energy sources and grid interfaces,” the company told POWER.

MAN already offers a digital platform, MAN CEON, to allow the company to efficiently collect, store and evaluate huge data volumes. “To do this, we employ state-of-the-art, cloud-based technology and algorithms that help to identify and report problems,” Vögtle said. And to support its customers, MAN has introduced a “digital proactive service solution,” PrimeServ Assist.

Using data provided by MAN CEON, “service engineers at Remote Operation Centers worldwide aim to detect anomalies and avert potential breakdowns to optimize plant efficiency and ensure equipment availability,” he explained. PrimeServ Assist, notably, connects to main engines along with auxiliary systems such as generators, radiator cooling, lube oil, and fuel supplies, providing a “holistic data view” of the entire plant, Vögtle noted. “Currently, more than 60 power plants benefit from this service.”

New Business Models

For some giants in the engine space, tackling prominent market challenges has prompted a reconfiguration. Anticipating strong performance in the global energy resilience marketplace, Kohler Co. in November 2023 moved to separate its energy entities—including Power Systems, Engines, Home Energy, Kohler Uninterruptable Power, Clarke Energy, Curtis Instruments, and Heila Technologies—as a separate independent business, Kohler Energy, with global investment firm Platinum Equity as its majority investment partner. The transaction is slated to close in the first half of 2024. Platinum Equity Managing Director Matthew Louie noted push for the change leveraged “attractive tailwinds driving a sustained need for reliable power solutions in industrial, commercial, residential, and equipment applications.”

Other manufacturers are shifting how they interact with customers. Caterpillar, for example, has introduced “energy-as-a-service” (EaaS) solutions in a bid to offer “holistic market expertise.” The solutions combine “an industry-leading technology platform with expert insights, managed services, and cutting-edge technology to significantly enhance the operational and economic opportunities of distributed generation and storage assets,” the company told POWER.

“All services are individualized to the needs of each customer, comply with all requirements at their location, and respond to their unique energy opportunities and challenges.” A key aspect is that customers require no upfront capital costs, so the solution may be well-suited to customers who want to transform their backup power assets into revenue generation assets, the company noted.

Emerging Trends

All diesel and gas engine players POWER spoke to highlighted sustainability as a key priority, and most underscored the need for scalability of power solutions. Several players also underscored enduring challenges.

Kohler’s Rummel, for example, pointed to customers’ continued need for intelligent maintenance solutions. “Implementing advanced maintenance strategies can significantly reduce greenhouse gas emissions,” he suggested. To address this, Kohler recently rolled out the Kohler Conscious Care maintenance program for its KD Series generators to help customers reduce their fuel consumption and carbon footprint without compromising reliability, he said. “It enables operators to exercise backup generators at no load and extend the required interval to every four months. This approach drives down fuel and load bank expenses while reducing sound and air pollution and overall greenhouse gas emissions.”

MAN’s Vögtle said the biggest challenges on the horizon hover around fuel availability in sufficient quantities—and specifically climate-neutral fuels. “Not only does the power sector need it to decarbonize gas-fired power plants, but also other sectors such as steel, chemicals, and shipping depend on it. We will need huge amounts of green hydrogen in the future, and ramping up its green production and building the correspondent infrastructure is a gigantic task,” he noted.

Progress has been slow as “clear policies and regulations are mostly missing, or discussions are taking too long,” he said. The monumental task of building the massive global hydrogen and synthetic fuels infrastructure now falls to governmental bodies around the world, he said.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).