National Grid's Evolution: Branching Out from Deep Roots

Rooted in the birth of the UK’s energy industry, National Grid’s operations have traversed critical periods of the energy industry’s tumultuous history. While it is today one of the world’s largest publicly listed utilities and holds a broad mix of energy assets in the UK and the U.S., it has arrived at a critical juncture in a “fundamentally different” transformation.

Gleaning a series of groundbreaking discoveries in the 1800s, Britain’s power industry quickly began to take shape by the turn of the 20th century. “From Michael Faraday’s discovery of magnetoelectric induction in 1831, to the perfection of the high-speed reciprocating steam engine, and the introduction of the steam turbine in the 1890s, a whole series of technical innovations and developments had seen electric power generation become progressively more large-scale, manifest, and refined,” notes UK public body Historic England.

While the country’s first powerhouses mostly used steam engines, gas engines, and steam turbines to serve private houses or estates, they were quickly adapted to power street tramways and electric railways, and then to serve towns and cities. Between 1897 and 1905, a series of private laws spurred the creation of 20 large power companies, and in 1909, in the wake of technical developments in generation and transmission, a law incentivized local authorities and broader companies to supply electricity in bulk.

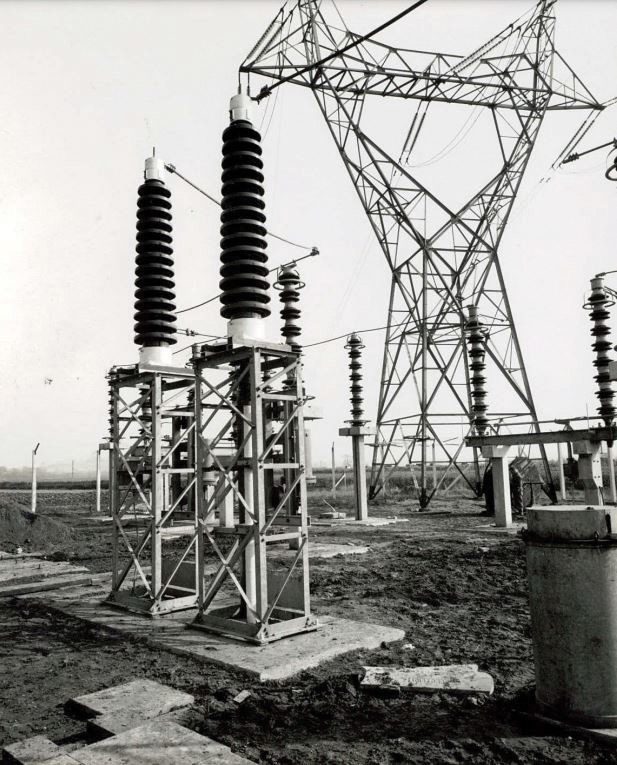

However, “During the First World War there was growing discontent with the disorganized, piecemeal, and uneconomic nature of electricity supply and distribution,” the historical society notes. While that kicked up myriad efforts to unify the system, Britain in 1926 solidified rationalization by establishing the Central Electricity Board (CEB), a public corporation tasked with building a “national gridiron” to link the most efficient stations. Construction of the 132-kV, 4,000-mile National Grid quickly followed under an eight-year program, but at the end of its completion, the system—which encapsulated seven individual grids—was still severely limited.

|

|

The Second World War, characterized by desperate fuel shortages, damaged power plants, and spates of electricity rationing, demonstrated the value of broader interconnection. In 1947, Britain moved to nationalize and expand its grid under the new British Electricity Authority (BEA). A shining BEA priority was establishing a 275-kV “supergrid” network engineered to carry six times more power and easily accept future upgrades (Figure 1).

As demand soared and the network grew, in 1958, the UK formed an Electricity Council to coordinate the whole industry and replaced a recent BEA-successor, the Central Electricity Authority, with the Central Electricity Generating Board (CEGB). State-owned CEGB, responsible for a significant portion of generation in England, Wales, and the South of Scotland, also oversaw the supergrid’s expansion through the 1960s and 1970s with new overhead 400-kV lines, underground cables, and substations connecting new power sources like nuclear and gas plants.

Owing to significant changes in the 1980s and early 1990s, the UK rapidly began to embrace market deregulation and privatization, and in 1989, with passage of the Electricity Act, CEGB’s transmission activities covering England and Wales were transferred to the National Grid Company plc. Shares of the new company, initially owned by 12 regional electric companies, were listed for public trading on the London Stock Exchange in 1995. Within five years, the company entered the U.S. electric delivery market, expanded into upstate New York in 2003, and, through various acquisitions, established itself as a global player in the energy sector.

A Giant That Sits at the Heart of the Energy System

But today, National Grid plc. is still an energy behemoth with nearly 30,000 employees. In the UK, it operates several core, regulated businesses focused on electricity transmission and distribution. These include National Grid Electricity Transmission (NGET), which owns and operates the high-voltage transmission network in England and Wales. The entity in April 2023 opened a new unit, Strategic Infrastructure (SI), which works to deliver transmission projects through the UK’s Accelerated Strategic Transmission Investment (ASTI) framework, armed with a critical objective to connect 50 GW of offshore generation by 2030.

National Grid Electricity Distribution (formerly WPD), another core business, owns and operates electricity distribution networks for the Midlands, the South West, and South Wales. Combined, that network makes National Grid the “largest distribution network operator (DNO) group in the UK,” the company noted. In mid-2023, National Grid’s distribution network connected 11.3 GW, 7.5 of which was “low-carbon generation.”

Meanwhile, though the company divested its giant historic gas distribution business in 2017, National Grid still functions as the UK’s Electricity System Operator (ESO). The affiliate, however, is slated to transfer out of the company’s structure and become part of the UK’s newly created Future System Operator (FSO) in 2024 (along with National Gas Transmission, a licensed gas system operator). As FSO, the ESO will likely assume its current responsibilities.

Today, the National Grid business, regulated by the UK Office of Gas and Electricity Markets (Ofgem), moves more than 730 GWh every day across Great Britain, using infrastructure owned by the country’s three transmission companies: NGET, Scottish Hydro Electric Transmission, and SP Energy Networks. It also oversees reliability measures and executes decisions to keep the system reliable. These, for example, include contingency coal contracts for the upcoming winter and what it says is a “world-leading” demand flexibility service that brings forward “future system flexibility by several years.” After 2024, as FSO, the entity will evolve into an impartial, “trusted and expert body at the center of the gas and electricity systems,” with “an important duty to facilitate net zero whilst also maintaining a resilient and affordable system,” Ofgem says.

A World-Class Grid OperatorAs the transition gains momentum, National Grid ESO (NGESO) has tackled multiple challenges, including fielding escalating energy prices, which were exacerbated by Russia’s invasion of Ukraine. It also oversees reliability measures and executes decisions to keep the system reliable. These, for example, include contingency coal contracts for the upcoming winter, and what it says is a “world-leading” demand flexibility service that brings “forward future system flexibility by several years.” To drive competition and innovation, it has launched “pathfinder contracts,” under three Pathfinder Projects. The projects seek to resolve regional high-voltage issues, grid stability issues—including national inertia and local short circuit needs in Scotland—and network constraint issues, which could in turn lower balancing costs. Pathfinders “are designed to find new ways of operating the system to reduce costs for consumers” as the UK charges ahead to operate at zero-carbon by 2025, NGESO has noted. “This service is an innovative way of managing the risk of very rare network faults.” |

Branching Out in the U.S.

National Grid’s U.S. operations are housed under its National Grid North America segment. These entities own and operate transmission facilities, power distribution networks, and gas distribution networks across Massachusetts, New Hampshire, Vermont, and upstate New York. (It recently sold its Rhode Island business to PPL). Entities include Niagara Mohawk Power, Massachusetts Electric Co., New England Power Co., the Brooklyn Union Gas Co., KeySpan Gas East Corp., Boston Gas Co., and National Grid Generation.

|

|

In New England, to meet Massachusetts’ net-zero goals by 2050, National Grid’s utilities are heavily invested in electric vehicle adoption and energy efficiency programs, along with exploring new energy options like geothermal (Figure 2). In New York, the group has embarked on Smart Path Connect‚ an ambitious 100-mile transmission project that could reduce congestion during peak hours and unlock new renewable electricity potential. Another potential energy solution underway is HyGrid, a gas decarbonization project on Long Island that is slated to demonstrate the use of hydrogen in its gas networks.

National Grid Ventures (NGV), another business segment, runs separately from the group’s regulated operations. NGV owns and operates energy businesses in competitive markets in the UK and U.S., armed with a portfolio that includes five electricity interconnectors that connect the UK with the Netherlands, Belgium, Norway, and two connections to France. A sixth interconnector to Denmark (Viking Link) is under construction. When it becomes operational in early 2024, it will expand NGV’s portfolio of interconnector capacity to 7.8 GW. NGV also operates the Isle of Grain LNG facility, the UK’s liquefied natural gas (LNG) gateway to the European energy market.

NGV’s power generation business—a fraction of National Grid Group’s overall operations—is wholly based in the U.S. These include large-scale renewable generation and battery storage in varied states. In 2022, notably, NGV partnered with RWE to acquire a seabed lease for offshore wind in the New York-New Jersey Bight, with the potential to host 3 GW of capacity. NGV is also part of a consortium led by the New York State Energy Research and Development Authority (NYSERDA) seeking federal funding for a hydrogen hub. Finally, but just as notably, NGV also owns a 4-GW fleet of oil- and gas-fired power units on Long Island. It sells all that capacity to the Long Island Power Authority via a power purchase agreement slated to end in 2028.

A Key Driving Factor: Building a Responsible Business

Today, National Grid is guided by four strategic priorities. First, it strives to “enable the energy transition for all” through capital investments, innovation, and policy influence (Figure 3). Another priority involves delivering reliable, resilient, and affordable energy. This aspect includes, for example, providing additional grid flexibility services, using dynamic line ratings to unlock additional network capacity and reduce constraints, and ensuring fuel security through its Grain LNG facility.

|

|

National Grid’s strategic priorities also focus on transforming internal processes to tamp down its greenhouse gas emissions dramatically. The company has committed to slashing its operational sulfur hexafluoride (SF6) emissions by 50% by 2030 and removing SF 6 from electrical assets by 2050. In January, it completed a 10-week trial to test a 250-kW hydrogen-powered generator at its Deeside Centre for Innovation (DCI), which hosts a 400-kV modified test substation. It is also committed to energy efficiency. In October 2022, for example, it launched a pioneering project to demonstrate demand flexibility in its networks with heat pumps.

But perhaps National Grid Group’s most prominent strategic driver is its “Responsible Business Charter,” which it says is an articulation of the elements that may have the “most impact” on the environment, society, the economy, its workforce, and its governance. In September, the company unveiled a revision of its 2020 “Charter” so that its near-term Scope 1, 2, and 3 emissions targets, validated by the Science Based Targets initiative (SBTi), will better align to a 1.5-degree pathway amid new transitional challenges. The new targets call for a reduction of Scope 1 and 2 emissions by 80% by 2030 (compared to a 1990 baseline), aiming to achieve net-zero by 2050 without offsets. It also aims to reduce Scope 3 emissions across its entire value chain by 37.5% by 2033/34, compared to a 2018/19 baseline.

It will mean that the company will “need to push a bit harder on decarbonizing our gas networks to align with our clean energy vision,” Rhian Kelly, National Grid Chief Sustainability Officer, said during a Sept. 21 investor webinar. “We’ll also need to accelerate some of the emissions reductions in our [4-GW fossil] generation fleet on Long Island.” That may involve “working with the Long Island Power Authority and working with them to meet state goals, but we’ll also need a few enabling policies to think through renewable natural gas [RNG] and hydrogen, those opportunities for our generation fleet, and also we’ll need to deliver on our existing retirement plan for those assets,” she said.

Grappling with Multiple Challenges

A more significant hurdle described by National Grid CEO John Pettigrew during that webinar will involve accelerating the pace and scale of capital investment to match the urgency of the transition. While the UK and the U.S. have separately set broad goals to decarbonize their power systems by 2035, the two regions face soaring power demand as electrification gains steam. Projections suggest, for example, that to meet the UK’s anticipated demand surge of as much as 50% over the next 10 years, the country will need to treble the amount of electricity generation connected to Great Britain’s grid.

National Grid has set out “a very clear trajectory” to spend £14 billion between 2021 and 2026, Pettigrew said, and the company’s strategy currently anticipates pivoting its shape so that the group will be invested “broadly 50% in the UK, 50% in the U.S.” However, “there are a few things we just need to get clarity on before we can give more visibility to the market on what the [capital expenditure] plan looks like,” he noted. “One is, exactly what is it that we’ve been asked to do?”

National Grid notes its businesses already sit “at the heart” of the energy transition. “We are connecting increasing volumes of low-carbon-generation customers to the network, and adapting our network and operations to deliver this in a way that is safe, clean, reliable, resilient, and affordable. We are influencing a whole system approach, working with developers, suppliers, environmental groups, and local communities to find the best solutions for creating the net zero infrastructure of the future,” it said.

However, to make any meaningful progress over the next five to 10 years, government and regulators “need to take action now if we are going to be able to achieve the targets that have been set to deliver the [necessary] scale of infrastructure,” Pettigrew said. In the UK, he noted that the prime minister recently made announcements about improving the planning and connection process. “On the U.S. side, very similar actually, permitting, siting is really an important part of what we need to see put in place.” On the gas side, the company needs to see a “clean gas standard” to realize its clean energy vision, he said.

National Grid notes it approaches both regions differently. While it partners with the European Union and the UK governments through its interconnector roll-outs, in the U.S., it “shares its expertise,” working with state regulators to make sure that its efforts align with state goals. Still, it noted that both regions share common challenges, including an urgent need to build an effective supply chain and secure necessary labor. Affordability is also a pervading concern in both regions, as highlighted by last year’s global gas crisis.

While these challenges are significant, Pettigrew suggested that tackling them together could offer an opportunity for holistic balance and alignment. “I think what we’ve seen over the last 12 to 18 months is actually the different elements of the trilemma coming into balance,” he said.

“I think for the cost-of-living crisis, people have become acutely aware of affordability in the energy sector. At the same time, because of obviously things like the Ukraine-Russian war, more security supplies have lifted up as well,” he said. “Then, of course, there’s still the aspiration … to achieve net-zero by 2050.” As an infrastructure giant, National Grid functions as “a true enabler” to achieve that balance, he said. “It is the route not only to net-zero but also to low-price energy.”

National Grid: Engineering Partnering and FrameworksLike many utilities worldwide, National Grid is urgently scaling its extensive energy infrastructure to meet burgeoning grid demands—including unknown future demand—while crafting a framework to support a clean, secure, affordable energy future. According to Graeme Cooper, who joined Dallas-headquartered global professional services firm Jacobs as vice president of Energy Transition—after serving five years as National Grid’s head of Future Markets and Transport Decarbonization in the UK—the mammoth endeavor puts the energy utilities industry “as a whole in uncharted territory.” It must work out “how to quickly, and at scale, deploy a new way of procuring and contracting agile projects to meet future energy security, sustainability, and reliability expectations of regulators, governments, and communities alike,” he told POWER. In the UK, the transition has hastened at a breakneck pace. Over the past five years, the country has “experienced a dramatic uptick in both upstream clean generation connections and downstream demand connections, creating a significant grid queue,” Cooper noted. “In fact, the 2020 Sixth Carbon Budget required under the Carbon Change Act in the U.K. estimates the use of electricity consumption by 2050 will double. To meet this demand, the U.K. will need at least four times the amount of clean generation it has today—which means the grid’s capacity has to deliver twice its current capacity.” But companies like National Grid “are taking bold, confident steps to actively change the way they think, act, and deliver increased scale and pace of delivery to keep up with the drivers of the energy transition,” Cooper said. “By being willing to consider innovative, new delivery models, National Grid demonstrates their dedication to implementing new agile and creative contracting on large energy infrastructure projects to deliver the critical infrastructure that needs to be in place to enable the connection of up to 50 GW by 2030 known as ‘the Great Grid Upgrade.’” A big part of National Grid’s successes can be attributed to solid partnerships and strategic and advisory foresight in the form of “frameworks,” which involve long-term global agreements with multiple suppliers. Jacobs, notably, supports National Grid through its four-year Design & Project Services Framework. This 2022-initiated effort covers all works related to building out the company’s electricity and gas transmission cycle. Earlier this year, National Grid doled out major contracts under its General Management Consultancy Framework, which seeks consultancy advice for finance risk, assurances, tax and treasury, corporate strategy, change management, service operations, regulation, and procurement. Jacobs, recently appointed to the General Management Consultancy Framework, will provide service operations support across National Grid—both in the UK and the U.S.—to help improve core business functionality, including strategic development, business planning, process improvement, and implementation support. “In addition, our Consulting and Advisory team supported National Grid’s U.K. distribution team with their five-year regulatory submission to secure investment for network operations and new infrastructure, including the net-zero transition,” Cooper noted. Jacobs, Cooper noted, has supported National Grid for more than 15 years, leveraging its experience in delivering high-capacity, fast-ramp projects across the energy, power, advanced manufacturing, health, environment, transportation, and water sectors. That experience “differentiates us from traditional pure-play energy peers because it allows us to apply multi-disciplinary learnings to energy sustainability, reliability, and security challenges through a holistic infrastructure and societal lens, rather than through the vacuum of one industry,” he said. |

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).

Utility SpotlightPOWER magazine is exploring the histories of some of the largest utilities in the U.S. as part of the magazine’s 140th-anniversary celebration. In October 2023, the publication, still one of the world’s only publications that comprehensively covers the world’s power industry, turned 141. Features that are part of this exclusive “Utility Spotlight” series are here: New Era for NextEra: A Utility Spotlight (February 2022) History of Power: Duke Energy’s Century-Old Legacy (May 2022) Southern Company: A History of a Prolific Power Technology Pioneer (August 2022) History of Power: Dominion Energy’s Fluid Transition (November 2022) Why Constellation Energy, a Nuclear-Heavy Giant, Is Primed for Power Futurity (February 2023) Enduring Value: Entergy’s More Than 100-Year-Old Story (May 2023) NRG Energy’s Pivot Amid Power Sector Change (August 2023) National Grid’s Evolution: Branching Out from Deep Roots (November 2023) |